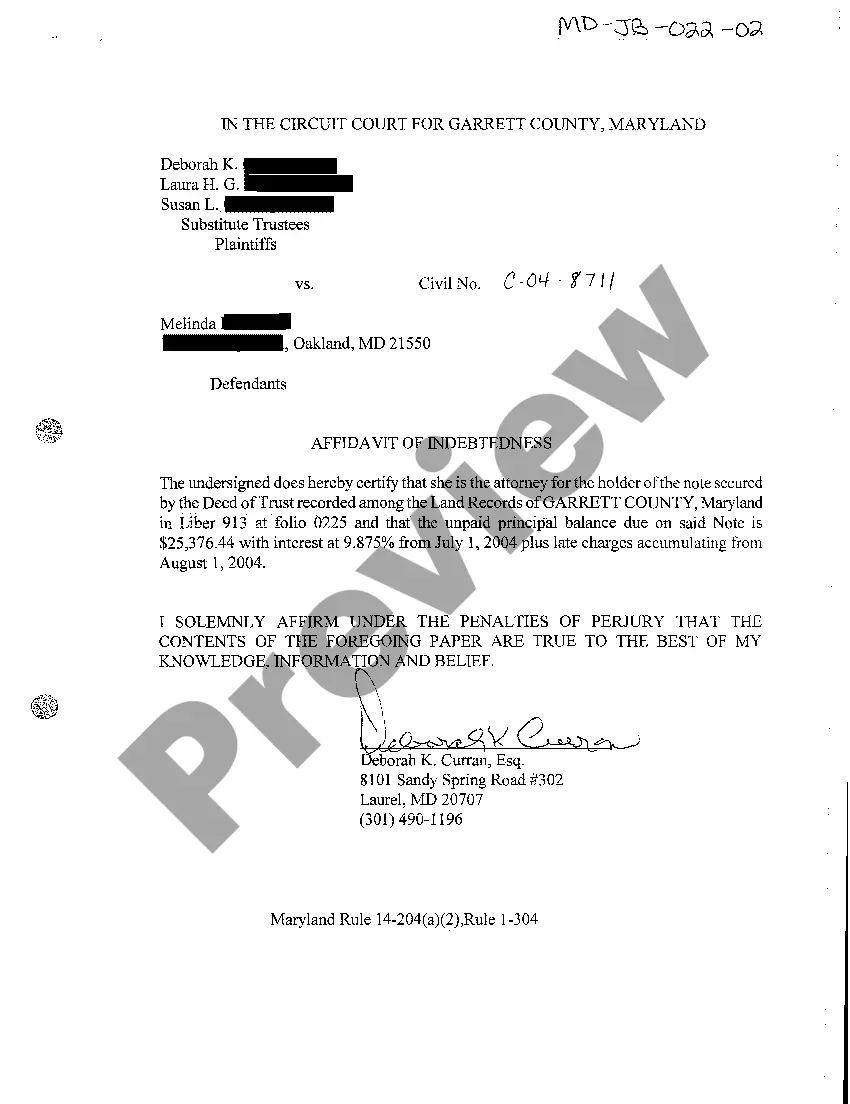

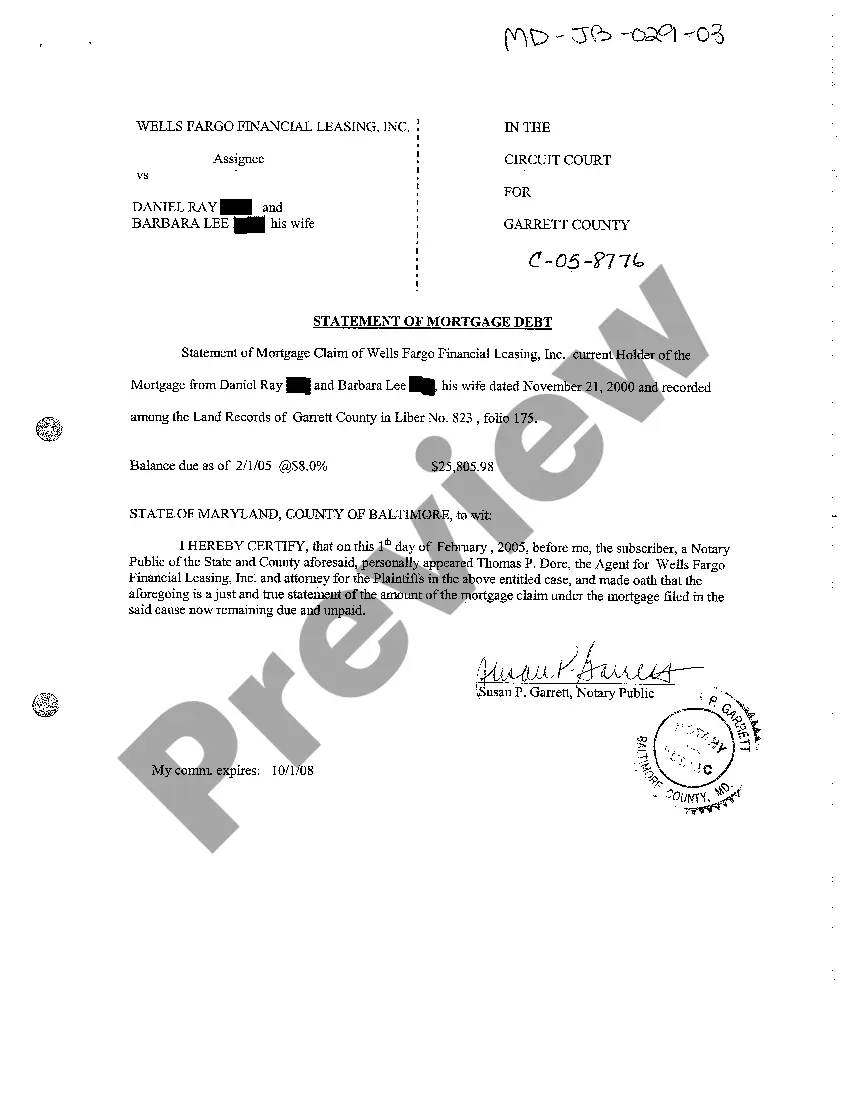

