South Dakota Promissory Note - Long Form

Description

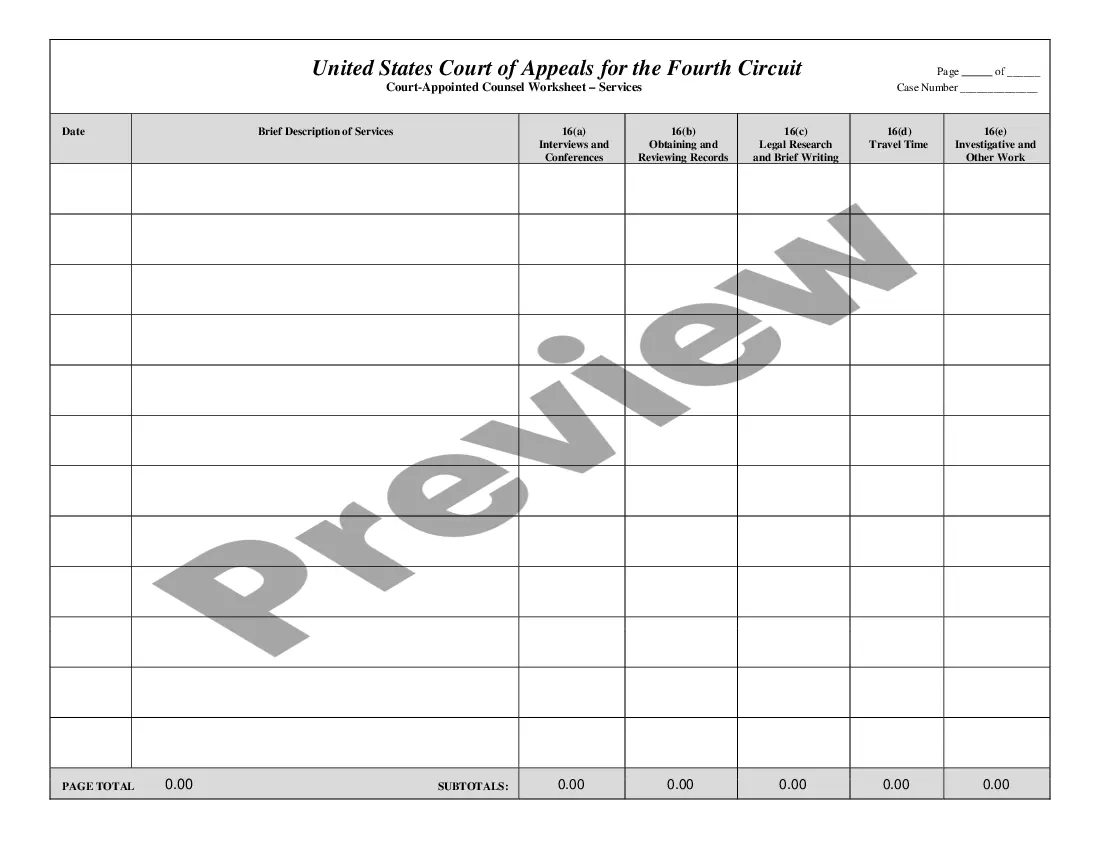

How to fill out Promissory Note - Long Form?

Are you in a situation where you regularly need to have documents for various business or personal reasons.

There are numerous reliable document templates available online, but finding trustworthy versions can be challenging.

US Legal Forms provides a vast selection of form templates, including the South Dakota Promissory Note - Long Form, that can be completed to satisfy state and federal requirements.

Once you locate the correct form, click on Purchase now.

Choose the pricing plan you prefer, fill in the necessary information to process your payment, and complete your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Promissory Note - Long Form template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the appropriate area/county.

