South Carolina Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

If you need to finish, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Utilize the site’s user-friendly and efficient search to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred payment method and provide your information to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the South Carolina Deferred Compensation Agreement - Short Form within just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to receive the South Carolina Deferred Compensation Agreement - Short Form.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

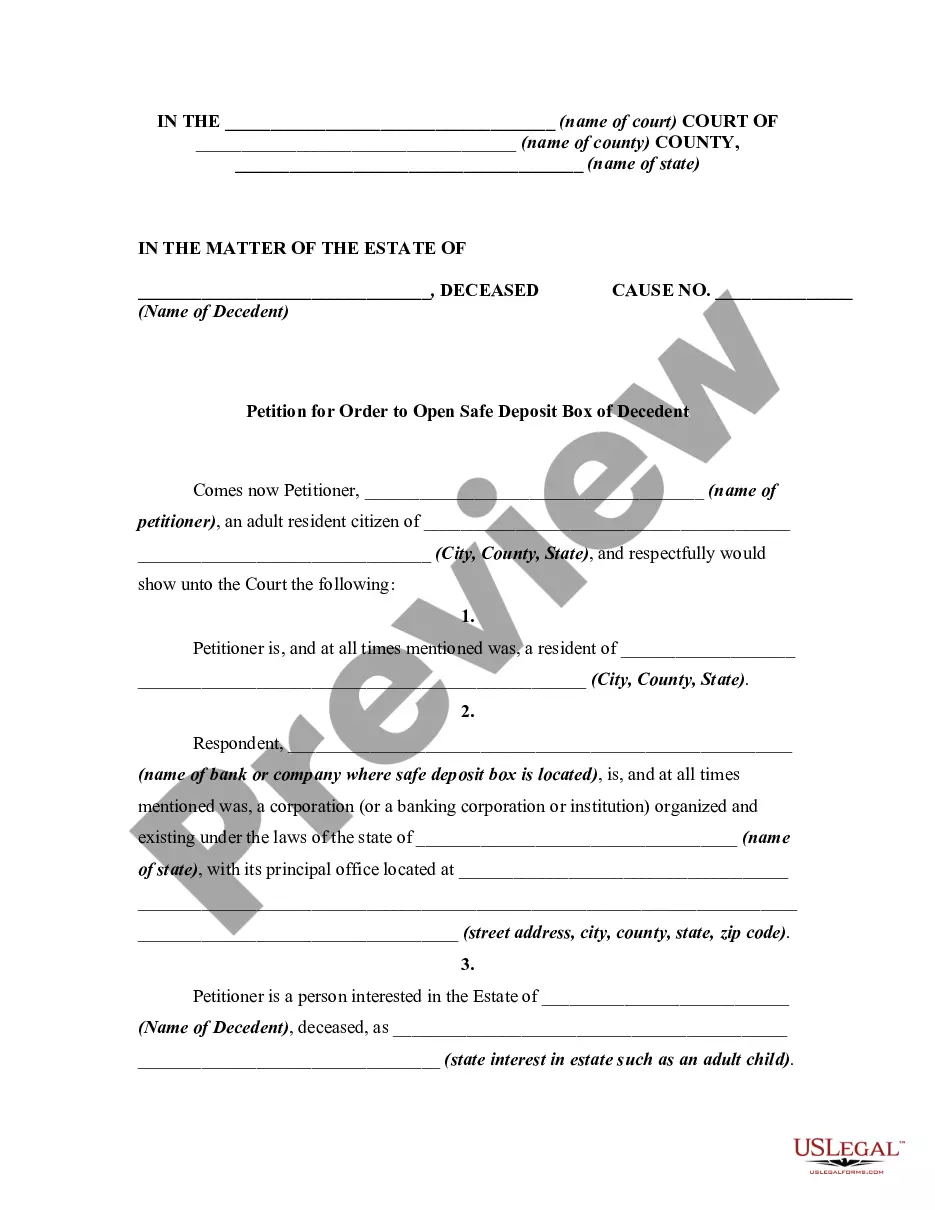

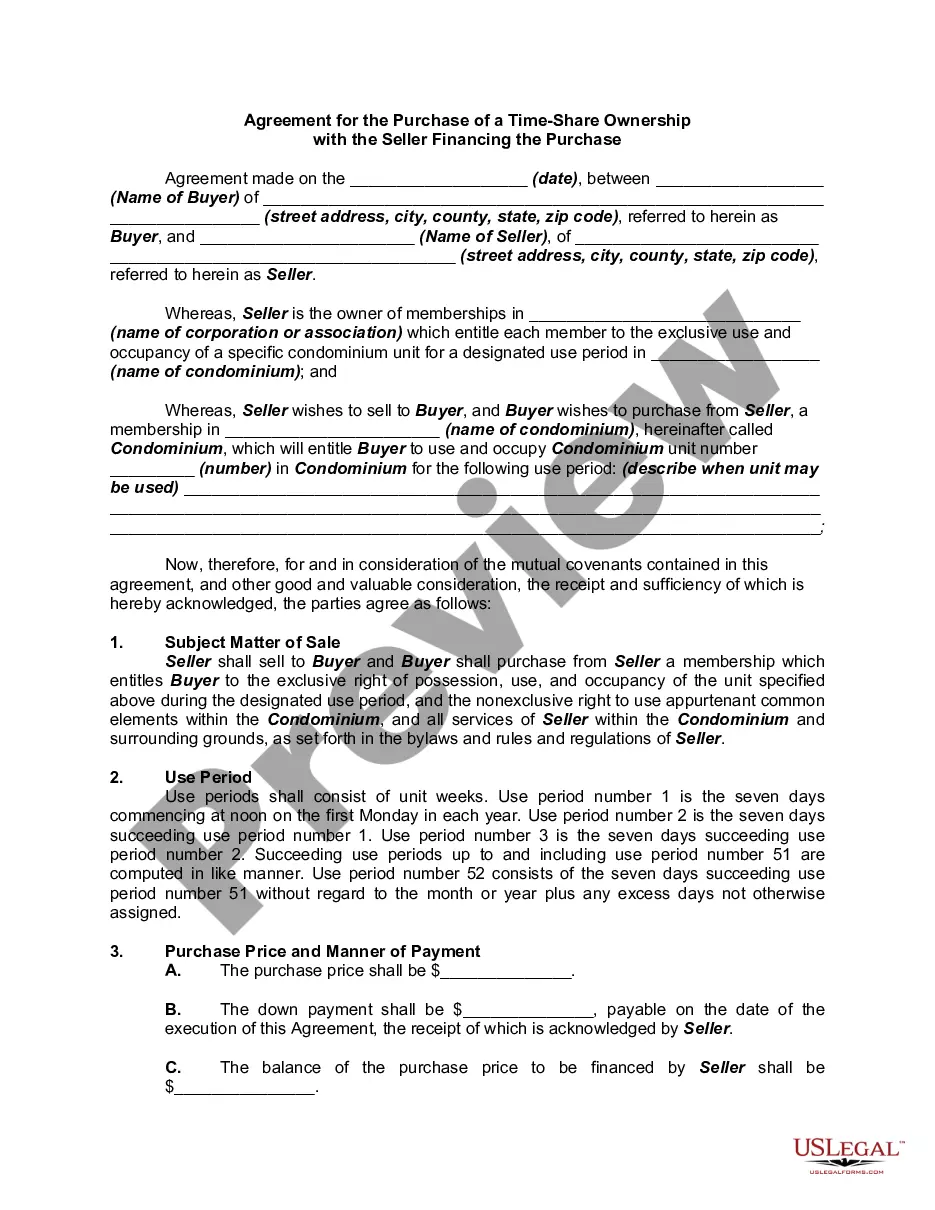

- Step 2. Use the Preview feature to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

The two main types of deferred compensation plans are non-qualified and qualified plans. Non-qualified plans allow more flexible contribution limits and often attract higher-income earners, while qualified plans, like the South Carolina Deferred Compensation Agreement - Short Form, adhere to federal regulations and offer tax benefits. Both types can strategically support your financial growth and retirement planning.

In South Carolina, the vesting period for state retirement benefits typically requires a minimum of five years of creditable service. This means you must work for a qualifying employer for this duration to fully claim your retirement benefits. Understanding the South Carolina Deferred Compensation Agreement - Short Form can provide additional insights into how this plan supplements your overall retirement strategy.

The South Carolina deferred compensation program is designed to help employees save for retirement through pre-tax contributions. The South Carolina Deferred Compensation Agreement - Short Form outlines the details of the program and offers various investment options tailored to individual needs. This program enhances financial readiness for retirement by allowing employees to build savings over time.

Setting up a deferred compensation plan involves several key steps. You should review the South Carolina Deferred Compensation Agreement - Short Form with your employer or financial advisor to determine eligibility and options. Ideally, complete the necessary forms, choose contribution amounts, and select investment options that align with your retirement objectives.

