Kentucky Closing Statement

What this document covers

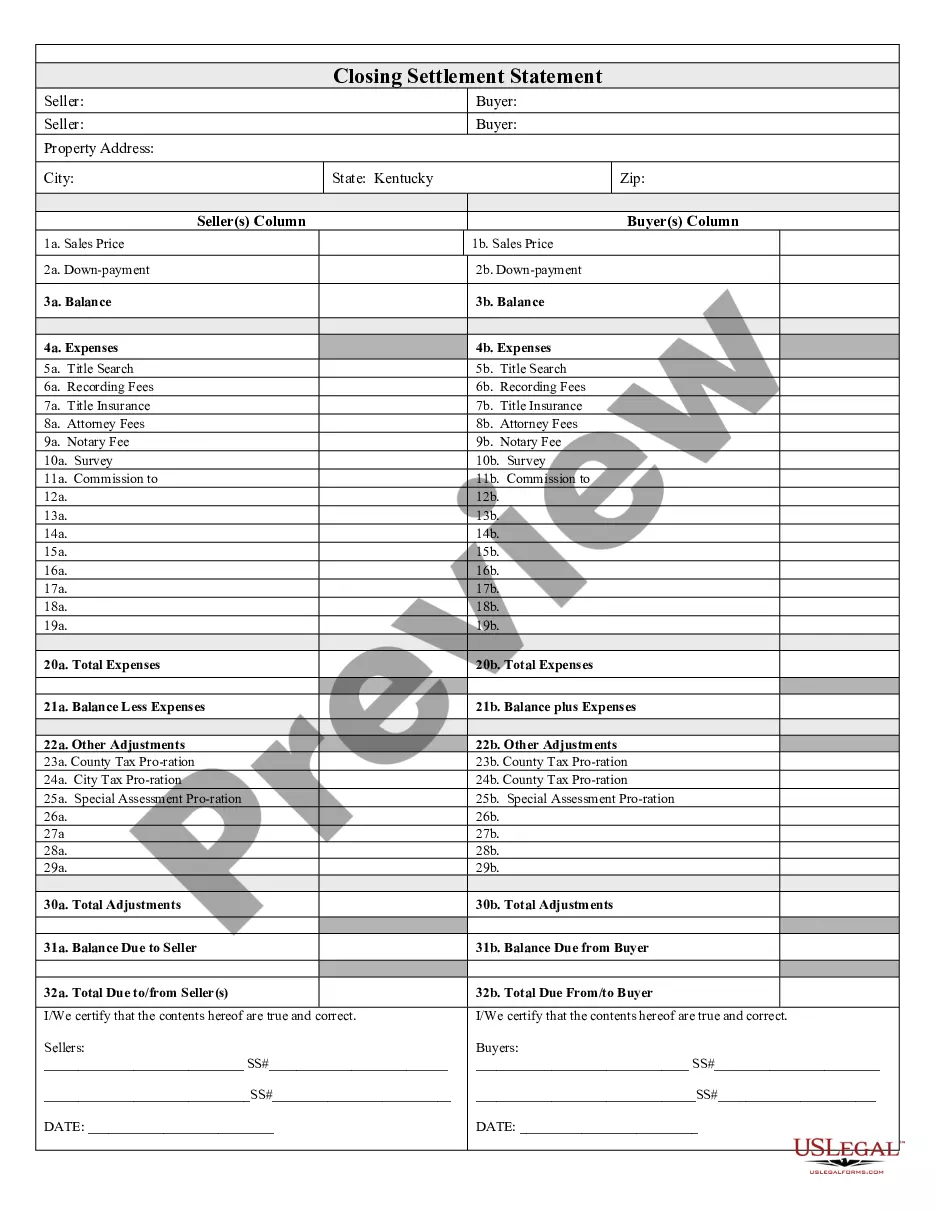

The Closing Statement is a crucial document used in real estate transactions, specifically for cash sales or owner-financed sales. It provides a comprehensive overview of all financial aspects of the transaction, including the costs incurred and the net amounts due to the buyer and seller upon closing. Unlike other real estate forms, it explicitly outlines the financial breakdown that both parties agree to, ensuring transparency and mutual understanding during the transaction process.

Key components of this form

- Balance: Shows the remaining amount after all expenses are deducted.

- Expenses: Lists various transaction expenses such as title search, recording fees, and attorney fees.

- Commission: Details any brokerage commissions agreed upon within the sale.

- Adjustments: Includes prorated county and city taxes as part of the net financial settlements.

- Certifications: Requires signatures from both sellers and buyers to confirm the accuracy of the statement.

Common use cases

This form is used during the closing process of a real estate transaction. It is essential in situations involving cash sales or owner financing. Use the Closing Statement to consolidate all costs and determine the financial settlement between the buyer and seller before finalizing the sale.

Intended users of this form

- Sellers and buyers in a real estate transaction.

- Real estate agents facilitating cash or owner-financed sales.

- Attorneys assisting with real estate closings.

How to prepare this document

- Identify the parties involved: Include full names of the seller and the buyer.

- Specify the property: Provide details about the property being sold.

- Enter all relevant expenses: Fill out expenses such as title search, recording fees, and taxes owed.

- Calculate total adjustments: Ensure any prorated amounts are accurately reflected.

- Obtain signatures: Both parties must sign and date the form to certify its accuracy.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Neglecting to include all applicable expenses in the statement.

- Failing to obtain signatures from both the buyer and seller.

- Incorrectly calculating prorated taxes or adjustments.

Benefits of completing this form online

- Convenient access: Download and fill out the form at your convenience.

- Editability: Easily make changes as needed before finalization.

- Reliability: Use a professionally drafted form that complies with legal standards.

What to keep in mind

- The Closing Statement is essential for clarifying financial details in real estate transactions.

- Both parties must review and sign the document to formalize the agreement.

- Accuracy in calculating expenses and adjustments is key to avoid disputes.

Looking for another form?

Form popularity

FAQ

According to data from ClosingCorp, the average closing cost in Kentucky is $2,276 after taxes, or approximately 1.14% to 2.28% of the final home sale price.

Alabama. Connecticut. Delaware. District of Columbia. Florida. Georgia. Kansas. Kentucky.

A settlement agent is also referred to as a closing agent. The closing agent's role is to make sure all parties involved receive required documents during a mortgage loan closing. They provide escrow instructions to third parties like real estate agents, to receive funds such as fees and commissions.

On average, sellers will have to pay about 1%-3% of their home's sale price in closing costs. This is on top of the typical 6% real estate commission. All this money due at closing can add up quickly, so if you have a low amount of equity in your home be sure to prepare yourself.

The so-called escrow states are California, Washington, Oregon, Texas, Nevada, New Mexico and Arizona.

The reality is having an attorney in your corner, especially at closing, protects you from documentation issues, titling errors and costly lawsuits. Most states don't require that sellers obtain legal representationbut even so, in certain cases, it would be reckless not to lawyer up.

The problem is that closing will be delayed because of a mortgage issue. What can we do? Figures from the National Association of Realtors (NAR) say that about three-quarters (76 percent) of all existing home sales close on time.

Several states have laws on the books mandating the physical presence of an attorney or other types of involvement at real estate closings, including: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New

Problems with a bank appraisal are a very common reason why a real estate closing can be delayed. The reasons issues that arise from a bank appraisal can delay a closing can vary from a home that under appraises and the buyer and seller cannot come to new terms or because of repairs that are required by the appraiser.