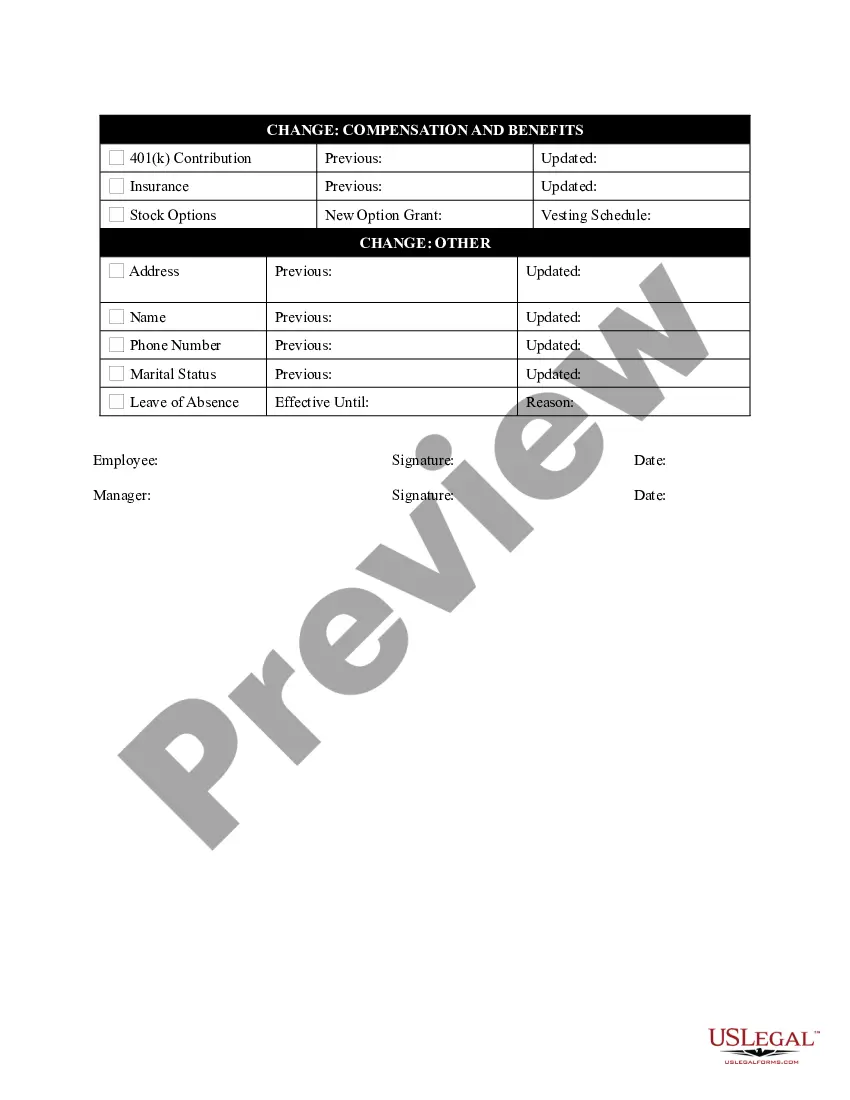

South Carolina Personnel Status Change Worksheet

Description

How to fill out Personnel Status Change Worksheet?

You can spend countless hours online searching for the valid document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of valid forms that are examined by experts.

It is easy to access or print the South Carolina Personnel Status Change Worksheet from the service.

If available, take advantage of the Preview button to view the document template as well. To find another version of the form, use the Search field to obtain the template that meets your requirements and specifications. After you have found the template you want, click on Get now to proceed. Select the pricing plan you prefer, enter your credentials, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the valid form. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, sign, and print the South Carolina Personnel Status Change Worksheet. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have an existing US Legal Forms account, you may Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the South Carolina Personnel Status Change Worksheet.

- Every valid document template you obtain is yours permanently.

- To get an additional copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of preference.

- Review the form description to confirm that you have selected the correct form.

Form popularity

FAQ

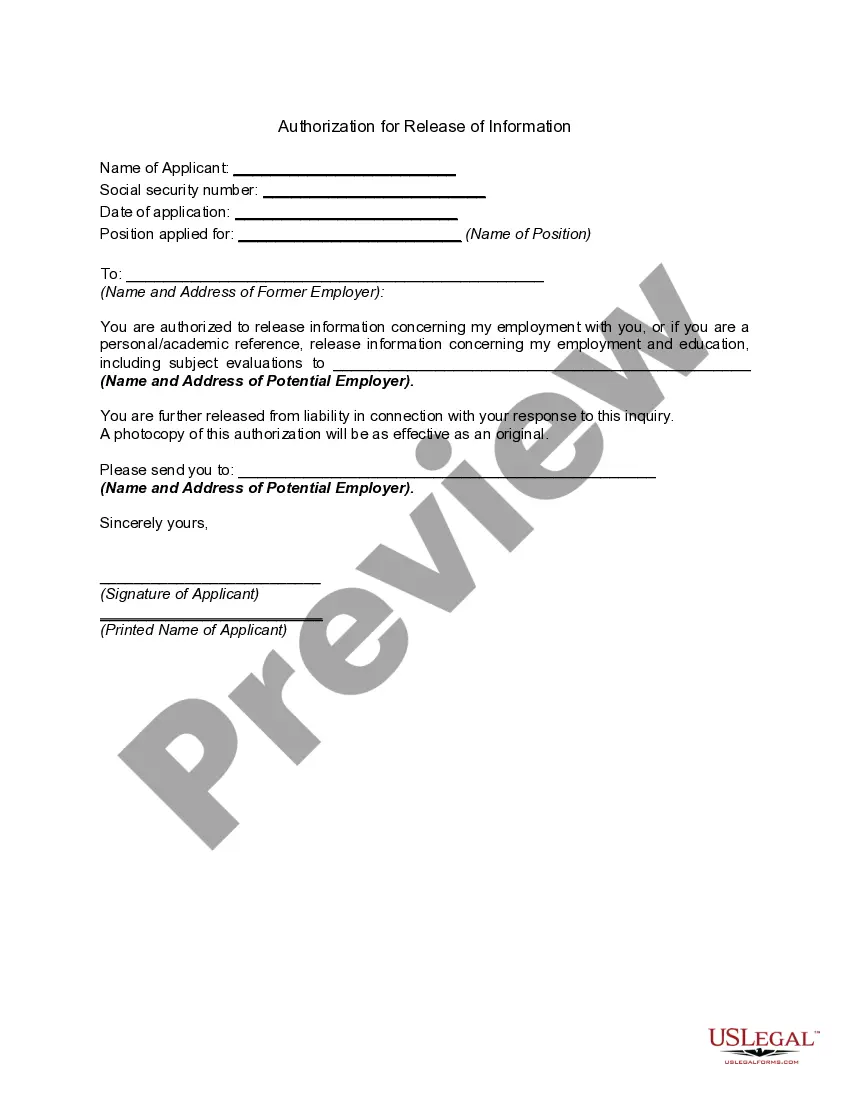

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

Here is a breakdown of each area:Step 1 (required): Enter Personal Information.Step 2 (optional): Multiple Jobs or Spouse Works.Step 3 (optional complete for only one job): Claim Dependents.Step 4 (optional complete (a) and (b) for only one job): Other Adjustments.Step 5 (required): Sign and date the form.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

If you (and your spouse) have a total of only two jobs, you may instead check the box in option (c). The box must also be checked on the Form W-4 for the other job.

Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction. (c): Extra withholding. Any extra withholding that you would like to withhold each pay period.