South Carolina Revocable Trust Agreement - Grantor as Beneficiary

Description

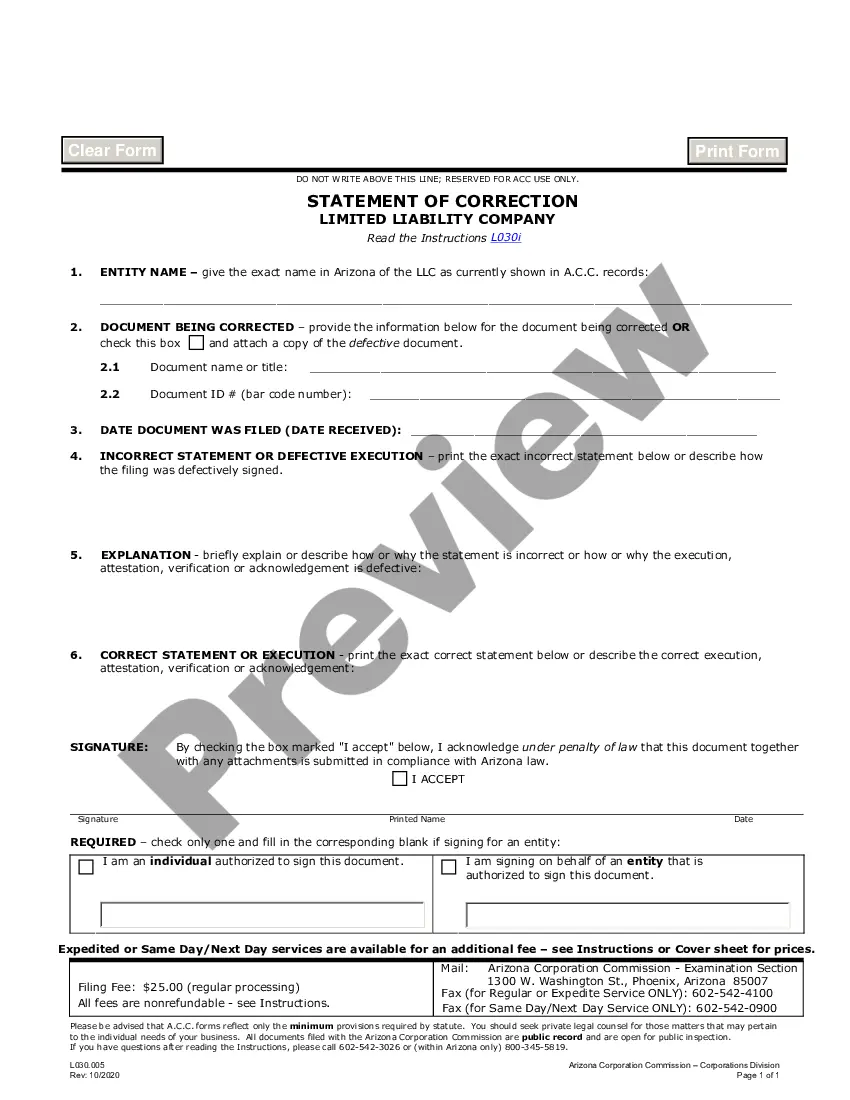

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

If you wish to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest array of legal forms accessible online.

Utilize the site's straightforward and convenient search feature to locate the documents you need.

Many templates for business and personal purposes are classified by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account.

Explore the My documents section and select a form to print or download again. Be proactive and obtain, and print the South Carolina Revocable Trust Agreement - Grantor as Beneficiary with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to locate the South Carolina Revocable Trust Agreement - Grantor as Beneficiary with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the South Carolina Revocable Trust Agreement - Grantor as Beneficiary.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the outline.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After locating the form you need, click on the Get now button. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the South Carolina Revocable Trust Agreement - Grantor as Beneficiary.

Form popularity

FAQ

To add a beneficiary to a revocable trust, you typically need to revise the trust document. In the process of creating your South Carolina Revocable Trust Agreement - Grantor as Beneficiary, amendments can be made easily due to the revocable nature of the trust. It's a straightforward process, but it's essential to follow the legal requirements to ensure the changes are valid. Consider using resources like USLegalForms to streamline the amendment process and ensure everything is handled correctly.

The beneficiary of a trust is the person or entity who benefits from the assets held in the trust. In a South Carolina Revocable Trust Agreement - Grantor as Beneficiary, the grantor can designate themselves as the initial beneficiary, allowing for personal use of the trust’s assets. Additionally, the grantor can name other individuals or organizations to receive benefits upon their passing. This feature helps ensure that your assets are distributed according to your wishes.

Yes, the grantor and the settlor of a trust refer to the same individual. When drafting a South Carolina Revocable Trust Agreement - Grantor as Beneficiary, the term 'grantor' indicates the person who establishes the trust and retains rights to modify it. This dual terminology highlights the grantor's role in creating, funding, and controlling the trust. Understanding these terms can clarify your rights and duties within the trust.

Yes, a grantor trust can make distributions to beneficiaries. Under the South Carolina Revocable Trust Agreement - Grantor as Beneficiary, the grantor retains control over the trust assets and can designate distributions as they see fit. This flexibility allows grantors to support their beneficiaries while managing their assets effectively. It is important to document these distributions clearly to maintain the trust's integrity.

In South Carolina, a certificate of trust does not need to be recorded, which provides certain privacy advantages. When you create a South Carolina Revocable Trust Agreement - Grantor as Beneficiary, this document serves as proof of the trust's existence without exposing all its details to the public. However, if your trust holds real estate or certain assets, recording may be necessary to establish ownership. It's advisable to consult with a legal expert for your specific situation.

The grantor of an irrevocable trust is the individual who sets up the trust and transfers assets into it, relinquishing control over those assets. In contrast to the South Carolina Revocable Trust Agreement - Grantor as Beneficiary, an irrevocable trust provides specific legal protections but limits the grantor's flexibility. Understanding the nature of an irrevocable trust is important for estate planning. It serves different purposes compared to a revocable trust, which offers more leeway for changes.

Upon the grantor's death, the revocable trust typically becomes irrevocable, and the grantor's role as a trustee concludes. In a South Carolina Revocable Trust Agreement - Grantor as Beneficiary, the successor trustee steps in to manage the trust according to the grantor's wishes. This continuity of management helps ensure that your assets are handled in line with your desires. It's a crucial aspect of estate planning that provides peace of mind for you and your beneficiaries.

Certainly, a revocable trust can be named as a beneficiary in various financial instruments, including life insurance policies and retirement accounts. In the context of a South Carolina Revocable Trust Agreement - Grantor as Beneficiary, this strategy ensures that assets are directed to the trust upon your passing. This approach simplifies the distribution process, as assets go directly to the trust rather than through probate. It also allows for more streamlined management of your estate.

Yes, in the South Carolina Revocable Trust Agreement - Grantor as Beneficiary, the grantor can also be a beneficiary. This arrangement enables you to retain access to the trust assets while enjoying the benefits they provide. As the grantor and beneficiary, you have significant control over your finances during your lifetime. This dual role is a common feature of revocable trusts.

Yes, a grantor can change the beneficiary of a trust, especially in a South Carolina Revocable Trust Agreement - Grantor as Beneficiary. This flexibility allows you to adapt to changing circumstances, ensuring that your trust reflects your current wishes. By maintaining your role, you have the power to revise beneficiaries as needed. It's a great way to keep your estate plan aligned with your intentions.