The Pennsylvania instructions for Tax Assessment Appeals from the Decision of the Board of Assessment Appeals can be divided into two categories: appeals by petition and appeals by notice. Appeals by Petition: Appeals by petition are used when taxpayers disagree with the decisions of the Board of Assessment Appeals. These appeals are filed in the county court of common pleas. The petition must be filed within 30 days of the date the Board of Assessment Appeals’ decision is mailed. The petition must include a statement of the facts and grounds on which the taxpayer is basing the appeal and the amount of the assessment that the taxpayer is challenging. The court will notify the Board of Assessment Appeals and the local taxing authority of the appeal. The court will then conduct a hearing to determine the validity of the appeal. Appeals by Notice: Appeals by notice are used when the taxpayer disagrees with the assessment of the local taxing authority. Taxpayers must file a notice of appeal with the local taxing authority within 30 days of the date the assessment is mailed. The notice must include a statement of the facts and grounds on which the taxpayer is basing the appeal and the amount of the assessment that the taxpayer is challenging. The local taxing authority must then provide notice to the Board of Assessment Appeals and the taxpayer of the appeal. The Board of Assessment Appeals will then hold a hearing to determine the validity of the appeal. Keywords: Pennsylvania, Tax Assessment Appeals, Board of Assessment Appeals, appeals by petition, appeals by notice, petition, notice, county court of common pleas, local taxing authority, statement of facts, grounds, assessment, hearing.

Pennsylvania instructions for Tax Assessment Appeals from the Decision of the Board of Assessment Appeals

Description

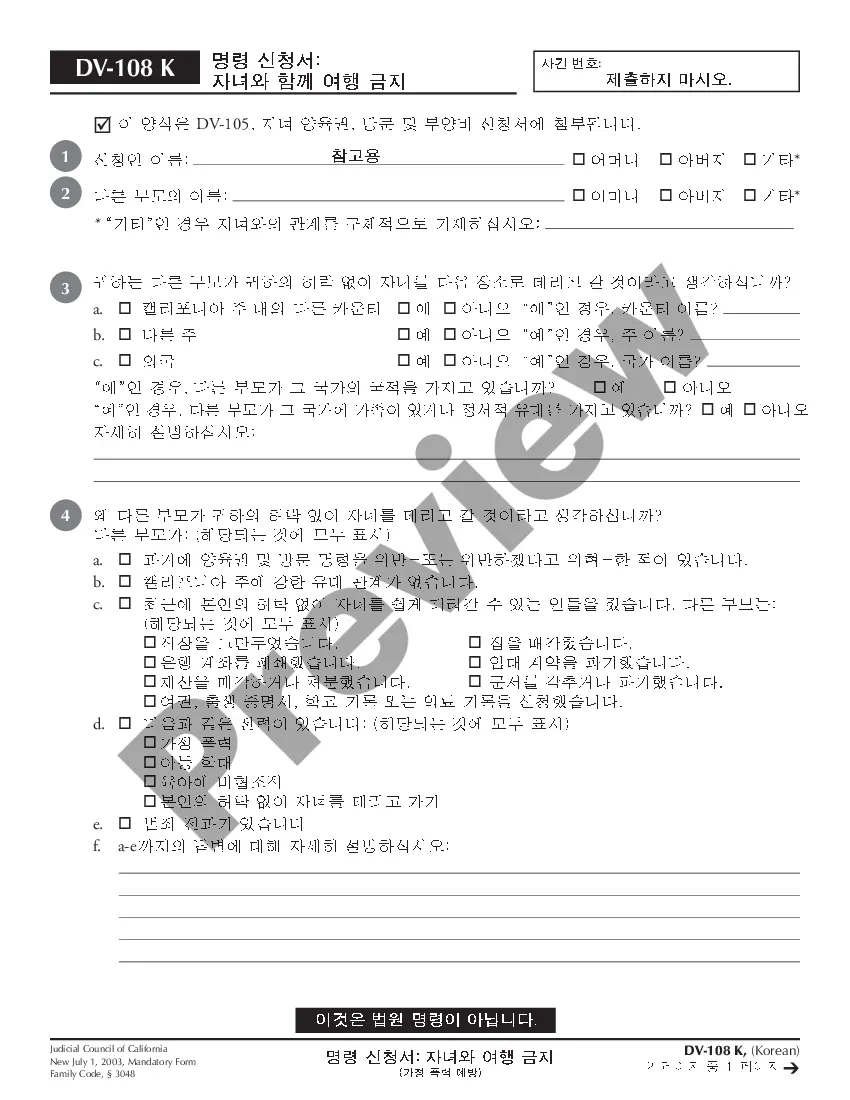

How to fill out Pennsylvania Instructions For Tax Assessment Appeals From The Decision Of The Board Of Assessment Appeals?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our experts. So if you need to prepare Pennsylvania instructions for Tax Assessment Appeals from the Decision of the Board of Assessment Appeals, our service is the perfect place to download it.

Obtaining your Pennsylvania instructions for Tax Assessment Appeals from the Decision of the Board of Assessment Appeals from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance check. You should attentively review the content of the form you want and check whether it suits your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Pennsylvania instructions for Tax Assessment Appeals from the Decision of the Board of Assessment Appeals and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Pennsylvania will continue its broad-based property tax relief in 2023-24 based on Special Session Act 1 of 2006. The Commonwealth's Budget Secretary certified that $777,200,000 in state-funded local tax relief will be available in 2023-24.

After you're convicted, you have 10 days to file a motion with the trial court. Once the court receives the motion, you then have 30 days to file a motion of appeal. The Pennsylvania Courts' appeals deadlines are strict, and submitting the required documents late will prevent you from seeking your appeal.

The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

Real estate taxes are calculated for each property, based on the Fair Market Value at a given point in time (base-year). This base-year value is used for assessments each year until a new base-year is established by a countywide reassessment. Ideally, a county should reassess all properties every three or four years.

Age requirements A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

You can file a petition electronically at .boardofappeals.state.pa.us. When an online appeal is submitted, the petitioner will be provided with a confirmation number that the appeal has been received. The petitioner should keep a record of that confirmation number.

The function of an appeals board is to determine the full value of property or to determine other matters of property tax assessment over which the appeals board has jurisdiction.

The Board of Revision of Taxes (BRT) hears property assessment appeals. The Office of Property Assessment (OPA) decides the dollar-value of every piece of real estate within Philadelphia and that value determines how much property tax is owed. Owners who disagree with the OPA can file an appeal with the BRT.