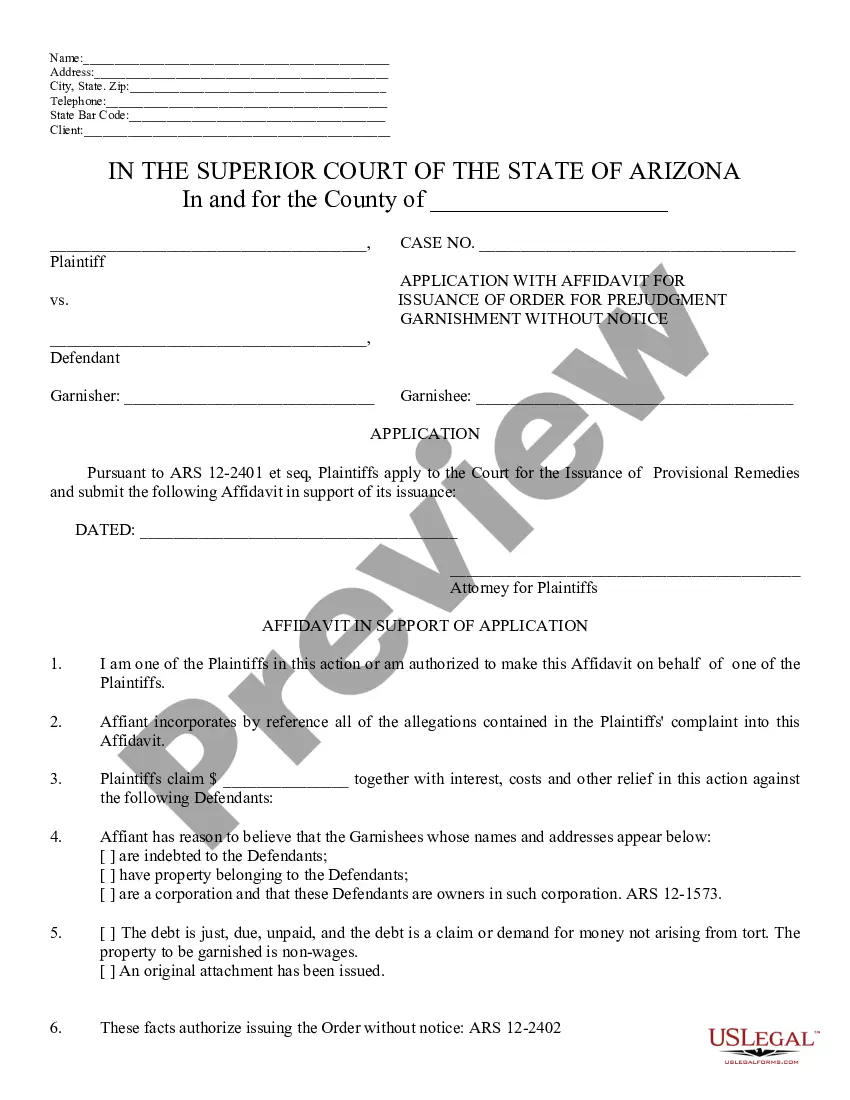

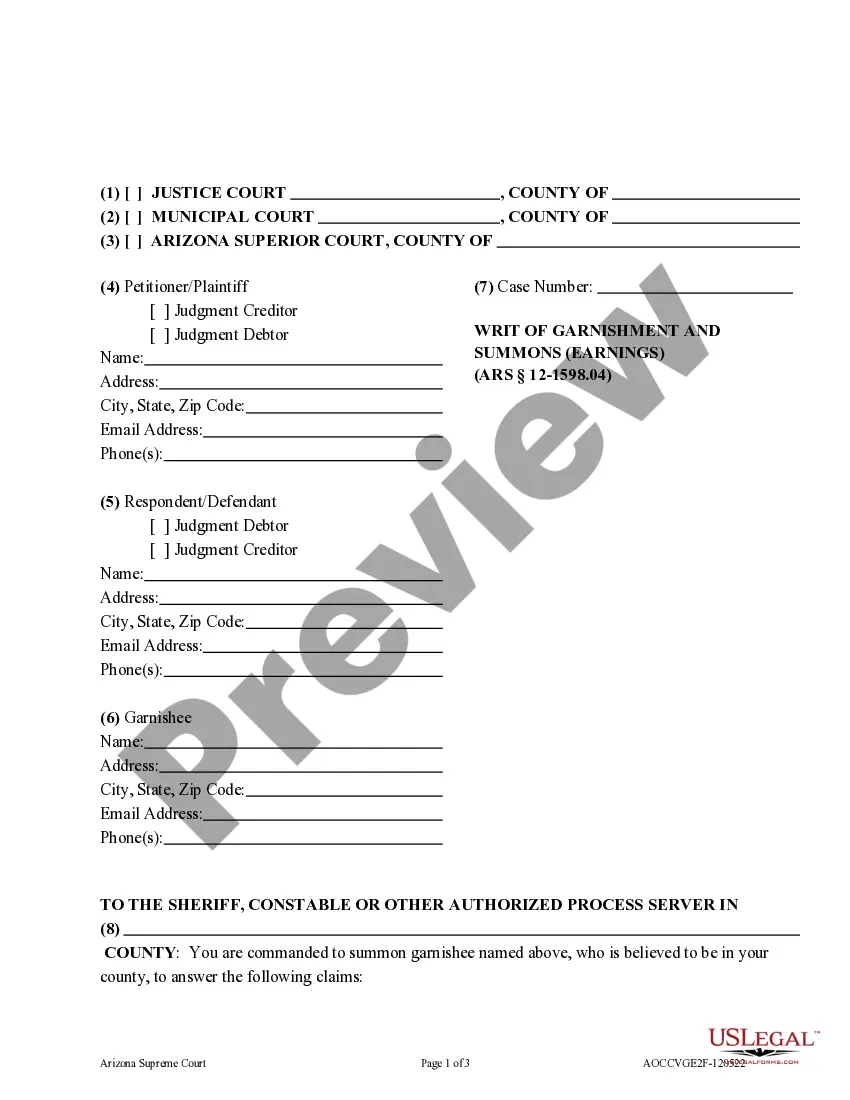

Application for Writ of Garnishment Earnings: This Application requests that the court issue an Order, garnishing the wages of a Judgment Debtor, who is currently not paying the Creditor. The motion states both the Debtor's and Creditor's name, as well as the Debtor's place of business. This form is available for download in both Word and Rich Text formats.

Arizona Application for Writ of Garnishment

Description

How to fill out Arizona Application For Writ Of Garnishment?

If you’re looking for the appropriate Arizona Application for Writ of Garnishment Earnings replicas, US Legal Forms is exactly what you require; obtain paperwork crafted and validated by state-authorized attorneys. Utilizing US Legal Forms not only shields you from complications regarding legal documents; additionally, you conserve time and effort, as well as money!

Acquiring, printing, and completing a professional template is significantly more economical than hiring a lawyer to prepare it for you. To commence, complete your registration process by supplying your email address and setting a password. Adhere to the steps below to set up an account and locate the Arizona Application for Writ of Garnishment Earnings template to manage your needs.

After creating your account, all subsequent requests will be processed even more easily. If you possess a US Legal Forms subscription, simply Log In to your account and click the Download button found on the form’s webpage. Therefore, when you wish to access this sample again, you will consistently be able to locate it in the My documents section. Don’t waste your time comparing numerous forms on different websites. Purchase precise documents from a single, reliable service!

- Utilize the Preview tool or examine the document details (if available) to ensure that the sample is the one you require.

- Verify its validity in your resident state.

- Select Buy Now to place your order.

- Choose a recommended pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a convenient file format and download the document.

- And there you have it. In just a few easy clicks, you've obtained an editable Arizona Application for Writ of Garnishment Earnings.

Form popularity

FAQ

The application for a writ of garnishment is a legal document requested by a creditor to collect a debt through withholding a portion of your wages or bank account. This writ must comply with Arizona's legal requirements and procedures for it to be valid. Completing the Arizona Application for Writ of Garnishment accurately is crucial for the creditor, as mistakes could delay the process. Utilizing a platform like US Legal Forms can streamline this process, helping you understand your obligations and rights efficiently.

Stopping a wage garnishment in Arizona can be achieved through a few different methods. You may negotiate a payment plan directly with your creditor or file a motion with the court to contest the garnishment if you believe it’s unjust. Another option involves filing for bankruptcy, which can halt garnishments temporarily. Seeking guidance on the Arizona Application for Writ of Garnishment from professionals can help you navigate your options.

