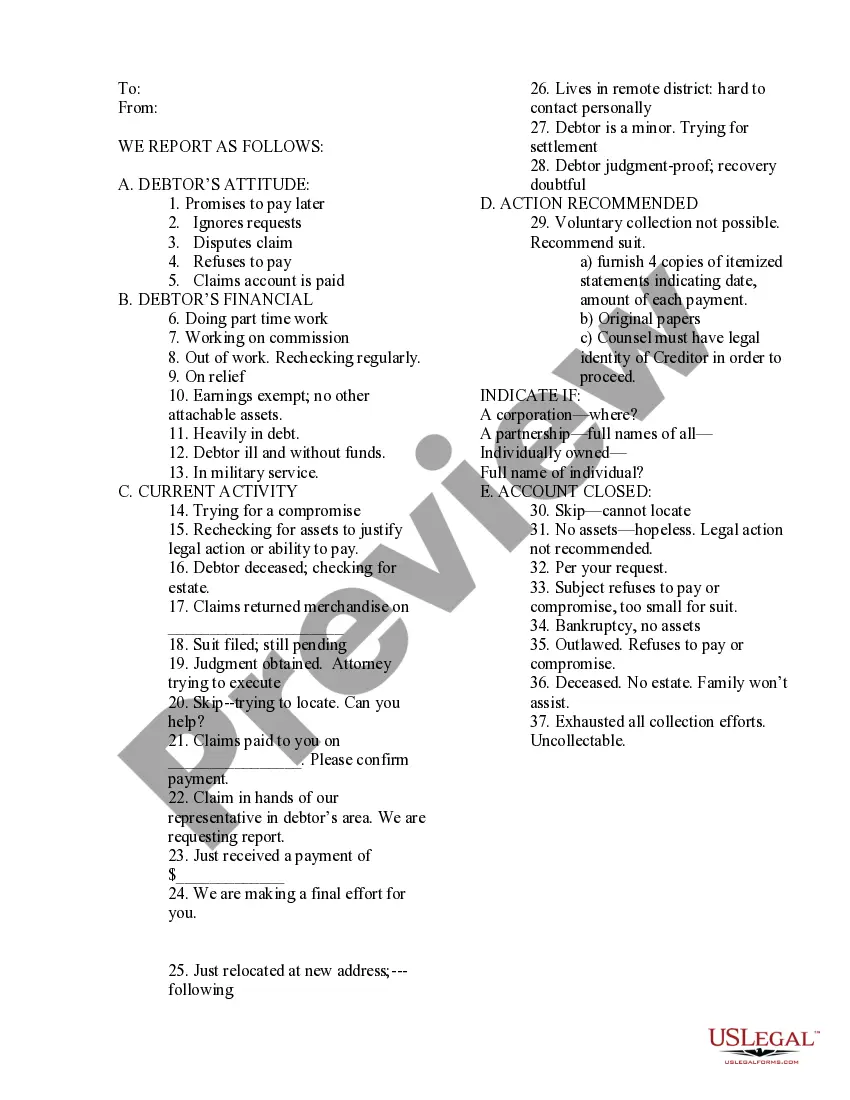

Louisiana Collection Report

Description

How to fill out Collection Report?

If you require to complete, acquire, or create sanctioned document templates, utilize US Legal Forms, the primary source of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need. A variety of forms for business and personal purposes are organized by categories and claims, or by keywords.

Utilize US Legal Forms to find the Louisiana Collection Report in just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every document you downloaded in your account.

Click the My documents section and select a document to print or download again. Compete and download, and print the Louisiana Collection Report with US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to obtain the Louisiana Collection Report.

- You can also access templates you have previously downloaded from the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you want, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it onto your device.

- Step 7. Fill out, modify and print or sign the Louisiana Collection Report.

Form popularity

FAQ

When a state department of revenue sends you a letter, it usually is to start a dialogue about proposed changes to your state return. You won't owe any tax to the state until you agree with the proposed changes.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Individual income tax liabilities may be paid electronically by an electronic bank account debit using the Louisiana File Online application or by credit card using Official Payments. Credit card payments may also be initiated by telephone at 1-888-272-9829. Credit card payments incur a 2.49 percent convenience fee.

Annual reports can only be filed within 30 days of renewal date. You have received a Renewal Notice from the Louisiana Secretary of State and can therefore file your annual report online by going to \\renewal and following the steps below. Review the information currently on file with our office.

What would you like to do?Check the status of your refund: WHERE'S MY REFUND?Send email inquiry concerning: Refund Status. Billing Notice Received.Submit an Address Change: Address Change Request.Contact the department at 1-855-307-3893.Provide feedback concerning your interaction with the department's Call Center.

Electronically using Louisiana File Online; By credit card using Official Payments ; By mail using the Louisiana Estimated Tax Declaration Voucher For Individuals, Form IT-540ES. Payments by check should be made to the Department of Revenue.

The office of debt recovery, within the Department of Revenue and the attorney general's office shall jointly serve as debt-collecting entities for any agency of the state and in that capacity shall collect delinquent debts on behalf of all agencies which refer delinquent debts to the office for collection.

What/who is the Office of Debt Recovery (ODR)? Act 399, through La. R.S. 76, established the ODR as a centralized debt collection unit authorized and required to collect delinquent debt owed to the state of Louisiana.

The statute of limitations for most Louisiana debts is 10 years. Louisiana exempts 75% of wages from garnishment. Louisiana does not allow liens on personal property.