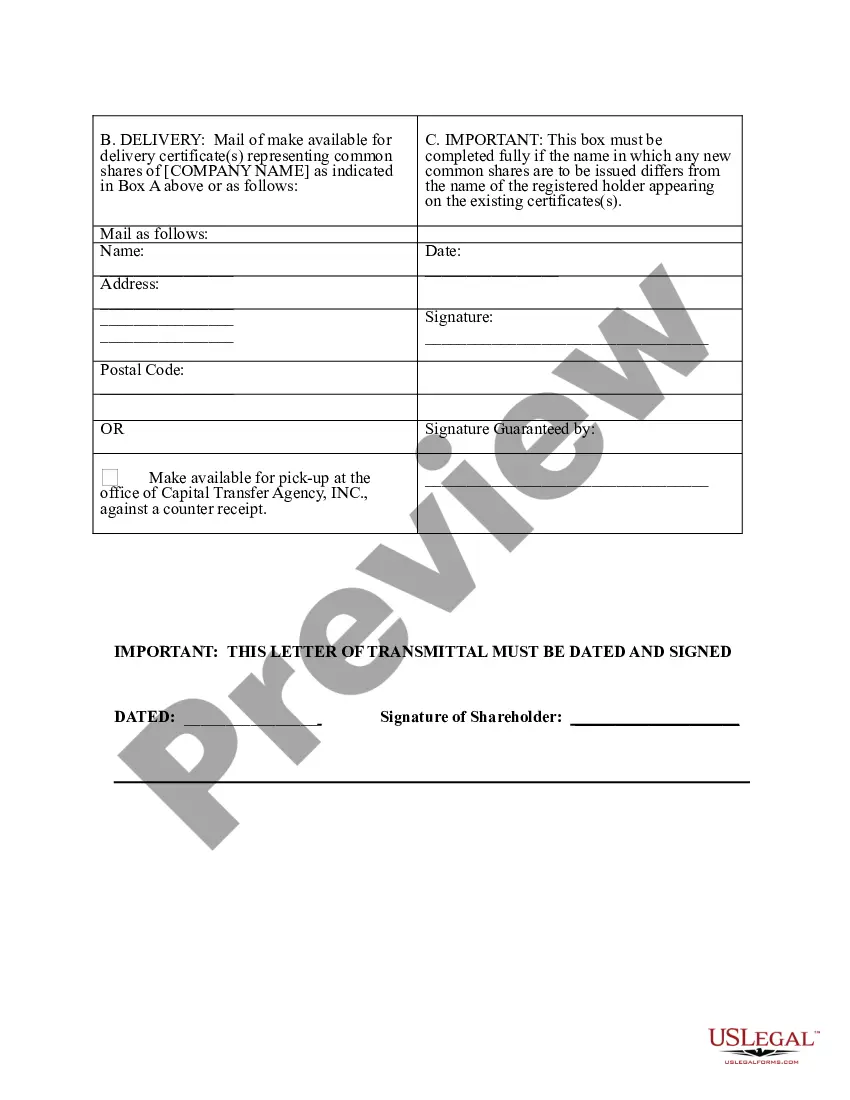

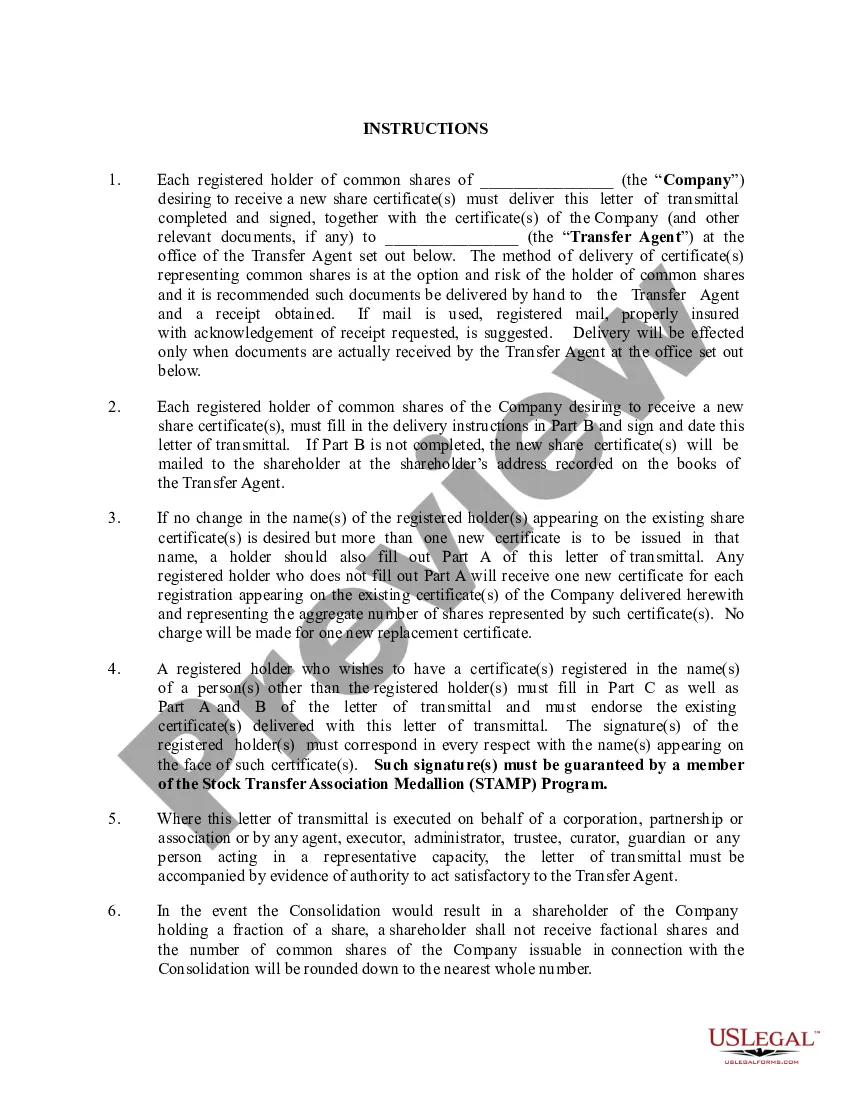

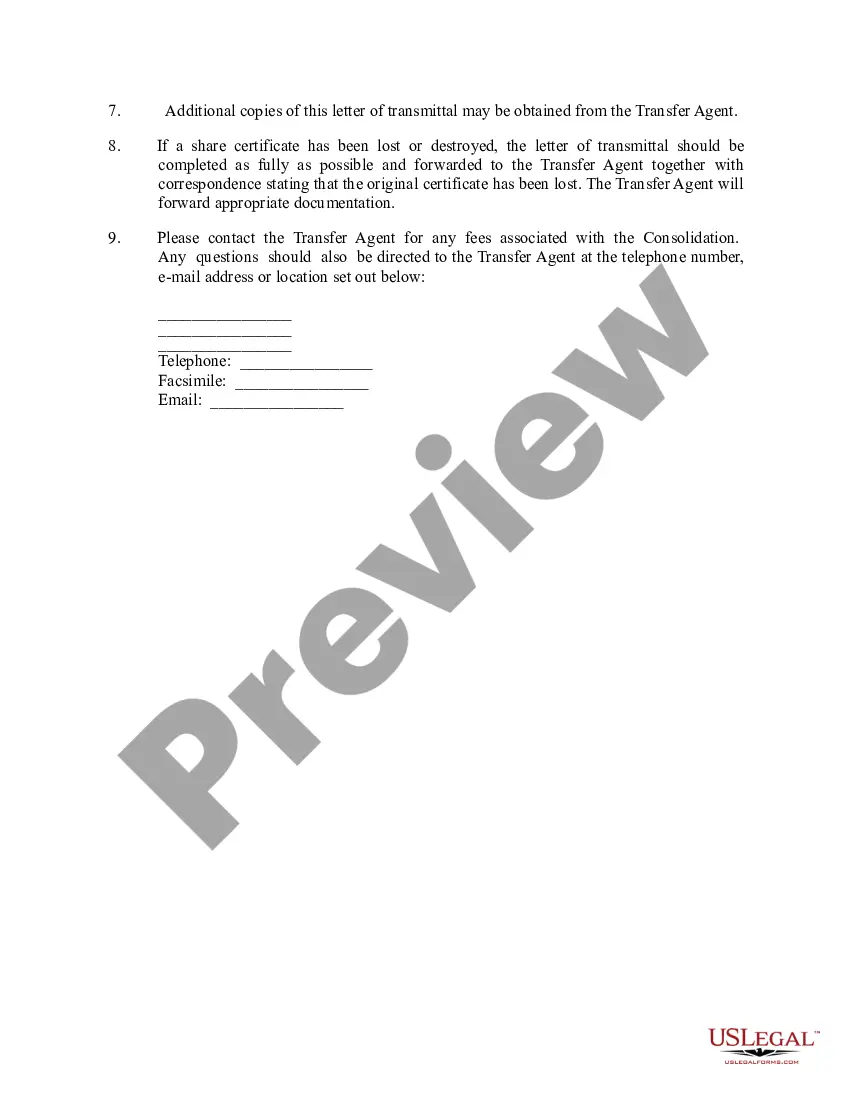

South Carolina Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

US Legal Forms - one of many most significant libraries of legitimate varieties in the United States - delivers an array of legitimate record templates you can acquire or print. Using the website, you may get thousands of varieties for company and specific purposes, categorized by categories, says, or keywords and phrases.You will discover the most recent types of varieties such as the South Carolina Letter of Transmittal in seconds.

If you currently have a membership, log in and acquire South Carolina Letter of Transmittal through the US Legal Forms collection. The Acquire option will show up on every form you view. You get access to all earlier delivered electronically varieties from the My Forms tab of your own account.

If you would like use US Legal Forms the first time, allow me to share easy instructions to get you started out:

- Be sure you have chosen the proper form to your area/area. Go through the Preview option to examine the form`s content material. See the form description to ensure that you have chosen the correct form.

- When the form does not satisfy your requirements, make use of the Research discipline near the top of the display to discover the the one that does.

