South Dakota Order Refunding Bond

Description

How to fill out Order Refunding Bond?

If you want to finish, obtain, or print valid document templates, utilize US Legal Forms, the largest assortment of valid forms, which can be accessed online.

Employ the site's straightforward and user-friendly search to locate the documents you require. Various templates for business and individual purposes are categorized by types and categories, or keywords.

Utilize US Legal Forms to find the South Dakota Order Refunding Bond in just a few clicks of the mouse.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the South Dakota Order Refunding Bond. Every legal document template you purchase is yours indefinitely. You will have access to every form you acquired in your account. Visit the My documents section and choose a form to print or download again. Stay competitive and download, and print the South Dakota Order Refunding Bond with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the South Dakota Order Refunding Bond.

- You can also access forms you have previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Verify that you have selected the form for your specific area/state.

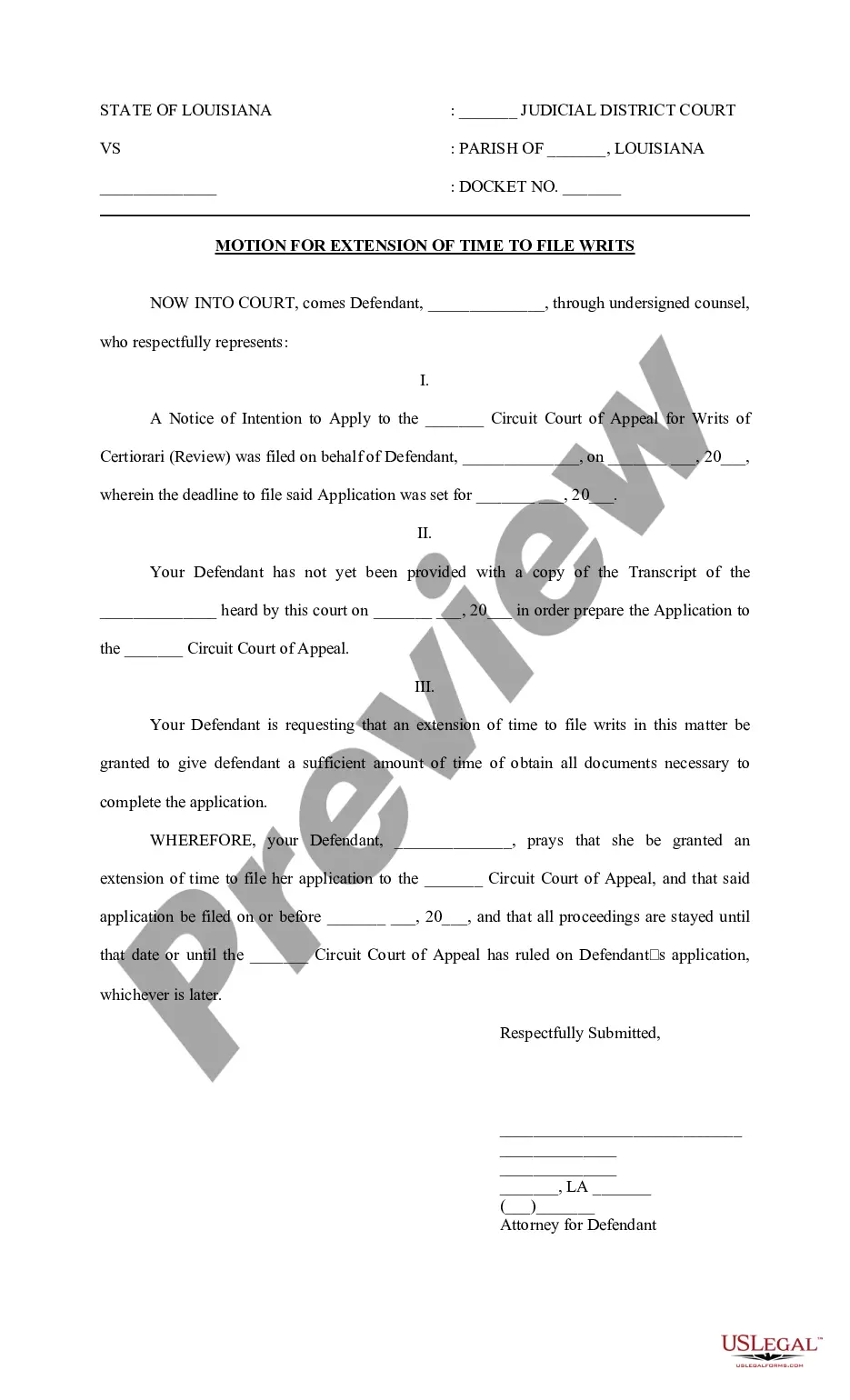

- Step 2. Use the Review option to examine the content of the form. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find alternative types of your legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

(in determining whether an appellant has been denied his right to a speedy trial under the Sixth Amendment, an appellate court considers the following factors: (1) the length of the delay; (2) the reasons for the delay; (3) whether the appellant made a demand for a speedy trial; and (4) prejudice to the appellant).

23A-16-3. (Rule 18) Right to speedy trial by impartial jury--Venue in county where offense committed. The accused has the right to a speedy public trial by an impartial jury of the county in which the offense is alleged to have been committed.

In South Dakota, all misdemeanors carry a lengthy seven-year statute of limitations. Most felonies also have a seven-year statute of limitations. Class A, B, and C felonies do not have any statute of limitations.

1. SDCL 23A-44-5.1, the so called "180-day rule," requires trial of a criminal case within 180 days of a defendant's first appearance before a judicial officer on an indictment, information or complaint. The rule also specifies certain periods of time that are to be excluded from calculation of the 180 days. 2.

Overview of Penal Code 1382 PC A formal charge (aka, an "information) must be filed against the defendant within 15 days of arrest; For infractions and misdemeanors, a trial must be held within 30-45 days of arraignment; For felonies, a trial must be held within 60 days of arraignment.