Yes, creditors can garnish your bank account in Arizona, but specific legal procedures must be followed. Typically, a creditor must first obtain a judgment against you before they can initiate garnishment through an Arizona Application for Writ of Garnishment. Once a writ is issued, funds in your account may be frozen and deducted per the judgment. It's essential to understand your rights in these situations, and utilizing resources such as US Legal Forms can guide you through the process.

In Arizona, the maximum wage garnishment typically limits how much of your earnings can be withheld. Generally, this is 25% of your disposable earnings after taxes, or the amount by which your wages exceed 30 times the minimum wage, whichever is less. Understanding these limits is crucial when dealing with the Arizona Application for Writ of Garnishment. If you find yourself facing garnishment, it's important to consult with a legal expert to ensure your rights are protected.

The maximum garnishment allowed in Arizona generally follows established guidelines of 25% of disposable earnings. Additionally, there are special rules for different types of debt, such as child support or tax obligations. To get a comprehensive understanding of these figures, you can refer to the Arizona Application for Writ of Garnishment.

To stop wage garnishment in Arizona, you may need to file a motion with the court to challenge the garnishment. Providing sufficient evidence, such as financial hardship or incorrect calculation of the garnished amount, is necessary. The Arizona Application for Writ of Garnishment can help you understand the process and submit the necessary paperwork effectively.

When it comes to wage garnishment in Arizona, creditors can take up to 25% of your disposable earnings for most debts. However, if you are dealing with taxes or child support, those amounts may differ. Understanding the rules through the Arizona Application for Writ of Garnishment can empower you to manage your financial situation better.

Arizona has specific laws regarding maximum garnishment amounts. The law generally permits the garnishment of 25% of your disposable income or the amount by which your income exceeds 30 times the federal minimum wage, whichever is lower. Using the Arizona Application for Writ of Garnishment can guide you through this process and ensure compliance with legal guidelines.

In Arizona, the amount that can be garnished from your paycheck typically depends on your income and the type of debt. Generally, creditors can garnish up to 25% of your disposable earnings. To navigate these situations, the Arizona Application for Writ of Garnishment can serve as a useful tool to understand your rights and obligations.

The fastest way to stop wage garnishment is to file a motion with the court as soon as possible. Many times, you can expedite the process by presenting evidence of financial hardship or any discrepancies in the garnishment claim. Utilizing the Arizona Application for Writ of Garnishment effectively can simplify this procedure. Legal assistance is often beneficial for quick resolution.