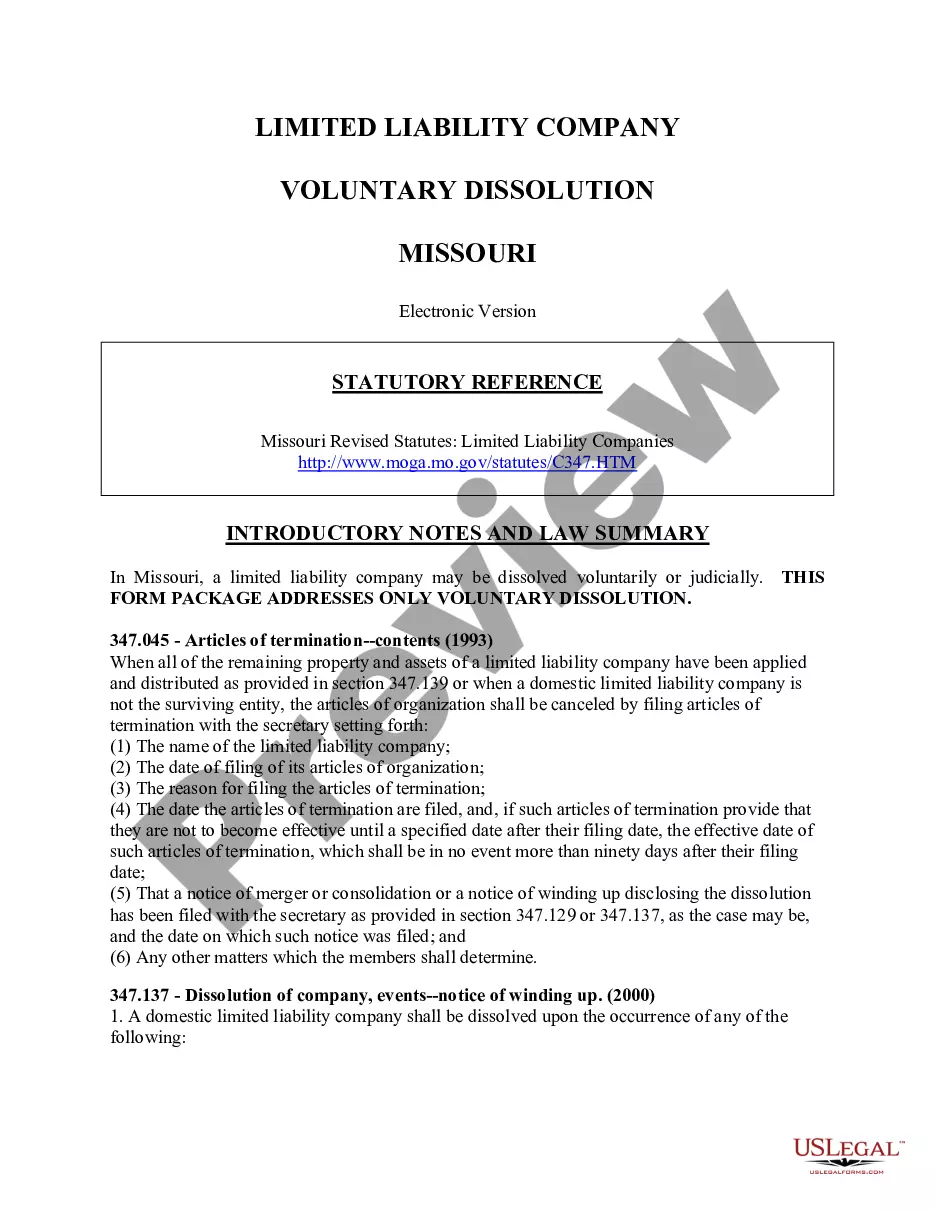

Missouri Dissolution Package to Dissolve Corporation

About this form

The Missouri Dissolution Package to Dissolve Corporation includes all necessary documents and instructions for voluntarily dissolving a corporation in Missouri. This form package distinguishes itself by providing step-by-step guidance, ensuring compliance with legal requirements, and making the dissolution process straightforward and manageable for users.

Common use cases

This form package is essential when the owners or directors of a corporation in Missouri decide to voluntarily dissolve the corporation. This may occur due to various reasons, such as a strategic business decision, financial difficulties, or a determination that the corporation is no longer needed or profitable.

Who this form is for

- Corporation owners or shareholders seeking to dissolve their business.

- Directors of a corporation wishing to submit a proposal for dissolution.

- Legal representatives assisting in the dissolution process.

Completing this form step by step

- Identify the corporation's name exactly as it appears on state records.

- Complete the Resolution to Dissolve Affidavit if there are no issued shares or business activity.

- File the Articles of Dissolution with the required voting information and signatures.

- Notify known claimants in writing and publish a notice to inform unknown claimants.

- Submit the Request for Termination once all affairs have been wound up, along with any necessary fees.

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to obtain the necessary votes or consents from shareholders for dissolution.

- Neglecting to notify claimants, which could lead to future liability issues.

- Not completing all required forms or submitting them with incorrect or incomplete information.

Why use this form online

- Convenience of downloading the forms instantly and accessing them anytime.

- Editability to customize forms according to specific corporation details.

- Reliability of legally compliant documents reviewed by licensed attorneys.

Looking for another form?

Form popularity

FAQ

The process of dissolving a corporation includes several key actions. Start by holding a meeting to approve dissolution, then file the Articles of Dissolution with your state. Afterward, address any outstanding debts and notify all stakeholders. Utilizing the Missouri Dissolution Package to Dissolve Corporation can ensure you follow all the necessary steps and complete the process correctly.

Dissolving a corporation involves multiple steps that ensure compliance with state laws. Begin by obtaining board approval and filing the necessary dissolution documents with the state. Next, you should notify creditors, settle debts, and distribute remaining assets to shareholders. The Missouri Dissolution Package to Dissolve Corporation provides a comprehensive guide to make this process smoother.

When you dissolve a C corporation, the tax consequences can vary. Generally, the corporation may owe taxes on any gains from asset sales, and shareholders may face taxes on distributions received. It is essential to work with a tax professional to understand these implications fully. The Missouri Dissolution Package to Dissolve Corporation can help you navigate these tax considerations effectively.

Closing a C corporation involves several crucial steps. First, you should hold a board meeting to approve the dissolution, followed by filing the Articles of Dissolution with the state. Finally, you will need to settle any debts and distribute remaining assets. The Missouri Dissolution Package to Dissolve Corporation simplifies these steps, guiding you through each phase effectively.

To notify the IRS of the dissolution of your corporation, you must file your final tax return, marking it as a 'final return.' Additionally, ensure you include all relevant forms, such as Form 966 for corporate dissolution. Using the Missouri Dissolution Package to Dissolve Corporation can help streamline this process, ensuring you fulfill all necessary requirements.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority. Reinstatement is the action taken that restores an administratively dissolved business entity's rights, powers, and authority.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

For Missouri residents, forms to complete the dissolution of a company can be found on the Missouri Secretary of State's website. For-profit corporations need to complete Articles of Dissolution by Voluntary Action, Request for Termination and Resolution to Dissolve.