Kansas Release of Notice and Waiver of Lien by Corporation or LLC

What this document covers

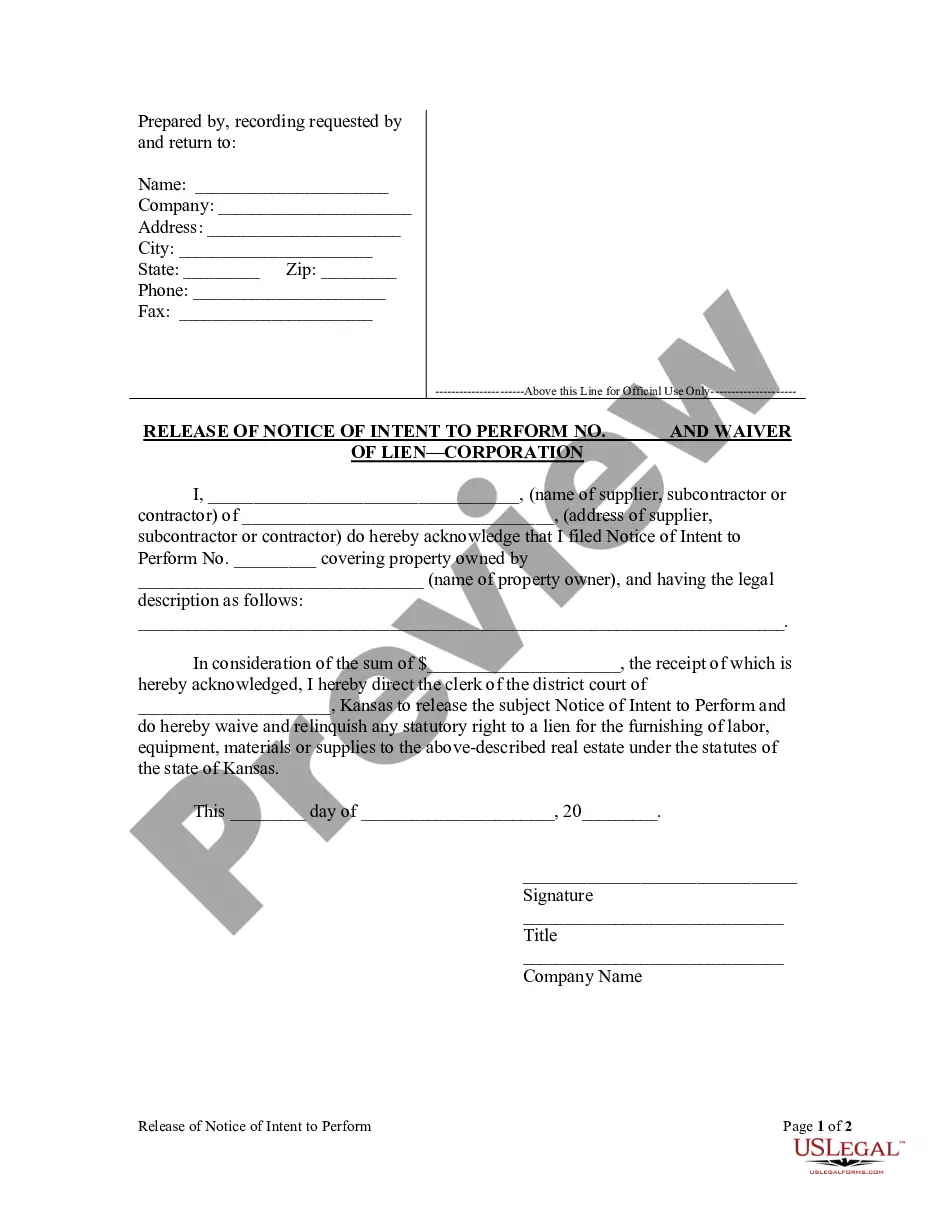

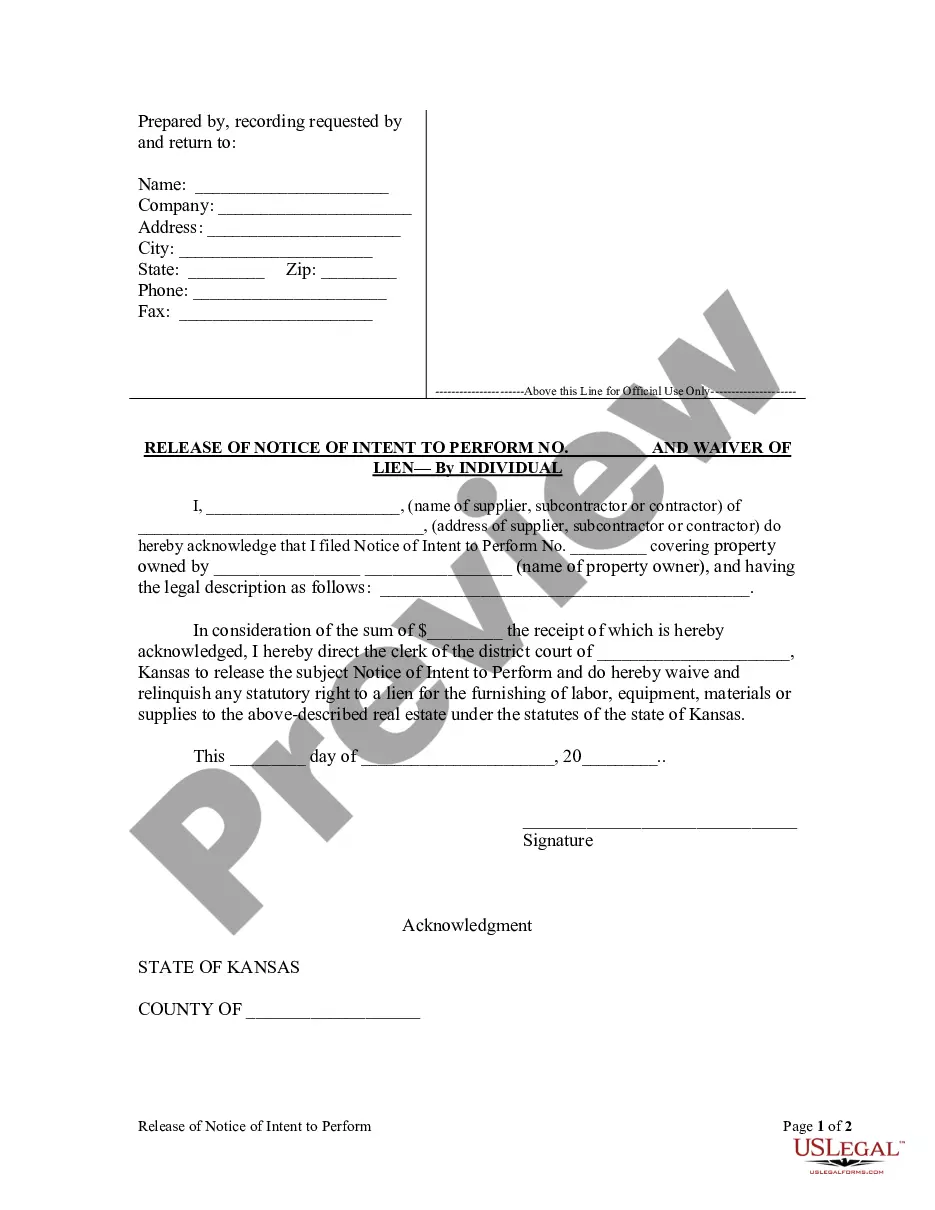

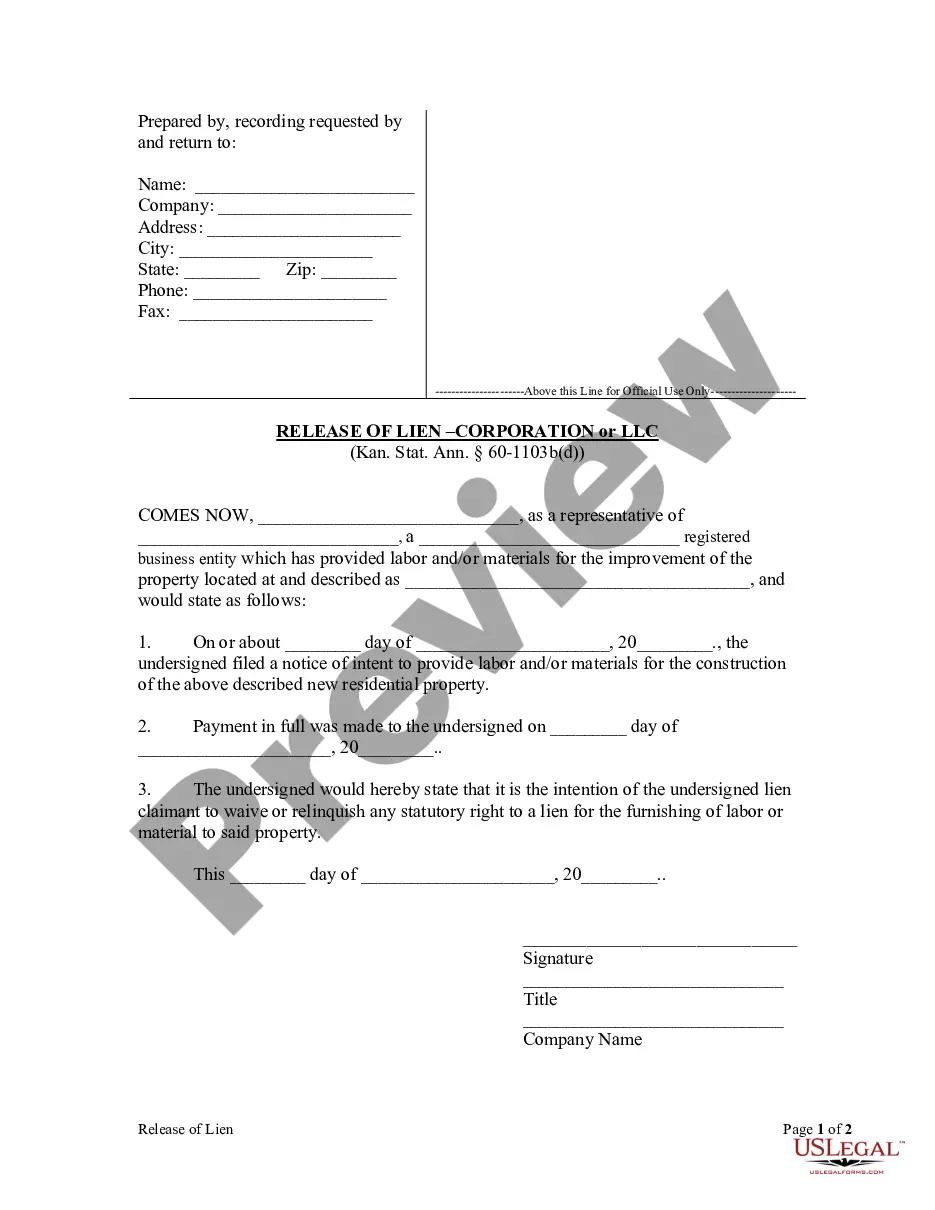

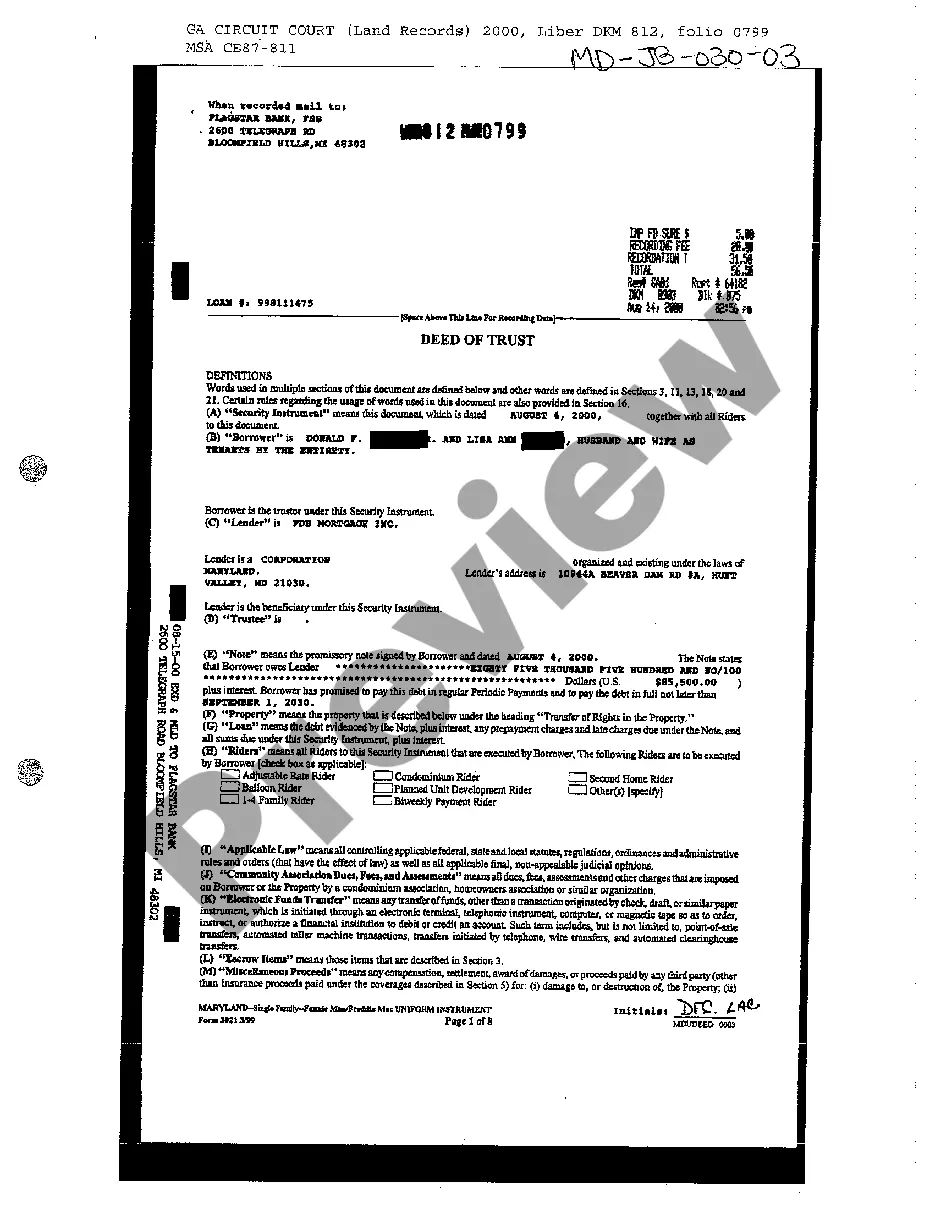

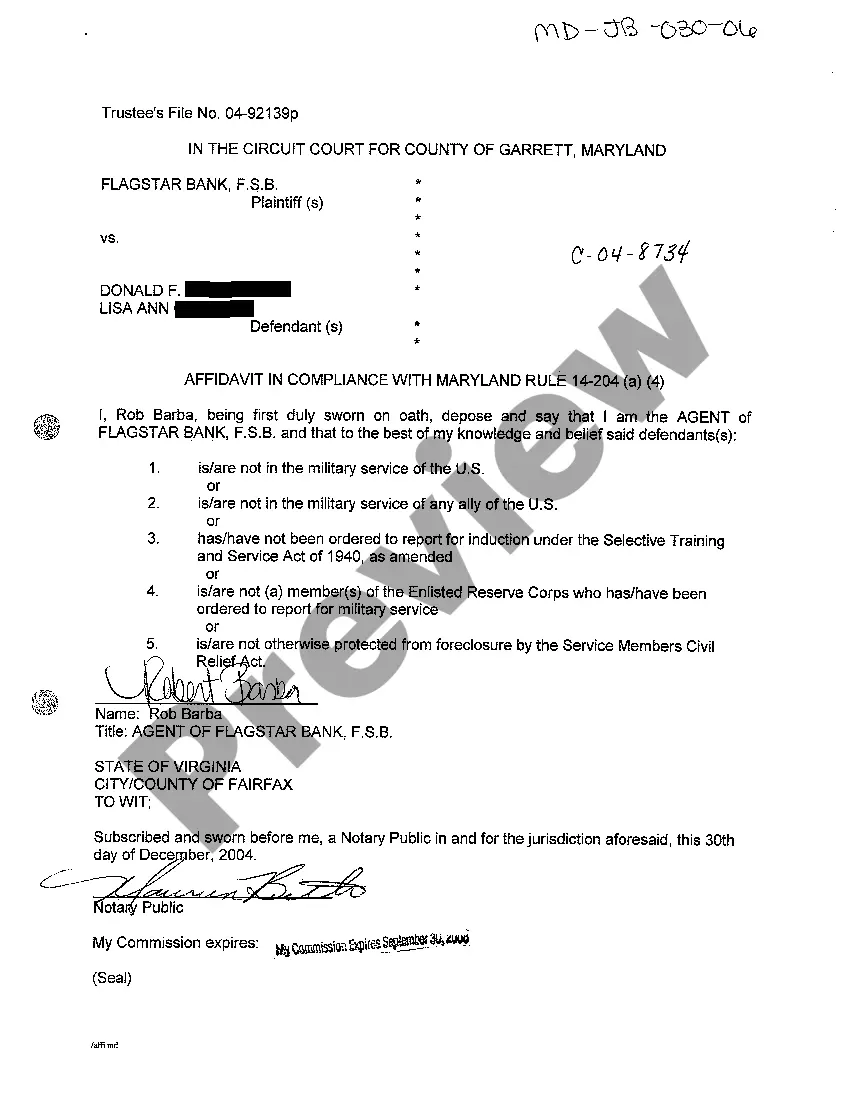

