South Dakota Revocable Trust for Property

Description

How to fill out Revocable Trust For Property?

Are you presently in the situation where you require documents for either organization or specific purposes almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust isn't easy.

US Legal Forms provides a wide variety of form templates, such as the South Dakota Revocable Trust for Property, that are designed to meet state and federal requirements.

When you locate the correct form, click on Get now.

Choose the pricing plan you want, complete the necessary information to create your account, and purchase your order using your PayPal or credit card. Pick a suitable document format and download your copy. Find all the document templates you have purchased in the My documents section. You can obtain another copy of the South Dakota Revocable Trust for Property at any time, if needed. Click the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms site and have your account, simply Log In.

- Then, you may download the South Dakota Revocable Trust for Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

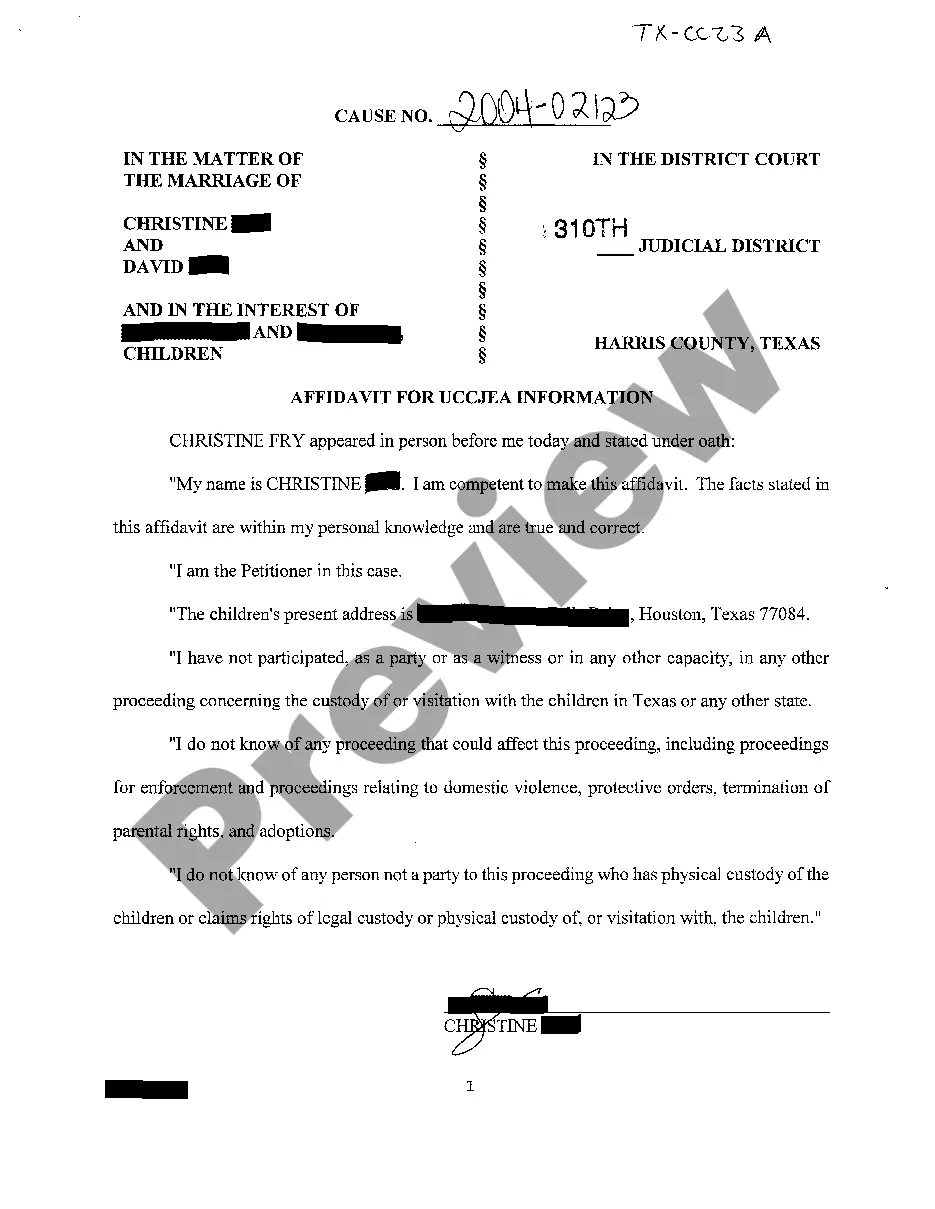

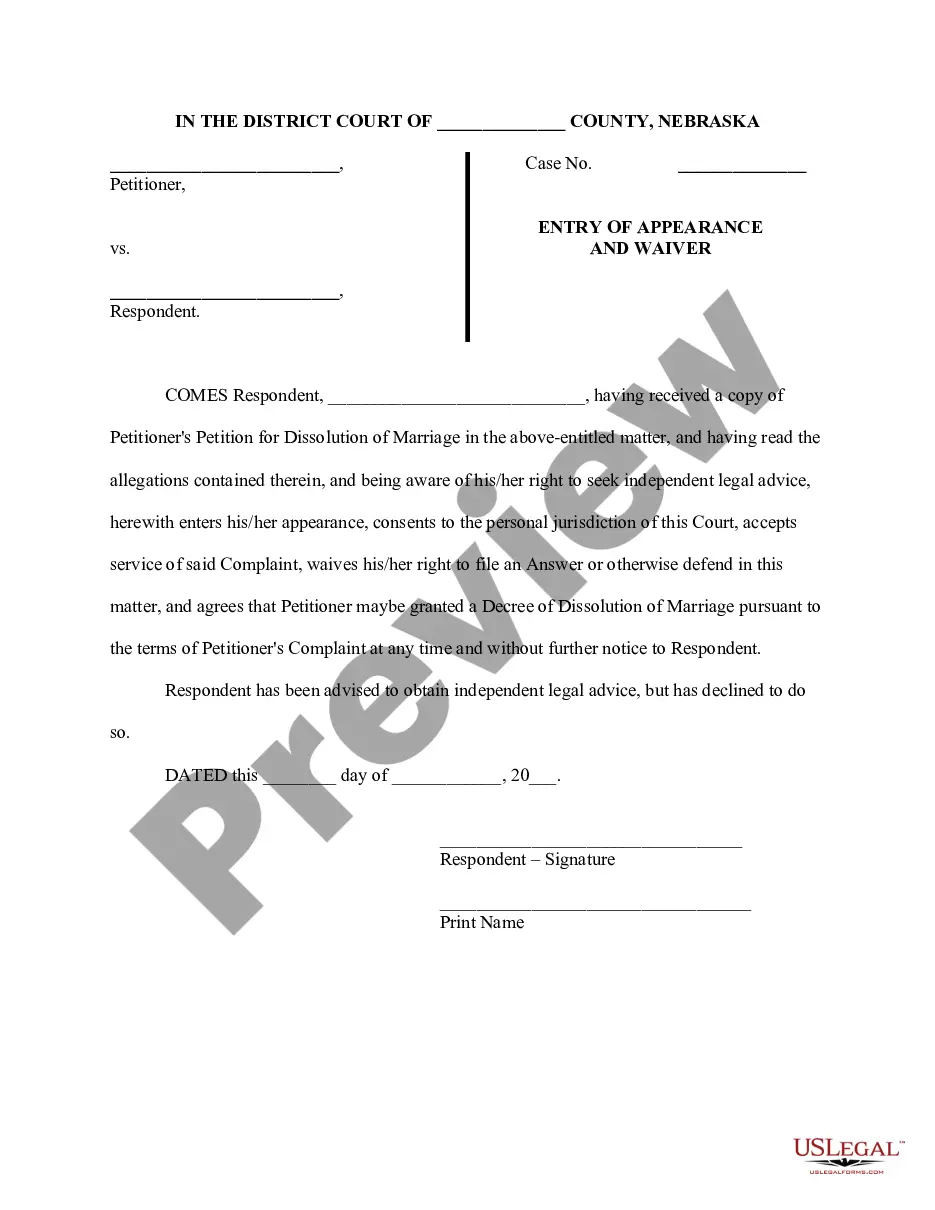

- Use the Review button to examine the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

South Dakota does not impose an inheritance tax, making it an attractive place for estate planning. Instead, individuals can benefit from utilizing tools like a South Dakota Revocable Trust for Property. These trusts allow for the seamless transfer of assets to beneficiaries without the burden of tax. Therefore, by establishing a revocable trust, you can effectively manage your property and minimize potential tax issues.

South Dakota trusts function by holding and managing your assets according to your specifications. With a South Dakota Revocable Trust for Property, you can modify or revoke the trust during your lifetime, allowing flexibility. Upon your passing, the assets within the trust are distributed as per your instructions, minimizing court involvement. This streamlined approach simplifies estate management and provides clarity for your beneficiaries.

In South Dakota, a trust can last for a remarkable duration, given that it can exist for up to 365 years. The ability to create lasting trusts offers peace of mind, allowing you to plan effectively for your heirs. Using a South Dakota Revocable Trust for Property, you can ensure that your wishes are fulfilled long into the future. This flexibility is crucial for comprehensive estate planning.

A dynasty trust in South Dakota can last for a maximum of 365 years. This longevity allows you to provide for future generations without incurring taxes on distributions. By utilizing a South Dakota Revocable Trust for Property, you can ensure that your assets benefit your family over a long period. This unique feature makes South Dakota an attractive state for creating lasting trusts.

