South Carolina Statement to Add to Credit Report

Description

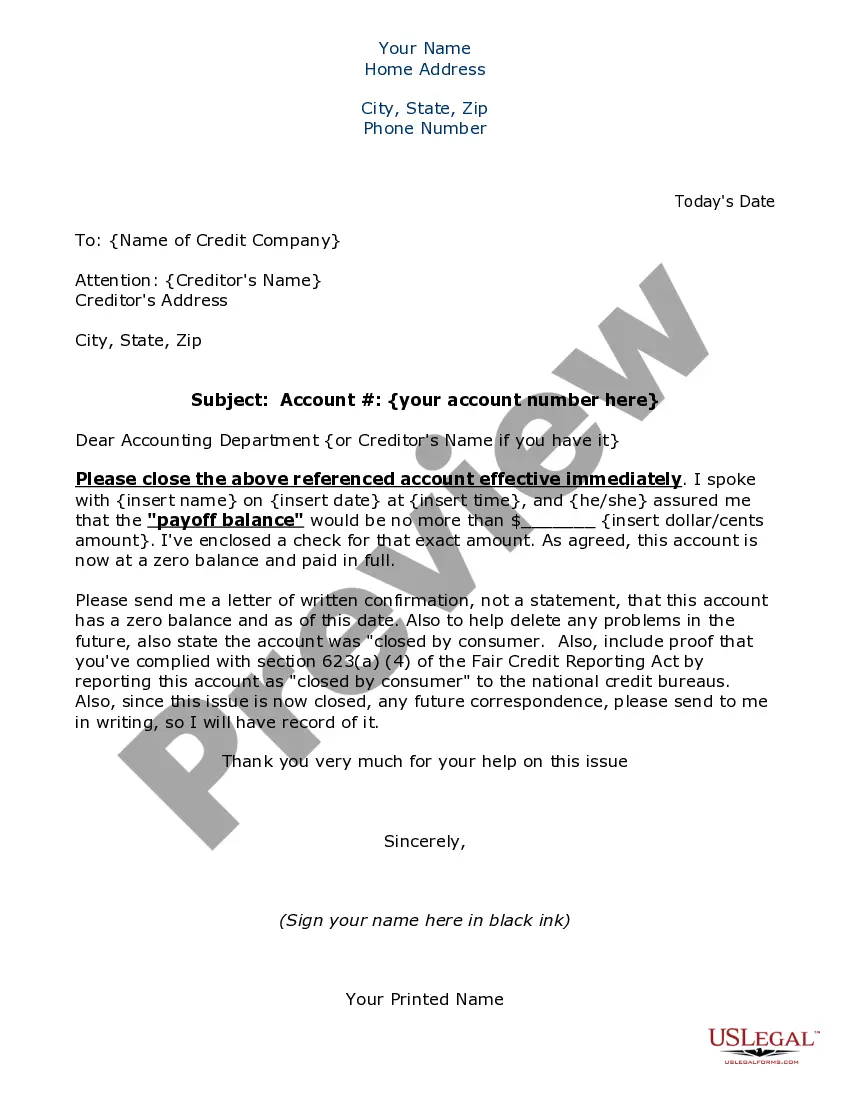

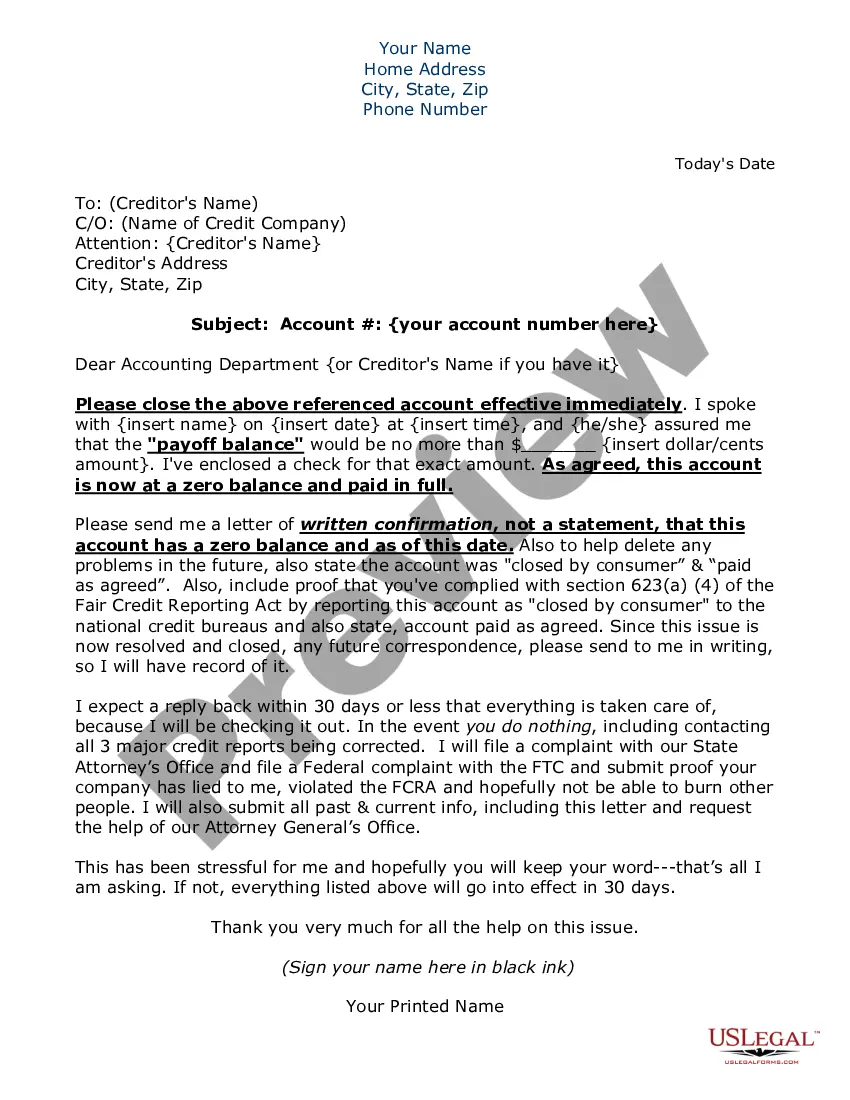

How to fill out Statement To Add To Credit Report?

It is feasible to spend time online looking for the valid document template that meets the state and federal standards you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can obtain or create the South Carolina Statement to Add to Credit Report from their service.

If available, use the Review button to browse through the document template as well. To find another version of your form, use the Search section to locate the template that meets your needs and requirements. Once you have found the format you want, click Purchase now to continue. Select the pricing plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the South Carolina Statement to Add to Credit Report. Download and print a vast number of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the South Carolina Statement to Add to Credit Report.

- Every legal document template you receive is yours indefinitely.

- To obtain another copy of an acquired form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Read the form description to ensure you have chosen the correct template.

Form popularity

FAQ

The fastest way to update your credit report involves contacting the credit bureau directly, such as Experian, and submitting any necessary documentation. If you need to include a South Carolina Statement to Add to Credit Report, ensure you have it ready to submit. Additionally, using platforms like US Legal Forms can streamline the process by providing templates and guidance for the necessary statements. This ensures that your updates are reflected promptly and accurately.

To add a South Carolina Statement to Add to Credit Report with Experian, you first need to log into your Experian account. Once logged in, navigate to the section where you can manage your credit report. There, you will find an option to add a consumer statement. Make sure your statement is clear and concise, as it will be displayed alongside your credit report for potential lenders to see.

To add a statement to your credit report, start by contacting the credit reporting agencies directly. You will need to provide a clear and concise explanation of your circumstances along with the South Carolina Statement to Add to Credit Report. This addition can help potential lenders understand your credit history better. With US Legal Forms, you can access templates and guidance to streamline this process and ensure your statement is submitted correctly.

