South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor

Description

How to fill out Agreement By Self-Employed Independent Contractor Or Subcontractor Not To Bid Against Painting General Contractor?

It is feasible to dedicate time online attempting to locate the legitimate document template that satisfies the state and federal requirements you need.

US Legal Forms offers thousands of legal documents that are evaluated by experts.

You can effortlessly download or print the South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete Against Painting General Contractor from your service.

First, ensure that you have chosen the correct document template for your state/city of choice. Review the form details to confirm you have selected the right document.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Then, you can fill out, modify, print, or sign the South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Compete Against Painting General Contractor.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Yes, South Dakota does require certain contractors to hold licenses, particularly for specialized trades. Obtaining a license ensures compliance with state regulations and establishes credibility in the industry. When drafting a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, always confirm that licensing requirements are met to avoid potential legal issues.

Writing a simple contract agreement starts with stating the parties involved and outlining the work to be done. Clearly include payment details, timelines, and any relevant legal provisions. For added protection, consider integrating elements from a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, which can help manage competitive practices within your industry.

To write a subcontractor agreement, begin with the details of the main contract and specify the tasks that the subcontractor will undertake. Define payment terms, project deadlines, and confidentiality obligations. Including references to a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor will help uphold professional standards and reduce competition risks.

The agreement between a contractor and a company outlines the responsibilities, deliverables, and payment terms agreed upon by both parties. It usually includes clauses related to project timelines, quality standards, and communication protocols. Adding specific requirements in line with a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor ensures that both parties are aligned and protected throughout the project.

An example of an independent contractor is a freelance graphic designer who provides services to various clients under separate contracts. This designer operates independently, setting their own hours and methods of work. A well-crafted South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can clarify such working relationships and protect both parties involved.

Writing an independent contractor agreement involves detailing the work to be performed, payment terms, and both parties' obligations. Be sure to specify the length of the agreement and any termination conditions. Additionally, incorporating a clause referencing a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can help ensure compliance with local regulations and protect proprietary information.

To make an agreement with a contractor, start by clearly defining the scope of work, including specific tasks and timelines. It's important to outline payment terms and conditions to avoid any misunderstandings later. Including provisions related to confidentiality and non-competition, such as in a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, can protect your business interests.

The contractors tax in South Dakota is applicable to those working as self-employed independent contractors or subcontractors. This tax is designed to ensure that contractors contribute to the state's revenue through their operations. If you enter into a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, it may be beneficial to understand this tax. Consulting with professionals or using platforms like uslegalforms can help clarify your tax responsibilities and assist with compliance.

South Dakota does not impose a contractor-specific tax; however, contractors must be aware of sales tax and use tax obligations. The South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor may involve financial aspects that include a thorough understanding of potential tax liabilities. To navigate these tax obligations efficiently, utilizing resources such as uslegalforms can provide valuable guidance and necessary documentation.

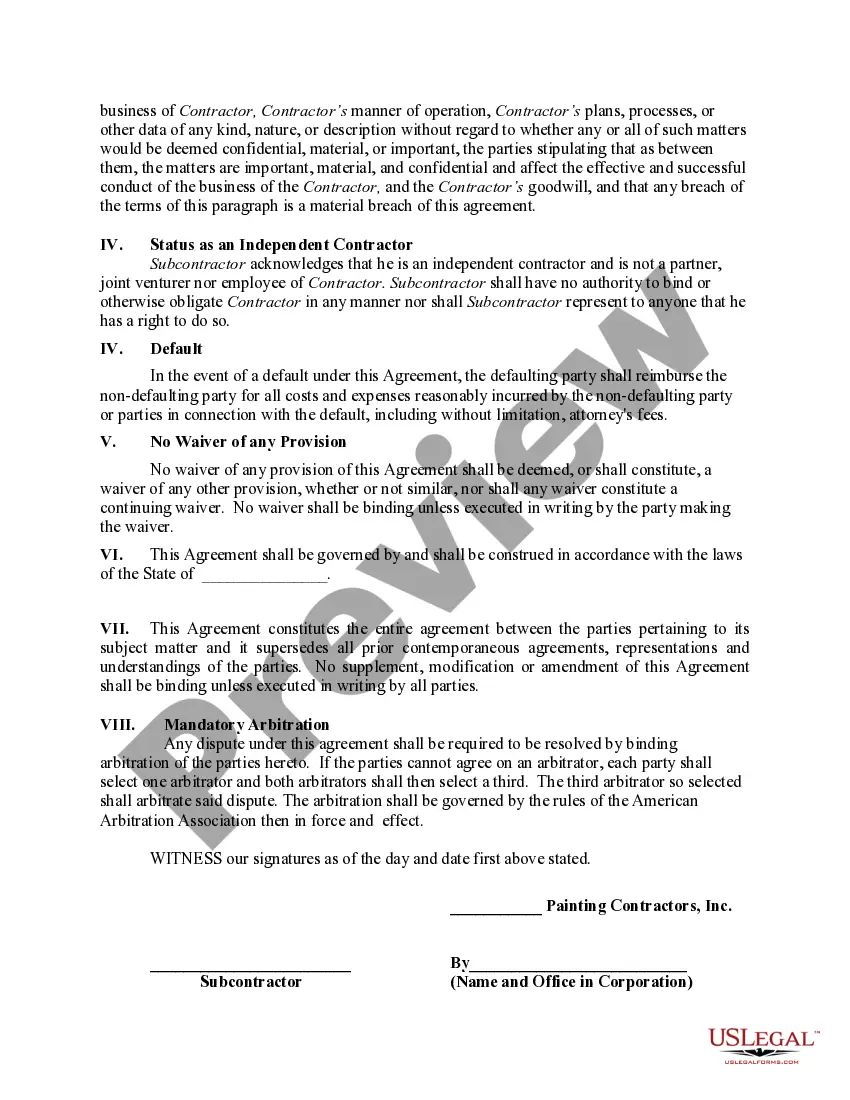

In the context of a South Dakota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, the contract clause outlines the responsibilities and limitations of the subcontractor. This clause typically includes stipulations about the work scope, payment terms, and non-competition agreements, ensuring clarity and protecting the interests of the general contractor. It is essential for subcontractors to understand these clauses to comply with the contractual obligations and to avoid potential legal disputes.