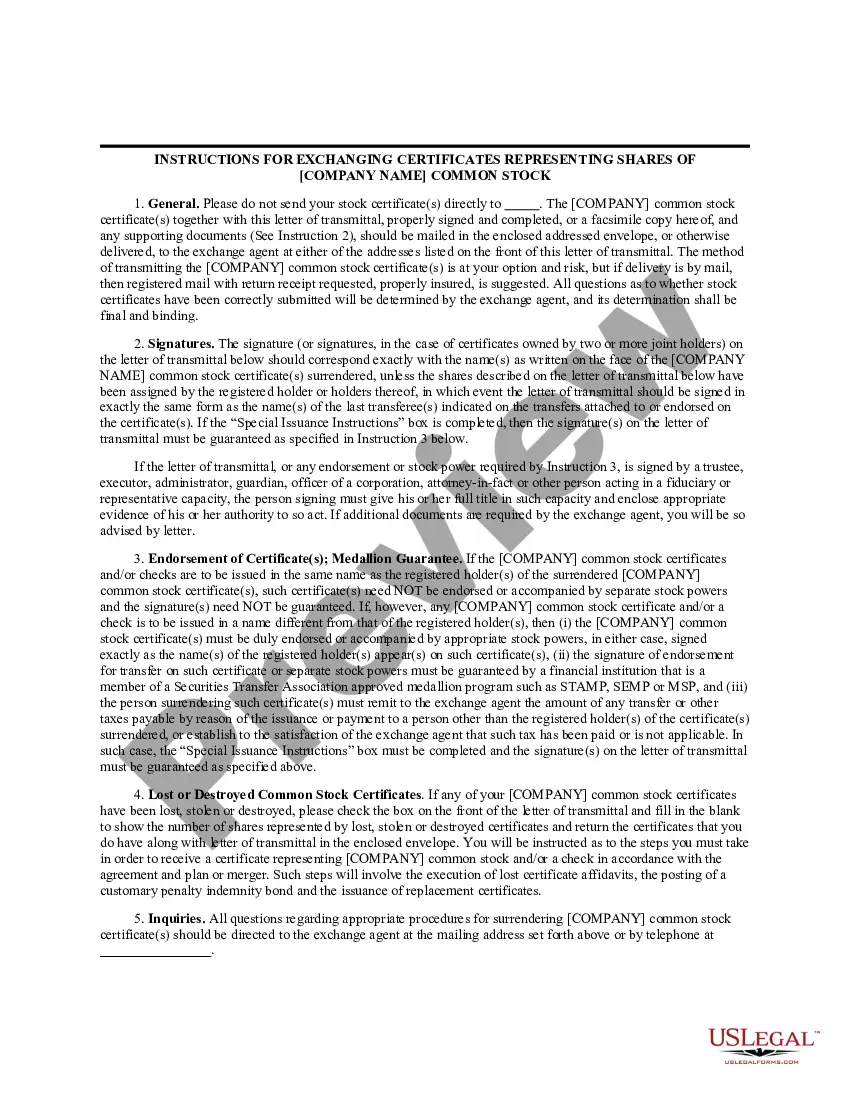

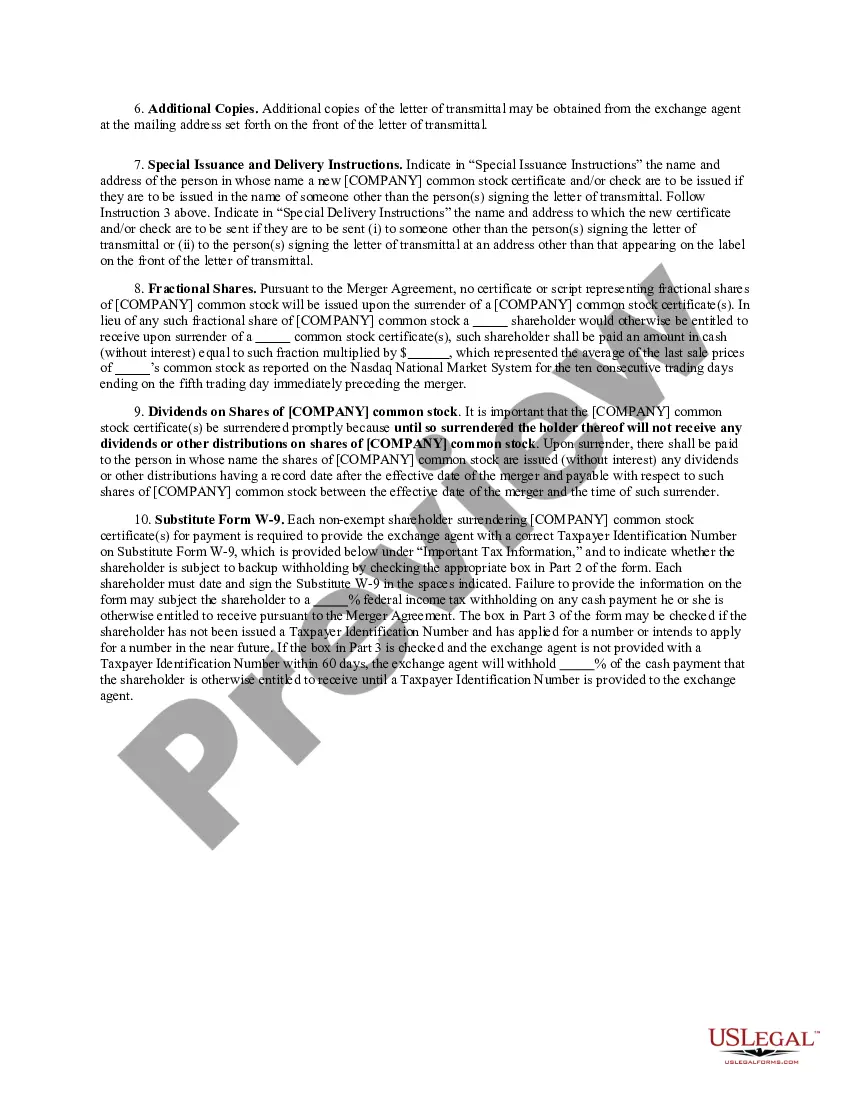

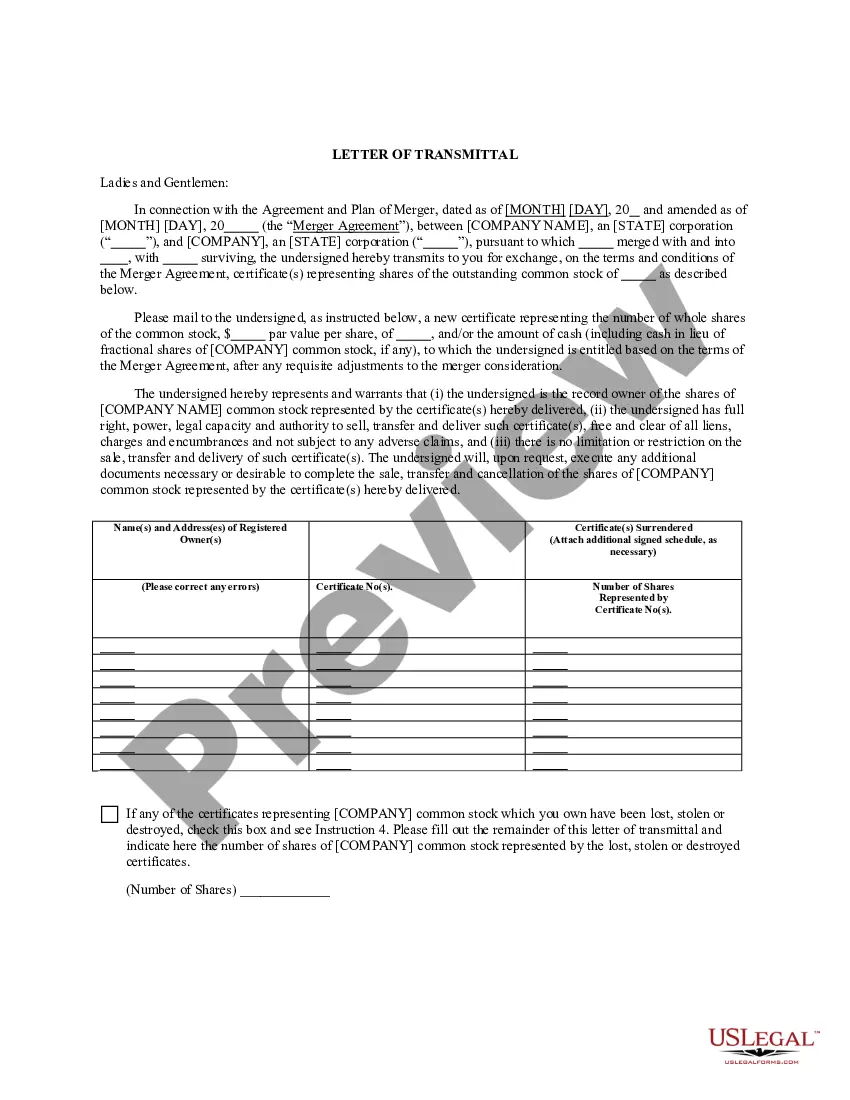

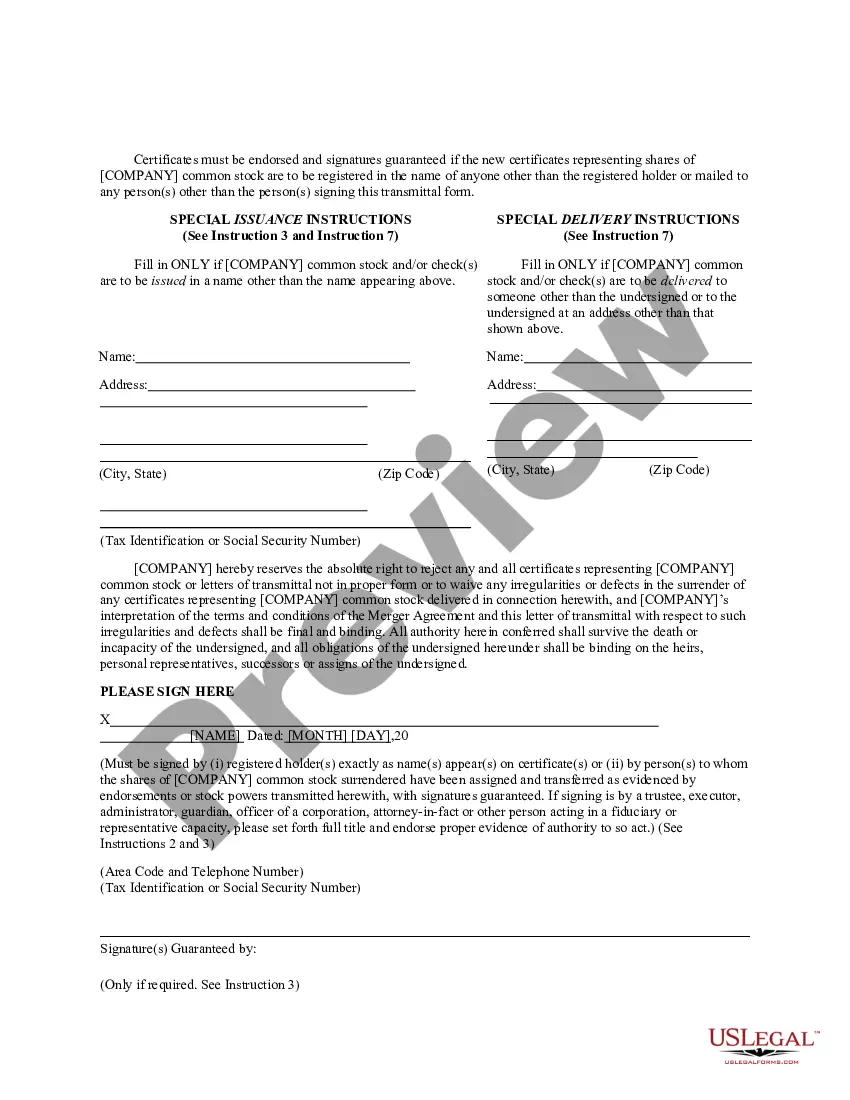

South Carolina Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

If you have to comprehensive, download, or printing legitimate document web templates, use US Legal Forms, the biggest variety of legitimate types, that can be found on the Internet. Utilize the site`s simple and handy lookup to discover the documents you want. Various web templates for enterprise and personal uses are categorized by types and states, or search phrases. Use US Legal Forms to discover the South Carolina Letter of Transmittal in a handful of clicks.

If you are previously a US Legal Forms consumer, log in in your accounts and click the Down load key to get the South Carolina Letter of Transmittal. You can also gain access to types you in the past acquired in the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for your right area/nation.

- Step 2. Take advantage of the Preview method to look through the form`s articles. Never forget to learn the information.

- Step 3. If you are unhappy together with the type, utilize the Search field near the top of the monitor to locate other versions from the legitimate type format.

