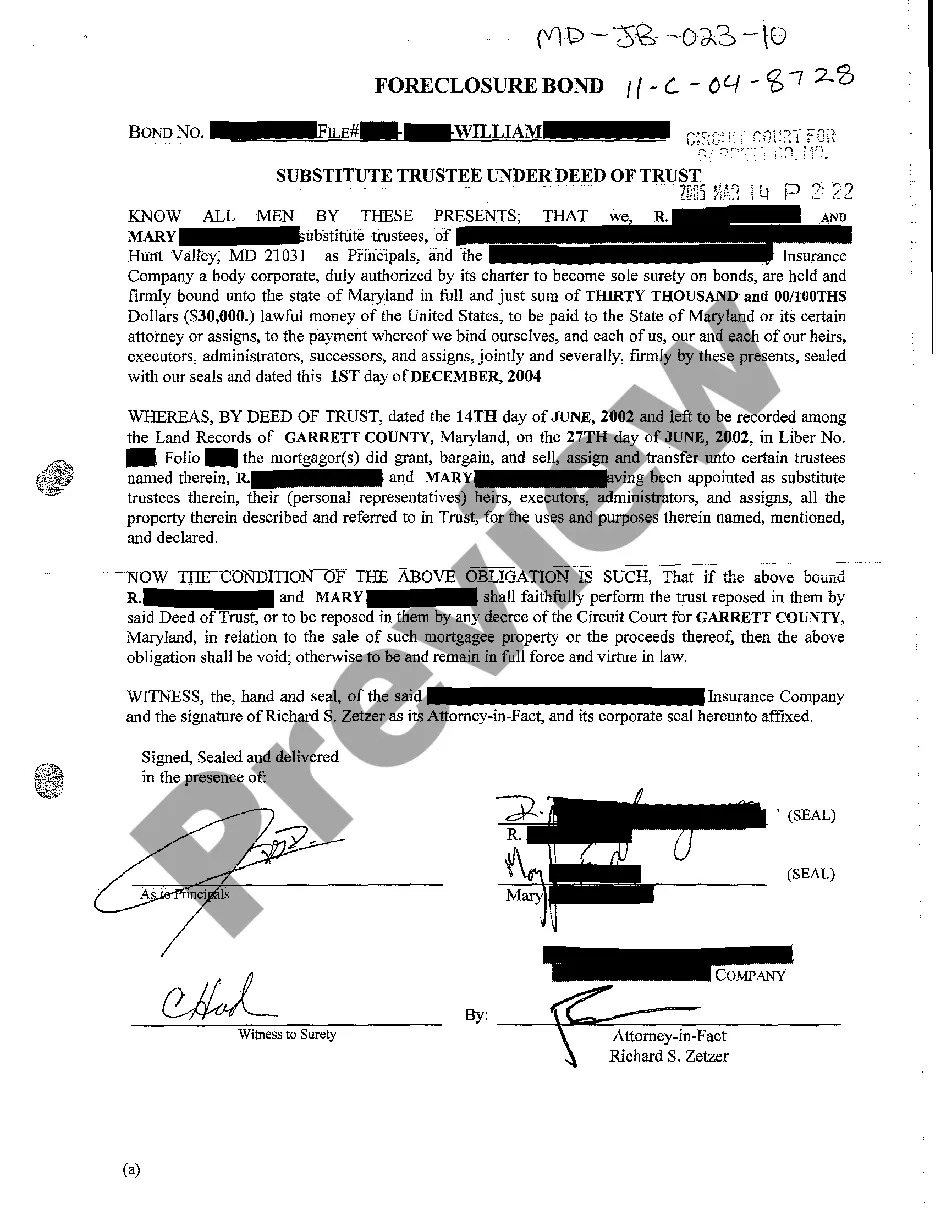

Maryland Foreclosure Bond

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Foreclosure Bond?