A deferred compensation plan can be an excellent option for many individuals. By utilizing the South Carolina Deferred Compensation Agreement - Short Form, you can secure a portion of your earnings for retirement while potentially lowering your taxable income. This strategy often complements other retirement savings, providing a more robust financial future.

To start a deferred compensation plan, you should first consult your employer or financial advisor to understand the options available. The South Carolina Deferred Compensation Agreement - Short Form can guide you through the enrollment process. Once you gather the necessary documents and information, you can choose the contributions and investment options that fit your goals.

The South Carolina Public Employee Benefit Authority (PEBA) provides retirement plans for employees, including traditional pensions and optional deferred compensation plans. Employees contribute a portion of their salary to the pension plan, which, along with employer contributions, funds retirement benefits. Additionally, the South Carolina Deferred Compensation Agreement - Short Form can work alongside these benefits for enhanced retirement planning.

To qualify for a pension with the South Carolina Retirement System, you typically need to serve a minimum of five years. However, the exact requirements can vary based on your job and the specific retirement plan in place. It's wise to consult the South Carolina retirement guidelines to ensure you meet all necessary criteria for pension eligibility.

A South Carolina Deferred Compensation Agreement - Short Form allows employees to set aside a portion of their salary for retirement savings before taxes. This means your taxable income decreases, providing immediate tax savings. The funds grow tax-deferred until you withdraw them, allowing you to accumulate more savings over time. This plan is a practical way to complement your pension.

Generally, you can withdraw from your South Carolina Deferred Compensation Agreement - Short Form without penalties when you reach age 59½. However, you may also access your funds if you leave your job, face financial hardship, or retire. It's important to review the specific terms of your deferred compensation plan and consult with a financial advisor for tailored guidance.