Building your credit from 500 to 700 can take anywhere from several months to a few years, depending on your financial habits. You should focus on paying bills on time, reducing debt, and using credit responsibly. Additionally, consider adding a South Carolina Statement to Add to Credit Report, which can clarify your credit situation and improve your score. Utilizing resources from US Legal Forms can guide you through this process effectively.

Yes, you can add a statement to your credit report. This statement serves as a personal note to explain any negative items on your report. USLegalForms can assist you in creating a well-structured South Carolina Statement to Add to Credit Report, ensuring it meets all necessary requirements for inclusion on your credit report.

Achieving an 800 credit score in 45 days requires strategic financial actions. Focus on paying down existing debts, making timely payments, and reducing credit utilization. Additionally, consider adding a South Carolina Statement to Add to Credit Report, if relevant, to clarify your credit situation and enhance your profile. Services like USLegalForms can provide further assistance.

To add a statement to your credit report, you must contact the credit reporting agencies directly. You can submit your statement online or by mail, ensuring it meets the required guidelines. USLegalForms offers resources that can help you draft a clear and concise South Carolina Statement to Add to Credit Report that effectively communicates your message.

Filing a South Carolina annual report is a straightforward process. You need to complete the report form and submit it to the Secretary of State's office. Using USLegalForms can simplify this process, providing you with the necessary templates and guidance to ensure your South Carolina Statement to Add to Credit Report is accurate and timely.

Yes, you can include a 100-word statement on your credit report. This statement allows you to explain any discrepancies or provide context for negative information. To ensure your statement is added correctly, consider using services like USLegalForms, which can guide you through the process of submitting a South Carolina Statement to Add to Credit Report.

Yes, South Carolina offers various debt relief programs that provide assistance to residents facing financial difficulties. These programs may include credit counseling, debt management plans, and bankruptcy options. Utilizing a South Carolina Statement to Add to Credit Report can also improve your financial standing while you navigate through these relief options. Be sure to research and find a program that fits your needs effectively.