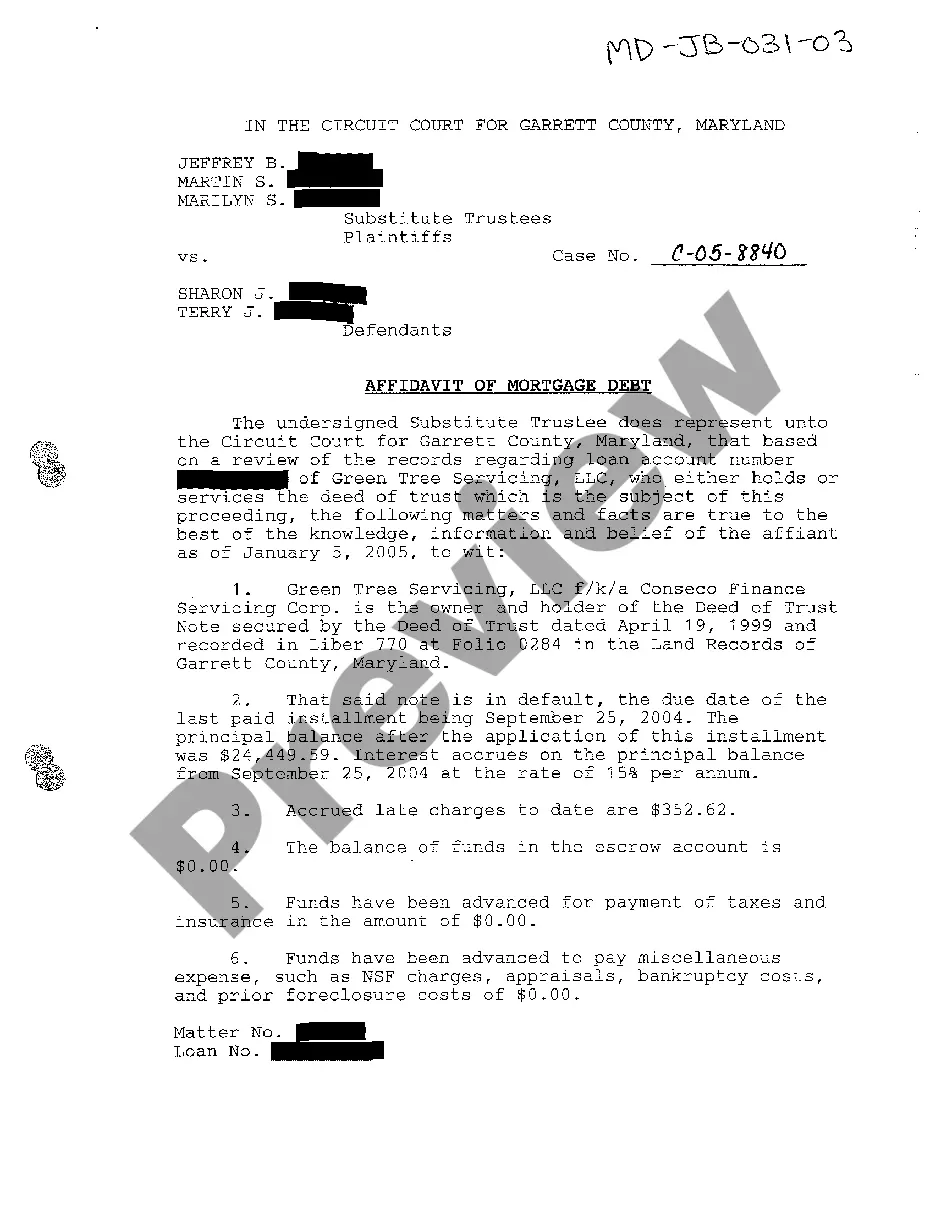

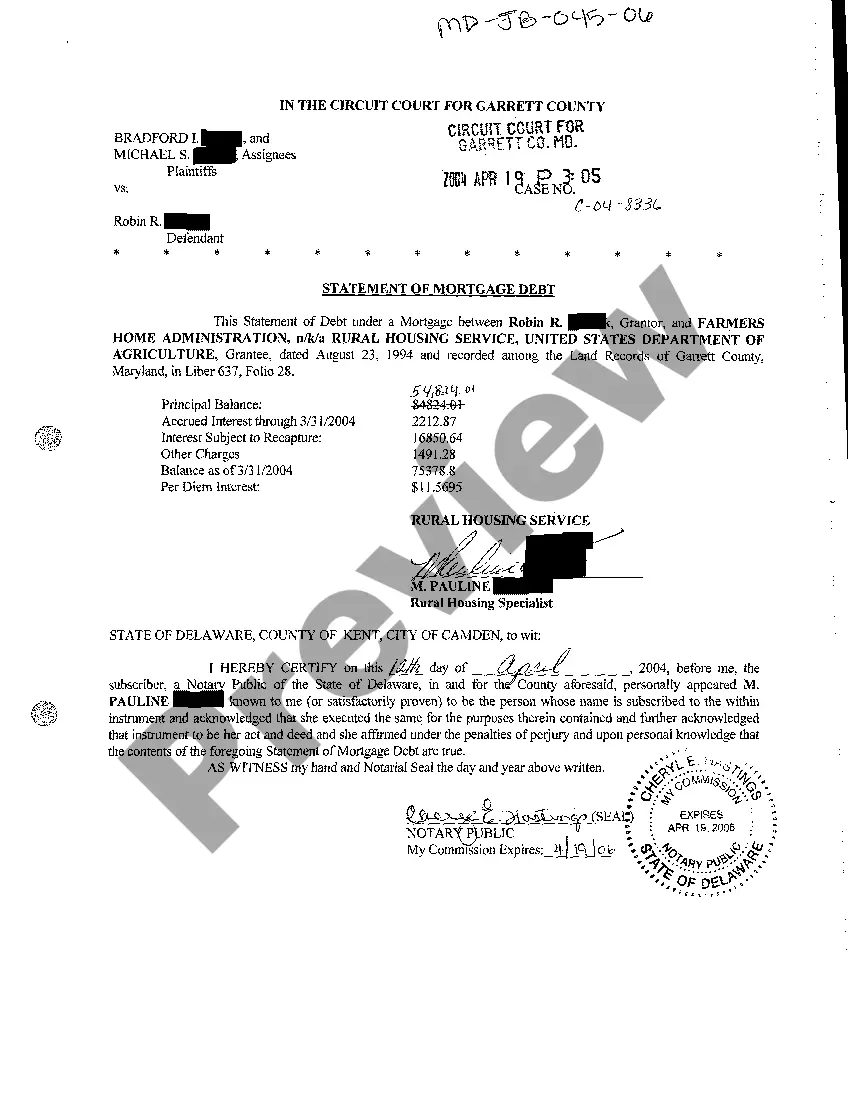

