South Dakota Motion to Adjourn at a Reasonable Time

Description

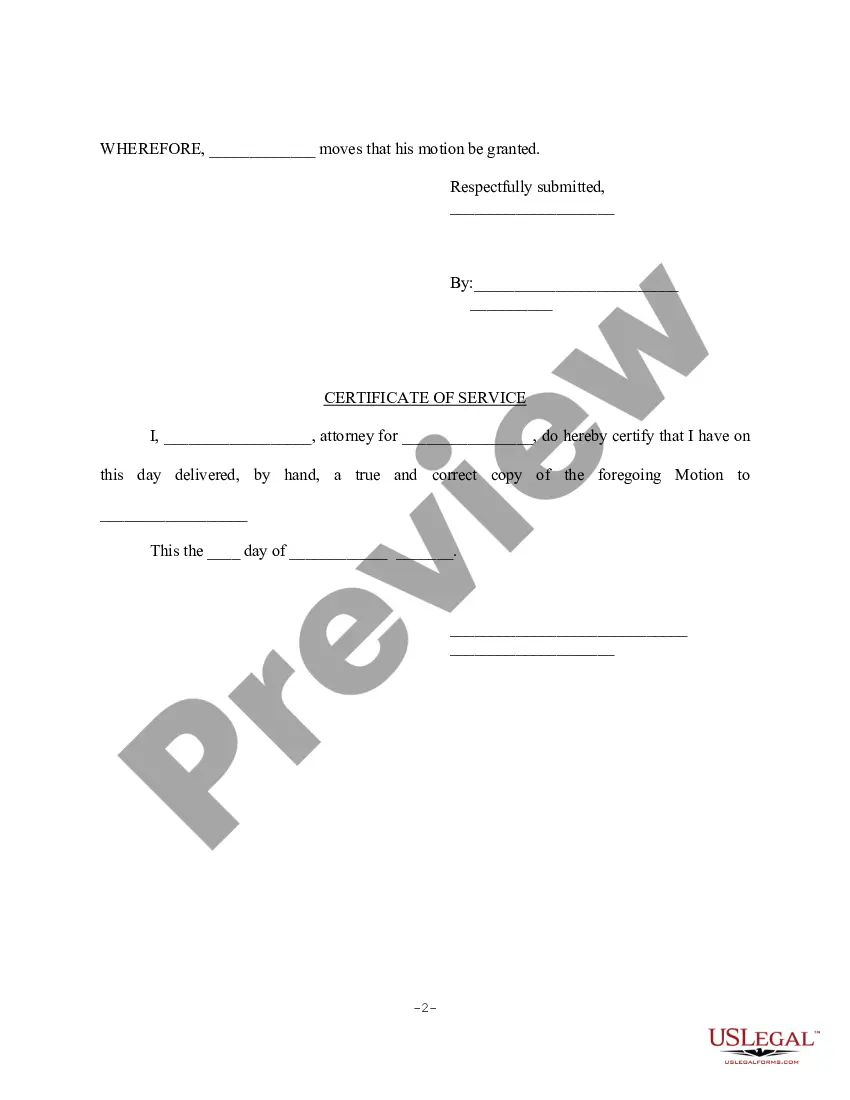

How to fill out Motion To Adjourn At A Reasonable Time?

US Legal Forms - one of the largest collections of lawful templates in the United States - offers a variety of legal document formats that you can obtain or print. By utilizing the website, you can access numerous templates for commercial and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the South Dakota Motion to Adjourn at a Reasonable Time in moments.

If you possess a subscription, Log In and obtain the South Dakota Motion to Adjourn at a Reasonable Time from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your city/state. Choose the Preview option to review the document's content. Check the form summary to confirm you have chosen the appropriate form. If the form does not meet your needs, utilize the Search area at the top of the screen to find one that does. When satisfied with the form, confirm your choice by clicking the Acquire now button. Next, select your preferred pricing plan and provide your details to register for the account. Process the payment. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded South Dakota Motion to Adjourn at a Reasonable Time. Every format you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the South Dakota Motion to Adjourn at a Reasonable Time with US Legal Forms, the most comprehensive library of legal document formats.

- Utilize a wide range of professional and state-specific templates that meet your business or personal requirements and expectations.

Form popularity

FAQ

See SDCL 15-26A-3. A motion for reconsideration is not a separate and appealable order. Rather, it is ?an invitation to the court to consider exercising its inherent power to vacate or modify its own judgment.? Breeden v. , 598 NW2d 441, 444 ( 1999).

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

The subpoena must be served sufficiently in advance of the date upon which the appearance of the witness is required to enable such witness to reach such place by any ordinary or usual method of transportation which he may elect.

South Dakota allows for a trust to exist in perpetuity, i.e., for an unlimited duration.

South Dakota Open Meetings Law embodies the principle that the public is entitled to the greatest possible information about public affairs and is intended to encourage public participation in government. SDCL 1-25 requires that official meetings of public bodies must be public and noticed in advance of the meetings.

What makes South Dakota special? South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.

Under South Dakota trust law, dynasty trusts offer robust protection against legal claims and financial risks. When assets are transferred into a dynasty trust, they are no longer considered the property of individual beneficiaries.

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.