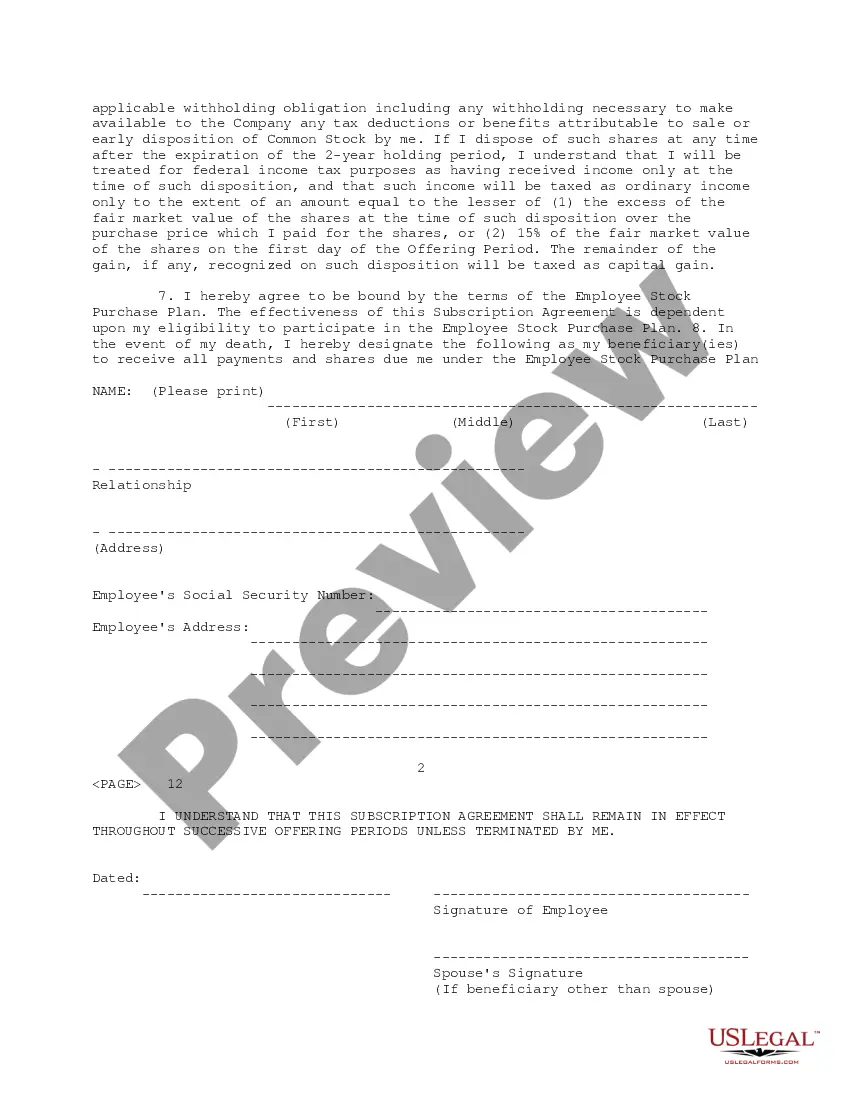

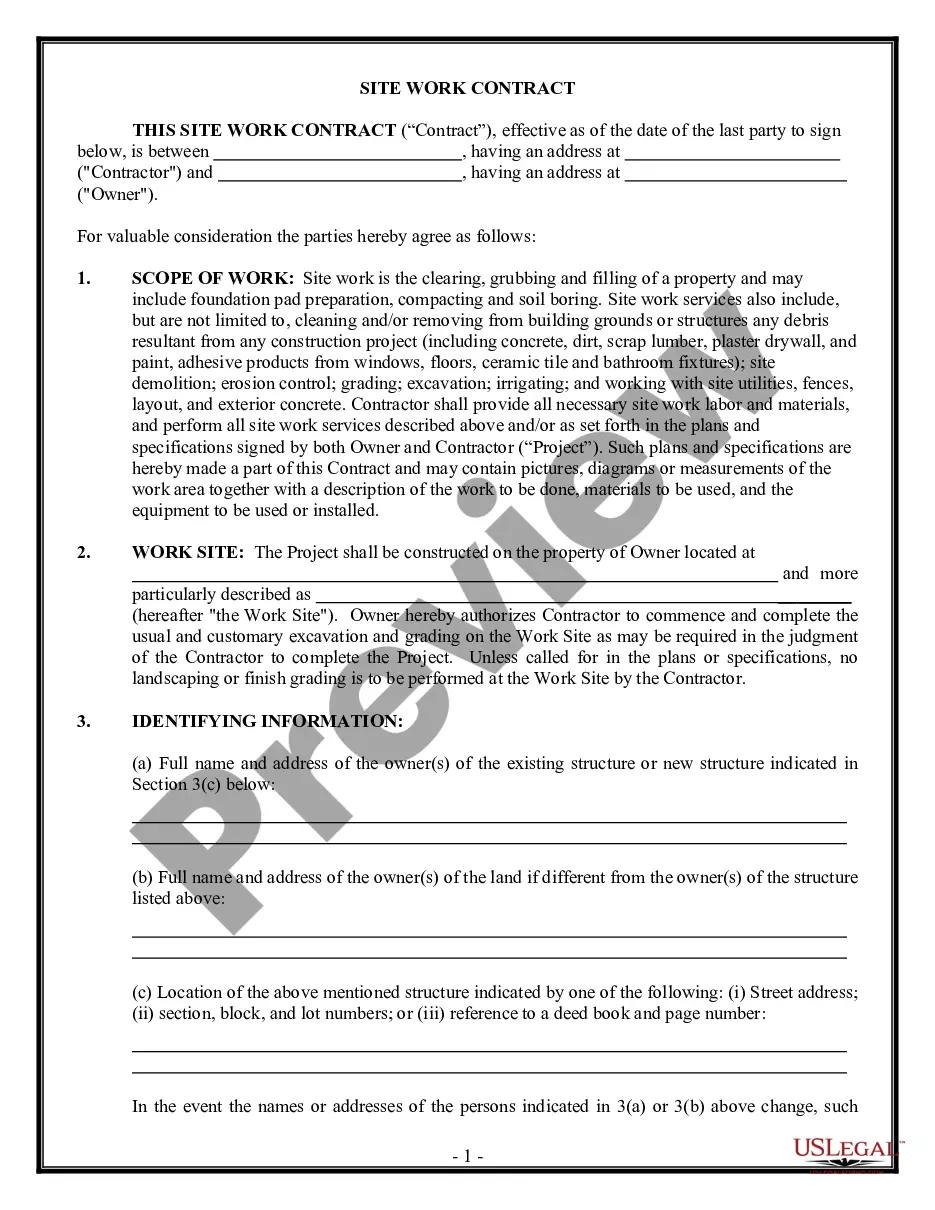

South Carolina Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc.

Description

How to fill out Subscription Agreement For Employee Stock Purchase Plan Of Gadzoox Networks, Inc.?

If you want to full, acquire, or print authorized record templates, use US Legal Forms, the biggest collection of authorized types, which can be found on the web. Make use of the site`s basic and convenient lookup to find the papers you require. Various templates for enterprise and person functions are categorized by categories and suggests, or keywords. Use US Legal Forms to find the South Carolina Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc. within a handful of clicks.

If you are presently a US Legal Forms customer, log in to your profile and then click the Obtain option to get the South Carolina Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc.. You can even access types you formerly saved inside the My Forms tab of your own profile.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the shape for that correct metropolis/country.

- Step 2. Use the Review option to look over the form`s content. Do not forget about to learn the information.

- Step 3. If you are unsatisfied with the kind, make use of the Search field on top of the display to locate other versions of your authorized kind design.

- Step 4. When you have discovered the shape you require, click the Acquire now option. Choose the prices strategy you favor and include your accreditations to register for an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Choose the formatting of your authorized kind and acquire it on your device.

- Step 7. Total, change and print or indicator the South Carolina Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc..

Each and every authorized record design you buy is yours forever. You possess acces to each and every kind you saved inside your acccount. Select the My Forms section and decide on a kind to print or acquire again.

Contend and acquire, and print the South Carolina Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc. with US Legal Forms. There are thousands of specialist and state-distinct types you can use for your personal enterprise or person requires.

Form popularity

FAQ

How much should I put in an employee stock purchase plan? You can contribute 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. The more disposable income you have, the more you can afford to put in an employee stock purchase plan. Employees contribute through payroll deductions.

A: Yes. You may withdraw from the ESPP by notifying Fidelity and completing a withdrawal election. When you withdraw, all of the contributions accumulated in your account will be returned to you as soon as administratively possible and you will not be able to make any further contributions during that offering period.

You will continue to own stock purchased for you during your employment, but your eligibility for participation in the plan ends. Any funds withheld from your salary but not used to purchase shares before the end of your employment will be returned to you, normally without interest, within a reasonable period.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

If your company offers one, why should you invest in an ESPP? Since you are acquiring stock, that would otherwise not be available, at a discounted price it is generally a good idea to participate. ESPPs offer an easy, cost-efficient way to pursue a disciplined savings plan.