Iowa Closing Statement

Understanding this form

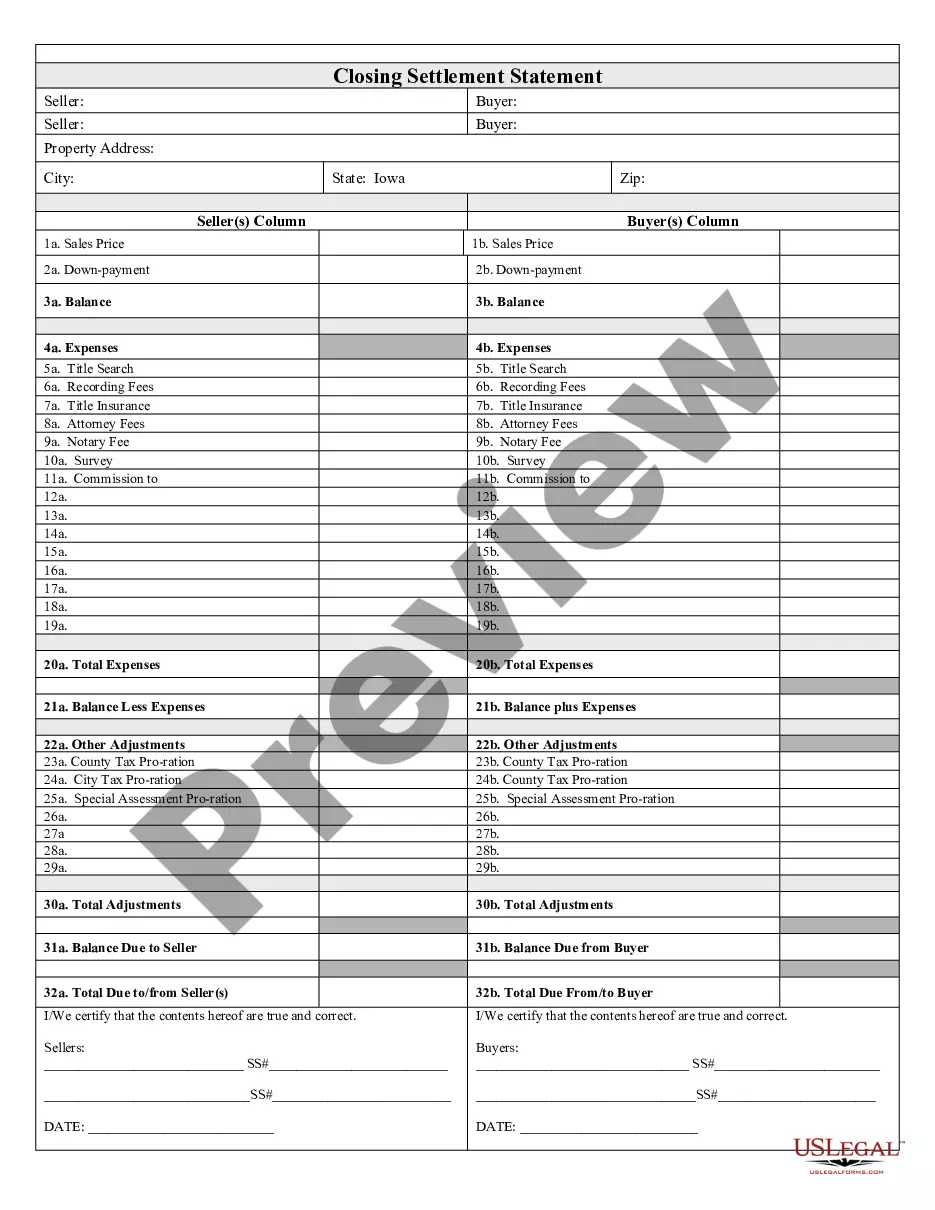

The Closing Statement is a crucial document in real estate transactions, especially for cash sales or owner financing. This form details all costs and proceeds associated with the sale, providing a transparent overview for both the buyer and seller. Unlike other forms, the Closing Statement is verified and signed by both parties, ensuring accountability in the transaction process.

Key components of this form

- Balance: This section summarizes the remaining balance after expenses are deducted.

- Expenses: Lists various costs such as title fees, attorney fees, and recording fees.

