South Dakota Daily Accounts Receivable

Description

How to fill out Daily Accounts Receivable?

It is feasible to spend hours online trying to locate the legal document template that meets the state and federal requirements you have. US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can download or print the South Dakota Daily Accounts Receivable from our service.

If you already possess a US Legal Forms account, you may Log In and then click the Acquire button. After that, you can complete, modify, print, or sign the South Dakota Daily Accounts Receivable. Every legal document template you purchase is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make modifications to your document if needed. You can complete, edit, sign, and print the South Dakota Daily Accounts Receivable. Obtain and print a wide range of document formats using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- To obtain an additional copy of any purchased form, visit the My documents section and click the associated option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the right document template for the state/city you select. Review the form details to confirm you have chosen the correct form.

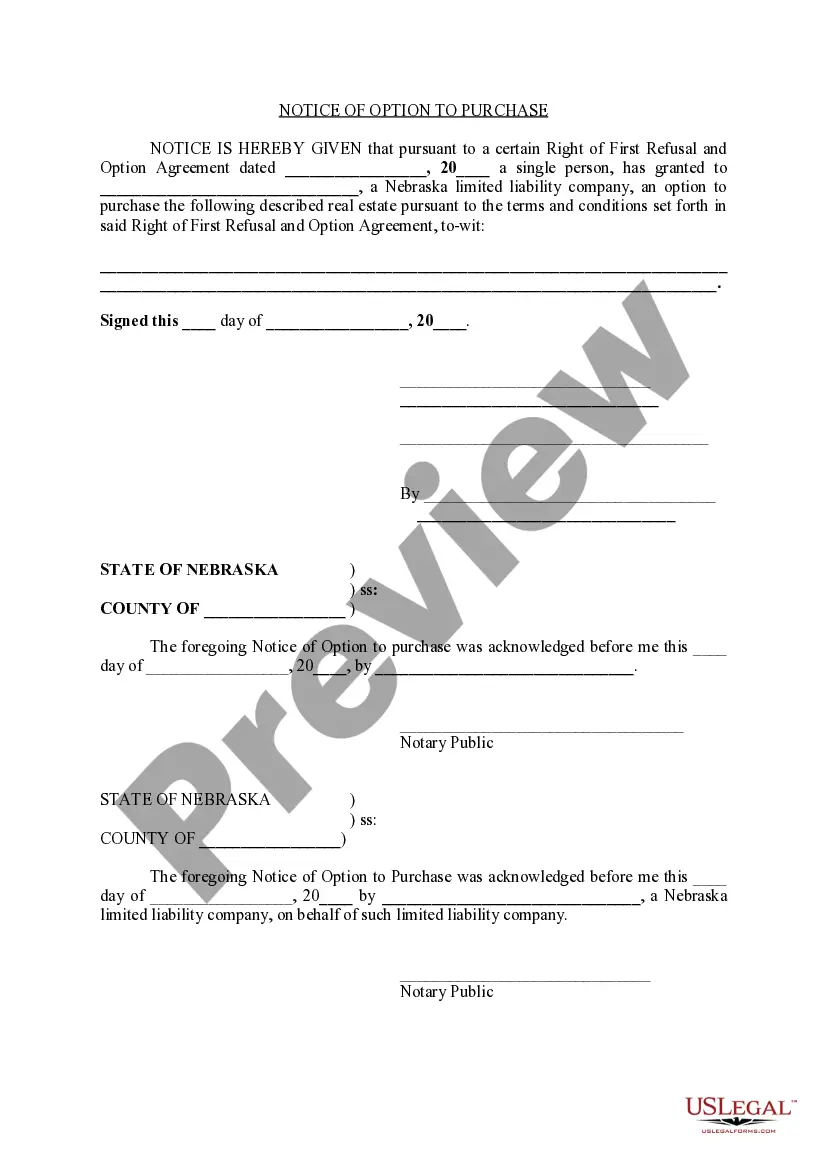

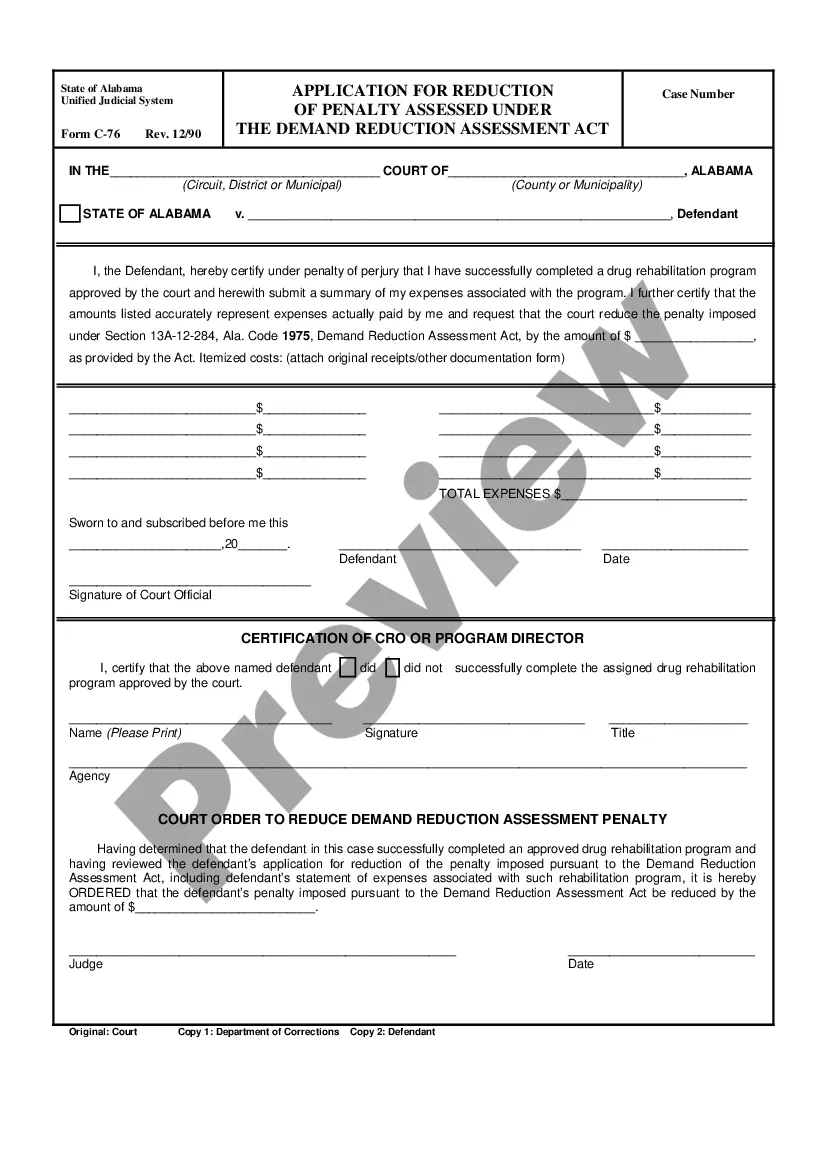

- If available, use the Preview option to review the document template as well.

- If you wish to find another version of the form, use the Search section to locate the template that fits your needs and requirements.

- Once you have found the template you want, click on Get now to move forward.

- Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

To calculate days in AR,Compute the average daily charges for the past several months add up the charges posted for the last six months and divide by the total number of days in those months.Divide the total accounts receivable by the average daily charges. The result is the Days in Accounts Receivable.

Aging of Accounts Receivables = (Average Accounts Receivables 360 Days)/Credit SalesAging of Accounts Receivables = ($ 4, 50,000.00360 days)/$ 9, 00,000.00.Aging of Accounts Receivables = 90 Days.

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. This report displays the amount of money owed to you by your customers for good and services purchased.

Debtor Days = (Receivables / Sales) 365 DaysDebtor Days = (3,000,000 / 20,000,000) 365.Debtor Days = 54.75 days.

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.

Key TakeawaysDividing 365 by the accounts receivable turnover ratio yields the accounts receivable turnover in days, which gives the average number of days it takes customers to pay their debts.

Use TODAY() to calculate days away. You might want to categorize the receivables into 30-day buckets. The formula in D4 will show 30 for any invoices that are between 30 and 59 days old. The formula is =INT(C6/30)30.

An accounts receivable aging report is a record that shows the unpaid invoice balances along with the duration for which they've been outstanding. This report helps businesses identify invoices that are open and allows them to keep on top of slow paying clients.

Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected.