This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Gift of Entire Interest in Literary Property

Description

How to fill out Gift Of Entire Interest In Literary Property?

You might spend numerous hours online attempting to locate the legal document format that aligns with the federal and state standards you desire.

US Legal Forms offers thousands of legal templates that can be examined by professionals.

You can effortlessly obtain or print the South Carolina Gift of Entire Interest in Literary Property from your service.

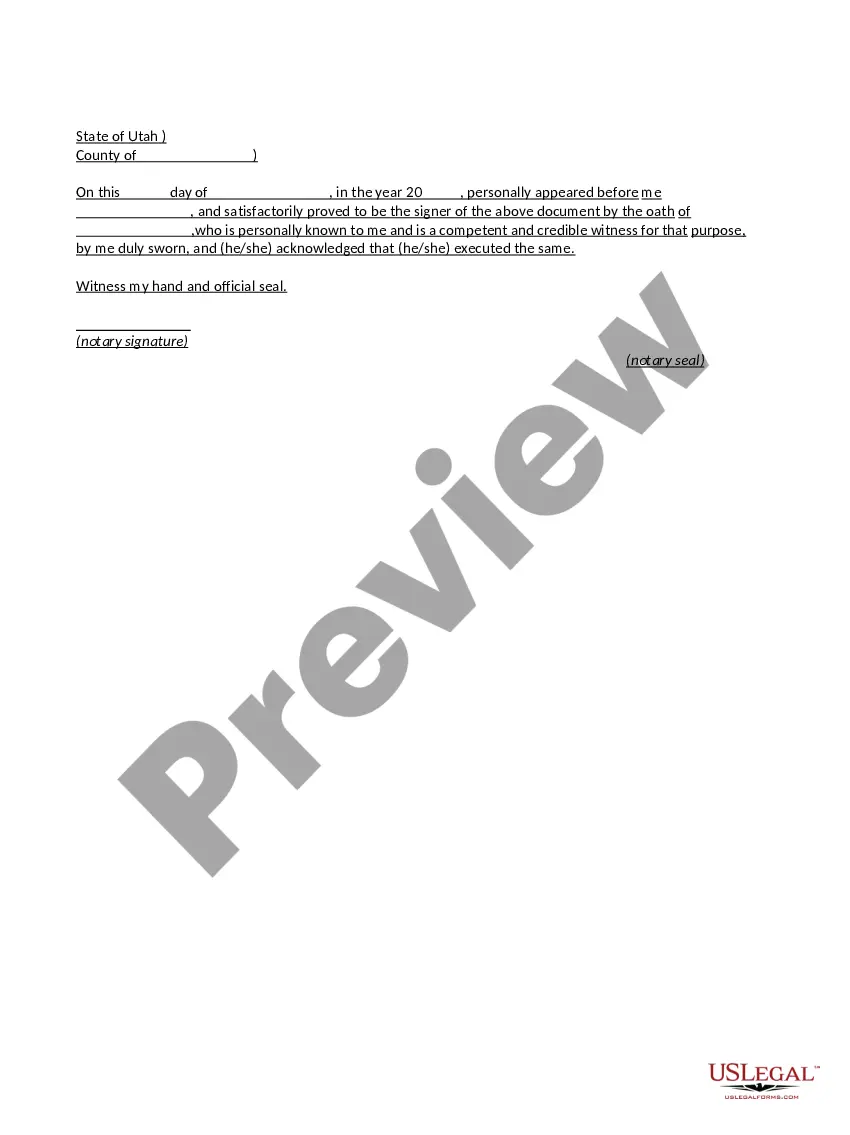

First, ensure that you have selected the correct document format for your state/town of choice. Review the form description to confirm that you have chosen the correct document. If available, use the Preview option to browse through the document format as well. To get another version of the form, use the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can fill out, modify, print, or sign the South Carolina Gift of Entire Interest in Literary Property.

- Every legal document format you obtain is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

The recipient of a gift typically does not have to report it to the IRS, especially if the value falls below the exclusion limit. However, if the gift involves significant assets like the South Carolina Gift of Entire Interest in Literary Property, it is wise to maintain documentation. Clear records can help clarify your financial situation if needed, ensuring peace of mind regarding your gift.

Generally, you do not have to report receiving a gift up to $15,000, as it falls under the annual gift exclusion limit. However, if you receive a South Carolina Gift of Entire Interest in Literary Property valued above this amount, the donor must file a gift tax return. It is important to understand these limits to avoid any potential issues with tax reporting down the line.

To gift land in South Carolina, you must draft a deed that clearly states the transfer of ownership. Ensure that the deed complies with South Carolina laws, especially when transferring assets like the South Carolina Gift of Entire Interest in Literary Property. It may be beneficial to consult a legal professional or use platforms like USLegalForms to create the necessary documents, ensuring a smooth and legal transfer.

While a gift deed allows for easy transfer of property, it comes with certain disadvantages. For instance, once you transfer your South Carolina Gift of Entire Interest in Literary Property through a gift deed, you no longer retain any control over that property. Additionally, if the recipient faces financial challenges, creditors may claim the gift, affecting your original intention of benefitting them.

The present interest gift tax exclusion allows individuals to give gifts up to a certain limit each year without incurring gift tax. In the context of the South Carolina Gift of Entire Interest in Literary Property, this exclusion enables you to transfer ownership without significant tax implications. Understanding this exclusion can help you effectively manage your gifts, ensuring that you maximize your financial generosity without unexpected tax burdens.

Section 62 7 401 of the South Carolina Code discusses trusts and their creation, providing detailed information on how assets can be managed or distributed. This section is key for anyone involved in estate planning. Understanding these provisions can aid in effectively organizing a South Carolina Gift of Entire Interest in Literary Property and ensuring it serves your intended purpose.

A durable financial power of attorney in South Carolina allows you to designate someone to manage your financial affairs even if you become incapacitated. This setup is essential for individuals looking to ensure their financial decisions align with their intentions. For matters involving a South Carolina Gift of Entire Interest in Literary Property, such a tool can provide security and peace of mind.

Trespassing after warning occurs when a person enters or remains on property after being told to leave by the owner. In South Carolina, this can lead to criminal charges and penalties. Awareness of such laws is beneficial when managing property or assets, including a South Carolina Gift of Entire Interest in Literary Property.

SC Code 62 2 114 pertains to the authority granted under powers of attorney relating to health care decisions. This law ensures that an agent acts in accordance with the principal’s wishes. Knowing this can help safeguard your interests in situations such as the management of a South Carolina Gift of Entire Interest in Literary Property.

In South Carolina, a power of attorney can be overridden by the principal, who originally granted the authority. Additionally, a court can invalidate a power of attorney if it deems that the principal was not of sound mind during its creation. Understanding this can be important, especially in contexts like a South Carolina Gift of Entire Interest in Literary Property.