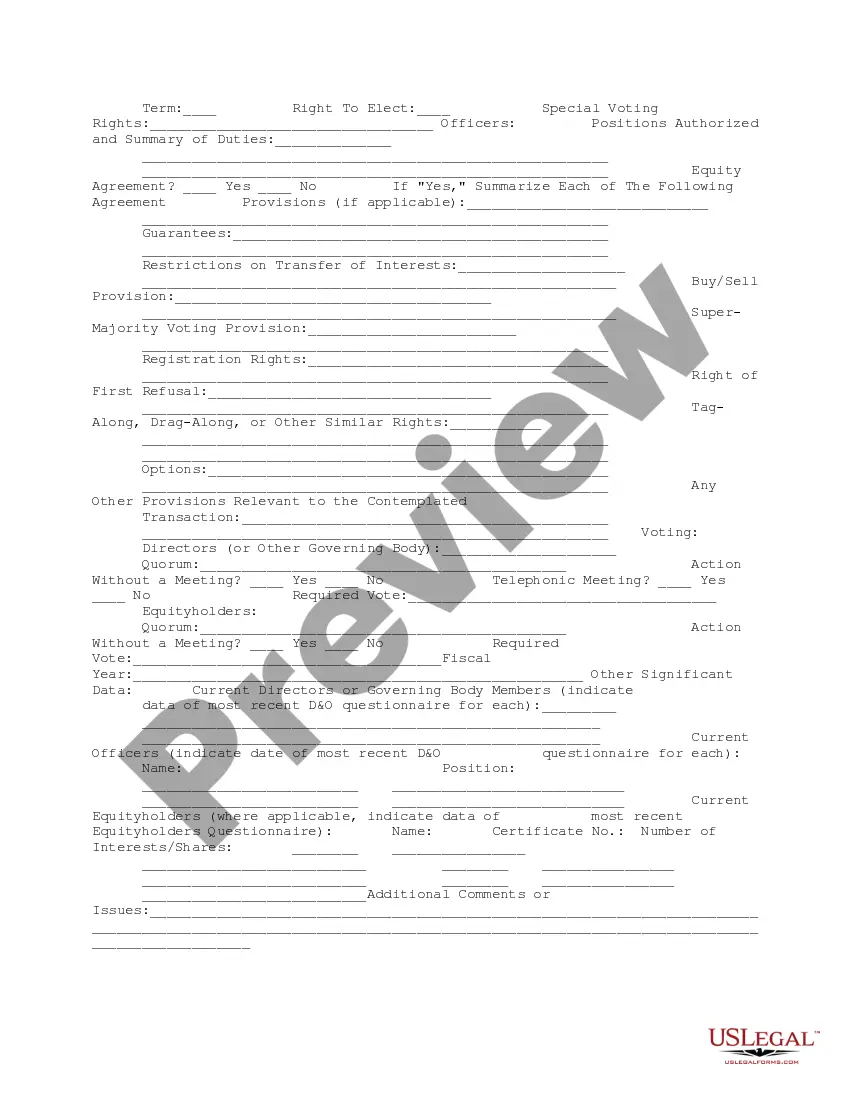

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

South Carolina Company Data Summary

Description

How to fill out Company Data Summary?

If you require extensive, retrieve, or create valid document formats, utilize US Legal Forms, the best array of valid templates accessible online.

Make use of the site’s simple and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you obtain is yours indefinitely. You have access to each document you have downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and retrieve, and print the South Carolina Company Data Summary with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Utilize US Legal Forms to obtain the South Carolina Company Data Summary in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to access the South Carolina Company Data Summary.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are dissatisfied with the template, use the Search field at the top of the screen to find other types of your legal document template.

- Step 4. Once you have found the form you wish to use, click on the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the South Carolina Company Data Summary.

Form popularity

FAQ

In South Carolina, you do not need to renew your LLC every year as long as you file your annual report on time. However, maintaining compliance with state regulations is crucial to keep your LLC active. Staying informed through the South Carolina Company Data Summary will help you meet all requirements and keep your business running smoothly.

Yes, filing an annual report for your LLC in South Carolina is mandatory. This report ensures that your business remains in good standing with state authorities and provides updated information about your company. To make the process easier, refer to the South Carolina Company Data Summary and consider leveraging platforms like uslegalforms for assistance.

Yes, if you are forming a corporation or an LLC in South Carolina, you need to file a CL-1 form, which serves as an application for a Certificate of Authority. This form is essential for businesses wishing to operate in the state and provides important legal structure. For detailed guidance and to streamline the process, consult the South Carolina Company Data Summary or use resources available through uslegalforms.

Yes, you can file for an S Corporation yourself, but the process requires careful attention to detail. You'll need to submit Form 2553 to the IRS and make sure you meet all eligibility criteria, which can be tricky. To ensure compliance and avoid errors, consider utilizing resources like the South Carolina Company Data Summary or platforms like uslegalforms that simplify the filing procedures.

If an LLC does not file an annual report in South Carolina, it may face penalties, including fines and the potential for administrative dissolution. This means that your business could lose its active status, which can impact your ability to operate legally. To avoid this, it's crucial to keep track of the filing deadlines and requirements detailed in the South Carolina Company Data Summary.

Yes, an S Corporation must file an annual report in North Carolina. This report ensures that the state has accurate records of your corporation’s status and activities. Failure to file can result in penalties or administrative dissolution. If your business operates in multiple states, it’s beneficial to review each state’s requirements along with your South Carolina Company Data Summary.

Verifying a business in South Carolina can be accomplished through the South Carolina Secretary of State's website. You can search for business names, status, and filing history. This process helps you gather essential information, which is often outlined in your South Carolina Company Data Summary. Using these resources can provide you with confidence in your business dealings.

In South Carolina, all corporations and limited liability companies (LLCs) are required to file annual reports. This requirement includes both domestic and foreign entities doing business in the state. Timely filing of annual reports ensures your company remains in good standing. For the most accurate details on requirements, refer to your South Carolina Company Data Summary.

To file an S Corporation in South Carolina, you first need to create a standard corporation by filing Articles of Incorporation. After that, you must file Form 2553, which declares your choice to be taxed as an S Corp. This process can seem daunting, but using platforms like uslegalforms can simplify your journey. Your South Carolina Company Data Summary will support your compliance with local regulations.

Several states do not require annual reports, such as Delaware, Nevada, and Wyoming. It’s essential to check specific business regulations as they vary widely. Understanding these differences can save you time and effort when managing your business across states. For a comprehensive view of requirements, consider reviewing your South Carolina Company Data Summary.