- When you are content with the form, confirm your decision by simply clicking the Buy now option. Then, choose the pricing prepare you favor and offer your accreditations to sign up to have an account.

- Method the deal. Utilize your bank card or PayPal account to complete the deal.

- Choose the formatting and acquire the form on the gadget.

- Make adjustments. Fill up, edit and print and indication the delivered electronically South Carolina Letter of Transmittal.

Every single design you added to your money does not have an expiration time and it is your own eternally. So, in order to acquire or print one more backup, just visit the My Forms portion and click on around the form you will need.

Obtain access to the South Carolina Letter of Transmittal with US Legal Forms, by far the most considerable collection of legitimate record templates. Use thousands of specialist and condition-particular templates that fulfill your company or specific demands and requirements.

Form popularity

FAQ

So just open up the Form 1099-NEC from the IRS website, and start filling it in on your browser. (Already downloaded the form? You can open it in a browser by right-clicking on the file and selecting ?Open with??) Once you've filled out your information, you can print the document the same way you would any other file.

Use Form 1096 To Send Paper Forms to the IRS You must send Copies A of all paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS with Form 1096, Annual Summary and Transmittal of U.S. Information Returns. Instructions for completing Form 1096 are contained on Form 1096.

You can use plain white paper to print W-2 Copy A and W-3 forms. For Form 1099s, Copy A uses red ink and must be ordered from the IRS or purchased from a tax supply vendor. All other parts of Form 1099 can be printed on plain white paper.

The State of South Carolina requires additional forms to be submitted with 1099s based on filing mode. When you e-file, you are required to submit only Form WH-1606 and WH-1612 with your 1099. If you paper file, you have to submit both WH-1606 and 1096. TaxBandits supports the e-filing of 1099 with SC.

The easiest way to fill a 1099 form is electronically, and you can do so using the IRS Filing a Return Electronically (FIRE) system. Before doing so, you need to request a Transmitter Control Code (TCC) and submit it at least 30 days before the tax deadline for your 1099.

Do not staple, tear, tape or fold any forms. Prepare Copy A for each 1099 and their corresponding 1096. Send the Copy A forms along with Form 1096 to the IRS in a flat mailing. Staples, tape or anything else will interfere with the IRS scanners.