South Dakota Contract between General Agent of Insurance Company and Independent Agent

Description

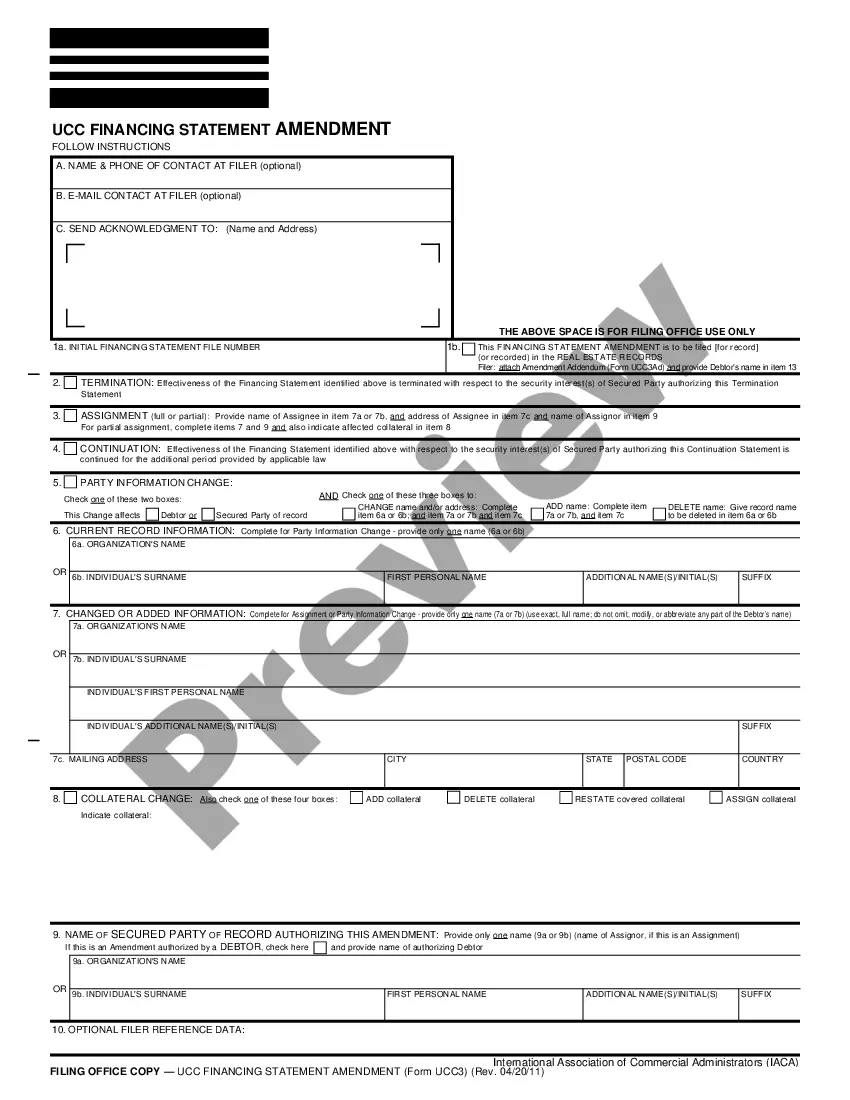

In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

It is feasible to devote numerous hours online looking for the validated document template that fulfills the state and federal criteria you require.

US Legal Forms offers thousands of validated forms that are evaluated by experts.

You can retrieve or print the South Dakota Contract between General Agent of Insurance Company and Independent Agent through my assistance.

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Contract between General Agent of Insurance Company and Independent Agent.

- Every validated document template you obtain is yours permanently.

- To retrieve another copy of any acquired form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- Firstly, make sure you have chosen the correct document template for your selected area/city.

- Review the document description to confirm you have selected the right form.

Form popularity

FAQ

The 22-42-5 law in South Dakota addresses the legal responsibilities and protections related to insurance agents and their contracts. This law outlines the parameters that govern the relationship between agents and insured parties. Reviewing this law in the context of a South Dakota Contract between General Agent of Insurance Company and Independent Agent can provide valuable information regarding compliance and your rights. Consulting uslegalforms can help clarify this legal framework further.

Yes, an independent contractor can serve as an agent of a company. This arrangement is common, particularly in the insurance industry, where independent agents represent multiple companies. Clear terms should be outlined in a South Dakota Contract between General Agent of Insurance Company and Independent Agent to define their rights and obligations. It is essential to ensure that the relationship aligns with legal and company requirements.

Breach of contract claims generally carry a limitation period of six years in South Dakota. This limitation ensures that parties cannot delay legal actions indefinitely, maintaining fairness in contractual relationships. Therefore, if you believe your rights under a South Dakota Contract between General Agent of Insurance Company and Independent Agent are violated, it is crucial to act within this timeframe. Gather necessary evidence promptly to support your claim.

The statute of limitations for breach of contract in South Dakota is typically six years. This means you have six years from the date of the breach to initiate legal action. Understanding this timeline is crucial for maintaining your rights under a South Dakota Contract between General Agent of Insurance Company and Independent Agent. Ensure you gather all necessary documentation to support your case effectively.

In South Dakota, the statute of limitations refers to the time frame in which you can file a lawsuit. Generally, this period can vary from two to six years, depending on the type of claim. For example, personal injury claims typically have a three-year statute of limitations. It’s essential to understand these time limits, particularly in matters involving a South Dakota Contract between General Agent of Insurance Company and Independent Agent.

Yes, you can sue for emotional distress in South Dakota, but the process can be complex. You need to prove that the distress is a direct result of another party's negligent or intentional actions. Establishing a clear connection between your emotional pain and the harmful act is key to your claim. Reviewing a South Dakota Contract between General Agent of Insurance Company and Independent Agent may provide insights into liability and responsibility.

Becoming an insurance agent in North Dakota involves a few clear steps. You need to undergo pre-licensing education, pass the licensing exams, and submit your application for a license with the state. Engaging with the concepts behind the South Dakota Contract between General Agent of Insurance Company and Independent Agent can further enhance your knowledge base, preparing you for a successful career in the insurance field.

To become an insurance agent in North Dakota, you first need to complete the necessary pre-licensing education and pass the state examination. Following that, you must apply for your license through the North Dakota Department of Insurance. Familiarity with agreements like the South Dakota Contract between General Agent of Insurance Company and Independent Agent can provide you with a competitive edge in your training and understanding of agency relationships.

Insurance laws in North Dakota regulate how insurance companies operate within the state. These laws cover licensing, underwriting, and policy requirements, ensuring that agents and providers maintain fair practices. Understanding these laws is crucial, especially when entering the South Dakota Contract between General Agent of Insurance Company and Independent Agent, to ensure compliance when conducting business.

The complexity of obtaining an insurance license can vary by state, but many agents find the life and health insurance license to be particularly challenging. It requires a deep understanding of laws, policies, and product details. If you are navigated through the South Dakota Contract between General Agent of Insurance Company and Independent Agent, you may gain valuable insights and strategies that can ease the licensing process.