South Dakota Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of templates for business and personal applications, organized by categories, states, or keywords.

You can find the most recent versions of templates such as the South Dakota Revocable Trust for Estate Planning in just a few minutes.

Read the document description to ensure you have chosen the appropriate template.

If the template does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you already have a monthly membership, Log In and retrieve the South Dakota Revocable Trust for Estate Planning from the US Legal Forms library.

- The Download button will appear on every template you view.

- You can access all previously saved templates in the My documents tab of your account.

- If you are new to US Legal Forms, here are some simple steps to get started.

- Ensure you have selected the correct template for your city/county.

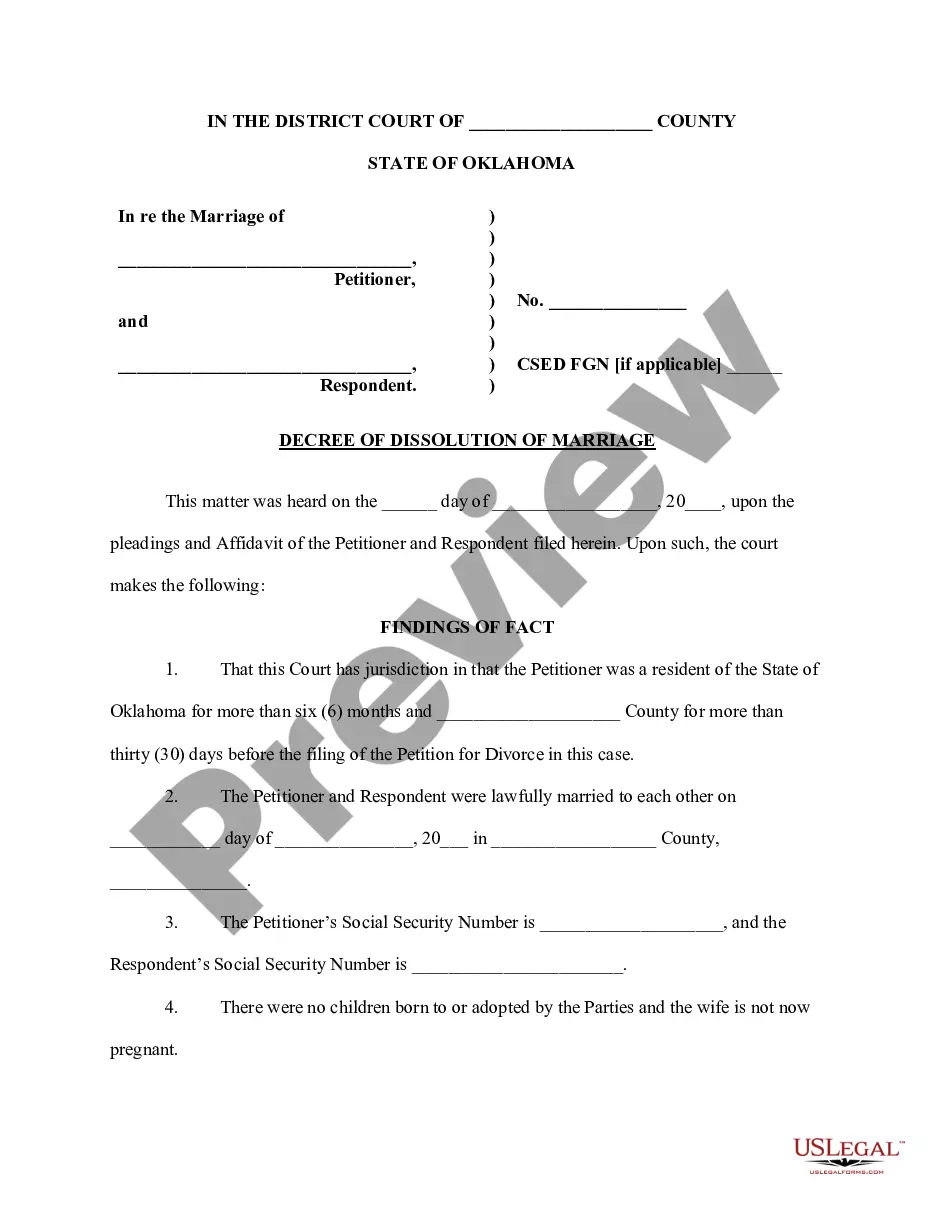

- Click the Review button to examine the document's content.

