South Dakota Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage

Description

How to fill out Notice Of Intention To Foreclose And Of Liability For Deficiency After Foreclosure Of Mortgage?

You can invest hours online trying to find the authorized papers template that meets the federal and state needs you need. US Legal Forms offers 1000s of authorized types which are evaluated by specialists. You can easily download or printing the South Dakota Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage from our assistance.

If you already have a US Legal Forms profile, it is possible to log in and click on the Obtain option. After that, it is possible to complete, edit, printing, or indicator the South Dakota Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage. Each and every authorized papers template you get is the one you have for a long time. To get yet another duplicate of any purchased type, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms site the very first time, keep to the simple directions below:

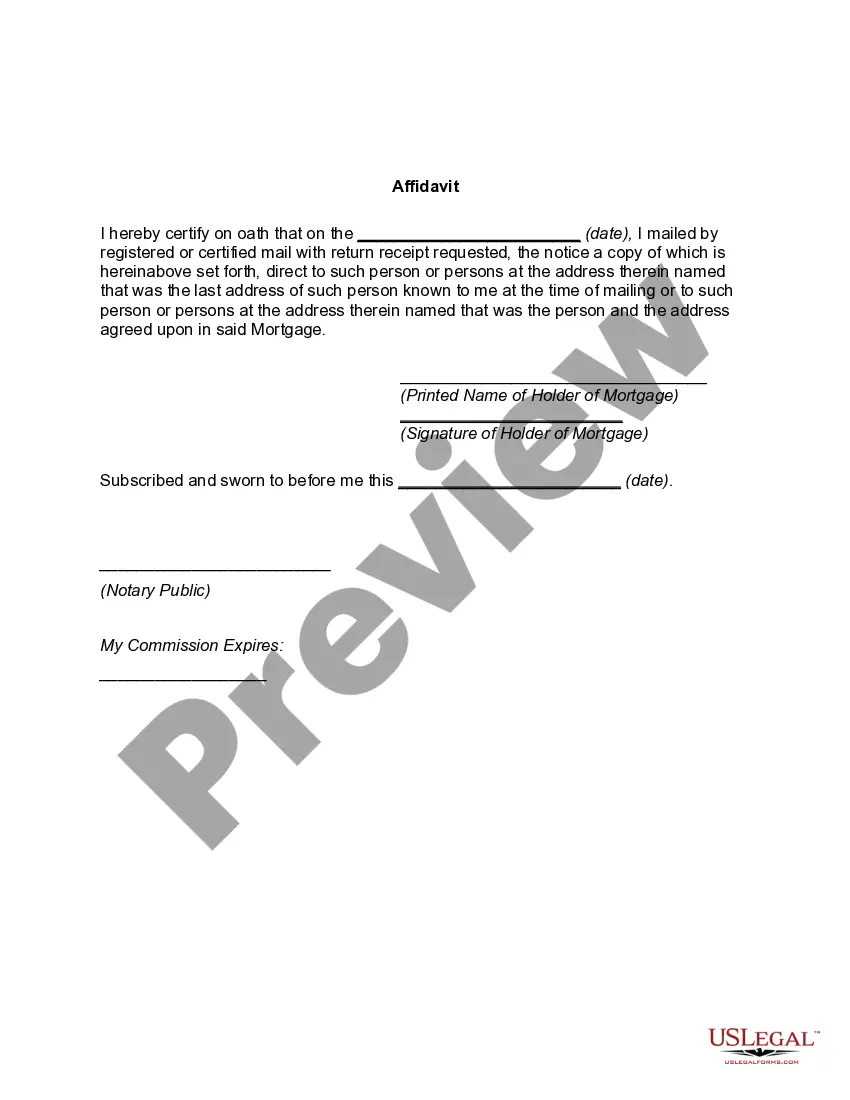

- Initial, ensure that you have selected the right papers template for the region/town of your choice. See the type description to make sure you have picked out the correct type. If available, make use of the Review option to check from the papers template at the same time.

- In order to discover yet another model of your type, make use of the Lookup discipline to discover the template that meets your requirements and needs.

- After you have identified the template you want, click Purchase now to proceed.

- Choose the rates plan you want, type your qualifications, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal profile to purchase the authorized type.

- Choose the structure of your papers and download it for your system.

- Make adjustments for your papers if required. You can complete, edit and indicator and printing South Dakota Notice of Intention to Foreclose and of Liability for Deficiency after Foreclosure of Mortgage.

Obtain and printing 1000s of papers templates while using US Legal Forms website, that provides the greatest variety of authorized types. Use skilled and state-particular templates to tackle your organization or person requirements.