Greetings to the most extensive collection of legal document resources, US Legal Forms. Here, you can discover any template including Maryland Foreclosure Bond samples and preserve them (as many as you desire/require). Create official documents in just a few hours, instead of days or even weeks, without having to pay a fortune for an attorney.

Obtain the state-specific form in just a few clicks and feel assured knowing it was prepared by our qualified legal experts.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Foreclosure Bond you seek. Since US Legal Forms operates online, you’ll typically have access to your downloaded documents, no matter what device you are using. Locate them in the My documents section.

Print the document and fill it in with your/your business’s information. Once you’ve completed the Maryland Foreclosure Bond, submit it to your lawyer for approval. This additional step is essential to ensure you’re entirely secure. Join US Legal Forms today and gain access to a large selection of reusable templates.

- If you do not have an account yet, what are you waiting for.

- Review our instructions below to begin.

- If this is a state-specific template, verify its validity in your jurisdiction.

- Examine the description (if available) to ensure it’s the right template.

- View more content with the Preview option.

- If the document meets your needs, click on Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you require (Word or PDF).

Form popularity

FAQ

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

A right of redemption bond protects a party that purchases a property through a foreclosure sale or auction in the event that the original owner exercises the right to redeem the property by paying off their debt after the sale.

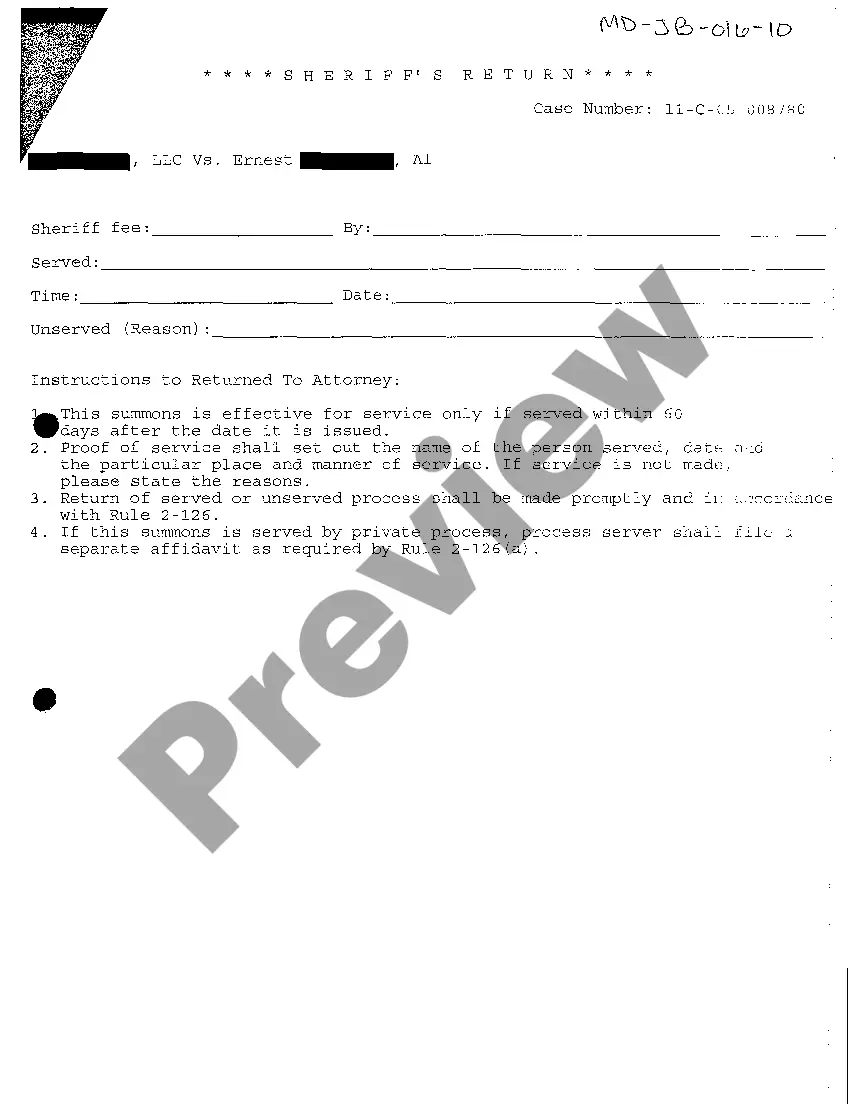

Foreclosure auctions are usually held at the courthouse in the county where the property is located. After a sale has taken place, it usually takes approximately 30-45 days for the sale to be ratified, however the ratification time can vary significantly from county to county.