- Adjustments: Includes prorated taxes and other adjustments that may impact the total amount owed.

- Certification: Both seller and buyer certify the accuracy of the statements by signing the form.

When to use this form

Use the Closing Statement when finalizing a real estate transaction, particularly in cash sales or transactions involving owner financing. This form provides a clear account of all financial matters involved in the sale, making it necessary for closing the deal and ensuring both parties understand the financial obligations.

Who can use this document

This form is intended for:

- Real estate sellers who are closing a transaction.

- Buyers purchasing property through cash or owner financing.

- Real estate agents or attorneys facilitating property sales.

How to complete this form

- Identify the parties involved in the transaction (buyer and seller).

- List all expenses related to the transaction, including title insurance and attorney fees.

- Specify any adjustments, such as prorated taxes.

- Calculate the total amount due to or from each party.

- Both parties must review and sign the form to certify its accuracy.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Common mistakes to avoid

- Failing to accurately list all expenses can lead to disputes later.

- Not including prorated amounts for taxes, which may cause confusion.

- Leaving sections incomplete or incorrect, leading to delays in the transaction.

Benefits of completing this form online

- Convenient access to templates that can be filled electronically.

- Editable fields allow for easy input of specific transaction details.

- Reliability of having forms created by licensed attorneys.

Summary of main points

- The Closing Statement is essential for finalizing real estate transactions.

- Accuracy in detailing expenses and adjustments is crucial.

- Both parties must sign the form to validate its contents.

Form popularity

FAQ

You can get your Iowa Closing Statement by requesting it from your lender, real estate agent, or closing attorney. They will ensure you receive the statement as part of the final paperwork before your property transaction closes. If you're using the uslegalforms platform, you can also access customizable templates and resources to assist you in generating your closing statement efficiently.

Typically, the closing statement in Iowa is provided by the closing agent or attorney handling the transaction. This individual compiles information from both parties, detailing the financial aspects of the deal. In some cases, the lender may also contribute to the closing statement, ensuring transparency for all involved in the property transfer.

To transfer a car title in Iowa, you must sign the current title over to the new owner and provide them with a properly filled Iowa Closing Statement. The new owner will then need to visit their local county recorder's office to apply for a new title. Don't forget to keep copies of all documents for your records, as they may be required for future reference.

In Iowa, a bill of sale is not always required if you have the title. However, including a bill of sale can help document the transaction and provide proof of agreement between the buyer and seller. It also serves as a useful reference should any issues arise later. When completing the Iowa Closing Statement, make sure to outline all terms clearly for both parties.

To settle an estate without a will in Iowa, you must follow the state's intestacy laws to determine how assets are distributed. This typically involves appointing an administrator to oversee the probate process. The court will handle claims from creditors and ensure an equitable distribution of assets to rightful heirs. With the help of uslegalforms, you can create the necessary forms to facilitate this process more smoothly.

The process to close an estate in Iowa can take several months to over a year, depending on various factors such as the size of the estate and the complexity of the probate process. After the necessary paperwork is filed, the executor must account for all assets, debts, and court requirements. Utilizing uslegalforms can help streamline this process by guiding you through each step clearly and efficiently.

If there is no will, Iowa intestacy laws determine who receives the estate. Typically, the deceased’s spouse and children acquire the majority of assets, with parents and siblings as next in line. The probate court oversees this distribution to ensure fairness and adherence to state regulations. Without proper documentation, you can face lengthy disputes, making the Iowa Closing Statement essential for organized planning.

In Iowa, if a person dies without a will, the state's intestacy laws govern who inherits their estate. Generally, spouses and children are first in line to receive assets. Other relatives may inherit if no immediate family members exist. This process underlines the importance of documenting your wishes with uslegalforms for clarity and peace of mind.

When there is no will, the inheritance is distributed according to Iowa intestacy laws. These laws outline who inherits, often favoring spouses, children, and other close relatives. If disputes arise, the probate court may become involved to resolve them. Adopting the Iowa Closing Statement can help streamline estate management in such situations.

In Iowa, if there is no will, the executor cannot unilaterally decide how to distribute the estate. Instead, Iowa laws dictate the distribution of assets among heirs. The executor must follow these laws and ensure transparency in the probate process. For clarity in your estate planning, consider using uslegalforms for creating a comprehensive living will.