South Carolina Assignment of Debt

Description

How to fill out Assignment Of Debt?

Have you encountered a scenario where you require documentation for either professional or personal purposes almost every day.

There are many legal document templates accessible online, but finding versions you can trust is not simple.

US Legal Forms provides a vast collection of form templates, including the South Carolina Assignment of Debt, which are created to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the South Carolina Assignment of Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

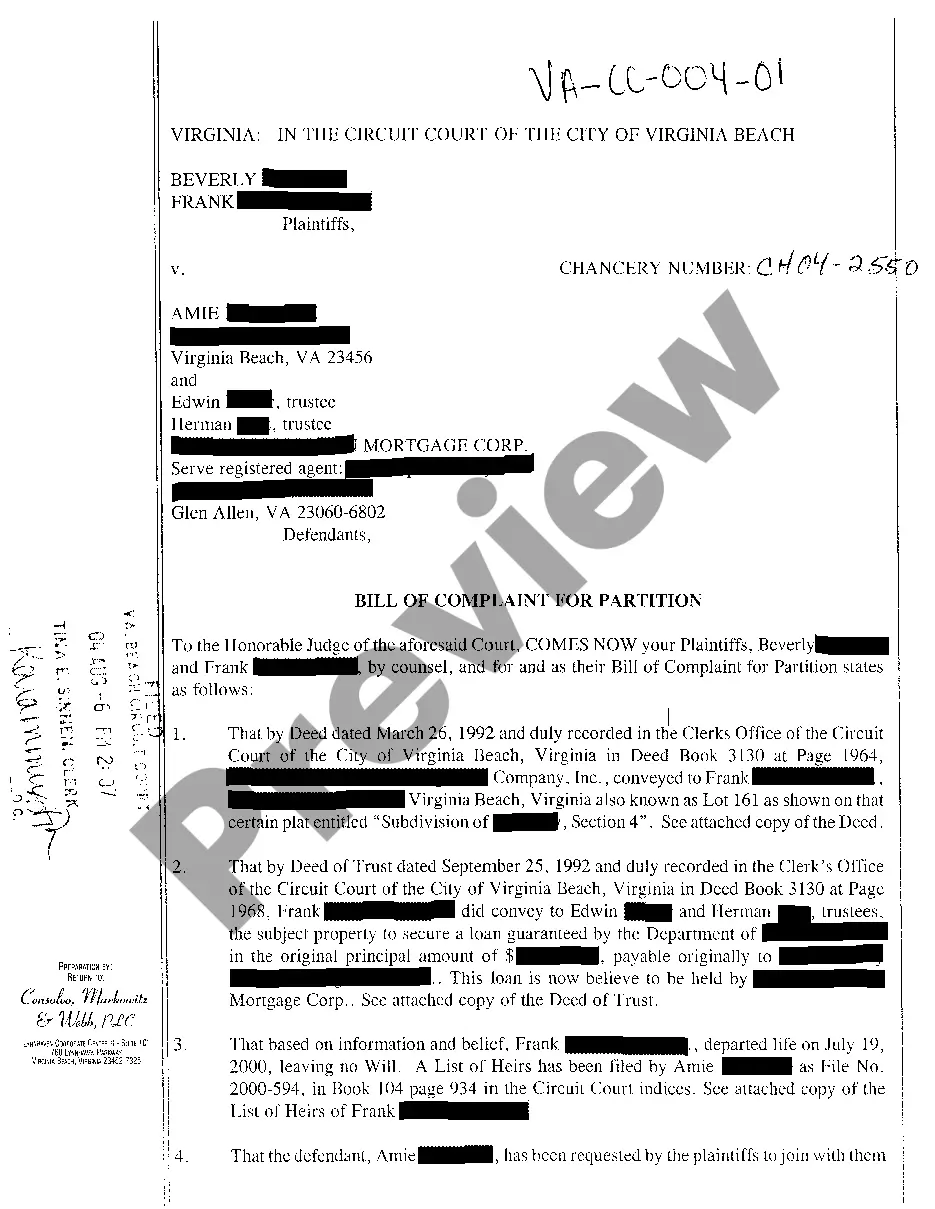

- Use the Review button to view the form.