Form popularity

FAQ

The fastest way to avoid foreclosure is to reinstate your loan, by paying the amount provided on the reinstatement quote. The reinstatement quote can be obtained from the lender, along with a good through date. If you cannot pay your mortgage, or can only pay a portion, contact your servicer.

Be honest with your lender: Don't agree to pay more than you can handle. Request a Forbearance. A forbearance pauses your mortgage payments for a time. ... Conduct A Short Sale. If you don't quality for other forms of assistance, you may need to consider a short sale. ... Sign A Deed In Lieu Of Foreclosure.

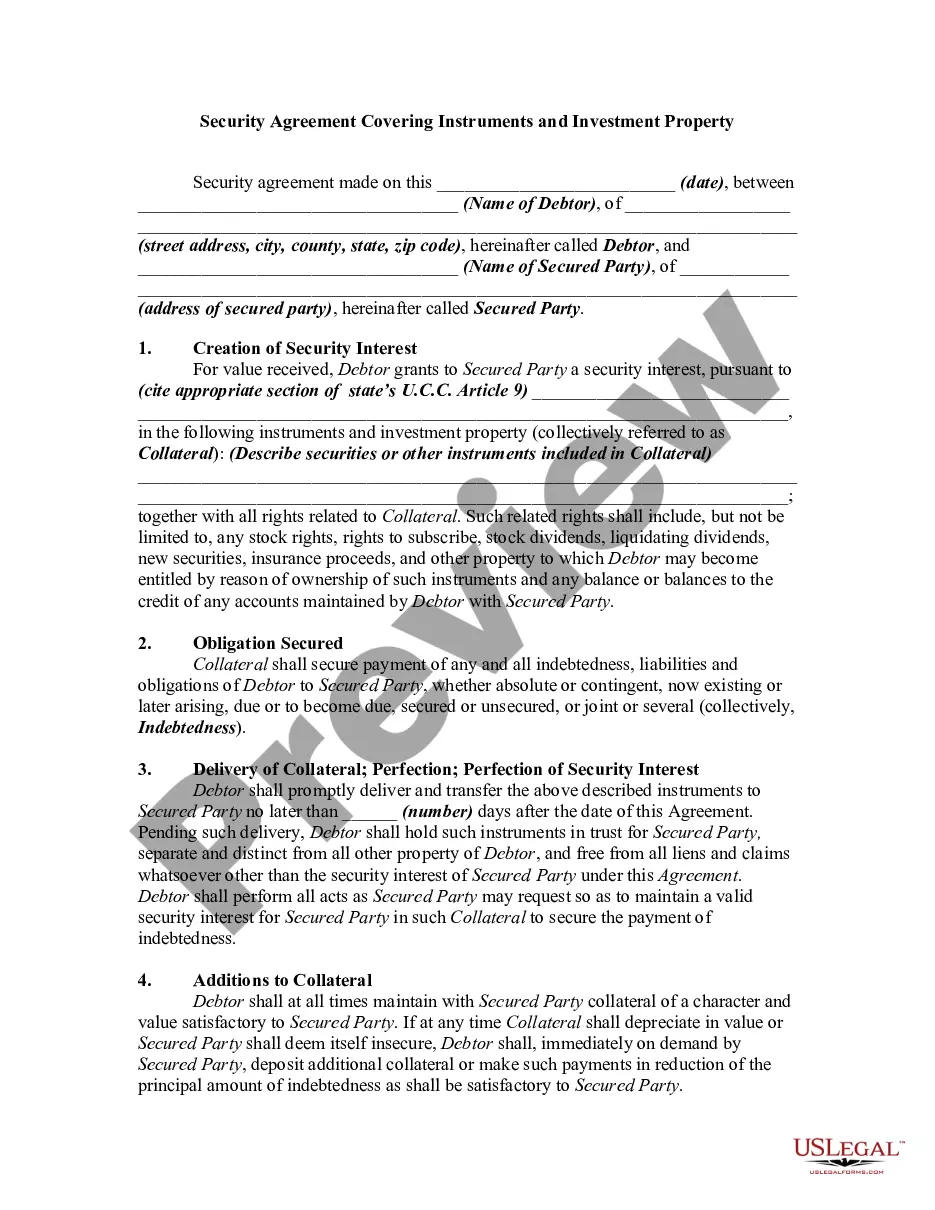

44-8-26. Collateral real estate mortgages. A mortgage which contains the following statement in printed or typed capital letters: THE PARTIES AGREE THAT THIS MORTGAGE CONSTITUTES A COLLATERAL REAL ESTATE MORTGAGE PURSUANT TO SDCL 44-8-26, is subject to the provisions of this section.