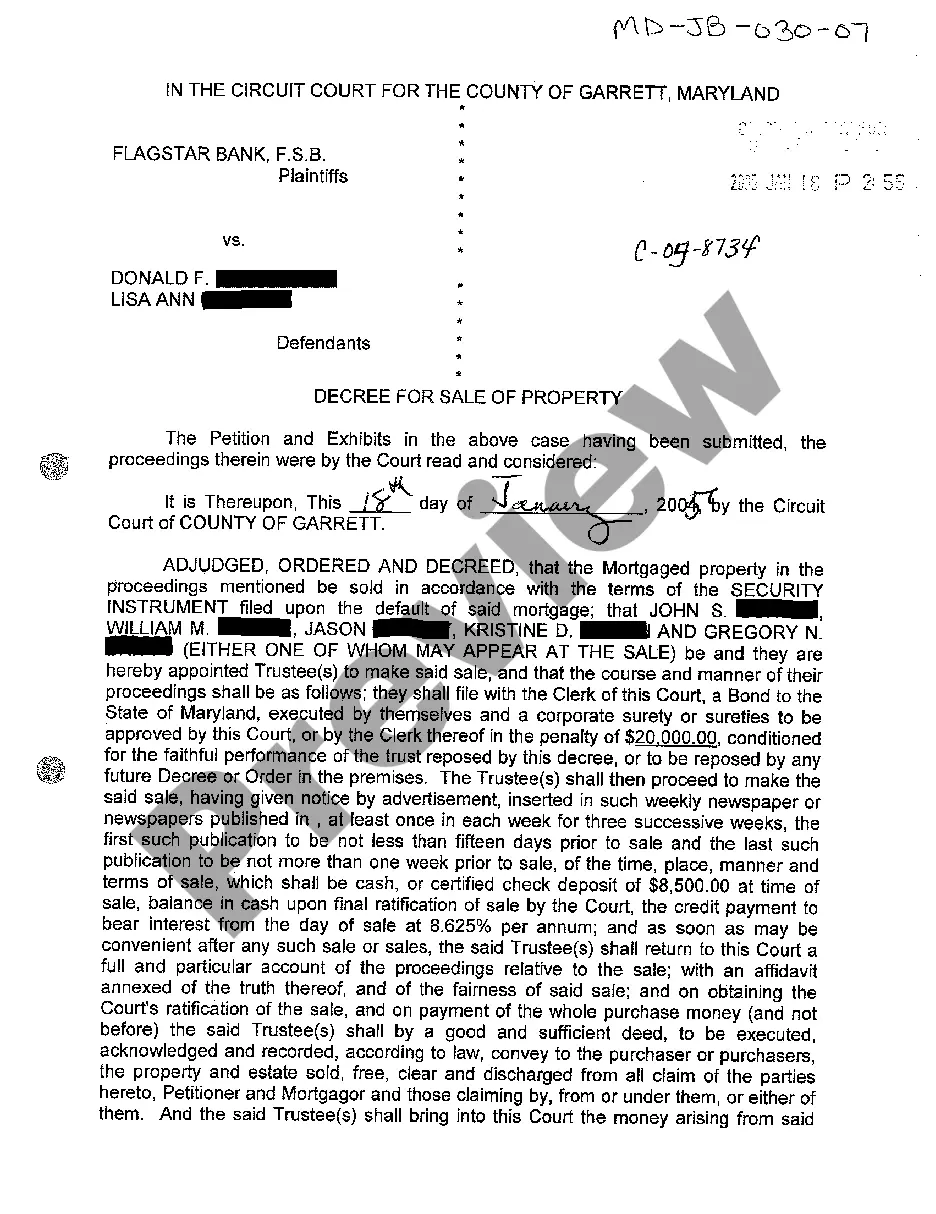

The Release of Notice and Waiver of Lien by Corporation or LLC is a legal document used in Kansas to effectively release a previously filed Notice of Intent to Perform for construction-related services. This form is typically filed after the subcontractor, supplier, or contractor has received full payment for the work or materials provided, waiving any right to claim a lien against the property in question. This differs from other lien-related forms by focusing specifically on the acknowledgment of payment and the release of lien rights.

Situations where this form applies

This form should be used when a subcontractor, supplier, or contractor has been fully paid for their services or materials provided to a residential property in Kansas. It serves as an important legal step to release any claims of a lien on the property, ensuring that the property owner can maintain clear title without the risk of future claims related to the provided services.

Who needs this form

- Corporations or LLCs that have provided labor or materials for a construction project.

- Subcontractors or suppliers seeking to confirm receipt of payment.