Form popularity

FAQ

Trusts in South Dakota, including the South Dakota Revocable Trust for Estate Planning, operate by managing your assets during your lifetime and posthumously distributing them according to your wishes. You set the terms of the trust, and you can modify or revoke it as needed. Moreover, a proficient legal platform, such as uslegalforms, can help you navigate the process of creating and managing your trust. This ensures that your estate planning goals are effectively met.

While many states offer revocable trusts, South Dakota stands out due to its progressive trust laws and tax advantages. A South Dakota Revocable Trust for Estate Planning allows for more flexibility and prolonged duration compared to other states. As such, individuals seeking optimal estate planning benefits often find South Dakota to be the best choice. The state's commitment to protecting trust assets enhances its reputation as a premier destination for establishing trusts.

South Dakota does not impose a state income tax on trusts, which is beneficial for those considering a South Dakota Revocable Trust for Estate Planning. This absence of state tax can lead to significant savings compared to other states where trusts may be taxed. However, it is wise to consult with a tax professional to understand any federal implications. Overall, this tax-friendly environment enhances the attractiveness of establishing a trust in South Dakota.

In South Dakota, a trust can last for a maximum of 1,000 years, thanks to the state’s progressive approach towards trust duration. This allows you to create a South Dakota Revocable Trust for Estate Planning that can provide benefits for generations to come. The extended term gives families the flexibility to manage and allocate assets effectively over a long period. This durability makes it a valuable tool for effective wealth management.

South Dakota has favorable trust laws that support the use of South Dakota Revocable Trust for Estate Planning. The state allows for flexible terms and conditions, which grant you significant control over your assets during your lifetime. Notably, South Dakota does not impose a state income tax on trust income, making it an appealing choice for many individuals. You can tailor your trust to meet your unique objectives.

A South Dakota trust operates by transferring property and assets into a legally established entity, managed by a trustee for the benefit of your chosen beneficiaries. With a South Dakota Revocable Trust for Estate Planning, you maintain control over the assets during your lifetime, allowing for adjustments as needed. Upon your passing, the trust facilitates a smoother transfer of assets to your beneficiaries, avoiding the probate process.

Setting up a revocable trust in South Dakota involves creating a trust document that clearly states your intentions and designates beneficiaries. Utilizing a resource like uslegalforms can streamline this process, providing templates and guidance tailored for a South Dakota Revocable Trust for Estate Planning. After drafting the document, remember to fund the trust by transferring your assets into it.

To establish a trust in South Dakota, you need to draft a trust agreement that outlines the terms and beneficiaries. It's advisable to consult with a legal expert or use online services, such as uslegalforms, to create your South Dakota Revocable Trust for Estate Planning. Once the document is complete, you must transfer assets into the trust, officially establishing it.

The least expensive way to set up a trust, particularly a South Dakota Revocable Trust for Estate Planning, is to utilize online legal services or templates. Many platforms, like uslegalforms, offer affordable options that allow you to draft your trust documents efficiently. This approach minimizes legal fees while ensuring you cover essential aspects of your estate planning.

In South Dakota, the inheritance laws dictate how estates are distributed after a person's passing. Generally, if a person dies without a will, their assets will be divided according to state law. Creating a South Dakota Revocable Trust for Estate Planning allows you to specify how you want your assets distributed, avoiding state-mandated distribution. By establishing a trust, you maintain control over your assets even after death, ensuring your wishes are followed.