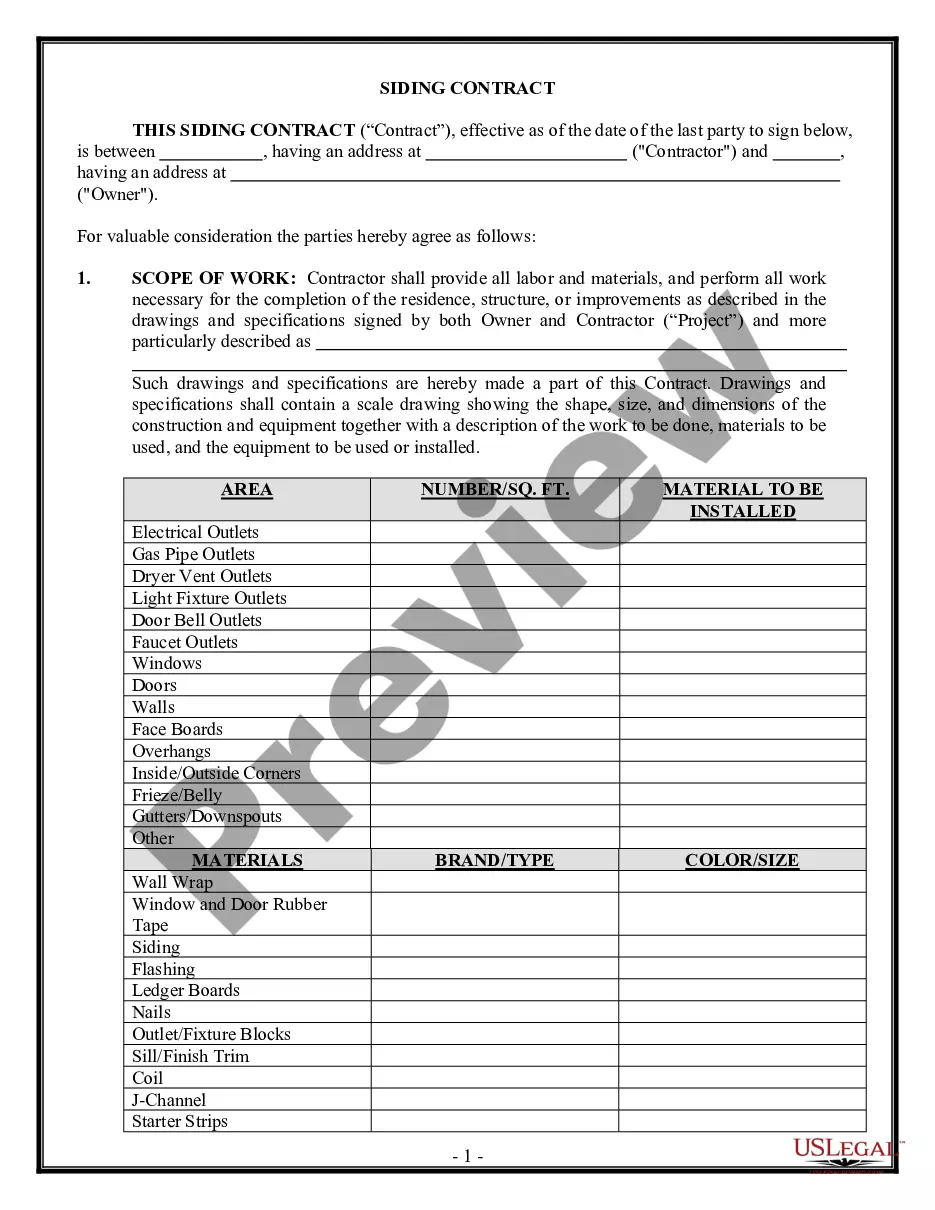

- Use the Review button to scrutinize the form.

- Check the details to confirm that you have picked the correct form.

- If the form is not what you are looking for, use the Search field to find a form that fits your requirements.

Form popularity

FAQ

You do not necessarily need a lawyer to create a South Dakota Promissory Note - Long Form. Many individuals successfully draft their own promissory notes using reliable templates. However, if your situation involves complex arrangements or significant amounts, consulting a lawyer can provide added security and clarity. Ultimately, the decision depends on the specific details of your agreement.

Promissory notes can be both short-term and long-term, depending on the agreement between the parties. A South Dakota Promissory Note - Long Form can specify a repayment timeframe that suits both the lender and the borrower. Thus, the duration can range from a few months to several years. Having clear terms in the document will clarify the expectations for all parties involved.

For a South Dakota Promissory Note - Long Form to be valid, it must clearly state the borrower's promise to repay a certain amount, as well as the repayment terms. It should include the signing dates and signatures of both the borrower and lender. Additionally, the note should be for a lawful purpose, as unlawful agreements will not hold up in court. Ensuring these elements are in place will strengthen the document's validity.

Promissory notes in South Dakota adhere to specific rules that ensure their effectiveness. These include providing a definite payment amount, specifying payment terms, and including the signatures of both parties. The South Dakota Promissory Note - Long Form also needs to comply with state and federal laws. Properly following these rules minimizes the risk of legal complications.

Typically, a South Dakota Promissory Note - Long Form does not require filing in any public office. Instead, both the lender and borrower should keep their copies for personal records. However, you may want to store it securely or with a legal professional for safekeeping. If you have further questions about documentation, consider leveraging platforms like uslegalforms for comprehensive guidance.

Yes, there is a time limit on a South Dakota Promissory Note - Long Form, known as the statute of limitations. Generally, this period lasts from three to six years, depending on the terms of repayment. After this time frame, the lender may not be able to enforce the note legally. It’s important to be aware of these limits and plan payments accordingly.

The length of a South Dakota Promissory Note - Long Form can vary based on the terms agreed upon by both parties. Typically, these notes can range from a few months to several years. It’s crucial to outline the repayment duration clearly within the document. Keeping these details transparent helps avoid future disputes over repayment timelines.

Yes, a notarized South Dakota Promissory Note - Long Form is legally binding. Notarization adds an extra layer of authenticity, confirming that the signatures were made willingly and with proper identification. This binding nature makes it essential for both parties to understand their obligations fully. It’s always wise to consult with a legal expert when drafting such documents.

There is no specific legal limit on the maximum amount for a South Dakota Promissory Note - Long Form. The amount typically depends on the agreement between the lender and borrower. It's essential to ensure that both parties understand the terms, including repayment schedules, interest rates, and any additional fees. Having a clear understanding promotes a smoother transaction.