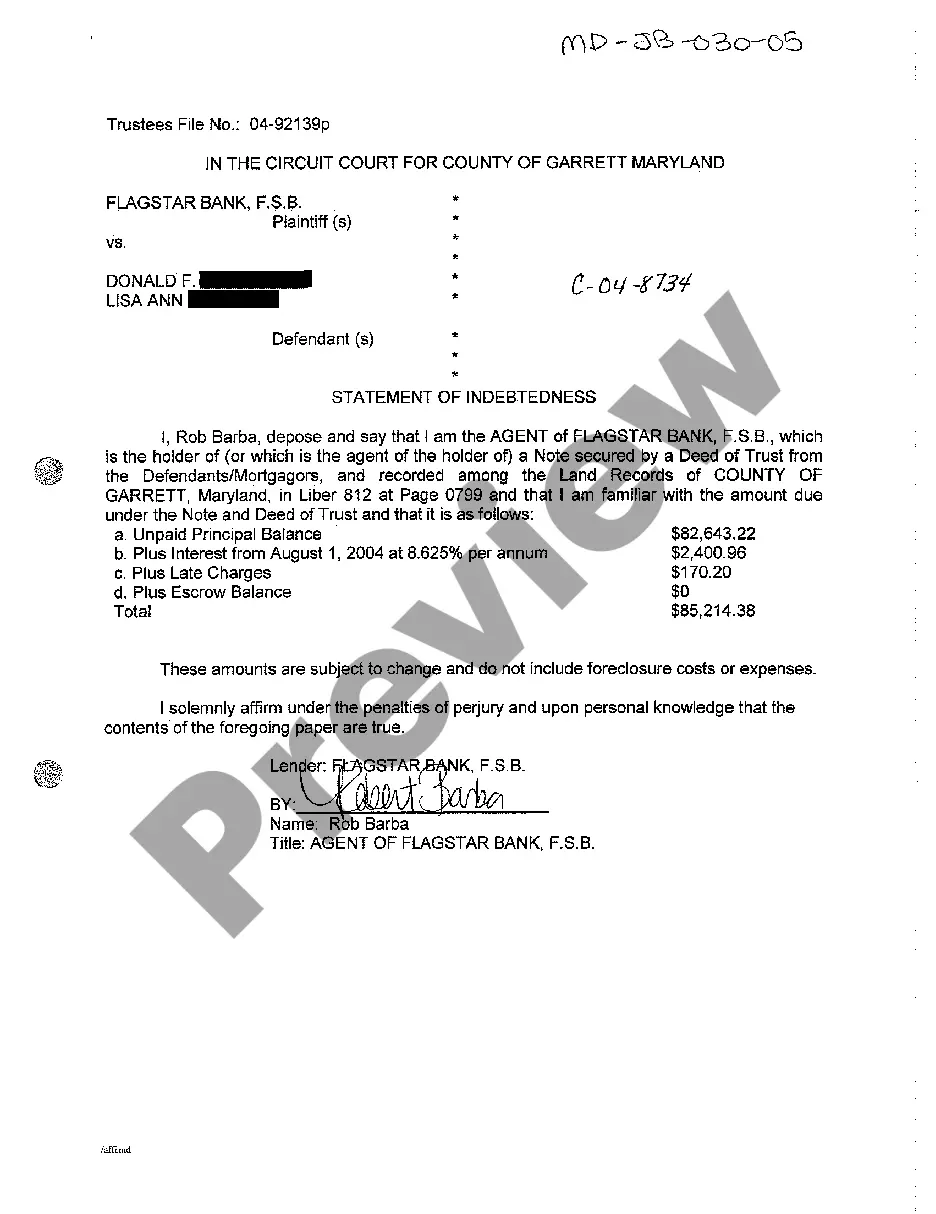

Maryland Statement of Indebtedness

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Statement Of Indebtedness?