- Examine the details to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field to locate the form that suits your requirements.

- Once you find the correct form, click Get now.

- Select the payment plan you prefer, enter the required information to create your account, and complete your purchase using PayPal or a credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the South Carolina Assignment of Debt at any time, if needed. Just select the required form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive selections of legal forms, to save time and avoid mistakes. The service offers well-crafted legal document templates for various purposes. Register on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

No, South Carolina is not a non-garnishment state; creditors can pursue wage garnishment under specific circumstances. However, there are limitations on how much of your wages can be garnished, ensuring that you retain a portion for your living expenses. Understanding the rules surrounding garnishment is vital, especially when dealing with South Carolina Assignment of Debt. Therefore, utilizing resources from platforms like USLegalForms can empower you to navigate these challenges.

Yes, you can be sued for debt in South Carolina, and it’s important to be aware of your rights. Creditors have the ability to take legal action to recover debts owed, which may lead to court judgments against you. If you find yourself facing a lawsuit related to South Carolina Assignment of Debt, getting legal advice is essential. Platforms like USLegalForms can provide resources to help you understand your options and responsibilities.

Yes, assignment of contract is legal in South Carolina, provided that the original contract does not prohibit such assignments. This process involves transferring rights and obligations from one party to another, which can be essential for managing debts. If you're considering South Carolina Assignment of Debt, understanding the legal framework surrounding contract assignments is crucial. Therefore, consulting with experts or utilizing reliable platforms like USLegalForms can clarify the necessary steps.

Yes, South Carolina is often recognized as a business-friendly state, attracting various industries and entrepreneurs. The state's tax incentives, strategic location, and strong workforce contribute to its favorable business environment. For those involved in South Carolina Assignment of Debt, the business-friendly climate can play a significant role in facilitating smooth financial transactions. Thus, whether you're starting a new venture or managing existing debts, South Carolina offers several advantages.

Debtor-friendly states generally provide strong protections for individuals facing financial difficulties. In the U.S., states such as Florida, Texas, and South Carolina are known for their favorable laws regarding debt management. For individuals considering options like South Carolina Assignment of Debt, understanding state-specific protections can guide decision-making. Consequently, you can take advantage of these friendly laws to navigate your financial situation more effectively.

In South Carolina, a debt typically becomes uncollectible after three years, known as the statute of limitations. This time frame can vary based on the type of debt involved, so it's essential to be aware of your specific circumstances. Understanding these timelines in relation to South Carolina Assignment of Debt can help you manage your financial situation more effectively.

Yes, South Carolina offers various debt relief options for consumers facing financial challenges. Programs may include counseling services, negotiation assistance, and educational resources to help manage debt effectively. If you are concerned about managing your debts, researching South Carolina Assignment of Debt programs through platforms such as US Legal Forms can provide useful insights.

Proof of debt assignment is the documentation that verifies a debt has been transferred from one creditor to another. This proof should include the original creditor's details, the new creditor's information, and the agreement terms. Accurately obtaining this documentation is vital in cases surrounding South Carolina Assignment of Debt to clarify responsibilities.

An assignment of debt occurs when a creditor transfers their right to collect payment on a debt to another party. This transfer can happen for various reasons, such as selling the debt to a collection agency. In the context of South Carolina Assignment of Debt, understanding this process can help you navigate any communications you receive regarding your debt.

A valid proof of debt should include clear identification of the creditor, the debtor, and the amount owed. It typically consists of contracts, invoices, or statements that outline the debt. In cases of South Carolina Assignment of Debt, having valid proof can significantly impact negotiations and potential resolutions.