South Dakota Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

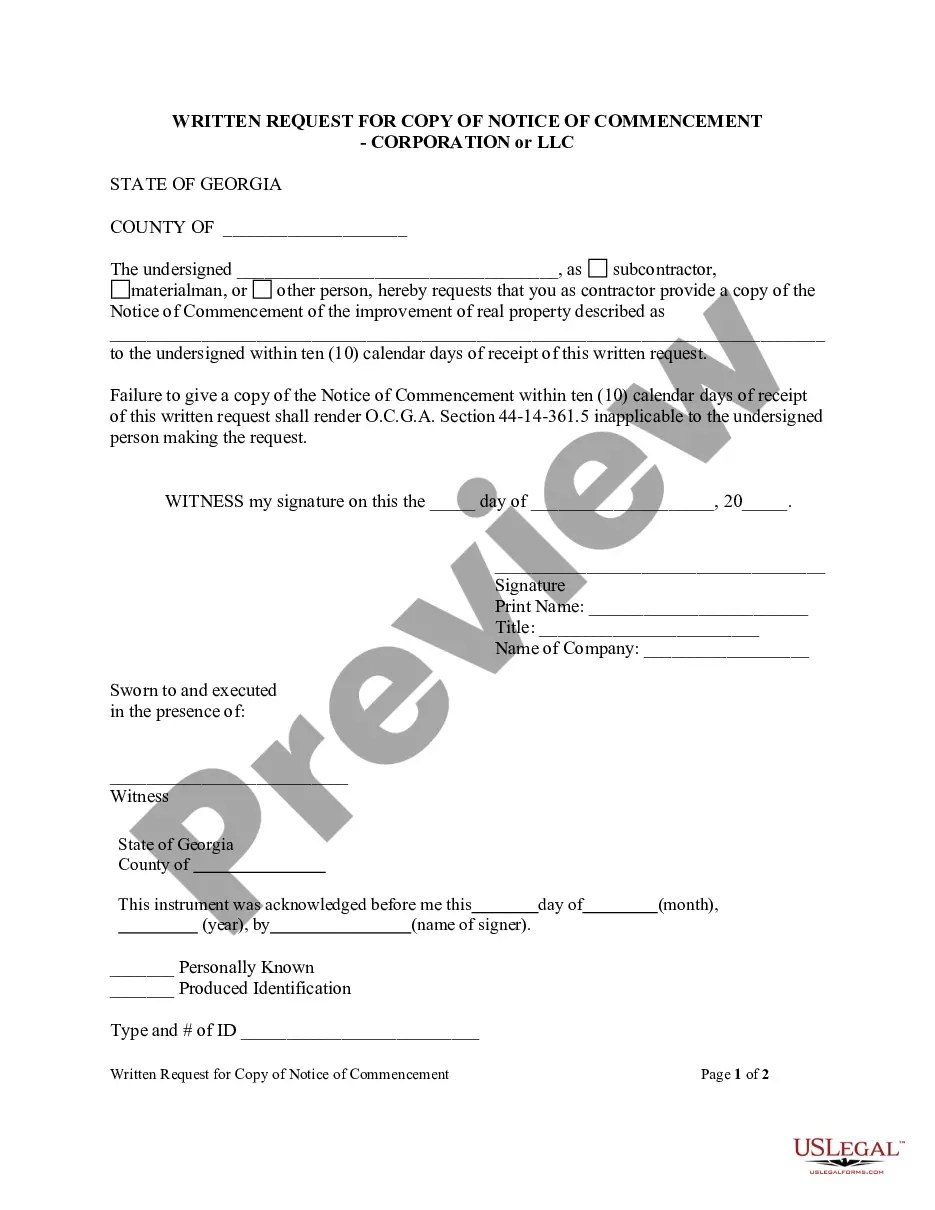

You can dedicate numerous hours online trying to locate the legal document format that meets the federal and state standards you desire.

US Legal Forms offers an extensive collection of legal templates that have been assessed by professionals.