In South Dakota, trusts can last for an extended duration thanks to the state’s favorable laws regarding perpetuities. A South Dakota Revocable Trust for Property can continue for up to 1,000 years, providing you with ample time to manage and distribute your assets according to your wishes. This longevity means that your estate plan can adapt and provide benefits for many generations, ensuring your legacy continues.

One of the major advantages of establishing a trust in South Dakota is that the state does not impose an income tax on trusts, including the South Dakota Revocable Trust for Property. This means that you can preserve more of your wealth for your heirs. However, it’s important to consult with a tax professional, as federal tax rules still apply, and you want to ensure compliance with all applicable regulations.

While several states offer favorable conditions for revocable trusts, South Dakota is widely regarded as one of the best due to its comprehensive trust laws and lack of state income tax. The South Dakota Revocable Trust for Property specifically provides significant benefits, such as privacy and control over your assets. Many individuals and families choose South Dakota for its innovative trust legislation and efficient legal processes.

In South Dakota, trusts operate by allowing a person to transfer property to a designated trustee who manages it for the benefit of assigned beneficiaries. When setting up a South Dakota Revocable Trust for Property, you maintain control over your assets during your lifetime, and can easily modify the trust terms as your needs change. Upon your passing, the trust assets are distributed according to your instructions, bypassing probate and ensuring a smoother transition.

South Dakota has clear and straightforward trust laws designed to benefit trust creators and beneficiaries alike. The state allows for various types of trusts, including the South Dakota Revocable Trust for Property, which provides flexibility in managing your assets. Additionally, South Dakota does not impose state income tax on trusts, making it an attractive option for individuals seeking to minimize tax burdens.

To set up a South Dakota Revocable Trust for Property, first, draft a trust agreement that specifies your wishes for asset management and distribution. You can utilize resources like uslegalforms for templates and step-by-step instructions to simplify the process. Finally, transfer your properties into the trust, ensuring that all titles and accounts are updated to reflect the trust as the new owner.