- Property owners who want to ensure proper lien release after all contractors have been paid.

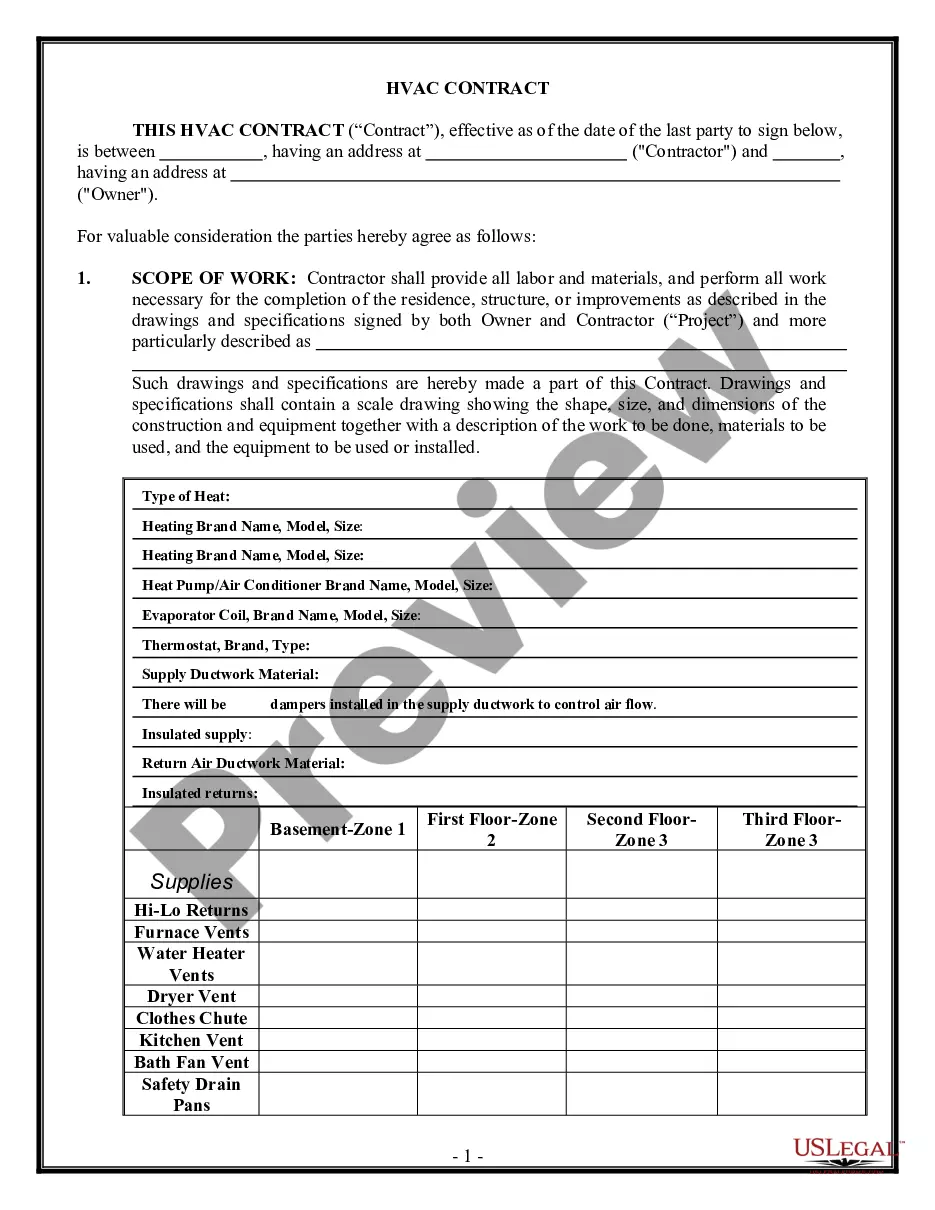

How to complete this form

- Identify the full name and address of the supplier, subcontractor, or contractor.

- Provide the number of the previously filed Notice of Intent to Perform.

- Include the name and legal description of the property owned by the property owner.

- Specify the total amount received for the services or materials furnished.

- Sign and date the form, indicating your official title within the corporation or LLC.

- Have the completed document notarized to confirm its authenticity.

