South Carolina Invoice Template for Sole Trader

Description

How to fill out Invoice Template For Sole Trader?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal form templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the South Carolina Invoice Template for Sole Proprietor in moments.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your credentials to register for an account.

- If you already have a monthly subscription, Log In and download the South Carolina Invoice Template for Sole Proprietor from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms within the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple tips to help you get started.

- Ensure you have selected the correct form for your location/area.

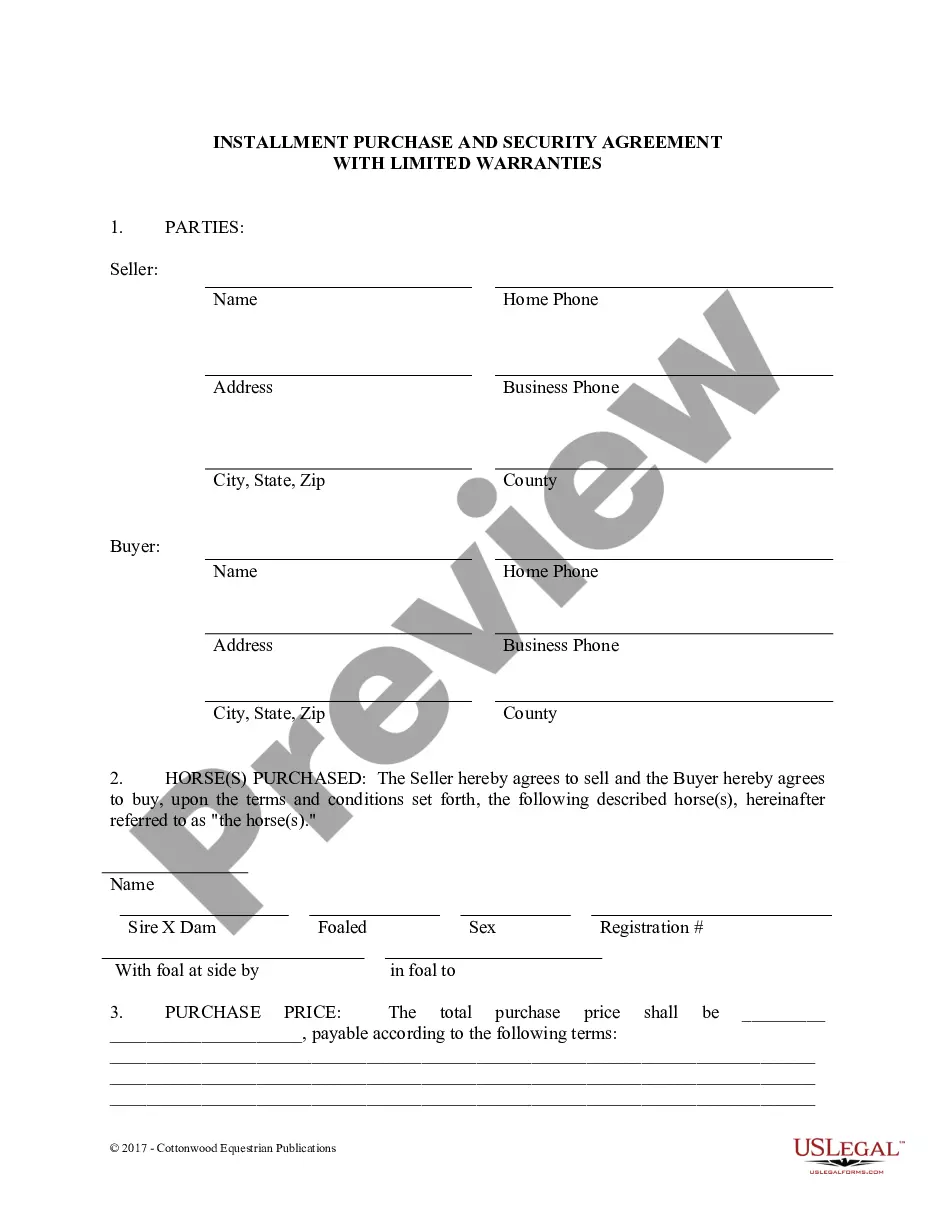

- Click the Preview button to review the details of the form.

Form popularity

FAQ

Making an invoice as a sole trader is straightforward when you use tools designed for this purpose. Start with a South Carolina Invoice Template for Sole Trader, which provides a structured format. Include your business name, the items or services provided, the costs, and payment instructions. This template not only saves time but also enhances your professionalism when dealing with clients.

To invoice as a sole proprietor, start by including your name and contact information, along with your client's details. A South Carolina Invoice Template for Sole Trader can help you format this information correctly. Make sure to specify the services rendered, payment terms, and due date. This clarity is essential for prompt payments and effective communication with your clients.

Absolutely, you can generate an invoice from yourself as a sole trader. There are various tools available, including the South Carolina Invoice Template for Sole Trader, that guide you through creating an invoice with the essential details. When you use a template, it ensures consistency and professionalism in your billing process, making it easier for your clients to understand their charges.

Yes, you can invoice without an LLC. Being a sole trader allows you to create invoices directly, even if you are not registered as an LLC. Using a South Carolina Invoice Template for Sole Trader simplifies this process, ensuring you include all necessary information for proper billing. This template provides a professional appearance and can help you maintain accurate records.

Writing a sole trader invoice requires a focus on clarity and completeness. Start with your business name and client details, then describe the services or products along with their prices. Don't forget to include the total amount due and payment modalities. A South Carolina Invoice Template for Sole Trader can greatly assist in structuring your invoice correctly.

To invoice using a sole trader template, start with the essential details, such as your name and contact info, followed by your client's details. Include a list of the services or products you've provided, along with their prices. It’s crucial to finalize with your total due and payment terms. Using a South Carolina Invoice Template for Sole Trader further simplifies this task.

Creating an invoice as a sole proprietor can be straightforward. You need to gather your business details, client information, and services provided. Clearly lay out the items, adding costs and a total amount. Consider utilizing a South Carolina Invoice Template for Sole Trader to ensure you cover all necessary elements.

Writing an invoice as a self-employed individual involves similar steps to those of a sole trader. Start with your contact information and your client’s details, then list the services provided with corresponding costs. Include the payment terms and any taxes applicable. A South Carolina Invoice Template for Sole Trader can offer a structured format to make this easier.

Yes, a sole trader can issue an invoice. Invoicing is crucial for documenting the sales you make and requesting payment from clients. Ensure that your invoice includes all pertinent information like services rendered and payment terms. Using a dedicated South Carolina Invoice Template for Sole Trader can enhance professionalism.

As a sole trader, you should clearly outline your services or products in the invoice. Include your business details, the date, invoice number, and your client's information. Don't forget to itemize expenses and apply any appropriate taxes. The South Carolina Invoice Template for Sole Trader can help streamline this process and ensure accuracy.