South Dakota Disclaimer of Inheritance Rights for Stepchildren

Description

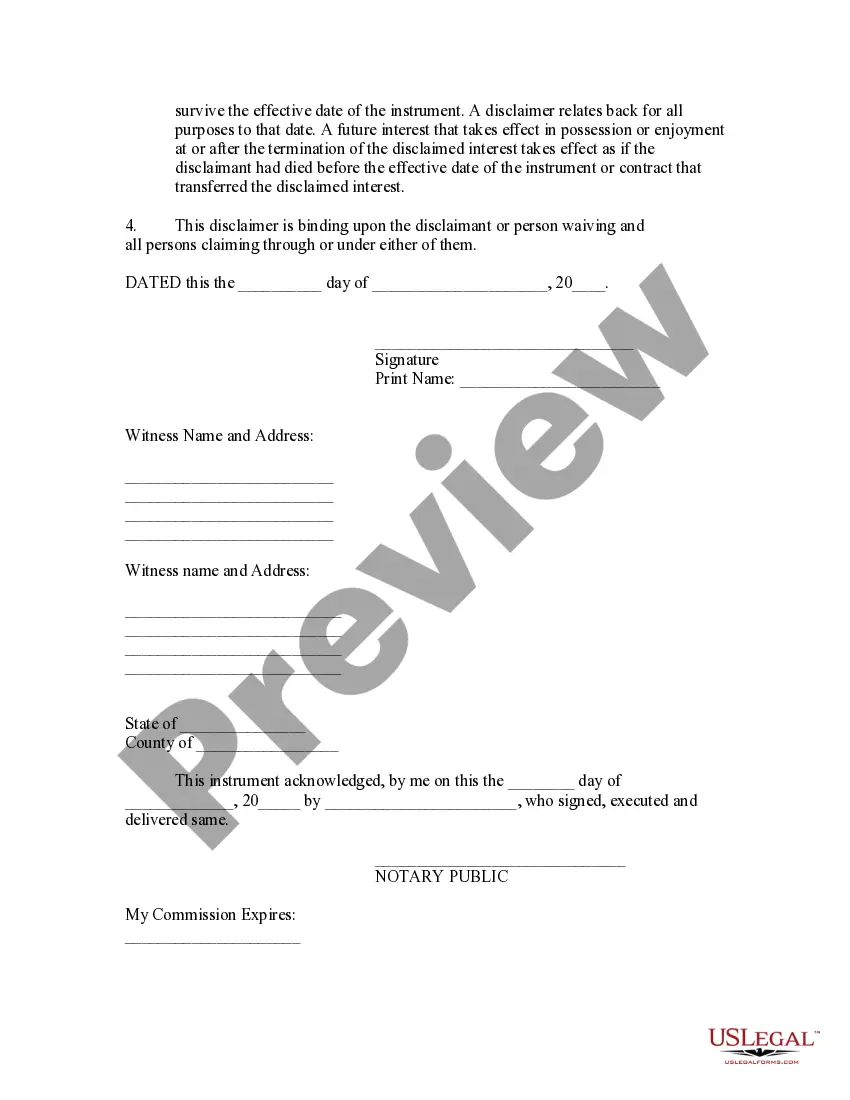

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

You may invest several hours on-line trying to find the authorized record web template that meets the state and federal requirements you require. US Legal Forms offers a large number of authorized forms that are analyzed by experts. You can easily acquire or printing the South Dakota Disclaimer of Inheritance Rights for Stepchildren from my assistance.

If you currently have a US Legal Forms account, it is possible to log in and then click the Download key. Following that, it is possible to total, modify, printing, or sign the South Dakota Disclaimer of Inheritance Rights for Stepchildren. Every authorized record web template you get is your own eternally. To have yet another version of any purchased develop, check out the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms internet site the first time, keep to the basic directions under:

- Very first, ensure that you have chosen the right record web template for your area/city of your choice. Browse the develop description to make sure you have picked the appropriate develop. If accessible, utilize the Review key to search with the record web template as well.

- In order to locate yet another model from the develop, utilize the Look for industry to get the web template that suits you and requirements.

- When you have found the web template you desire, click Purchase now to proceed.

- Choose the rates strategy you desire, type your credentials, and register for an account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal account to purchase the authorized develop.

- Choose the file format from the record and acquire it to the gadget.

- Make changes to the record if possible. You may total, modify and sign and printing South Dakota Disclaimer of Inheritance Rights for Stepchildren.

Download and printing a large number of record layouts while using US Legal Forms site, which provides the largest collection of authorized forms. Use professional and condition-distinct layouts to tackle your business or specific needs.

Form popularity

FAQ

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

South Dakota law does not allow a person to completely disinherit a spouse. If your spouse has recently passed away and their will leaves you nothing or very little, you can contest the will and take an ?elective share? of the augmented estate based on the number of years you've been married.

Inheritance and gifts are considered separate assets in South Dakota. It does not matter when they were acquired. They can become marital assets if a spouse commingles those assets into a joint bank account, or both spouses get use and enjoyment from them.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

It involves proving the will is valid, identifying and inventorying the deceased person's property, having the property appraised, paying debts and taxes, and distributing the remaining property as the will directs. In South Dakota, the cost for probate can range from $2,700 to $6,950 or more.