South Dakota Company Customer Profile Questionnaire

Description

How to fill out Company Customer Profile Questionnaire?

In the event that you need to gather, acquire, or print authorized document templates, utilize US Legal Forms, the foremost compilation of legal forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you require.

A variety of templates for corporate and personal purposes are categorized by classifications and jurisdictions, or keywords.

Every legal document template you download is yours indefinitely.

You have access to every form you acquired in your account. Visit the My documents section and select a form to print or download again. Compete and obtain, and print the South Dakota Company Customer Profile Questionnaire with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to access the South Dakota Company Customer Profile Questionnaire in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and click the Download button to retrieve the South Dakota Company Customer Profile Questionnaire.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first experience with US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the appropriate city/region.

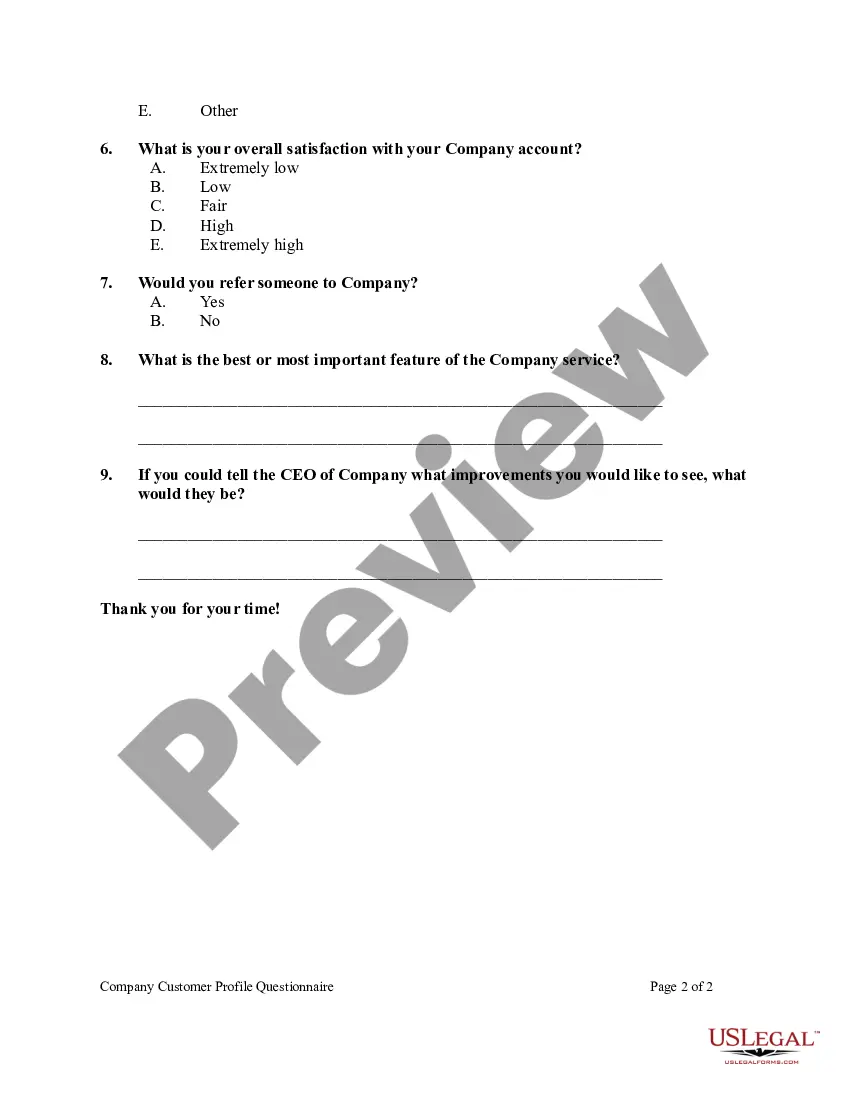

- Step 2. Utilize the Review option to examine the contents of the form. Always remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, select the Get now button. Choose the pricing plan you prefer and provide your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your system.

- Step 7. Complete, modify, and print or sign the South Dakota Company Customer Profile Questionnaire.

Form popularity

FAQ

In South Dakota, you do not have to file a state income tax return because the state has no personal income tax. This absence of income tax can significantly benefit residents and companies operating in the state. When you complete the South Dakota Company Customer Profile Questionnaire, understanding your tax obligations becomes easier. Utilizing this questionnaire ensures compliance and helps streamline your business operations without worrying about state income tax.

Acquiring a seller's permit in South Dakota involves applying through the Department of Revenue. This process includes submitting relevant business information, which may be similar to your sales tax license application. Make sure to gather the necessary details to facilitate the South Dakota Company Customer Profile Questionnaire.

Yes, registering your business in South Dakota is typically necessary to operate legally. This involves filing the appropriate forms and may vary depending on your business structure. Proper registration will also enhance the information provided in the South Dakota Company Customer Profile Questionnaire.

No, a sales tax license and an EIN (Employer Identification Number) serve different purposes. While a sales tax license enables you to collect sales tax in South Dakota, an EIN is needed for tax administration and employee identification. Understanding these distinctions will aid you in completing the South Dakota Company Customer Profile Questionnaire accurately.

To obtain a seller's permit in South Dakota, you must apply through the state's Department of Revenue. This process often coincides with acquiring your sales tax license, so be prepared with required business information. Having a seller's permit is a fundamental aspect of the South Dakota Company Customer Profile Questionnaire.

Applying for a South Dakota sales tax license requires you to fill out an application form available on the South Dakota Department of Revenue's website. You may need to provide information about your business and its location. Completing this step will assist in accurately completing the South Dakota Company Customer Profile Questionnaire.

Yes, South Dakota does impose a business personal property tax on certain types of assets. If your business owns property like equipment and machinery, you will need to report these on your tax returns. Understanding this is crucial when filling out the South Dakota Company Customer Profile Questionnaire.

To obtain a tax ID number in South Dakota, you will need to complete the application process through the IRS. You can apply online, by mail, or by fax. This tax ID is essential for your business and will help you complete the South Dakota Company Customer Profile Questionnaire efficiently.