South Carolina Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

If you desire to finalize, acquire, or print authentic document templates, utilize US Legal Forms, the largest assortment of official forms available online.

Make use of the site's straightforward and efficient search to find the documents you need.

A range of templates for commercial and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you want and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to retrieve the South Carolina Deferred Compensation Agreement - Long Form with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to receive the South Carolina Deferred Compensation Agreement - Long Form.

- You can also access forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the appropriate region/state.

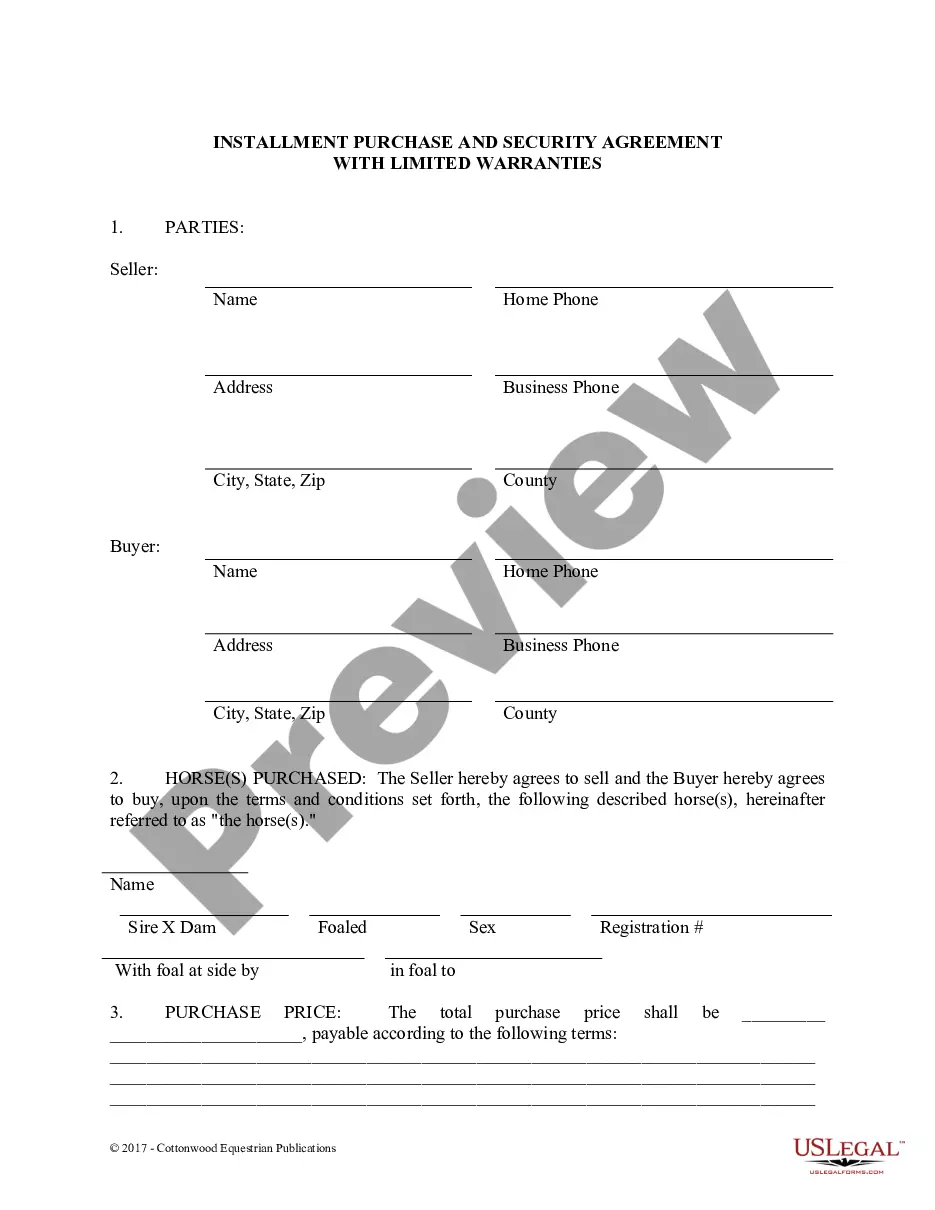

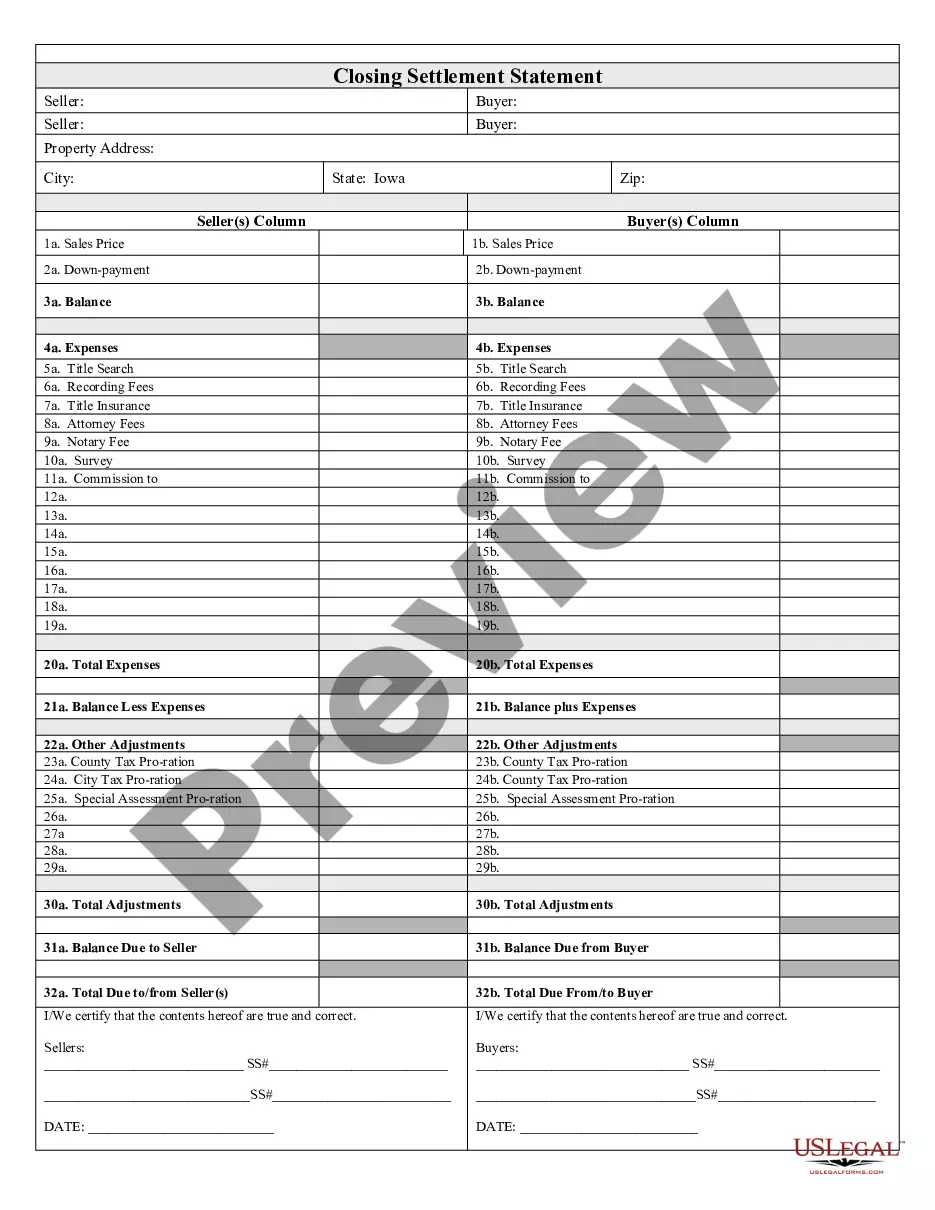

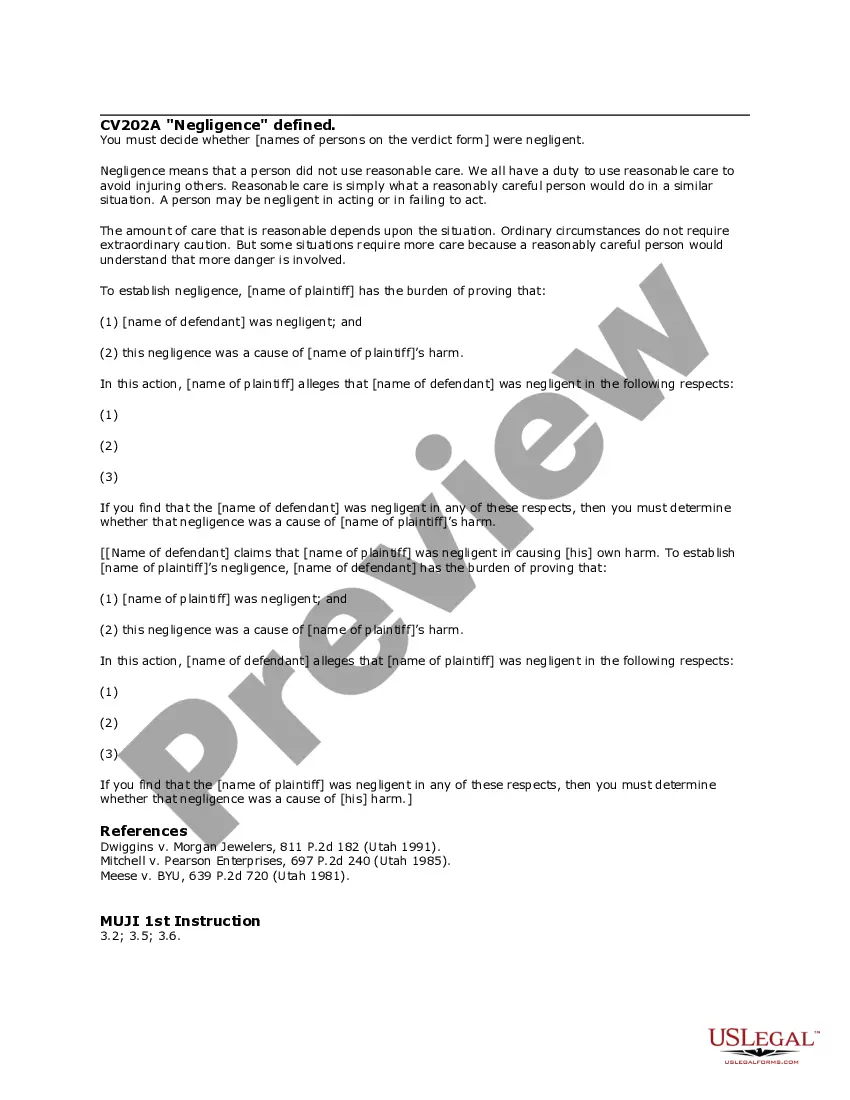

- Step 2. Utilize the Preview option to review the form's details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup area at the top of the screen to find other versions in the official form format.

Form popularity

FAQ

Determining how much to contribute to your deferred comp should be based on your individual financial goals and circumstances. Generally, it's wise to start with a percentage of your income that you can comfortably set aside, while considering your retirement needs. For those using the South Carolina Deferred Compensation Agreement - Long Form, consulting with a financial advisor might help tailor a contribution strategy that fits your lifestyle and future plans. Remember, maximizing your contributions can lead to significant benefits down the line.

