South Dakota Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

If you wish to acquire, download, or print official document templates, utilize US Legal Forms, the largest selection of official forms, which are accessible online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to obtain the South Dakota Accounts Receivable Write-Off Approval Form with just a few clicks.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to access the South Dakota Accounts Receivable Write-Off Approval Form.

- You can also view forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/state.

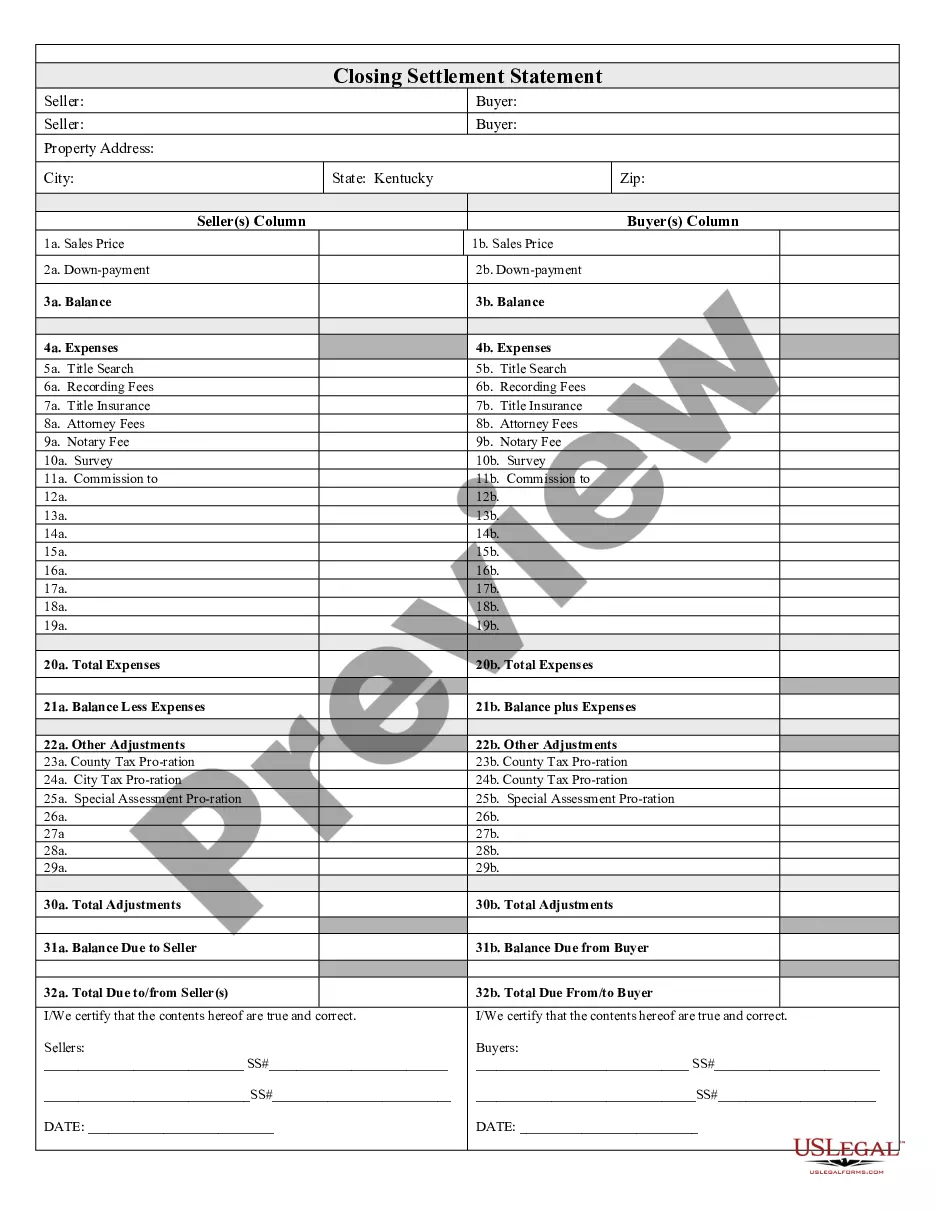

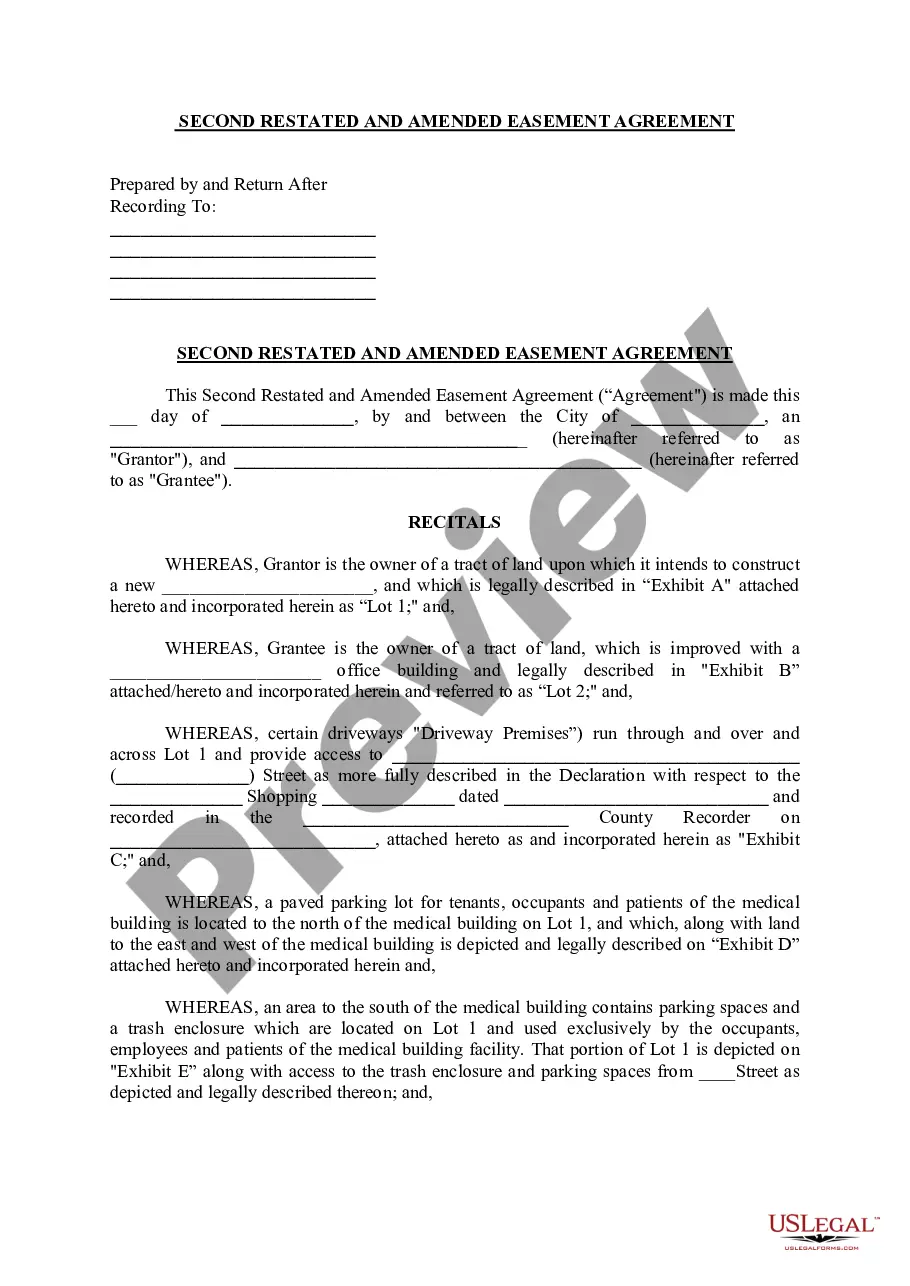

- Step 2. Utilize the Preview function to review the form’s content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

The direct write-off method of accounts receivable involves expensing uncollectible accounts immediately when they are deemed bad debts. This approach simplifies accounting because it does not require estimating doubtful accounts. However, it is important to document this with a South Dakota Accounts Receivable Write-Off Approval Form to ensure transparency and maintain accurate financial records.

An example of a write-off in accounting could involve a business recognizing that a customer is bankrupt, making the outstanding balance futile to collect. By utilizing a South Dakota Accounts Receivable Write-Off Approval Form, companies can formally document this financial event. This practice aids in maintaining clear records and enhancing the integrity of financial statements.

To record a write-off of accounts receivable, you need to create a journal entry that debits the allowance for doubtful accounts and credits the accounts receivable. Utilizing a South Dakota Accounts Receivable Write-Off Approval Form can streamline this process by providing a structured approach for recording uncollectible amounts. Proper documentation will also improve your financial reporting and compliance.

When you write off an account receivable, it reflects a significant decision that the amount will not be collected. This action changes the balance sheet by reducing both assets and retained earnings. Completing a South Dakota Accounts Receivable Write-Off Approval Form is crucial as it provides documentation for this financial adjustment, ensuring transparency in accounting practices.

