South Carolina Partnership Agreement

Description

How to fill out Partnership Agreement?

If you wish to total, acquire, or print out authorized file web templates, use US Legal Forms, the biggest variety of authorized kinds, which can be found on the Internet. Take advantage of the site`s simple and practical search to get the documents you require. A variety of web templates for company and specific uses are sorted by types and claims, or search phrases. Use US Legal Forms to get the South Carolina Partnership Agreement in a handful of clicks.

Should you be previously a US Legal Forms customer, log in to the account and click the Obtain switch to find the South Carolina Partnership Agreement. You can also gain access to kinds you formerly saved inside the My Forms tab of your respective account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for the proper area/land.

- Step 2. Make use of the Preview option to look over the form`s articles. Don`t forget about to read the outline.

- Step 3. Should you be not satisfied with the type, take advantage of the Search area at the top of the monitor to locate other models in the authorized type design.

- Step 4. Upon having found the shape you require, click on the Acquire now switch. Select the prices program you prefer and add your credentials to register for the account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal account to complete the financial transaction.

- Step 6. Pick the formatting in the authorized type and acquire it on the system.

- Step 7. Complete, modify and print out or sign the South Carolina Partnership Agreement.

Every single authorized file design you get is yours eternally. You have acces to each type you saved in your acccount. Go through the My Forms segment and decide on a type to print out or acquire once more.

Contend and acquire, and print out the South Carolina Partnership Agreement with US Legal Forms. There are thousands of skilled and condition-certain kinds you may use for your company or specific needs.

Form popularity

FAQ

Create a General Partnership in South Carolina Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN)

Here are the five steps you'll need to follow to file business taxes for your partnership. Prepare Form 1065, U.S. Return of Partnership Income. ... Prepare Schedule K-1. ... File Form 1065 and copies of the K-1 Forms. ... File state tax returns. ... File personal tax returns.

Two important topics to consider when you are forming a business are taxation and personal liability. In South Carolina partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes.

Purpose of Affidavit The affidavit is used by a nonresident shareholder or partner to request an exemption from the withholding required pursuant to SC Code Section 12-8-590. Shareholders or partners who will be included in a composite Individual Income Tax return do not need to complete this affidavit.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

Partnership taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically. To file by paper, use the SC 1065 Partnership Return.

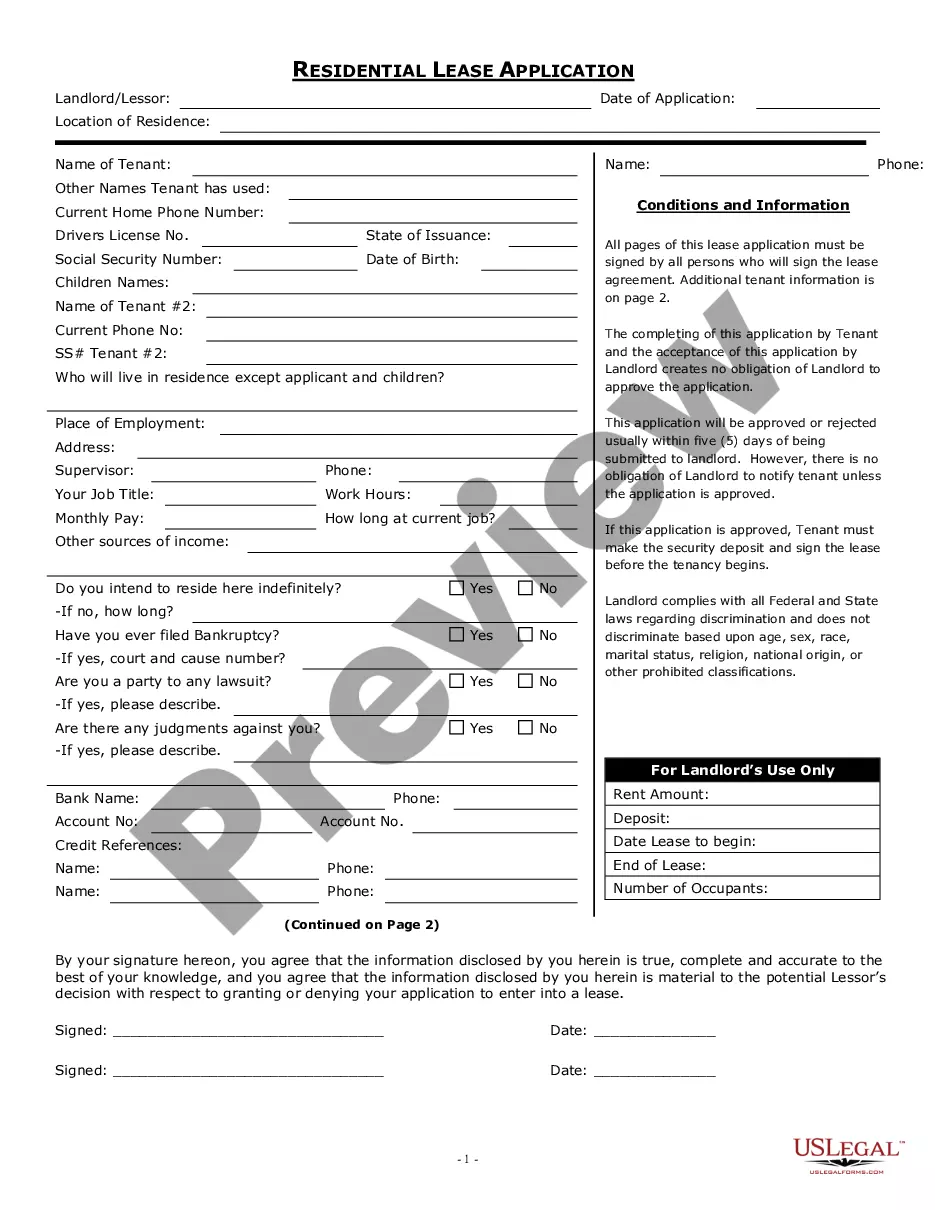

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

How to form a South Carolina General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.