Greetings to the most crucial legal documentation repository, US Legal Forms. Here, you will discover any template including Maryland Statement of Indebtedness forms and obtain them (as many as you desire/require). Prepare formal documents in a few hours, instead of days or even weeks, without incurring significant expenses on a lawyer.

Acquire your state-specific template in just a few clicks and feel confident knowing that it was created by our certified legal experts.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Statement of Indebtedness you wish. Since US Legal Forms is an online service, you’ll typically have access to your downloaded documents, no matter the device you are using. Find them in the My documents section.

Once you’ve finalized the Maryland Statement of Indebtedness, submit it to your attorney for validation. It’s a supplementary step but a vital one for ensuring you’re fully protected. Register for US Legal Forms today and gain access to a plethora of reusable templates.

- If you have not created an account yet, what are you holding out for? Review our instructions below to kick off.

- If this is a state-specific document, verify its legality in your locale.

- Examine the description (if available) to ascertain if it’s the correct template.

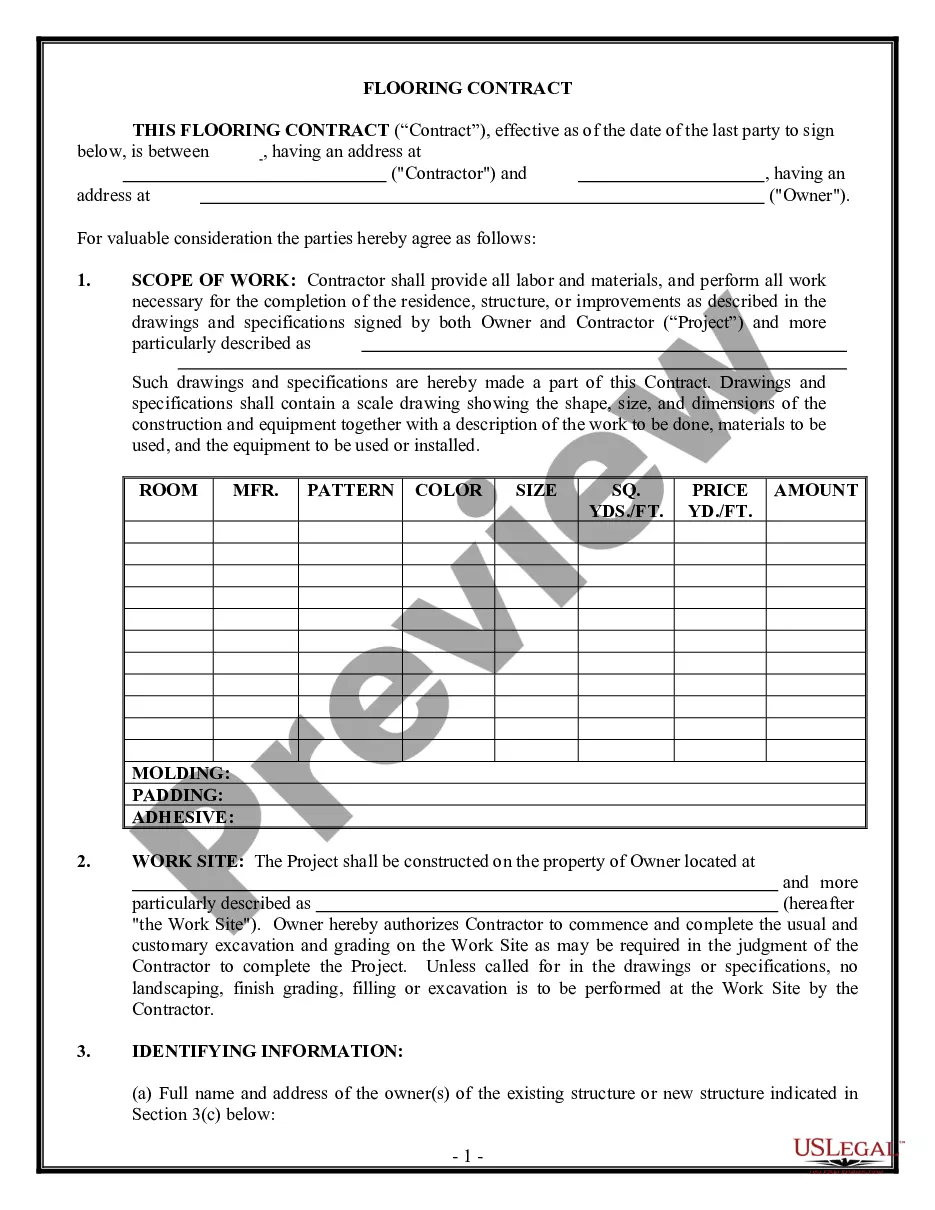

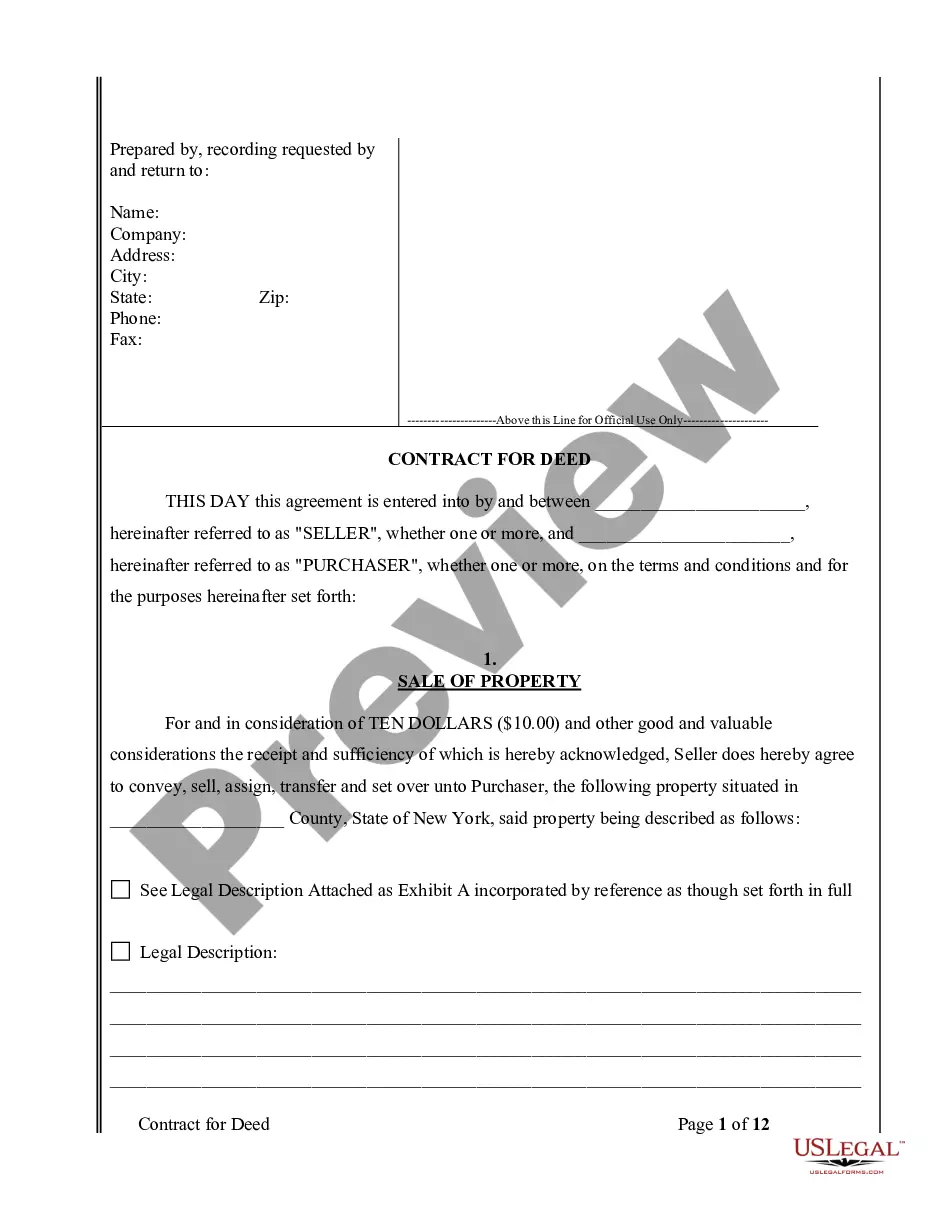

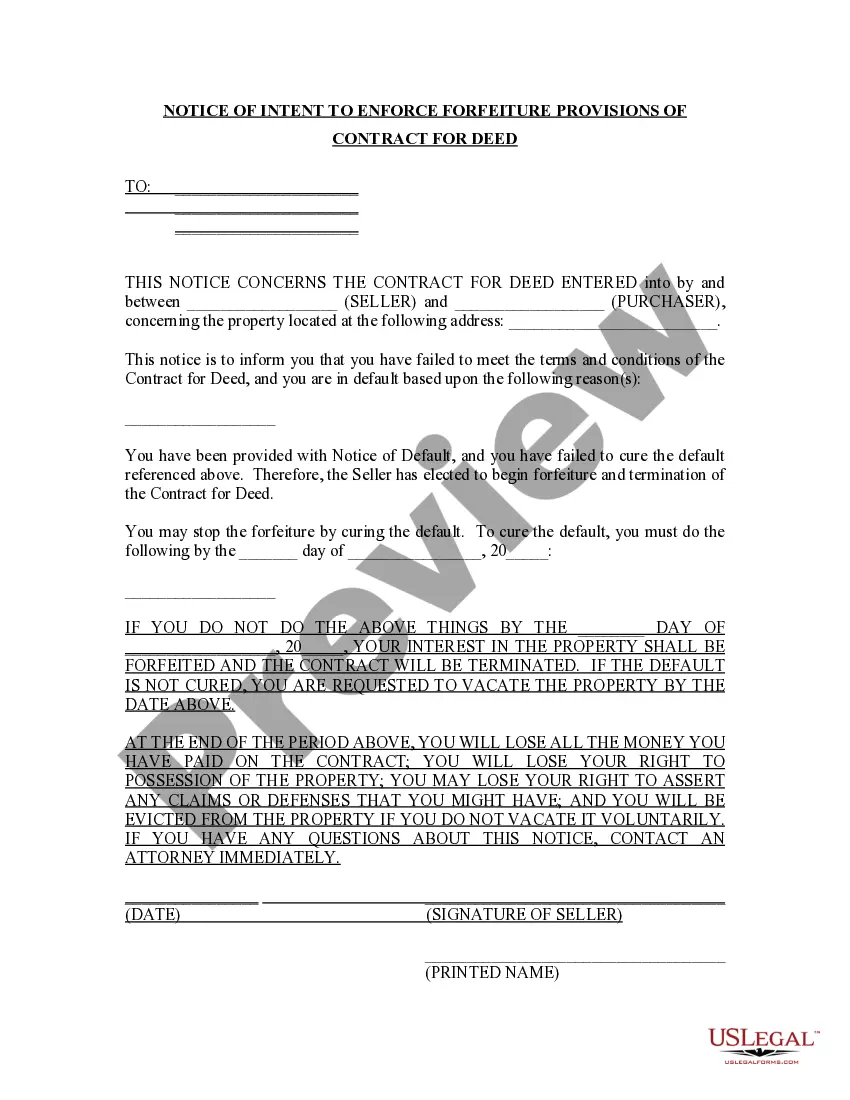

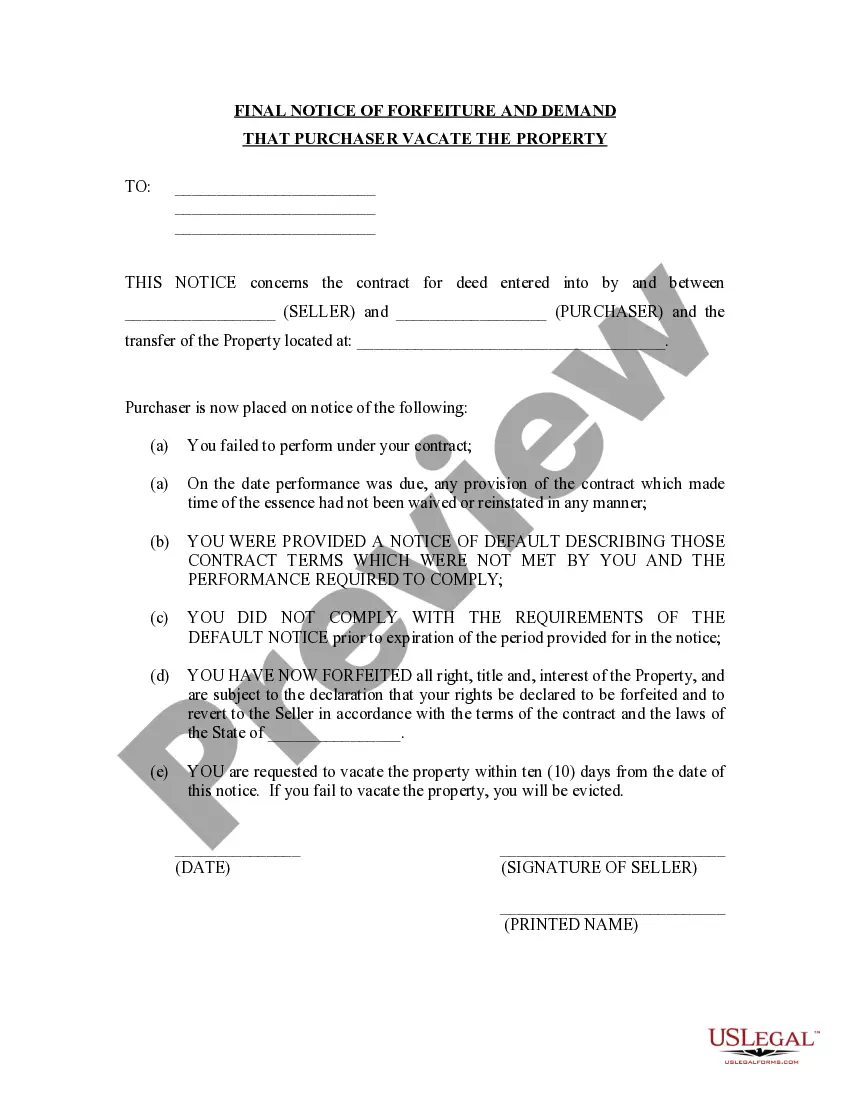

- View additional content using the Preview feature.

- If the template fulfills all your criteria, click Purchase Now.

- To establish your account, select a payment plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you prefer (Word or PDF).

- Print the document and complete it with your/your company’s details.

Form popularity

FAQ

