South Carolina Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Have you ever been in a location where you require documents for either business or personal purposes almost constantly? There are numerous legal form templates available online, but locating ones you can rely on is challenging.

US Legal Forms provides an extensive collection of form templates, such as the South Carolina Bill of Transfer to a Trust, that are designed to comply with federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the South Carolina Bill of Transfer to a Trust template.

- Locate the form you need and ensure it is for your correct area/county.

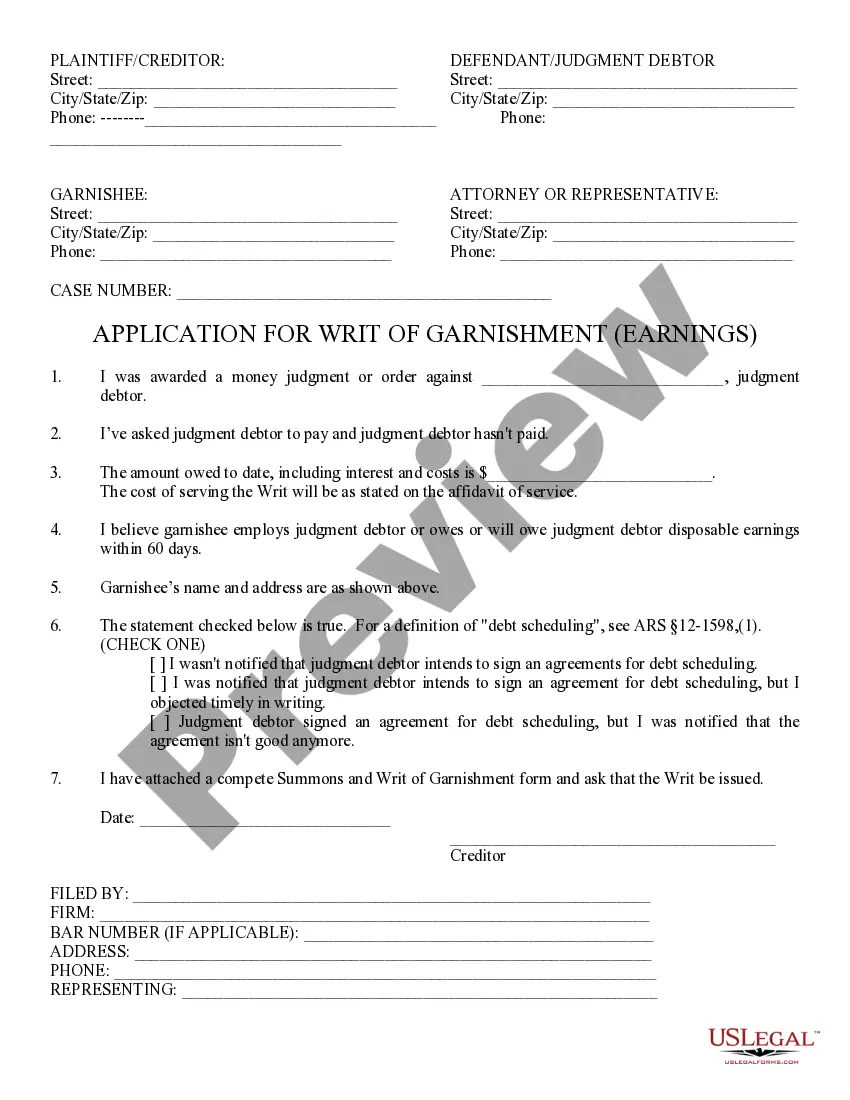

- Use the Review button to examine the form.

- Read the description to make sure you have selected the right form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs.

- Once you find the correct form, click Get now.

- Select the pricing plan you wish, fill in the necessary information to create your account, and complete the purchase with your PayPal or credit card.

- Choose a convenient document format and download your version.

Form popularity

FAQ

The bill of transfer for a trust, such as the South Carolina Bill of Transfer to a Trust, is a legal document that officially records the transfer of assets into a trust. This document serves as a formal declaration of intent, which can help clarify ownership and distribution in accordance with your estate planning objectives. It's crucial to maintain accurate records to facilitate smooth management of your trust.

To place your house in a trust in South Carolina, you would typically execute a South Carolina Bill of Transfer to a Trust. This legal document should detail the property being transferred and should be drafted in accordance with South Carolina law. Consulting a legal professional can help you navigate the specifics of the process and ensure that your trust is set up correctly.

The SC DMV Form 416 is a specific document used for transferring vehicle ownership in South Carolina. It can be particularly relevant when you are placing a vehicle into a trust. Utilizing the South Carolina Bill of Transfer to a Trust alongside this form can help ensure that vehicle ownership is transferred appropriately.

Choosing between a transfer on death and a trust often depends on your personal circumstances and preferences. A trust, particularly one backed by a South Carolina Bill of Transfer to a Trust, offers more comprehensive management and distribution options. This flexibility can be advantageous if you have diverse assets or complex estate planning needs.

Assets are added to a trust by executing a document like the South Carolina Bill of Transfer to a Trust. This legal instrument clearly delineates which assets you are placing into the trust, ensuring that they are managed according to your wishes. Adequate documentation is essential to establish your intent and ensure that all assets are effectively protected under the trust.

To transfer assets into a trust, you will sign a South Carolina Bill of Transfer to a Trust that details the specific assets being moved. This document acts as a legal record and helps ensure that the assets are properly designated to the trust. Always double-check the trust agreement for any specific requirements regarding the transfer process.

Typically, a transfer from a trust to another trust is not considered a taxable event in South Carolina. However, you should consult a tax advisor to ensure compliance with specific tax regulations and obligations. Incorporating a South Carolina Bill of Transfer to a Trust in your planning can provide clarity on ownership and potentially mitigate tax implications.

You can transfer items to a trust by executing a South Carolina Bill of Transfer to a Trust, which formalizes the transfer of ownership. This process may require you to collect documentation for each item and make a declaration indicating your intention to place those items in the trust. Keeping a detailed record of all transfers can simplify estate management in the future.

To transfer assets from one trust to another trust, you typically need to prepare a South Carolina Bill of Transfer to a Trust. This document officially records the movement of assets from the first trust's ownership to the second trust. It's essential to follow legal procedures carefully to ensure that the transfer holds up under South Carolina law and aligns with your estate planning goals.

Trust funds can carry certain risks that users should be aware of. For instance, the creation of a trust often requires ongoing management and can lead to complications if the terms are not clearly defined. Additionally, any changes to tax laws can affect the benefits of having a trust. By understanding the implications of the South Carolina Bill of Transfer to a Trust, users can better navigate these potential risks.