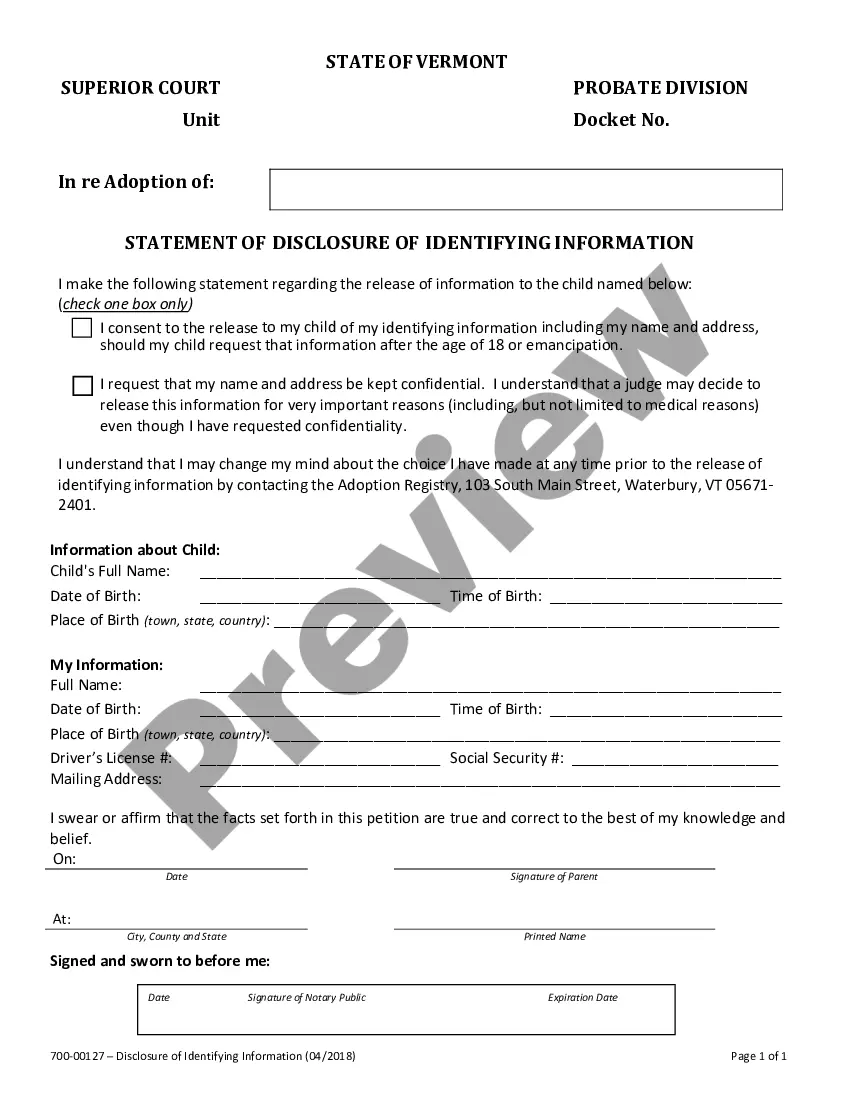

The nonjudicial process is pretty straightforward: The lender serves the borrower a notice of sale at least 21 days before the sale date and publishes the notice in a newspaper once a week for four weeks. (S.D. Codified Laws § 21-48-6.1, § 21-48-6). Then the lender can sell the property at a foreclosure sale.

The term ?foreclosure action? refers to legal proceedings initiated by a lender after a borrower defaults on their mortgage. Lenders can enforce their rights through a foreclosure when borrowers fail to either make mortgage payments or fulfill the obligations outlined in their mortgage agreement.

Your Options to Avoid Foreclosure Reinstate Your Loan. ... Enter Into a Repayment Plan. ... Enter Into a Forbearance Agreement. ... Refinance. ... File for Chapter 7 or Chapter 13 Bankruptcy. ... Give Up Your House In a Short Sale or Deed in Lieu of Foreclosure. ... Workouts for Government-Backed Mortgages. ... Getting Help.

A forbearance agreement may allow a borrower to avoid foreclosure until their financial situation gets better. In some cases, the lender may be able to extend the forbearance period if the borrower's hardship is not resolved by the original agreed-upon end date.

You may be able to avoid foreclosure by making arrangements with your lender, such as getting forbearance or agreeing to a loan modification. Other options may include refinancing with a hard money loan or reverse mortgage.