In South Dakota, a debt can typically be collected for up to six years before it is deemed uncollectible. It is essential to keep track of your debts within this timeframe, as different types of debts may have varying rules. To facilitate debt management and resolution, consider leveraging the South Dakota Accounts Receivable Write-Off Approval Form.

South Dakota's tax revenue primarily comes from sales taxes and various fees rather than income tax. This strategic approach contributes to a business-friendly environment, attracting new enterprises. When dealing with accounts receivable, using the South Dakota Accounts Receivable Write-Off Approval Form can help in organizing and processing any tax obligations efficiently.

In South Dakota, a 10-year-old debt is generally considered uncollectible due to the six-year statute of limitations. However, collectors might still attempt contact, but they cannot take legal action. Utilizing the South Dakota Accounts Receivable Write-Off Approval Form can help clarify your position on older debts.

Debts in South Dakota typically become uncollectible after six years, but this period might differ depending on the circumstances. Once this time frame lapses, collectors lose the legal right to pursue the debt. Consider filing the South Dakota Accounts Receivable Write-Off Approval Form to properly document debts as they expire.

In South Dakota, debt collectors generally have six years to file a lawsuit after a debt becomes overdue. This time frame can vary based on the type of debt, but understanding your rights is crucial. If you encounter issues, using the South Dakota Accounts Receivable Write-Off Approval Form can provide clarity on your obligations and options.

The South Dakota Obligation Recovery Center is a state initiative designed to aid in debt collection while ensuring compliance with local laws. It serves as a platform where debtors can engage with creditors regarding their obligations. If you need assistance with managing debt, consider using the South Dakota Accounts Receivable Write-Off Approval Form to streamline the process.