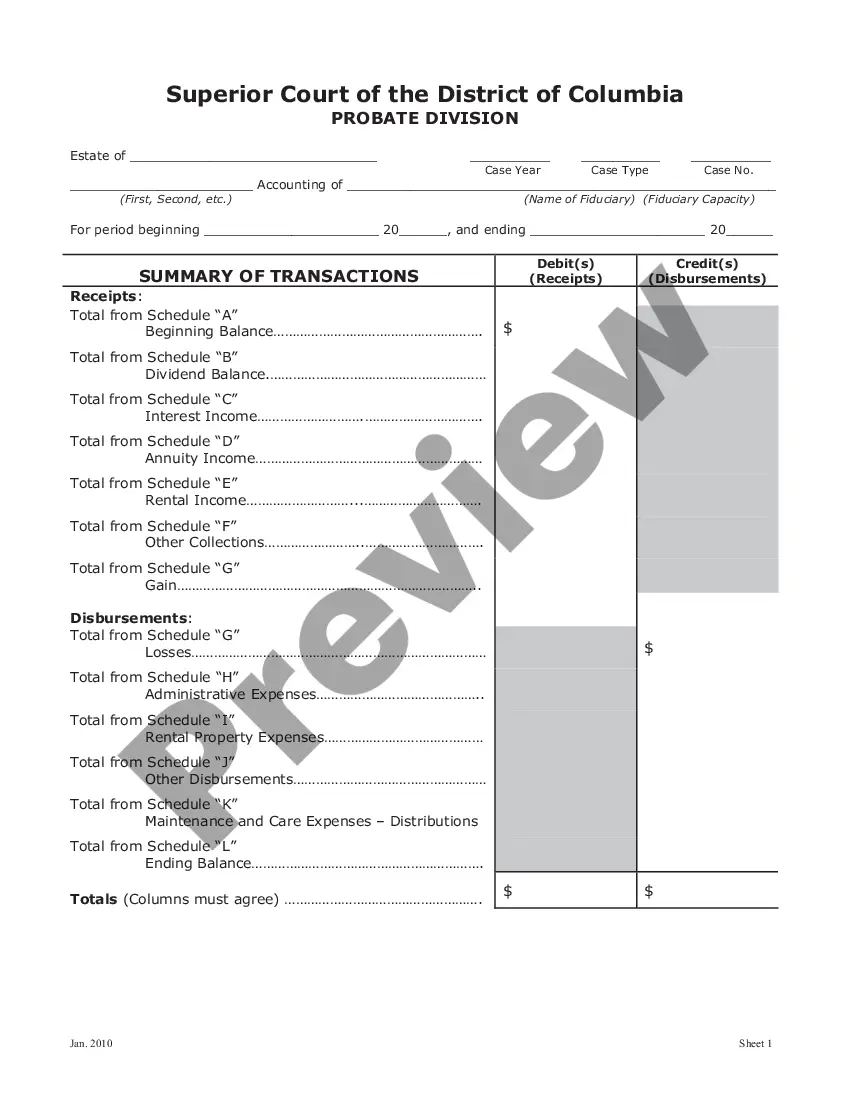

District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981

Description

How to fill out District Of Columbia Statement Of Account (and All Attached Sheets) And Order And Order - For Decedents Dying On And After January 1, 1981?

US Legal Forms is the most simple and lucrative method to discover suitable legal templates.

It boasts the largest online collection of business and personal legal documents created and validated by lawyers.

Here, you can locate printable and editable templates that adhere to federal and state regulations - just like your District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981.

Review the form description or preview the document to ensure you’ve located the one that matches your needs, or discover another using the search feature above.

Select Buy now when you’re confident of its suitability with all the criteria, and choose the subscription plan that suits you best.

- Acquiring your template involves just a few straightforward steps.

- Users with an existing account and an active subscription simply need to Log In to the site and download the document onto their device.

- Afterwards, they can access it in their profile under the My documents section.

- And here’s how you can secure a professionally prepared District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981 if you are using US Legal Forms for the first time.

Form popularity

FAQ

Yes, in D.C., a will generally must be probated to ensure that the decedent's estate is administered according to their wishes. This process validates the will and allows for the distribution of assets as intended. However, certain assets may bypass probate if they're jointly owned or have designated beneficiaries. To clarify these details, refer to the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981.

In Washington, D.C., the duration of probate can range from a few months to over a year. Factors such as estate size, asset types, and potential disputes influence the timing. A well-organized estate can minimize delays, making the process smoother. Being informed about the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981, is essential for managing expectations.

The probate process in D.C. varies, typically lasting from a few months to a year, depending on the complexity of the estate. If the estate is straightforward, it may conclude more quickly. However, disputes or claims against the estate can extend the timeframe significantly. Understanding these timelines can help you navigate the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981.

To avoid probate in Washington, D.C., consider establishing a trust, which allows your assets to be transferred outside probate. Additionally, designating beneficiaries on your accounts can simplify the transfer process. You may also use joint ownership for property, ensuring that assets pass directly to co-owners. It’s essential to document these arrangements clearly to complement the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981.

To avoid probate in the District of Columbia, consider establishing living trusts, making gifts while you are alive, or designating beneficiaries on accounts. These methods can help transfer assets directly to beneficiaries without going through probate. Additionally, understanding the implications of the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981 is essential in simplifying the estate administration process. Explore these options to protect your assets and your loved ones.

Probate is generally required in the District of Columbia when a deceased person leaves behind assets in their name. However, there are exceptions, especially if the assets are held in a trust or if they pass directly to a beneficiary. The necessity for probate also depends on the specifics of the estate and its relationship to the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981. Consulting with a legal professional can clarify whether probate is needed for your situation.

To change your address in the DC Court of Appeals, you must file a notice of change of address with the court. This change is crucial for ensuring you receive all relevant documents regarding your case, including any matters relating to the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981. Follow the court's specific guidelines and verify that your information is updated promptly.

Yes, there is a set timeframe for starting probate in the District of Columbia. Typically, you should initiate probate within three years after the decedent's death. After this period, assets may not be obtainable, complicating the distribution process and affecting the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981. It's wise to consult with a legal expert to ensure you meet all necessary deadlines.

In the District of Columbia, you generally have 90 days from the date of a person's death to file for probate. This timeframe is important to ensure that the estate is administered correctly under DC law. Delaying the filing may complicate matters, especially concerning the District of Columbia Statement of Account (and All Attached Sheets) and Order and Order - For Decedents Dying On and After January 1, 1981. To avoid any issues, consider starting the process promptly.