South Carolina Partnership Agreement

Description

How to fill out Partnership Agreement?

You may commit several hours on the web looking for the legitimate papers web template which fits the state and federal specifications you will need. US Legal Forms offers a large number of legitimate varieties that happen to be evaluated by experts. It is possible to acquire or print out the South Carolina Partnership Agreement from the assistance.

If you have a US Legal Forms account, you may log in and then click the Obtain button. After that, you may comprehensive, modify, print out, or indication the South Carolina Partnership Agreement. Each legitimate papers web template you purchase is your own property for a long time. To obtain one more version for any purchased kind, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms website the very first time, follow the simple directions under:

- First, make certain you have selected the right papers web template for that state/metropolis of your choosing. See the kind information to ensure you have picked the right kind. If readily available, use the Preview button to search with the papers web template at the same time.

- In order to locate one more model of your kind, use the Lookup area to discover the web template that fits your needs and specifications.

- Upon having found the web template you would like, click Get now to continue.

- Select the rates prepare you would like, key in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal account to purchase the legitimate kind.

- Select the format of your papers and acquire it to the product.

- Make modifications to the papers if possible. You may comprehensive, modify and indication and print out South Carolina Partnership Agreement.

Obtain and print out a large number of papers layouts utilizing the US Legal Forms site, that offers the greatest selection of legitimate varieties. Use specialist and state-particular layouts to deal with your small business or specific requirements.

Form popularity

FAQ

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

Purpose of Affidavit The affidavit is used by a nonresident shareholder or partner to request an exemption from the withholding required pursuant to SC Code Section 12-8-590. Shareholders or partners who will be included in a composite Individual Income Tax return do not need to complete this affidavit.

The withholding amount is 7% of the gain recognized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the gain recognized on the sale by a nonresident corporation or other nonresident entity, if the seller provides the buyer with a Seller's Affidavit stating the amount of gain.

South Carolina Partnerships Must File Form 1065 Although a partnership is taxed as a pass-through entity, the business entity itself still has to file a tax return. If you own a general partnership in South Carolina, it is imperative that you file your business return before the relevant deadline.