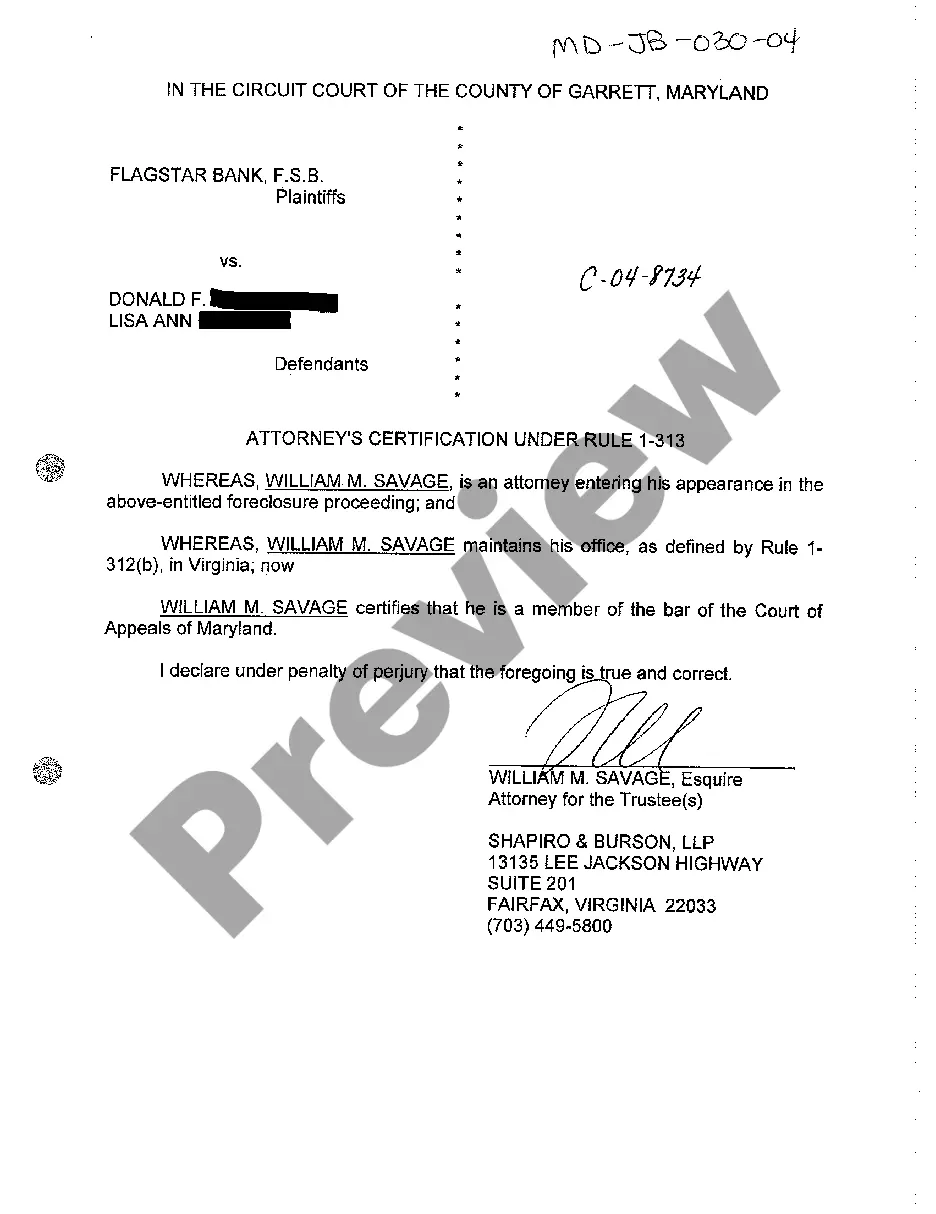

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the correct Notice of Intent to Perform number.

- Leaving out the legal description of the property.

- Not having the document notarized, which is essential for legal acceptance.

- Providing incorrect or incomplete payment information.

- Forgetting to sign the form before submission.

Why use this form online

- Easy and instant access to a legally vetted template.

- Convenient downloadable format allows for quick completion and submission.

- Reduced risk of errors with pre-filled fields and guided instructions.

- Secure storage options for completed documents.

Looking for another form?

