New York Minutes for Partnership

Description

How to fill out Minutes For Partnership?

Finding the correct legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you obtain the legal form you require.

Utilize the US Legal Forms site. This service provides thousands of templates, including the New York Minutes for Partnership, which can be used for business and personal purposes.

All templates are reviewed by experts and comply with federal and state regulations.

If the form does not meet your needs, use the Search field to find the appropriate template. Once you are confident that the form is correct, click the Order now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the received New York Minutes for Partnership. US Legal Forms is the largest directory of legal templates where you can find various document formats. Utilize this service to acquire professionally crafted paperwork that adheres to state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the New York Minutes for Partnership.

- Use your account to browse the legal forms you have previously purchased.

- Go to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your location/region.

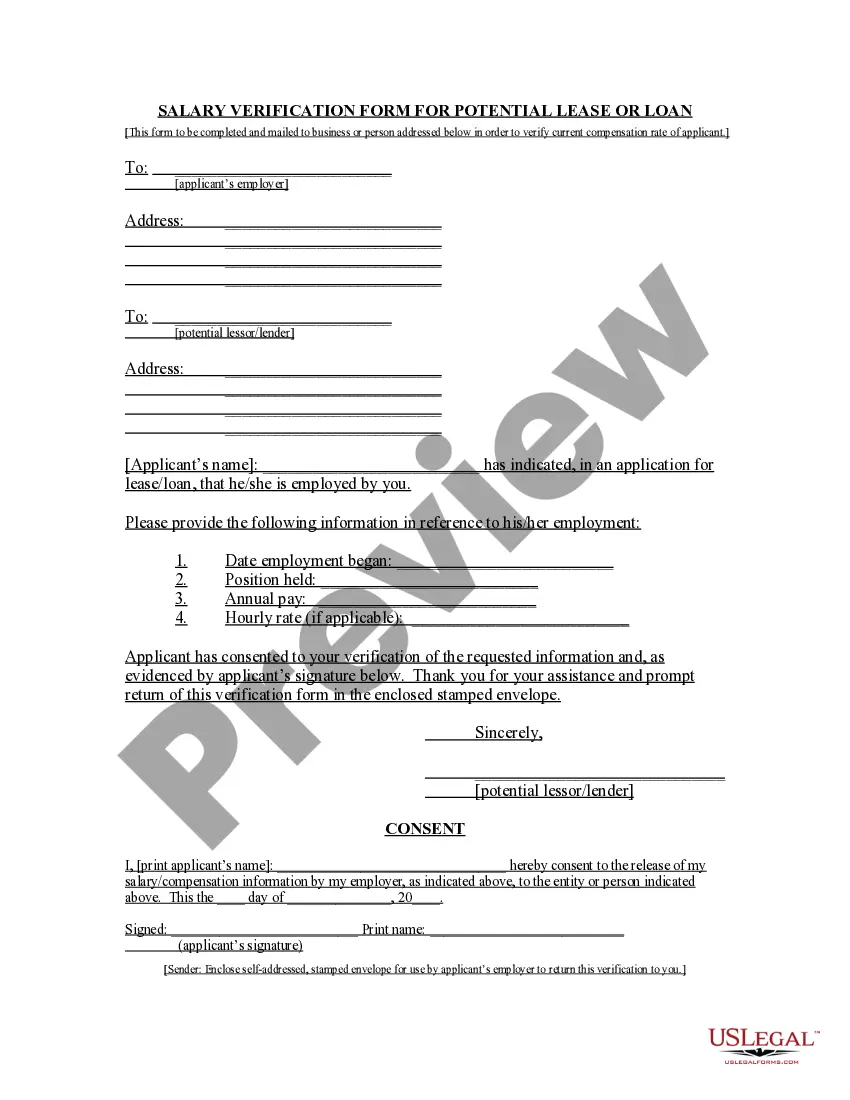

- You can review the form using the Preview button and read the form description to confirm it is the correct one for you.

Form popularity

FAQ

Form NY 204 LL is required for limited liability companies and certain partnerships with a New York source income of $1 million or more. If your partnership falls within this category, you need to file this form alongside your regular tax returns. Using platforms like uslegalforms can provide insights into completing your New York Minutes for Partnership accurately.

If your partnership conducts business in New York City or generates income from city sources, you must file a NYC partnership return, specifically Form NYC-204. This filing is essential for compliance with city tax regulations and prevents potential legal issues. You can find helpful resources for New York Minutes for Partnership that guide you through the filing process.

Yes, a partnership generally needs to register with the state if it plans to operate under a name different from the legal names of the partners. This registration helps establish legitimacy and protects your business name. Accessing detailed guides on New York Minutes for Partnership can aid you in ensuring compliance with registration requirements.

Any partnership operating in New York City must file Form NYC-204. This form is required for partnerships engaged in business or deriving income in the city. If you're not sure if you need to file, consult with a tax professional or consider using resources like uslegalforms for clarity on your specific situation regarding New York Minutes for Partnership.

To form a general partnership in New York, you do not need to file any documents with the state; however, a partnership agreement is highly recommended. This agreement outlines the management structure and responsibilities of the partners. To enhance your organization’s transparency, employing New York Minutes for Partnership can be beneficial in keeping track of meetings and decisions made within the partnership.

For a New York Limited Liability Company (LLC), the publication requirement involves publishing a notice in two newspapers for six consecutive weeks. The notice must contain details like the LLC's name, the address of its principal business location, and the date of formation. Using New York Minutes for Partnership can help you document your compliance steps and maintain organized records throughout this publication period.

Upon forming a limited partnership in New York, you must publish a notice of your formation in two local newspapers for six consecutive weeks. This publication must include the name of the partnership, its address, and the name of the general partner. Keeping accurate records with New York Minutes for Partnership can help ensure that you meet all legal obligations and requirements during this process.

A limited partnership must have at least one general partner and one limited partner, as required by New York law. The general partner manages the operations and assumes unlimited liability, while the limited partner provides capital and has limited liability. For detailed guidance, refer to resources like New York Minutes for Partnership, which provides templates for documenting essential agreements and meetings.

To establish a partnership in New York, start by drafting a partnership agreement that outlines the roles and responsibilities of each partner. It's essential to file your agreement with the appropriate authorities if you opt for a limited partnership or limited liability partnership. Utilizing New York Minutes for Partnership can assist in maintaining proper records of meetings and decisions, which further streamlines the formation process.

To form a limited partnership in New York, you must file a Certificate of Limited Partnership with the Department of State. This certificate needs to include the name of the partnership, the address of the office, and the name and address of the general partner. Additionally, completing the New York Minutes for Partnership ensures you have documented the decision-making processes and agreements that support your partnership's formation.