- Step 4. After you have located the shape you want, go through the Buy now key. Choose the prices prepare you choose and include your qualifications to sign up on an accounts.

- Step 5. Process the financial transaction. You should use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Pick the file format from the legitimate type and download it in your system.

- Step 7. Complete, revise and printing or sign the South Carolina Letter of Transmittal.

Each and every legitimate document format you acquire is the one you have permanently. You might have acces to each type you acquired inside your acccount. Click the My Forms portion and pick a type to printing or download once more.

Compete and download, and printing the South Carolina Letter of Transmittal with US Legal Forms. There are millions of expert and state-certain types you can use for the enterprise or personal needs.

Form popularity

FAQ

Do not staple, tear, tape or fold any forms. Prepare Copy A for each 1099 and their corresponding 1096. Send the Copy A forms along with Form 1096 to the IRS in a flat mailing. Staples, tape or anything else will interfere with the IRS scanners.

Use Form 1096 To Send Paper Forms to the IRS You must send Copies A of all paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS with Form 1096, Annual Summary and Transmittal of U.S. Information Returns. Instructions for completing Form 1096 are contained on Form 1096.

The State of South Carolina requires additional forms to be submitted with 1099s based on filing mode. When you e-file, you are required to submit only Form WH-1606 and WH-1612 with your 1099. If you paper file, you have to submit both WH-1606 and 1096. TaxBandits supports the e-filing of 1099 with SC.

The easiest way to fill a 1099 form is electronically, and you can do so using the IRS Filing a Return Electronically (FIRE) system. Before doing so, you need to request a Transmitter Control Code (TCC) and submit it at least 30 days before the tax deadline for your 1099.

So just open up the Form 1099-NEC from the IRS website, and start filling it in on your browser. (Already downloaded the form? You can open it in a browser by right-clicking on the file and selecting ?Open with??) Once you've filled out your information, you can print the document the same way you would any other file.

You can use plain white paper to print W-2 Copy A and W-3 forms. For Form 1099s, Copy A uses red ink and must be ordered from the IRS or purchased from a tax supply vendor. All other parts of Form 1099 can be printed on plain white paper.