South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out South Carolina Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

The work with papers isn't the most uncomplicated job, especially for those who almost never deal with legal papers. That's why we recommend making use of correct South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children samples made by professional lawyers. It allows you to stay away from problems when in court or working with official organizations. Find the files you require on our website for high-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the template page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers without an active subscription can easily get an account. Look at this short step-by-step help guide to get the South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children:

- Make certain that the form you found is eligible for use in the state it’s required in.

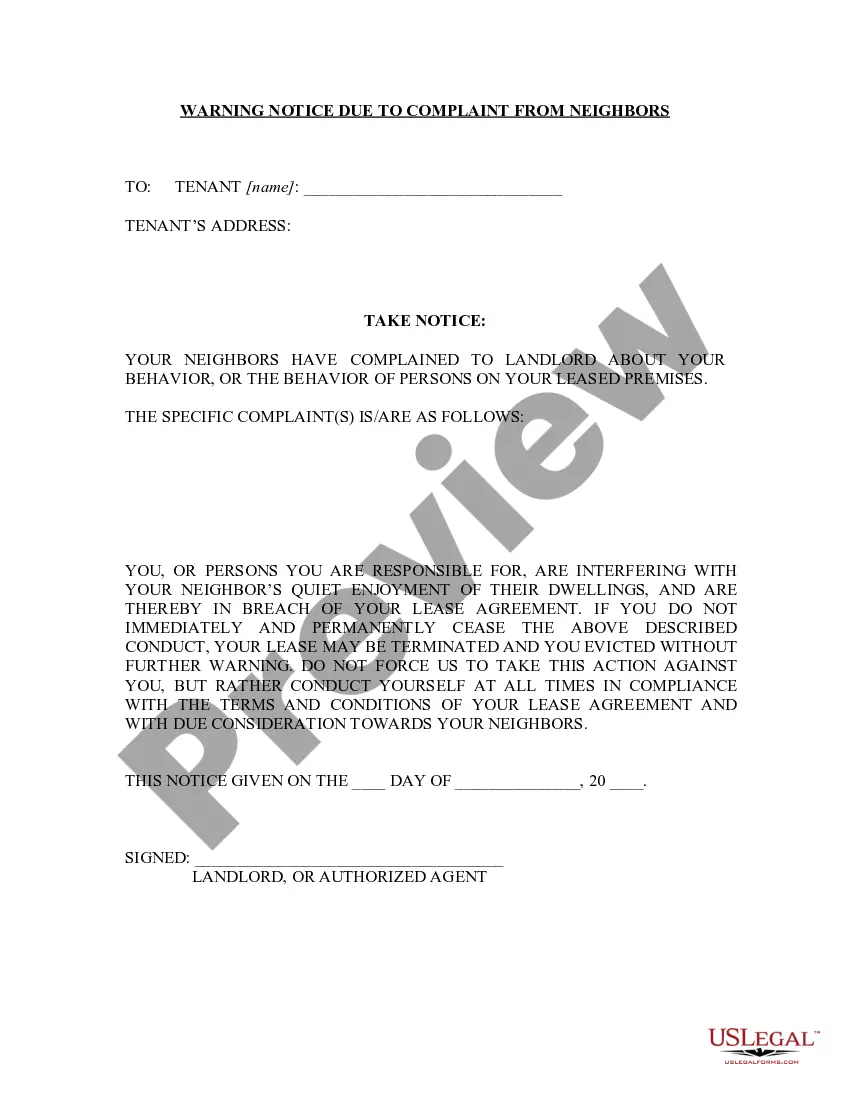

- Verify the document. Make use of the Preview feature or read its description (if offered).

- Click Buy Now if this file is what you need or utilize the Search field to find another one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these simple steps, it is possible to fill out the form in a preferred editor. Double-check completed data and consider requesting an attorney to examine your South Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

Who can create a Trust? A trust may be created by: Every person who is competent to contracts: This includes an individual, AOP, HUF, company etc. If a trust is to be created by on or behalf of a minor, then the permission of a Principal Civil Court of original jurisdiction is required.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.