Form popularity

FAQ

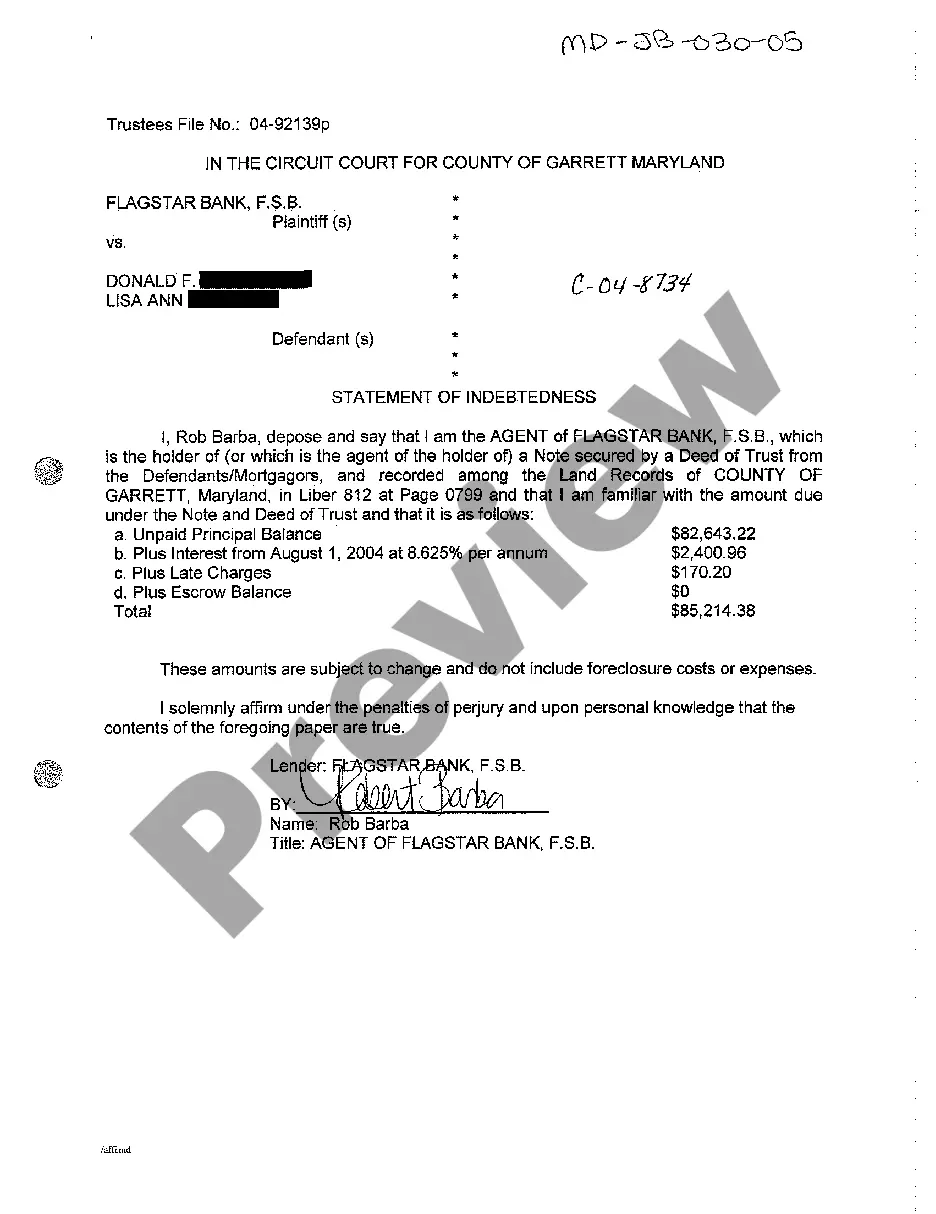

The lien can be released on the title, a notarized lien release, Form TR-150, or a letter from the lienholder releasing the lien. If the title for the vehicle was issued from another state (not a Kansas title) or the Bill of Sale is from an out of state owner, a vehicle inspection is required.

The release of lien for an electronic title may be accomplished by providing this completed form to the person who satisfied the lien, purchased the vehicle, or requested the release, and/or by faxing it to the Title & Registration Bureau at (785) 296-2383 or e-mail to KDOR_TR@ks.gov.

Write your name and return address in the top three lines of the letter. Insert the complete date (month, day, year). Enter the recipient's name, title, company name and address on the next five lines. Greet the reader by writing "Dear (recipient's name):" Skip two lines. State the subject in a subject line.

Lien releases may be faxed to (913) 715-2510, emailed to dmv@jocogov.org, or mailed to 111 S. Cherry St, Suite 1500, Olathe, KS 66061. Be sure to indicate the mailing address that the title is to be mailed to, along with a phone number in case there are questions.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

If the vehicle owner wishes to remove a lien holder's name from a registration receipt, an application for reissued title must be made at the local county treasurer's motor vehicle office. Bring the notarized lien release and a title will be requested and mailed to you within 5 to 7 days.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

If the lien has been paid off, use the assignment portion of the Lienholder Consent to Transfer Ownership, Form TR-128, attach the lien release in lieu of the lienholder's portion of the consent and go to your local county treasurer's motor vehicle office and make application for title.