South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor

Description

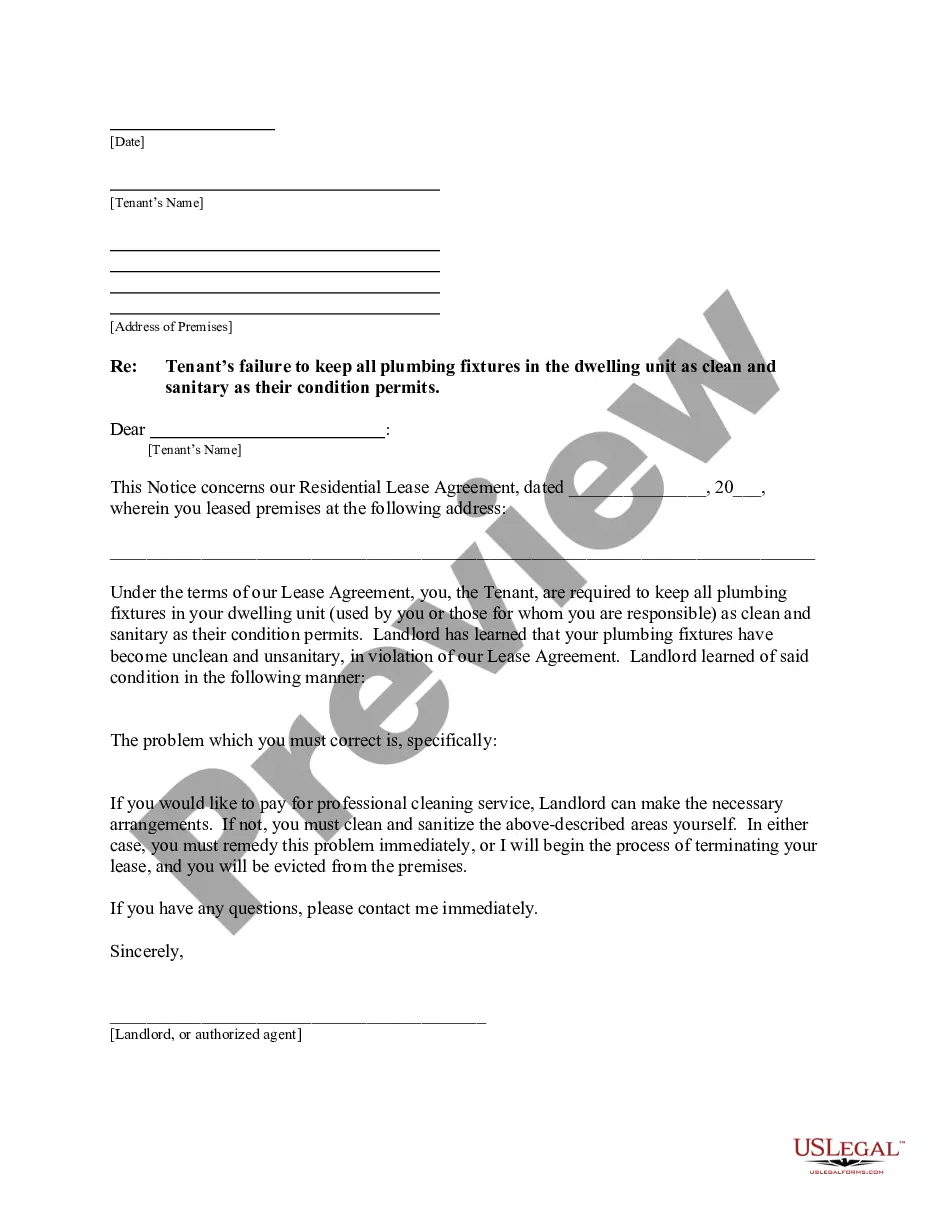

How to fill out Insurance Agent Agreement - Self-Employed Independent Contractor?

You can spend hours online trying to locate the legal document template that meets the state and federal requirements you need. US Legal Forms offers thousands of legal forms that are reviewed by experts.

It's easy to download or print the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor from the service. If you already have a US Legal Forms account, you may Log In and then click the Acquire button. After that, you can complete, modify, print, or sign the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor.

Every legal document template you purchase is yours permanently. To obtain another copy of any purchased form, go to the My documents tab and click the respective button. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the region/city of your choice. Review the form details to confirm you have chosen the right document. If available, use the Review button to browse the document template as well.

- If you want to find another version of the form, use the Search area to locate the template that suits your needs and requirements.

- Once you have found the template you desire, click Get now to continue.

- Select the pricing plan you want, enter your details, and create an account on US Legal Forms.

- Complete the payment. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your system.

- Make edits to your document if necessary. You can complete, modify, sign, and print the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor.

- Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Use professional and state-specific templates to manage your business or personal needs.

Form popularity

FAQ

A 1099 form typically indicates that a worker is classified as an independent contractor, not an employee. Thus, work reported on a 1099 involves contract or freelance work, usually under agreements like the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor. This classification allows for different tax treatment and benefits. Understanding this distinction can help you navigate the responsibilities that come with being self-employed.

Writing an independent contractor agreement involves outlining the key terms, such as the scope of work, payment structure, and duration of the contract. The South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor can serve as a helpful template, providing a foundation that you can customize to your situation. Ensure you are clear about the expectations and responsibilities of both parties to avoid misunderstandings. Consulting with a legal professional can also ensure compliance with state laws.

Yes, in most cases, an agent operates as an independent contractor. The South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor typically outlines the relationship, highlight how agents maintain control over their work and client interactions. This classification helps agents benefit from greater flexibility and autonomy in their operations. Always review your agreement to understand your rights and obligations clearly.

Yes, an independent contractor can be considered an agent if the terms of their agreement allow them to act on behalf of the hiring party. This relationship must be explicitly defined in the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor. It is crucial to clarify the level of authority granted to the contractor to avoid any legal complications. Always consult a legal expert if you're unsure about the specifics.

Filling out an independent contractor form involves gathering essential information about both the contractor and the hiring agency. Include details such as names, addresses, and the scope of work outlined in the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor. Make sure all parties agree on the terms before finalizing the form, and always keep a copy for your records. USLegalForms can guide you through this process with user-friendly templates.

To write an independent contractor agreement, start by clearly outlining the purpose of the agreement and the services to be provided. Both parties should define their roles, responsibilities, and the terms of payment. When detailing this, refer to the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor to ensure compliance with local regulations. You can also consider using platforms like USLegalForms to find templates tailored to your needs.

Filling out an independent contractor agreement requires careful attention to detail. You will need to include your business information, specific services offered, payment terms, and any deadlines. The South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor is a valuable resource that provides a structured form for you to complete. Make sure to review the document thoroughly before signing to ensure it meets your business needs.

Yes, insurance agents are often classified as self-employed. They run their own businesses, which allows them to have flexibility and control over their income. Utilizing a South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor provides the legal framework needed to operate effectively as a self-employed insurance agent. It is crucial to have a clear contract to outline your rights and obligations.

Yes, an insurance agent can be considered a freelance professional. They operate independently, often managing their own schedules and client lists. Many insurance agents use the South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor to formalize their freelance status. This agreement clarifies the terms of engagement with their clients or the insurance firms they represent.

Being self-employed means you work for yourself rather than being employed by someone else. This status applies if you earn income from your business activities, including selling insurance. The South Dakota Insurance Agent Agreement - Self-Employed Independent Contractor can help outline your responsibilities as a self-employed individual in the insurance industry. It is important to properly classify your work to ensure compliance with regulations.