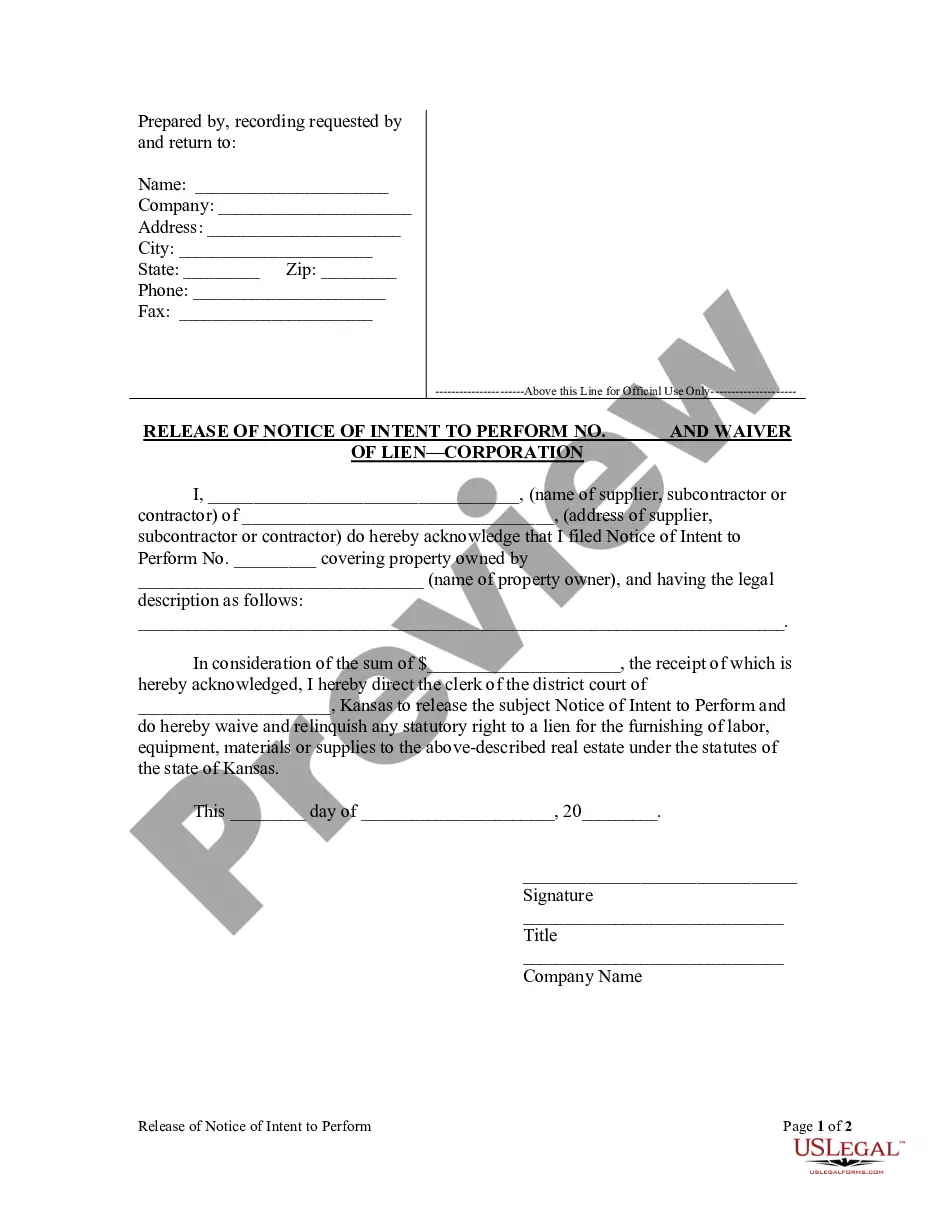

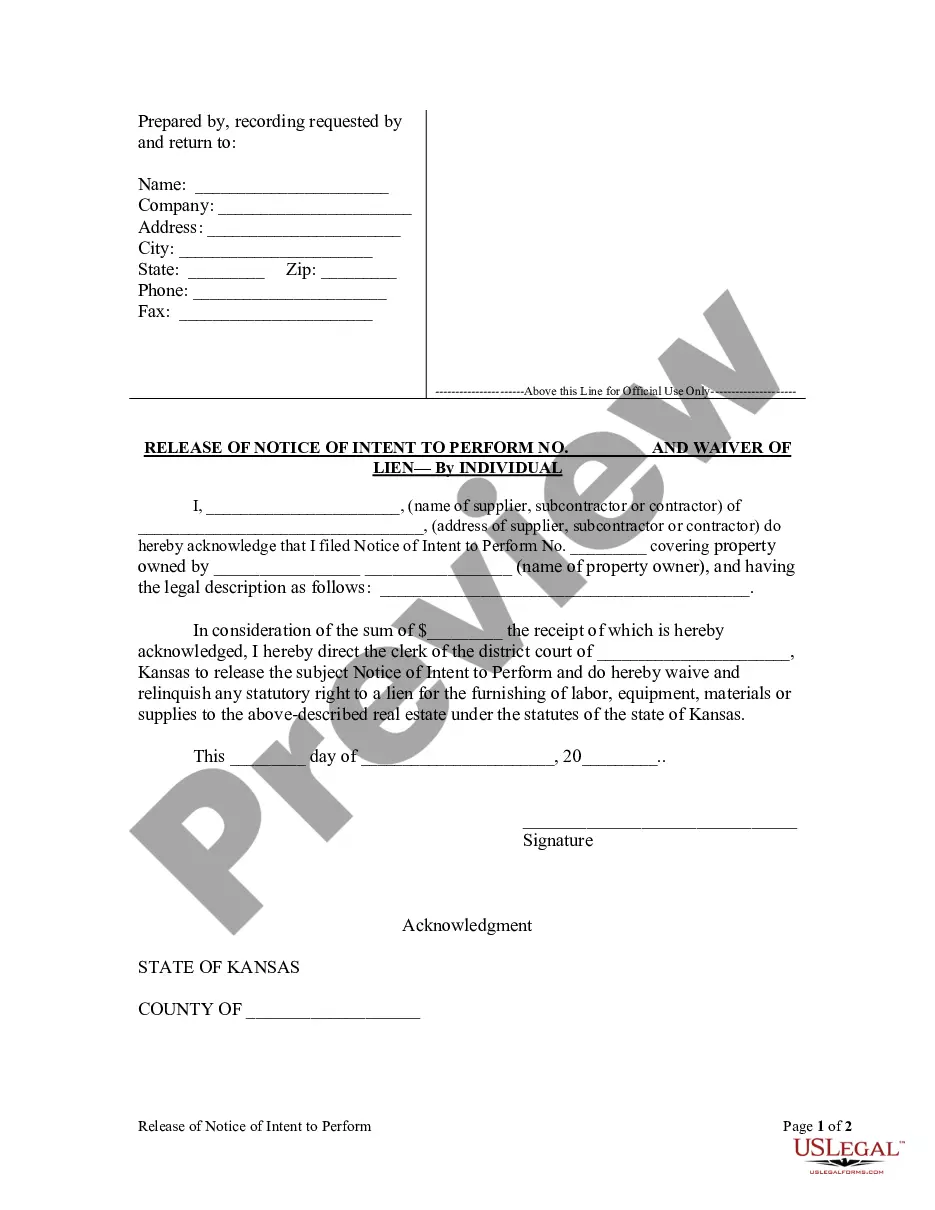

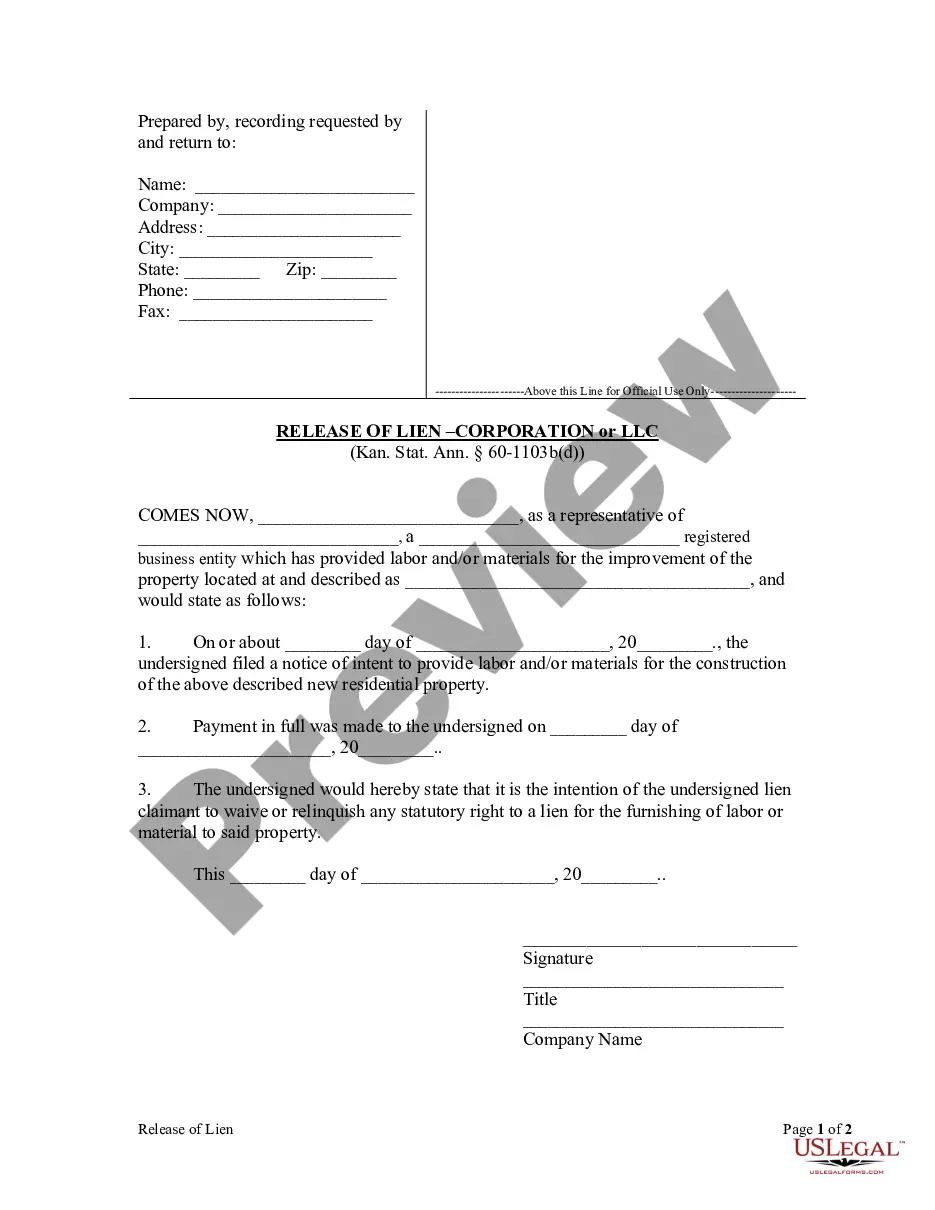

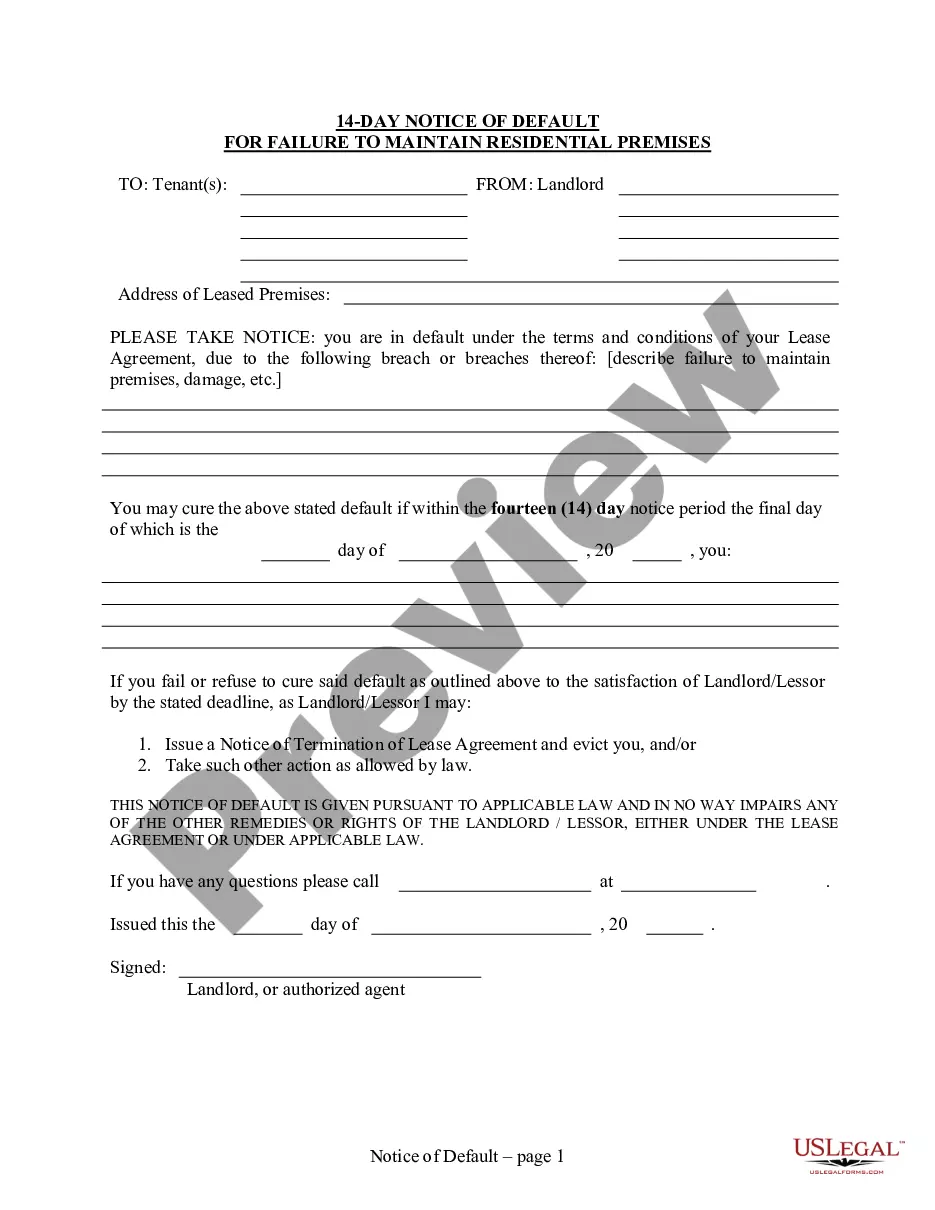

Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien.

Kansas Release of Notice and Waiver of Lien by Corporation or LLC

Description

How to fill out Kansas Release Of Notice And Waiver Of Lien By Corporation Or LLC?

Seeking to obtain Kansas Release of Notice and Waiver of Lien by Corporation or LLC forms and completing them can be quite challenging.

To conserve a significant amount of time, expenses, and effort, utilize US Legal Forms to locate the appropriate template tailored for your state in just a few clicks.

Our attorneys prepare every document, so all you need to do is fill them in. It's genuinely that straightforward.

You can print the Kansas Release of Notice and Waiver of Lien by Corporation or LLC template or complete it using any online editor. Don’t worry about making mistakes as your template can be used and submitted, and printed as many times as you like. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and revisit the form's page to download the document.

