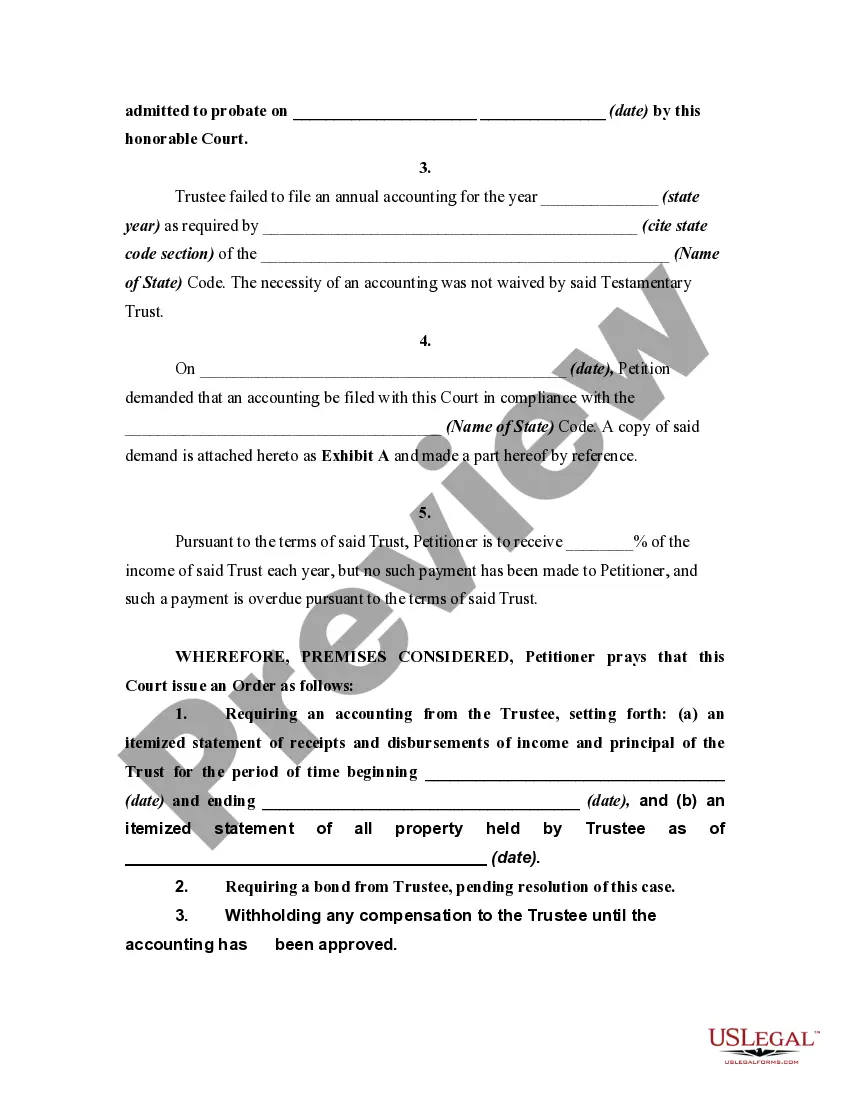

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

South Carolina Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

US Legal Forms - one of several most significant libraries of authorized types in the States - gives a wide array of authorized document web templates it is possible to download or produce. Making use of the website, you will get a large number of types for organization and personal uses, sorted by groups, suggests, or keywords and phrases.You can find the most recent variations of types like the South Carolina Petition to Require Accounting from Testamentary Trustee in seconds.

If you already have a monthly subscription, log in and download South Carolina Petition to Require Accounting from Testamentary Trustee from your US Legal Forms collection. The Download button will appear on every single kind you look at. You gain access to all formerly acquired types inside the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, listed here are simple instructions to obtain started out:

- Be sure you have selected the proper kind for the city/state. Click the Preview button to review the form`s articles. See the kind information to ensure that you have chosen the correct kind.

- In case the kind doesn`t satisfy your demands, take advantage of the Research discipline on top of the screen to obtain the one that does.

- In case you are satisfied with the form, affirm your decision by clicking the Purchase now button. Then, opt for the rates prepare you like and supply your qualifications to register for an profile.

- Method the purchase. Make use of Visa or Mastercard or PayPal profile to complete the purchase.

- Find the format and download the form on the product.

- Make alterations. Fill out, change and produce and indication the acquired South Carolina Petition to Require Accounting from Testamentary Trustee.

Every single format you added to your money lacks an expiry particular date and is also your own permanently. So, if you wish to download or produce an additional version, just visit the My Forms portion and click on the kind you will need.

Obtain access to the South Carolina Petition to Require Accounting from Testamentary Trustee with US Legal Forms, probably the most extensive collection of authorized document web templates. Use a large number of professional and express-specific web templates that meet up with your business or personal requirements and demands.

Form popularity

FAQ

SECTION 62-5-101. Definitions and use of terms. Unless otherwise apparent from the context, in this article: (1) "Adult" means an individual who has attained the age of eighteen or who, if under eighteen, is married or has been emancipated by a court of competent jurisdiction.

Revocation or amendment of revocable trust. (a) Unless the terms of a trust expressly provide that the trust is irrevocable, the settlor may revoke or amend the trust.

SECTION 62-7-102. Scope. This article applies to express trusts, charitable or noncharitable, and trusts created pursuant to a statute, judgment, or decree that requires the trust to be administered in the manner of an express trust.

(a) A trustee shall keep the qualified beneficiaries of the trust reasonably informed about the administration of the trust and of the material facts necessary for them to protect their interests.

Methods of creating trust. (iii) exercise of a power of appointment in favor of a trustee. (2) To be valid, a trust of real property, created by transfer in trust or by declaration of trust, must be proved by some writing signed by the party creating the trust.

SECTION 62-7-412. Modification or termination because of unanticipated circumstances or inability to administer trust effectively.

In South Carolina, the elective share statute provides that the surviving spouse has the right to claim 1/3 of the deceased spouse's ?probate estate.? Unlike the North Carolina elective share, the South Carolina elective share is fixed at 1/3 and does not increase over time based upon the length of marriage.

SECTION 62-2-207. Charging spouse with gifts received; liability of others for balance of elective share. (8) in a revocable inter vivos trust created by the decedent.