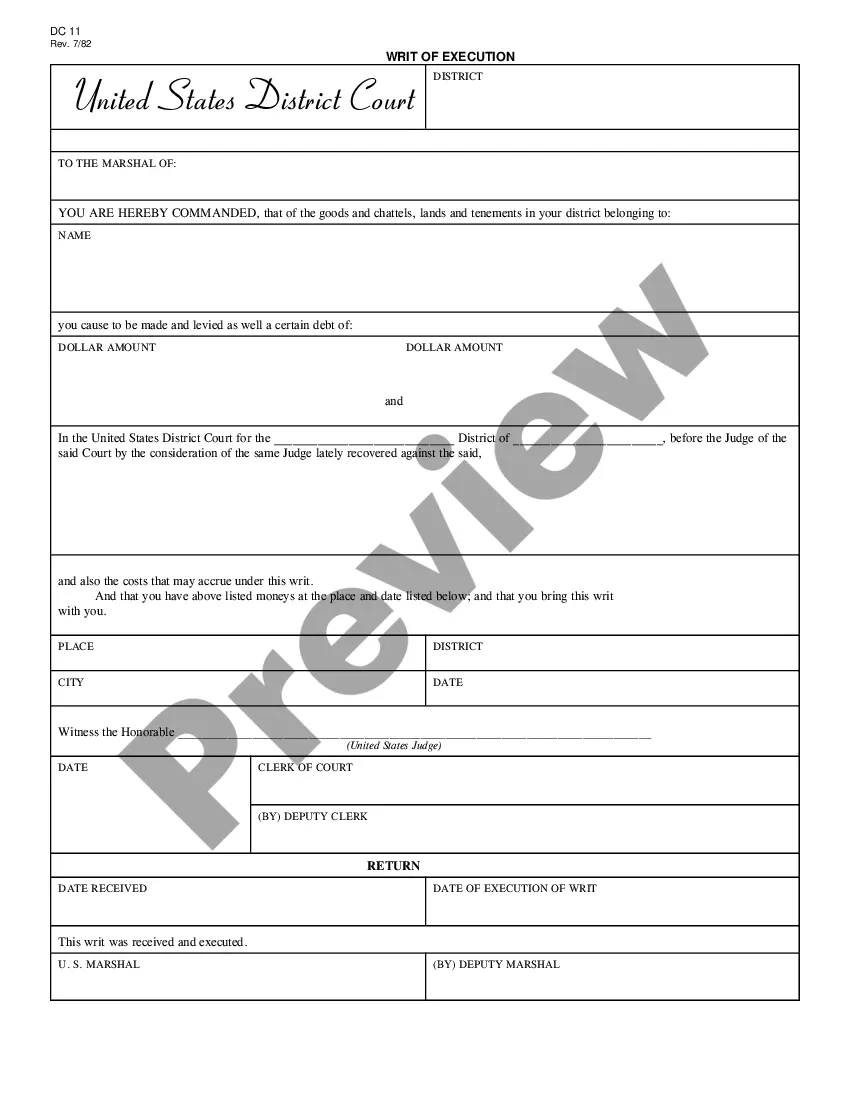

South Dakota Sample Letter for Payment Schedule

Description

How to fill out Sample Letter For Payment Schedule?

If you need to complete, down load, or print legitimate file web templates, use US Legal Forms, the largest variety of legitimate forms, which can be found on the Internet. Use the site`s simple and handy research to obtain the files you want. Different web templates for business and person uses are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the South Dakota Sample Letter for Payment Schedule in a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in in your account and then click the Down load key to obtain the South Dakota Sample Letter for Payment Schedule. Also you can accessibility forms you earlier acquired inside the My Forms tab of your account.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your correct area/land.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Do not overlook to read the outline.

- Step 3. Should you be unsatisfied using the develop, use the Search industry at the top of the display to locate other types in the legitimate develop format.

- Step 4. After you have discovered the form you want, go through the Buy now key. Opt for the prices prepare you prefer and add your credentials to sign up for an account.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Find the structure in the legitimate develop and down load it on your device.

- Step 7. Complete, revise and print or indication the South Dakota Sample Letter for Payment Schedule.

Each and every legitimate file format you buy is yours eternally. You have acces to each develop you acquired with your acccount. Click on the My Forms segment and pick a develop to print or down load yet again.

Remain competitive and down load, and print the South Dakota Sample Letter for Payment Schedule with US Legal Forms. There are thousands of specialist and condition-particular forms you can use for your business or person requirements.