You can download or print the South Dakota Notice of Returned Check from the services.

If available, utilize the Review button to inspect the document format as well.

- If you possess a US Legal Forms account, you may sign in and click on the Obtain button.

- Following that, you can fill out, modify, print, or sign the South Dakota Notice of Returned Check.

- Each legal document template you purchase is yours indefinitely.

- To retrieve another copy of any acquired document, navigate to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- First, ensure you have chosen the correct document format for the county/city of your preference.

- Review the document description to confirm you have selected the right form.

Form popularity

FAQ

South Dakota categorizes felonies into different classes, ranging from Class 1 to Class 6. Class 1 felonies are the most severe, resulting in harsher penalties, while Class 6 felonies carry lighter punishments. Being aware of these classifications is important, especially when dealing with issues such as a South Dakota Notice of Returned Check. Having the right legal advice can significantly influence your situation.

When a check is returned in South Dakota, you should first verify the reason for the return. Commonly, checks bounce due to insufficient funds or a closed account. Following this, consider sending a formal notice to the check writer. A South Dakota Notice of Returned Check can serve as a crucial document to initiate further actions or negotiations.

In South Dakota, a felony remains on your record indefinitely unless you pursue expungement. This process can relieve you of the legal burdens, but it requires fulfilling specific criteria. Having a South Dakota Notice of Returned Check on your record can impact your financial standing, so consider exploring your options for record expungement. Legal support can clarify your path forward.

A check may be returned to the sender for several reasons, including insufficient funds, a closed account, or a discrepancy with the signature. These reasons can lead to a returned check notice that outlines the problem clearly. Understanding why a check is returned can help prevent similar issues in the future. Utilizing resources from uslegalforms gives you access to useful information about managing circumstances surrounding a South Dakota Notice of Returned Check.

Receiving a returned check means a payment has not completed successfully due to insufficient funds or other banking issues. You will usually receive a notice explaining why the check was returned, which initiates the need to resolve the payment. It’s vital to act quickly, as unresolved checks can lead to additional fees or legal concerns. Consulting platforms like uslegalforms can provide you with the necessary tools to deal with a South Dakota Notice of Returned Check.

When you receive a bounced check, it means the issuer did not have enough funds to cover it. You will typically receive a returned check notice from your bank regarding this matter. It’s wise to reach out to the check issuer to resolve the issue and request an alternative payment method. In these situations, checking resources from uslegalforms can be beneficial to navigate issues related to the South Dakota Notice of Returned Check.

If your check was returned, the first step is to contact your bank to understand the reason for the return. Check whether you have enough funds to cover the payment and, if possible, communicate with the recipient to resolve the issue promptly. Keeping open communication can help maintain goodwill, and you may also consider using resources from uslegalforms to handle the situation more effectively. Alleviating problems related to a South Dakota Notice of Returned Check is crucial for your financial well-being.

A returned check notice is a formal communication indicating that a check has not cleared due to insufficient funds or other issues. This notice is essential as it informs the recipient regarding the failed transaction and the reason behind it. Receiving this notice prompts the involved parties to take necessary actions, such as resolving any outstanding payments. You can find useful resources on this subject, including the South Dakota Notice of Returned Check, through platforms like uslegalforms.

To deposit a returned check, first contact your bank to understand their specific process for handling bounced checks. Generally, you will need to endorse the back of the check and complete a deposit slip, indicating that it is a returned item. Ensure that you comply with any requirements for the South Dakota Notice of Returned Check to avoid future complications. Utilizing platforms like US Legal Forms can help you prepare the necessary documentation for such situations.

To write a bounced check letter, start by addressing the recipient with a polite greeting. Clearly state the reason for the letter, which is to notify them that their check was returned due to insufficient funds. Include relevant details such as the date the check was issued, the check number, and the amount. Make sure to specify that this is related to the South Dakota Notice of Returned Check, and encourage the recipient to resolve the issue promptly.