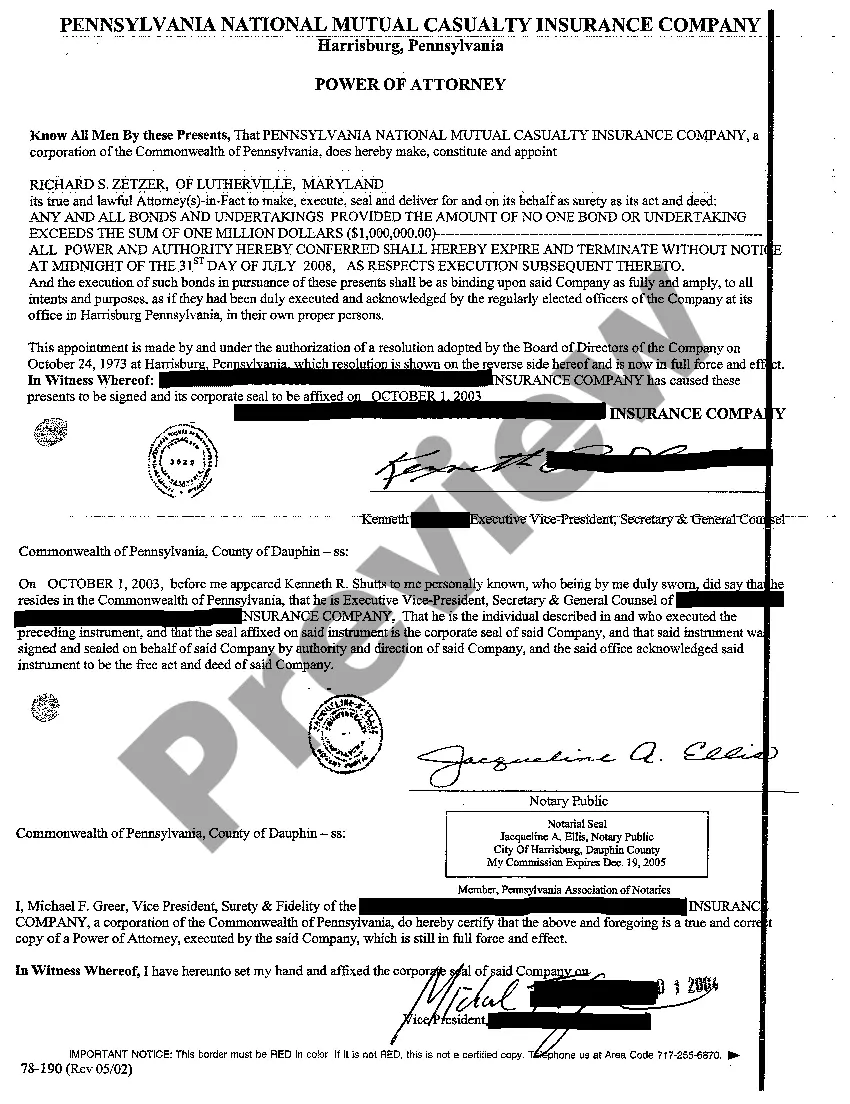

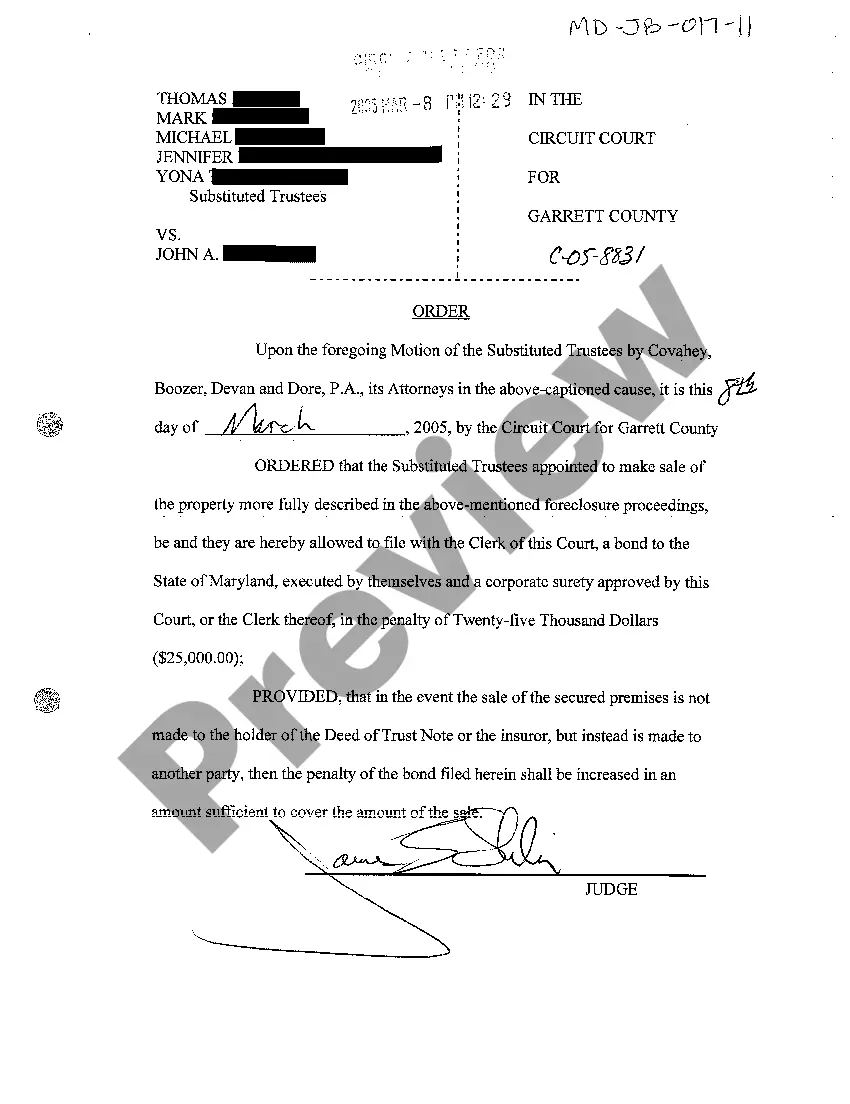

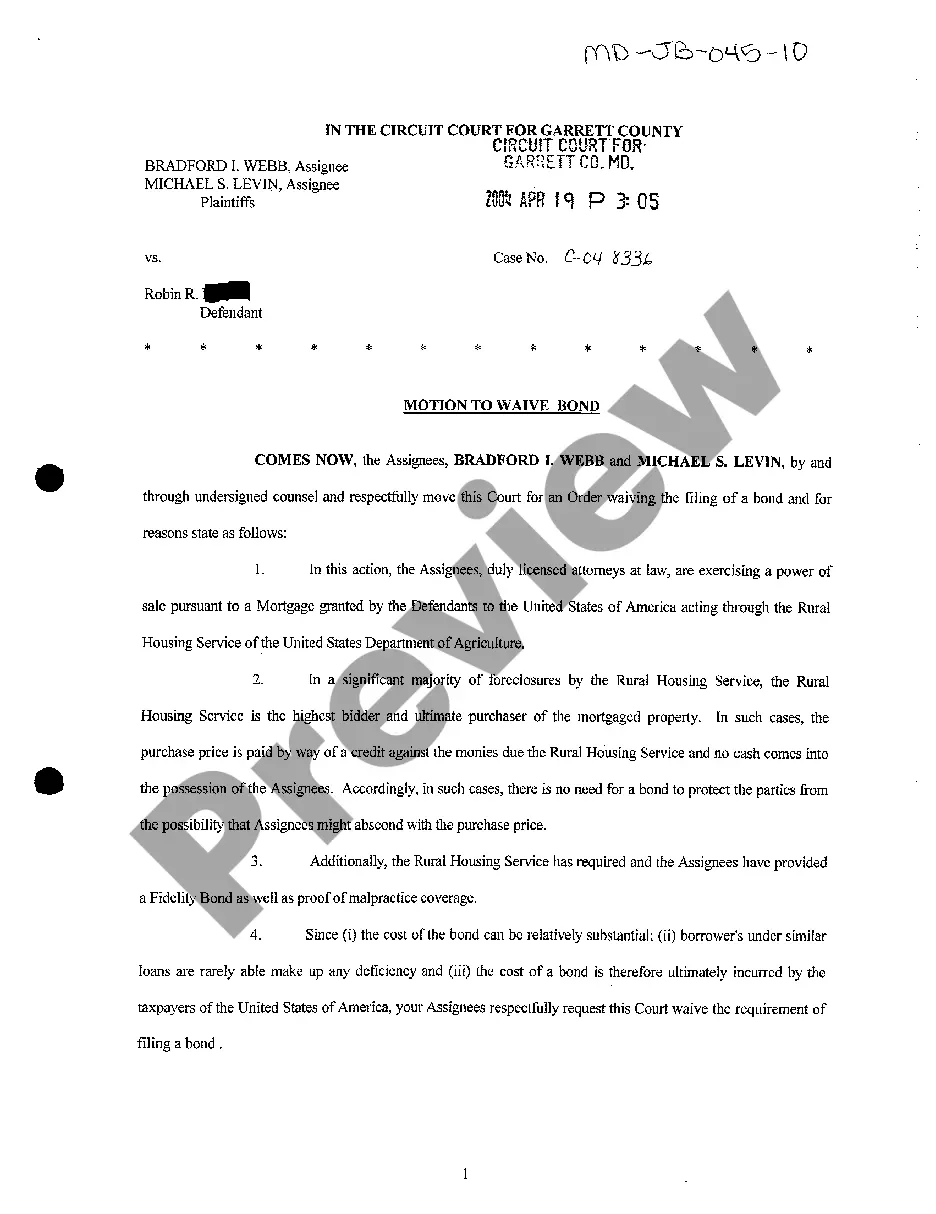

Maryland Trustee in Foreclosure Bonds are required by the various county courts. They are required by persons appointed as Trustee to foreclose on real estate. The required bond amount is set by the court. This is a one-time charge and there will not be any renewal premiums due.

Notice of Intent to Foreclose (NOI) The NOI is a warning notice to the homeowner that a foreclosure action could be filed against them in court. The mortgage company must send the NOI by certified and first-class mail to the homeowner no less than 45 days before a foreclosure action is filed in court.

Lenders will seize the home, which is typically used as collateral for the loan and will put the property up for sale to try and recoup losses. The foreclosure process from beginning to end typically takes a lender about 18 months to foreclose on a property during normal times.

Notice Of Default The lender will also give public notice to the County Recorder's office or file a lawsuit with the court. This officially begins the preforeclosure process, which can last 3 10 months.

Typically, it takes about 90 days to foreclose on a Maryland property if the borrower does not object to the foreclosure. If a lender pursues a judicial foreclosure in Maryland then the time frame for foreclosure will vary depending on the court's schedule and orders.

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.