South Carolina Assignment Creditor's Claim Against Estate

Description

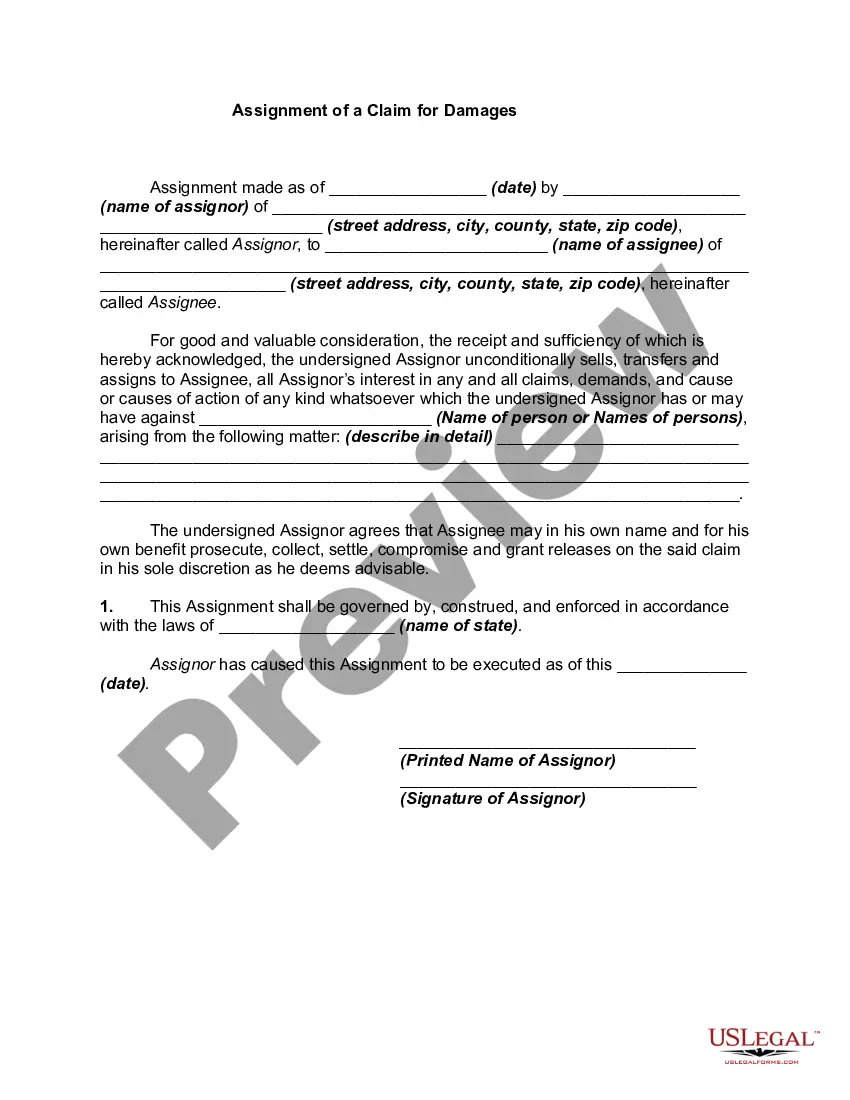

How to fill out Assignment Creditor's Claim Against Estate?

You can spend hours online searching for the legal document template that complies with the state and federal requirements you need.

US Legal Forms offers a variety of legal forms that are examined by experts.

It is easy to download or print the South Carolina Assignment Creditor's Claim Against Estate from our platform.

If available, use the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and select the Download option.

- Afterward, you can fill out, edit, print, or sign the South Carolina Assignment Creditor's Claim Against Estate.

- Every legal document template you buy is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your preference.

- Review the form details to verify that you have selected the right one.

Form popularity

FAQ

Fully documented claims (including documents of ID and personal representative documents) must be received within 30 years of the date of death.

Making a claim against an estate. After the death of a person, their Will can be contested by relatives, dependents and others. A claim can be made for 'reasonable financial provision' in the Court. Similarly, if a person died without a will, the claim can be made under intestacy rules.

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

The following can make a claim against an estate: Any spouse or civil partner. Any former spouse or civil partner, provided they have not remarried or registered a new civil partnership, and provided no court order was made at the time of their split that specifically precludes them from bringing such a claim.

In South Carolina, to collect from the estate, a creditor must file their claim either before 60 days from the mailing of the Written Notice of Creditors (sent by the estate's personal representative) or 8 months from the first publication of the Notice of Creditors in the newspaper, whichever is later.

In Pennsylvania, there is a 4 to 6 year statute of limitations, meaning 3 years after the estate administration is done, a creditor could have a valid claim, but had you advertised, the creditor could have known beforehand. Additionally, advertising the estate cuts off claims after one year.

If you received a cash inheritance, the court may order the bank account levied, which would allow the creditor to take the funds in the bank account to settle the debt. If the inheritance is real estate, the creditor may place a lien on the property.

The estate of a deceased person must be reported to the Master of the High Court within 14 days of the date of death. Any person that has control or possession of any property or a will of the deceased, can report the death by lodging a completed death notice with the Master.

Filing a claim against an estate is a fairly simple process: In the claim, you'll state under oath that the debt is owed and provide details on the amount of the debt and any payments the decedent made. If you have written documentation, you can attach it to your claim.

Remember, credit does not die and continues after the death of the debtor, meaning that creditors have a right to claim from the deceased's estate. Remember, the executor is obliged to pay all the estate's debts before distributing anything to their heirs or legatees of the deceased.