South Dakota Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

You are able to spend several hours on the Internet trying to find the legitimate file web template that meets the state and federal needs you require. US Legal Forms gives a huge number of legitimate kinds which are examined by pros. You can actually obtain or printing the South Dakota Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages from the services.

If you already have a US Legal Forms profile, it is possible to log in and click on the Acquire option. Afterward, it is possible to complete, revise, printing, or indicator the South Dakota Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages. Each legitimate file web template you purchase is the one you have for a long time. To obtain another copy associated with a purchased type, go to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms web site initially, stick to the straightforward instructions listed below:

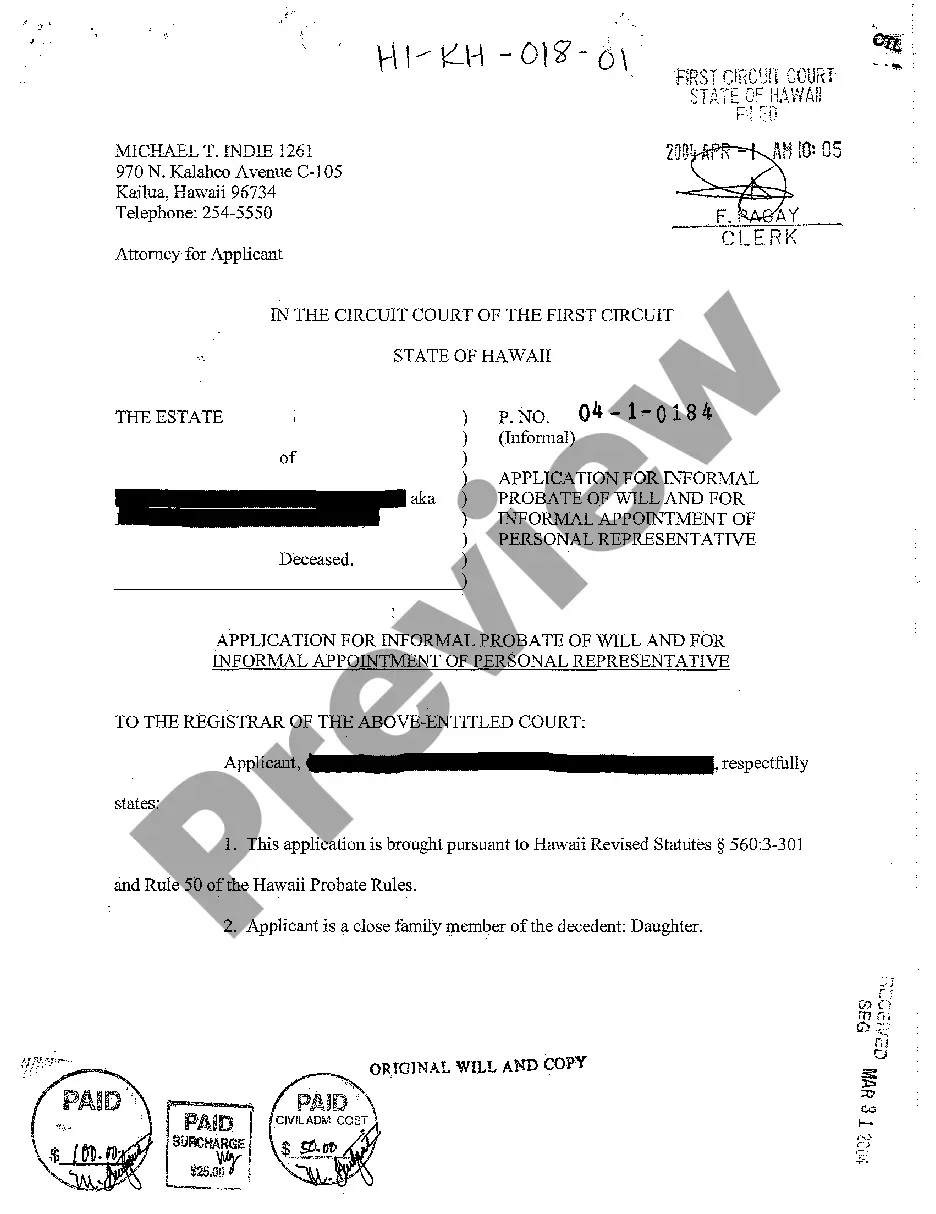

- First, make sure that you have chosen the correct file web template to the county/area of your choice. See the type outline to ensure you have chosen the appropriate type. If offered, utilize the Review option to appear from the file web template as well.

- If you would like discover another model of your type, utilize the Search field to obtain the web template that meets your needs and needs.

- Once you have identified the web template you would like, click Purchase now to proceed.

- Pick the rates prepare you would like, type your accreditations, and register for your account on US Legal Forms.

- Full the transaction. You should use your credit card or PayPal profile to cover the legitimate type.

- Pick the formatting of your file and obtain it for your gadget.

- Make adjustments for your file if needed. You are able to complete, revise and indicator and printing South Dakota Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages.

Acquire and printing a huge number of file themes making use of the US Legal Forms web site, which offers the biggest variety of legitimate kinds. Use expert and status-particular themes to deal with your business or person demands.

Form popularity

FAQ

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

Unmarried Individuals Without Children in South Dakota Inheritance Law Intestate Succession: Extended FamilyChildren, but unmarriedEntire estate to childrenParents, but no spouse, children, or siblingsEntire estate to parentsParents are deceased, and no spouse or childrenEntire estate goes to siblings.1 more row ?

South Dakota law does not allow a person to completely disinherit a spouse. If your spouse has recently passed away and their will leaves you nothing or very little, you can contest the will and take an ?elective share? of the augmented estate based on the number of years you've been married.

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

Inheritance and gifts are considered separate assets in South Dakota. It does not matter when they were acquired. They can become marital assets if a spouse commingles those assets into a joint bank account, or both spouses get use and enjoyment from them.

It involves proving the will is valid, identifying and inventorying the deceased person's property, having the property appraised, paying debts and taxes, and distributing the remaining property as the will directs. In South Dakota, the cost for probate can range from $2,700 to $6,950 or more.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.