South Dakota Renunciation of Legacy by Child of Testator

Description

How to fill out Renunciation Of Legacy By Child Of Testator?

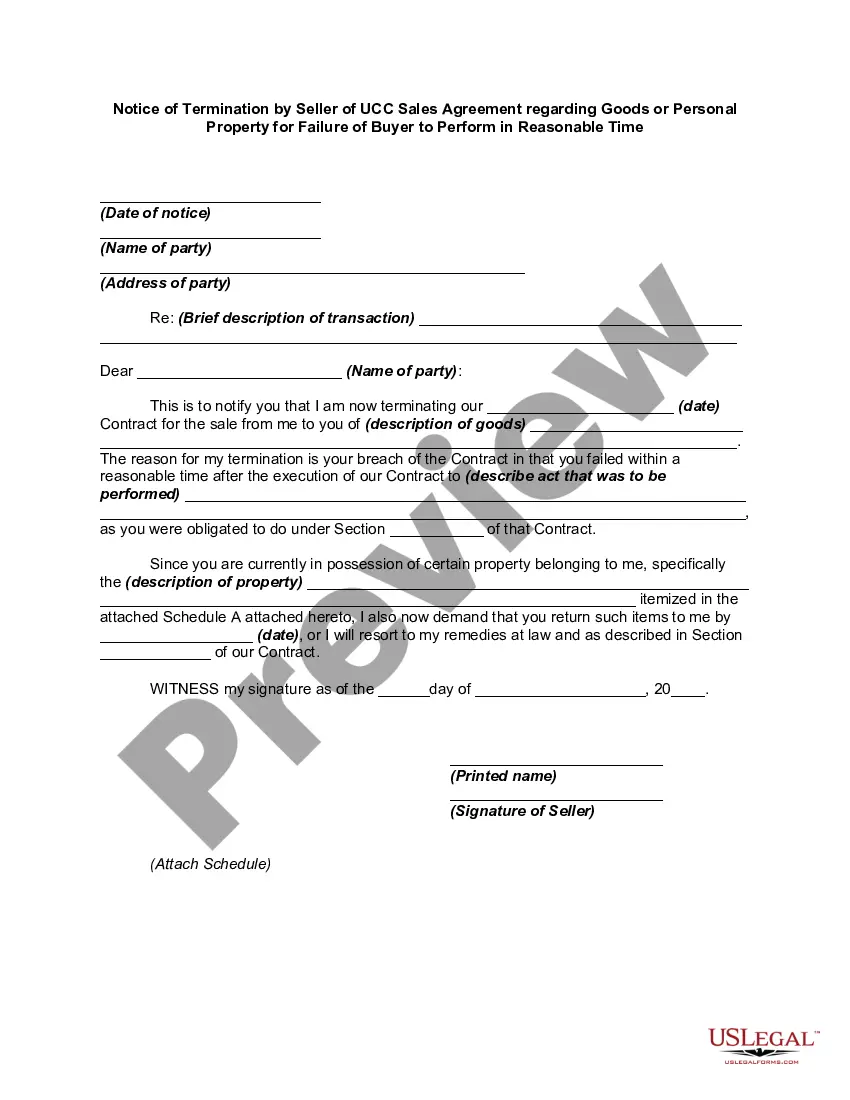

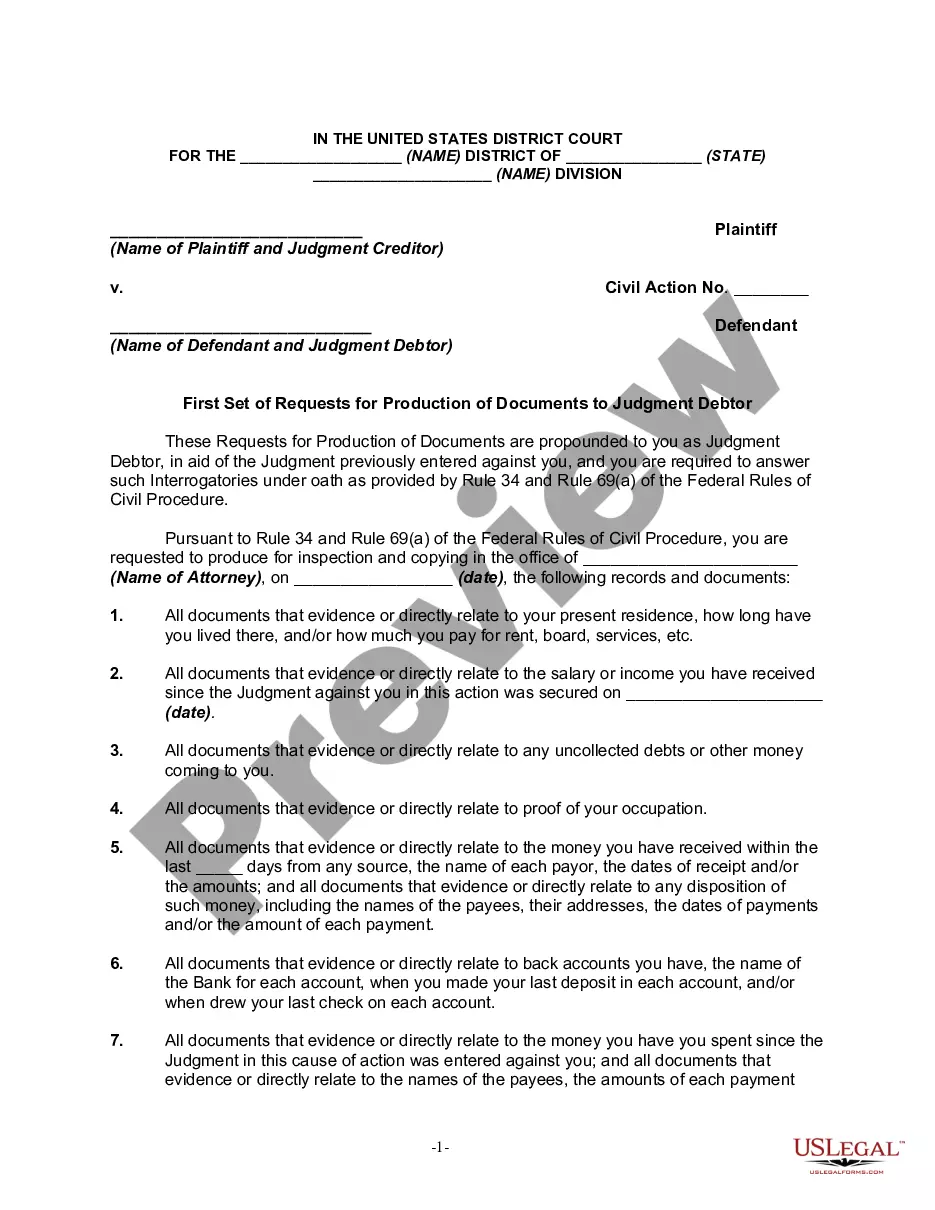

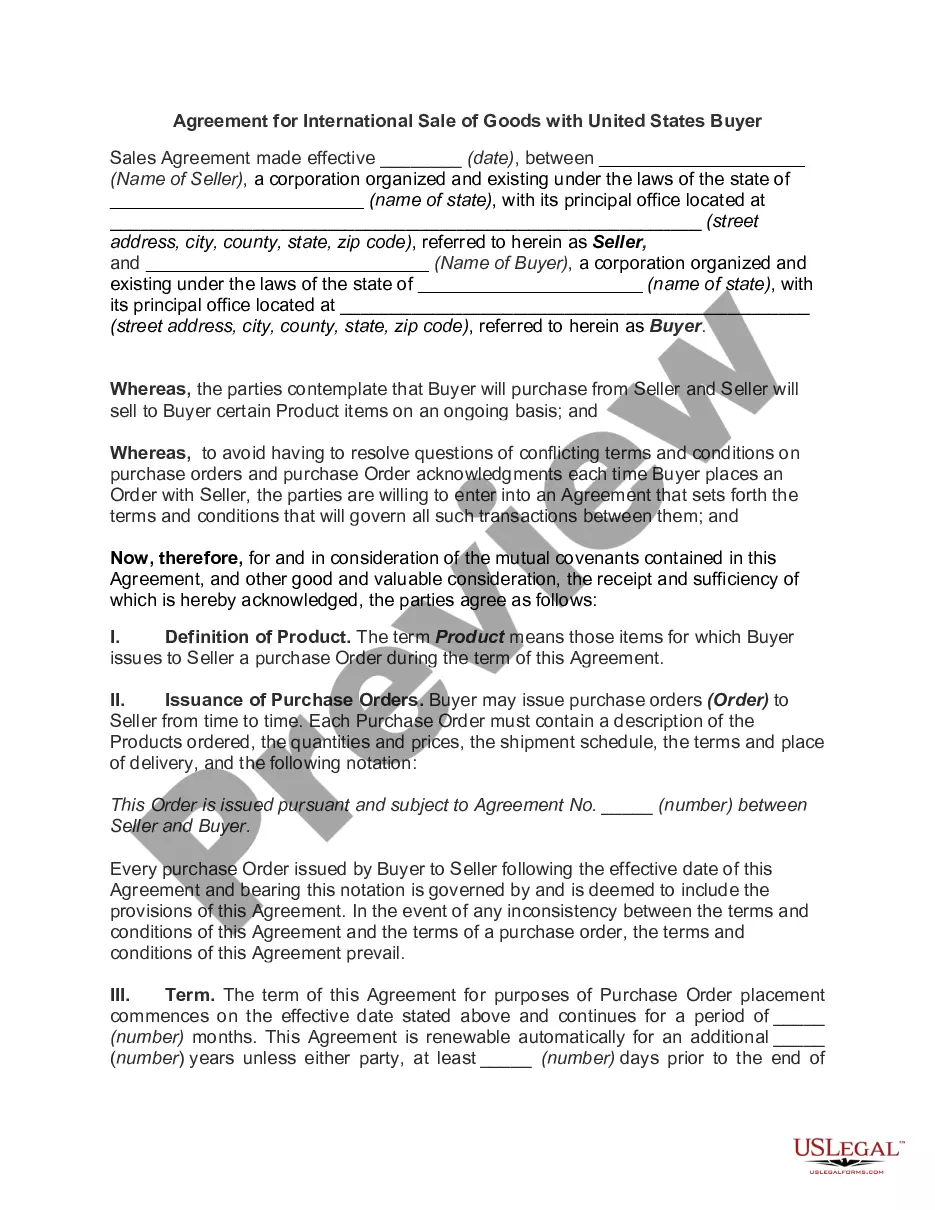

Finding the right authorized record design can be a struggle. Naturally, there are a lot of templates available on the Internet, but how can you find the authorized form you need? Take advantage of the US Legal Forms website. The services gives 1000s of templates, for example the South Dakota Renunciation of Legacy by Child of Testator, which can be used for business and private requires. Each of the forms are checked out by pros and satisfy state and federal specifications.

In case you are previously registered, log in for your account and then click the Download option to have the South Dakota Renunciation of Legacy by Child of Testator. Utilize your account to look with the authorized forms you have bought previously. Proceed to the My Forms tab of the account and acquire an additional copy of the record you need.

In case you are a whole new user of US Legal Forms, listed here are basic recommendations that you can comply with:

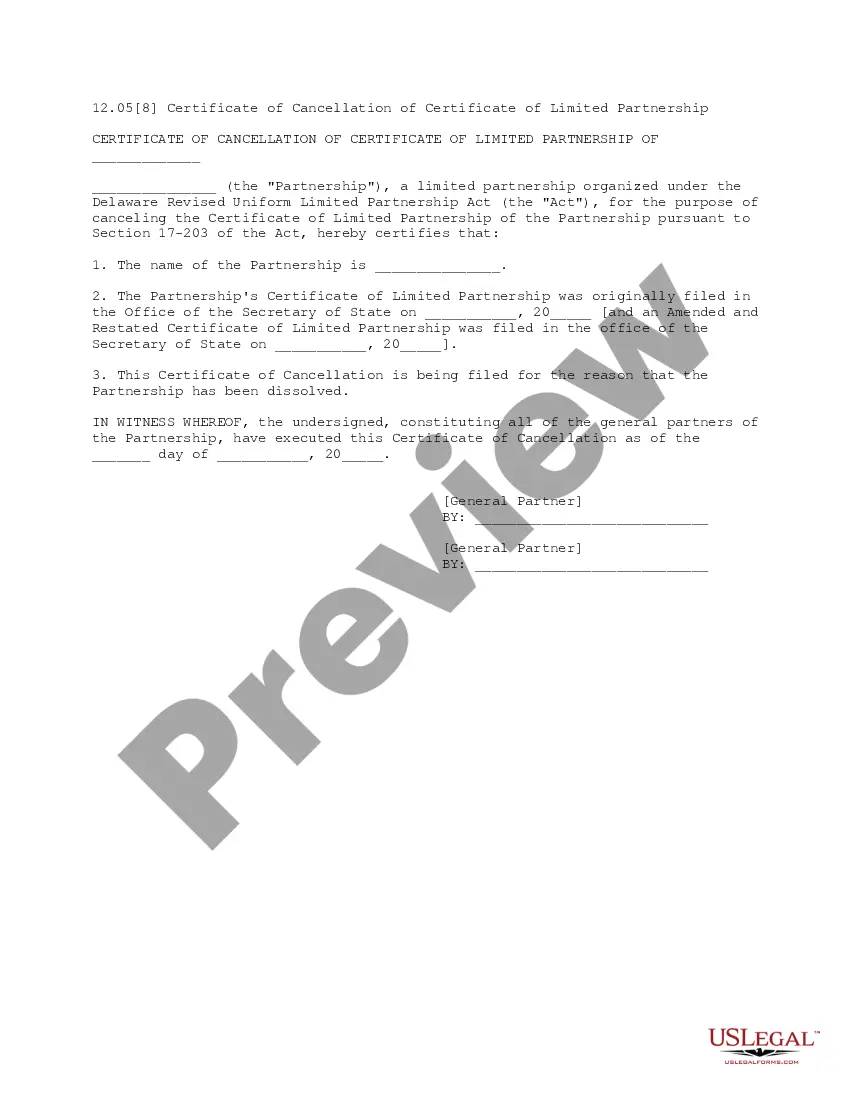

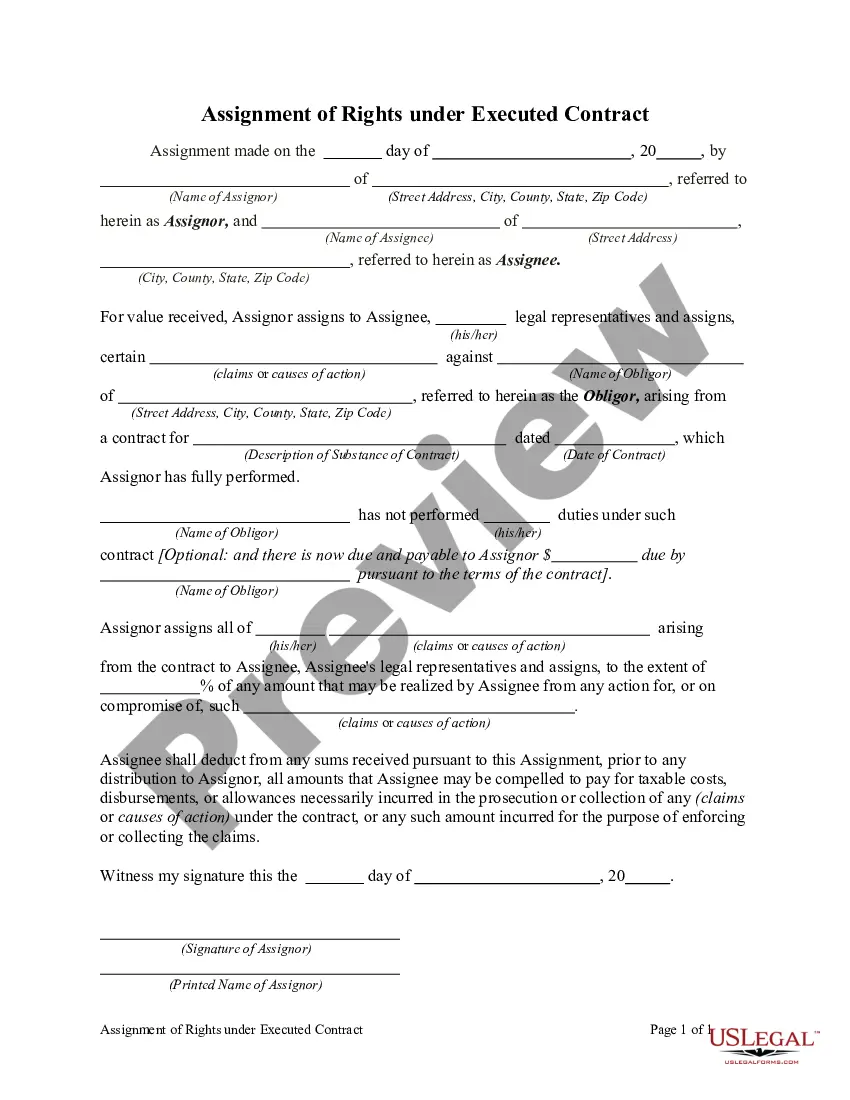

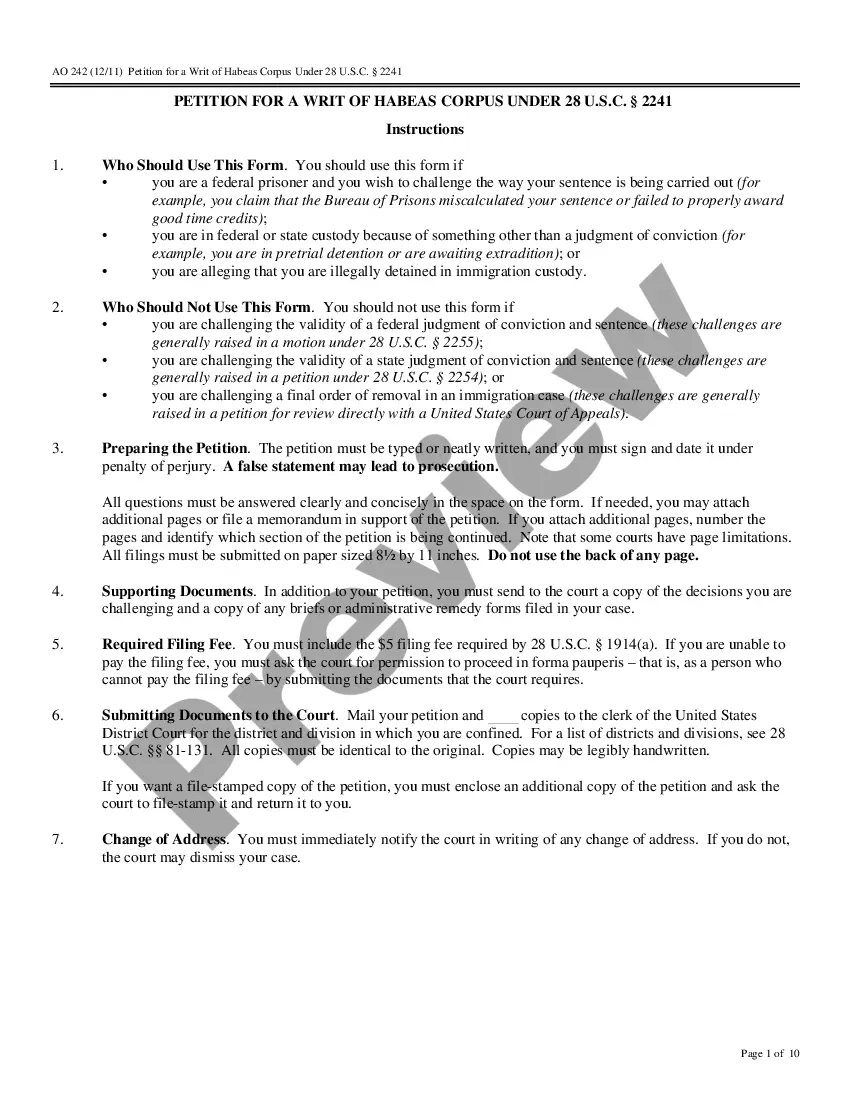

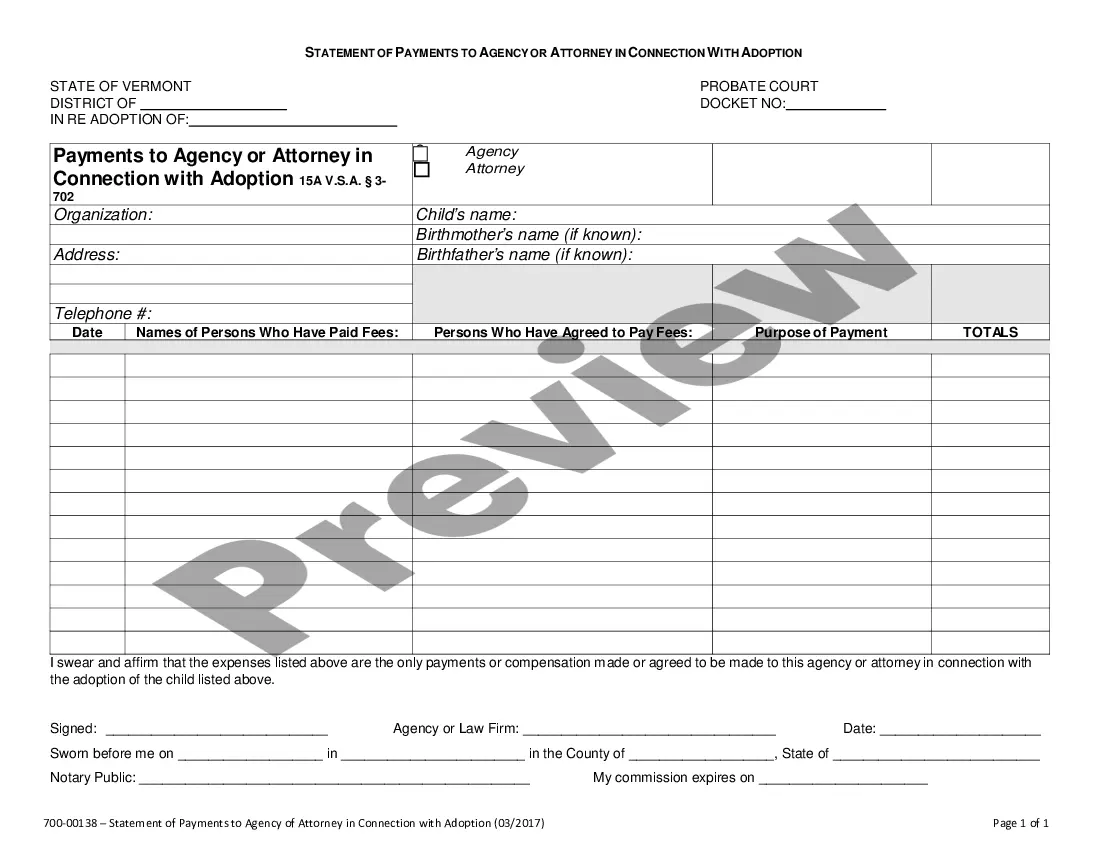

- Very first, ensure you have chosen the correct form for your personal town/area. You may check out the shape using the Review option and browse the shape description to make certain this is basically the right one for you.

- In case the form will not satisfy your expectations, use the Seach field to discover the proper form.

- Once you are positive that the shape would work, select the Purchase now option to have the form.

- Pick the pricing prepare you would like and enter the essential information. Build your account and pay money for the transaction using your PayPal account or credit card.

- Select the file format and obtain the authorized record design for your device.

- Comprehensive, edit and produce and sign the acquired South Dakota Renunciation of Legacy by Child of Testator.