A typical deferred compensation plan allows you to defer a portion of your earnings until a later date, usually retirement. This can be beneficial as it helps you manage your tax liability during your working years. In the context of the South Carolina Deferred Compensation Agreement - Long Form, these plans often involve investments that can grow tax-deferred until you withdraw them. Utilizing such a plan can strengthen your financial future while potentially lowering your taxable income.

Determining the right percentage of your paycheck to allocate to deferred compensation depends on your personal financial goals and current expenses. As a general guideline, many financial advisors recommend deferring 10-15% of your salary. However, with the South Carolina Deferred Compensation Agreement - Long Form, you can adjust this percentage based on your needs, allowing you to balance saving for the future while covering current living costs.

The South Carolina deferred compensation program is designed to help state employees save for retirement. Through the South Carolina Deferred Compensation Agreement - Long Form, participants can set aside a portion of their income before taxes. This program aims to enhance financial security for employees by offering investment options and the ability to grow their savings over time. Utilizing this resource is a beneficial strategy for building a solid financial future.

Starting a deferred compensation plan is straightforward, but it requires careful planning. First, consult with your employer or a financial adviser about the South Carolina Deferred Compensation Agreement - Long Form options available to you. After understanding the details, complete any necessary paperwork to enroll, and set the percentage of your salary you wish to defer. This proactive step can improve your financial future significantly.

The 10-year rule refers to a tax provision that impacts distributions from deferred compensation plans. Under this rule, participants must receive their deferred funds within 10 years after separation from service. This restriction is designed to help ensure that individuals do not hold onto their compensation indefinitely without facing tax implications. Understanding the South Carolina Deferred Compensation Agreement - Long Form can help you navigate these requirements effectively.