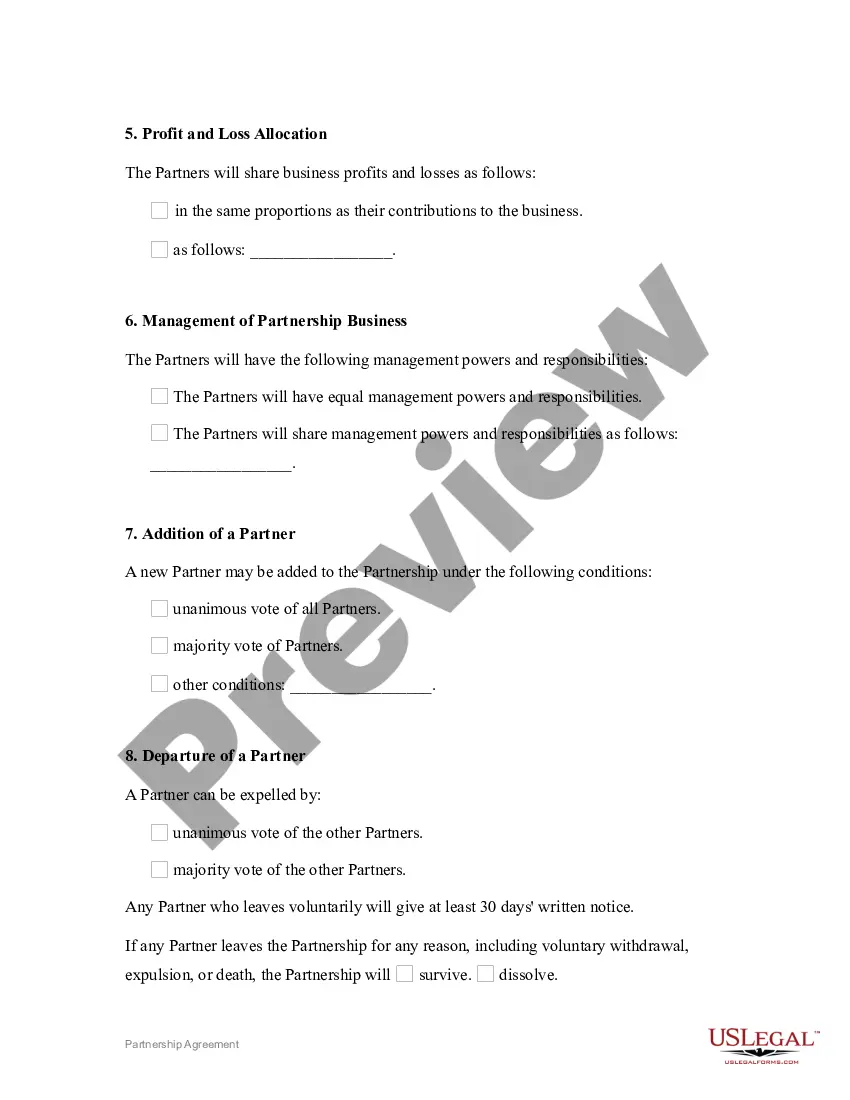

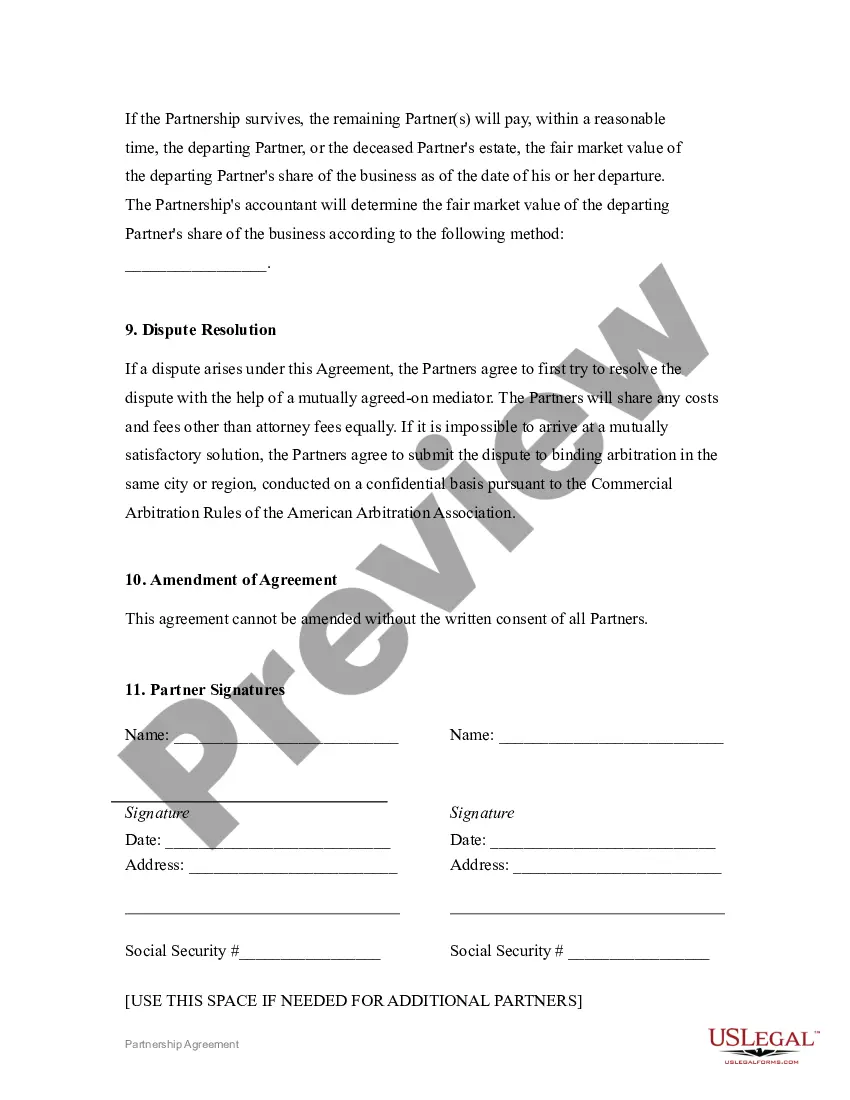

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

Partnership taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically. To file by paper, use the SC 1065 Partnership Return.

How to form a South Carolina General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

What are the withholding requirements on nonresident partners? ? Partnerships are required to withhold 5% of the South Carolina taxable income of partners who are nonresidents of South Carolina.