US Legal Forms may be the most significant collection of authorized forms in which you will find a variety of record templates. Take advantage of the service to obtain expertly-created documents that comply with state specifications.

Form popularity

FAQ

Under Internal Revenue Service (IRS) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your "irrevocable and unqualified" intent to refuse the bequest. How to refuse an inheritance | .com ? articles ? how-to-refuse-an... .com ? articles ? how-to-refuse-an...

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything. A Guide to South Dakota Inheritance Laws - SmartAsset smartasset.com ? financial-advisor ? south-dakota-... smartasset.com ? financial-advisor ? south-dakota-...

Codified Laws § 25-7-15. The parent of any child under the age of ten years and any person to whom any such child has been confided for nurture or education who deserts such child in any place with intent to wholly abandon the child, is guilty of a Class 4 felony. Desertion of child under ten as felony, S.D. Codified Laws § 25-7-15 casetext.com ? chapter-7-support-obligations ? sec... casetext.com ? chapter-7-support-obligations ? sec...

Forgery--Felony. Any person who, with intent to defraud, falsely makes, completes, or alters a written instrument of any kind, or passes any forged instrument of any kind is guilty of forgery. Forgery is a Class 5 felony.

To citizens of South Dakota: SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Government entities must provide an exemption certificate to the vendor or the vendor must keep documentation to show the purchase was paid from government funds. SDCL 10-45-10 exempts from sales tax the sale of products and ... sd.gov ? BTExemptionLetter-StateAuditor sd.gov ? BTExemptionLetter-StateAuditor