Wages cannot be garnished if the judgment debtor's disposable wages are less than 30 times the State minimum hourly wage multiplied by the number of weeks during which the wages due were earned. In any event, no more than 25% of your disposable wages for a week can be garnished.

A Maryland wage garnishment is a legal mechanism in Maryland debtor/creditor law that allows a creditor to take a percentage of your wages when they can't get money owed to them.Once your employer receives the Wage Garnishment Court Order, they must begin sending 25% of your take home pay to your Judgment Creditor.

When the income reported on the Maryland return is less than the income reported on the federal return, the Maryland return is adjusted to increase the income accordingly. A Notice of Adjustment (FAGIM) is issued to notify the taxpayer of the changes made and the resulting tax and interest due.

If you believe you owe state taxes but have not received a notice, call our taxpayer service office at 410-260-7980 from Central Maryland or 1-800-MDTAXES from elsewhere. This letter is to inform you that your tax account has been referred to Collections because the balance was not paid.

1. If an alleged employer reports that the debtor is not employed, creditor must file a request for a hearing within 15 days, or the court may dismiss the garnishment. File your request in writing or on a Request/Order form (DC-001).

In general, the statute of limitations in Maryland for debt collection is three or four years after you stopped making payments, although it can be as long as 12 years in limited cases.

In general, the statute of limitations in Maryland for debt collection is three or four years after you stopped making payments, although it can be as long as 12 years in limited cases.

No. The court will not put you in jail for not paying a consumer debt like a credit card bill, medical bill, or rent payment.If a creditor has a judgment against you, it may be able to garnish your wages or ask the court for the money in your bank account.