A deferred compensation plan can be a smart choice for individuals looking to save for retirement while reducing their taxable income. By participating in a South Carolina Deferred Compensation Agreement - Long Form, you can defer a portion of your salary until retirement or another agreed-upon date. This allows your investments to grow tax-deferred, which can significantly increase your savings over time. However, it's important to evaluate your personal financial goals and situation before deciding.

To retire from state employment in South Carolina, you need to have at least five years of service. This allows you to qualify for a monthly retirement benefit through the South Carolina Retirement System. Additionally, you may maximize your retirement benefits by considering options like a South Carolina Deferred Compensation Agreement - Long Form. Such agreements can help you prepare financially for retirement, ensuring you have a comfortable future.

The deferred compensation plan works by allowing employees to contribute a portion of their earnings to a retirement account before taxes are deducted. Under the South Carolina Deferred Compensation Agreement - Long Form, these contributions grow tax-deferred until you withdraw them in retirement. This structure can provide a valuable resource for your financial future, helping you achieve your retirement objectives.

Generally, you can begin withdrawing from your deferred compensation account at age 59½ without penalties under the South Carolina Deferred Compensation Agreement - Long Form. However, keep in mind that early withdrawals may incur taxes and penalties. Planning your withdrawals carefully can help you maximize your retirement funds.