South Carolina Employment Status Form

Description

How to fill out Employment Status Form?

Have you ever found yourself in a scenario where you require documentation for both business or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones is challenging.

US Legal Forms provides thousands of form templates, including the South Carolina Employment Status Form, which are designed to comply with state and federal requirements.

Once you find the right form, click Buy now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Employment Status Form template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds to the correct city/region.

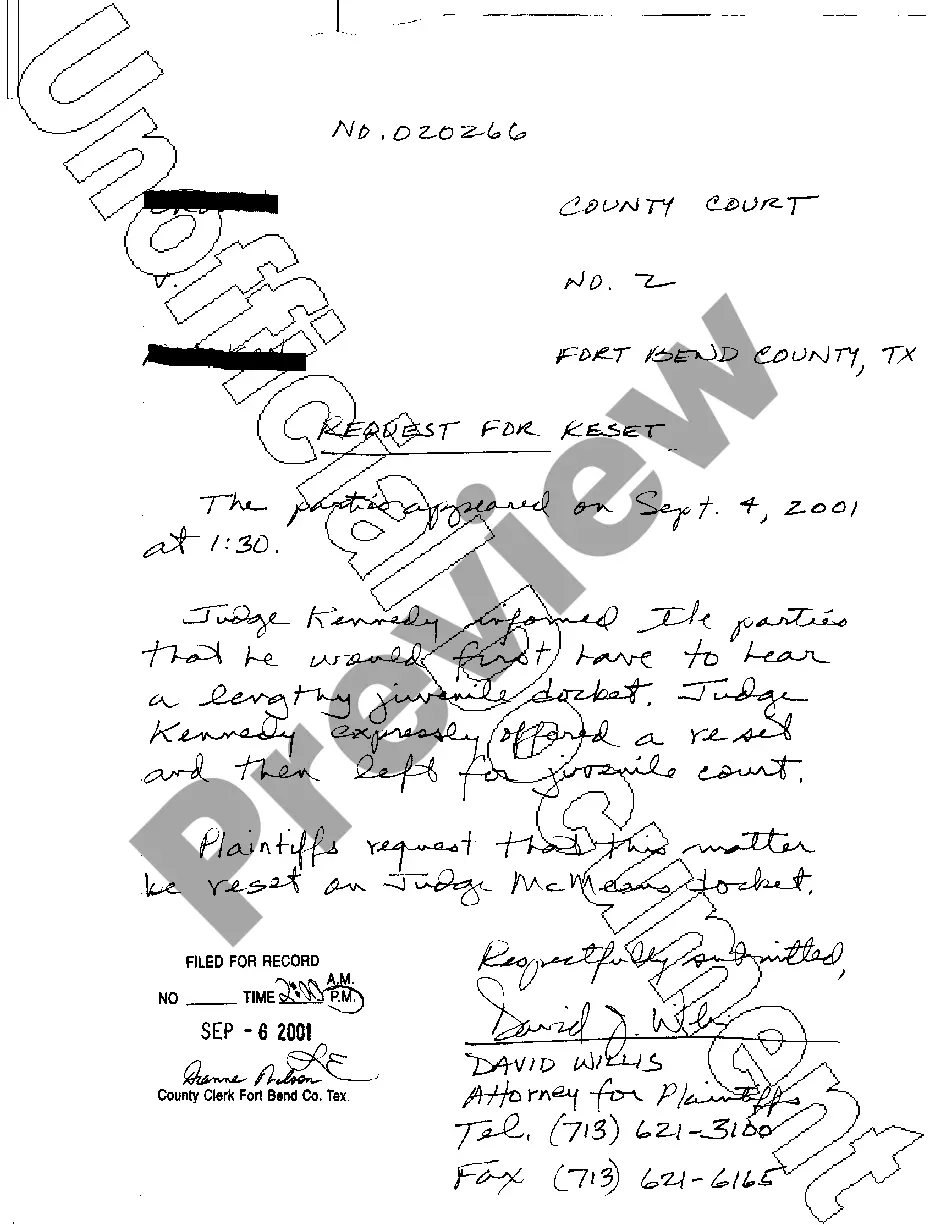

- Utilize the Review button to examine the form.

- Read the description to confirm you have chosen the correct form.

- If the form isn't what you want, use the Search section to locate the form that meets your needs and requirements.

Form popularity

FAQ

State unemployment is issued on form 1099-G, not a W-2. You can try to access your 1099-G online at this South Carolina webpage.

Your 1099-G will be sent to your mailing address on record the last week of January. You can also download your 1099-G income statement from your unemployment benefits portal.

SC UCE-120 InformationEvery employer must file this report for each calendar quarter showing each employee who was in employment at any time during the quarter. Employers must report the entire wage list on Form UCE-120.

How long does the appeals process take? It could take 60-120 days from the date you send in your appeal request to receive a decision on your appeal.

In addition to the contribution rate there is also an assessment, known as the Contingency Assessment, of . 06% on the taxable wages reported each quarter. In some cases, it may be possible to report wages and pay compensation in a companies' home state.

INSTRUCTIONS FOR STATEMENT TO CORRECT INFORMATION (FORM UCE-120-C) This form is used to correct errors on previously filed "Employer Quarterly Contribution and Wage Reports" (Form UCE-101 and UCE-120). The completed form should be mailed to: One form should be submitted for each quarter to be corrected.

In order to check your payment status, simply log into your MyBenefits portal and go to the portal homepage. Payments issued by DEW will be easily listed on the homepage under the payment header. You can also call 1-866-831-1724 Relay 711 to speak with a TelClaim representative.

Click on the MyBenefits button. Enter your username and password in the appropriate fields to login to your MyBenefits Portal account. The Quick Links section will now be listed on the far left side of your MyBenefits Portal Dashboard. Click on the View my 1099G for 2021 link to view and download your 1099G.