- Your saved templates can be found in My documents and are accessible at any time for future use.

- If you haven't registered yet, you should enroll.

- Review our comprehensive instructions on how to obtain your Kansas Release of Notice and Waiver of Lien by Corporation or LLC template in just a few minutes.

- To acquire a legitimate form, verify its relevance for your state.

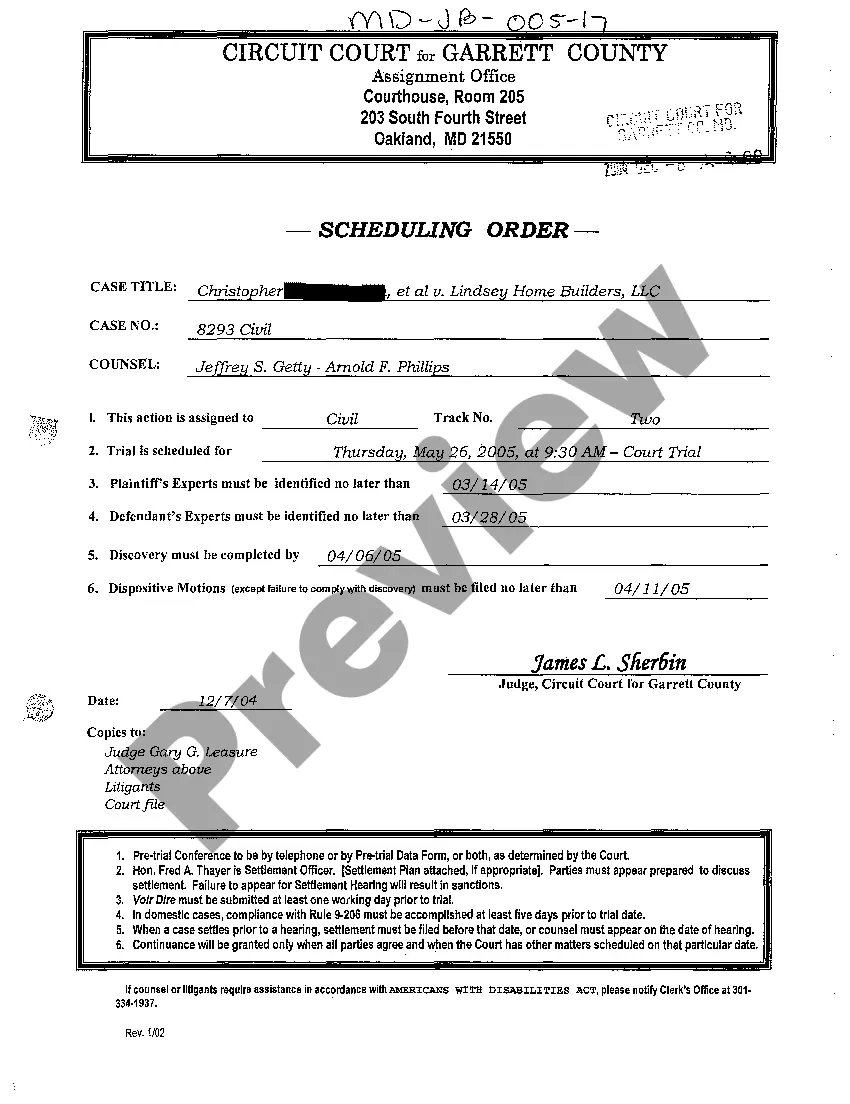

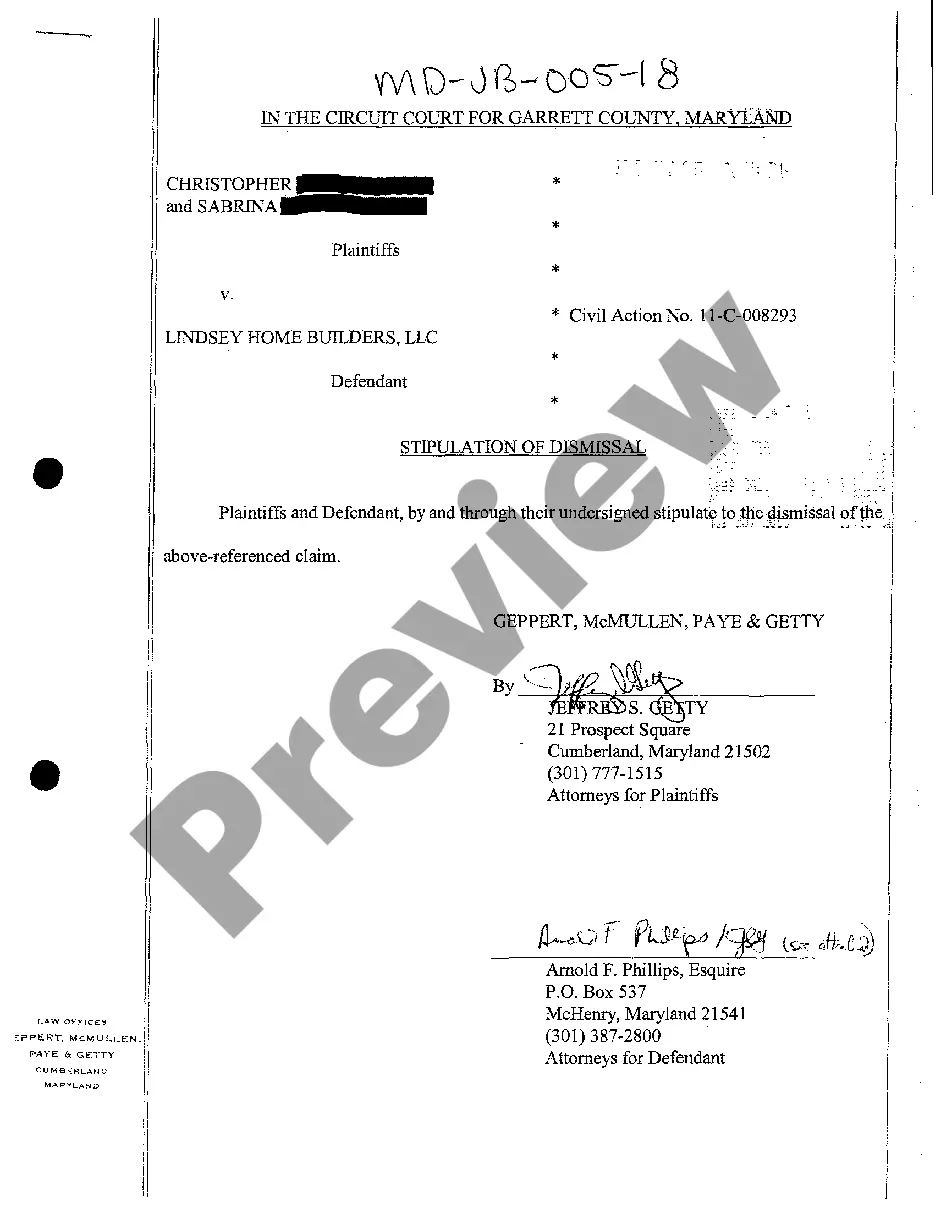

- Examine the form using the Preview feature (if available).

- If a description is provided, read it to understand the details.

- Click the Buy Now button if you discover what you're looking for.

Form popularity

FAQ

The lien can be released on the title, a notarized lien release, Form TR-150, or a letter from the lienholder releasing the lien. If the title for the vehicle was issued from another state (not a Kansas title) or the Bill of Sale is from an out of state owner, a vehicle inspection is required.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

Lien releases may be faxed to (913) 715-2510, emailed to dmv@jocogov.org, or mailed to 111 S. Cherry St, Suite 1500, Olathe, KS 66061. Be sure to indicate the mailing address that the title is to be mailed to, along with a phone number in case there are questions.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.