South Carolina Accounts Receivable - Contract to Sale

Description

How to fill out Accounts Receivable - Contract To Sale?

Are you currently in a position that requires paperwork for either business or specific purposes almost all the time.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms offers thousands of form templates, such as the South Carolina Accounts Receivable - Contract to Sale, designed to comply with state and federal regulations.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes.

The service provides well-crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Accounts Receivable - Contract to Sale template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

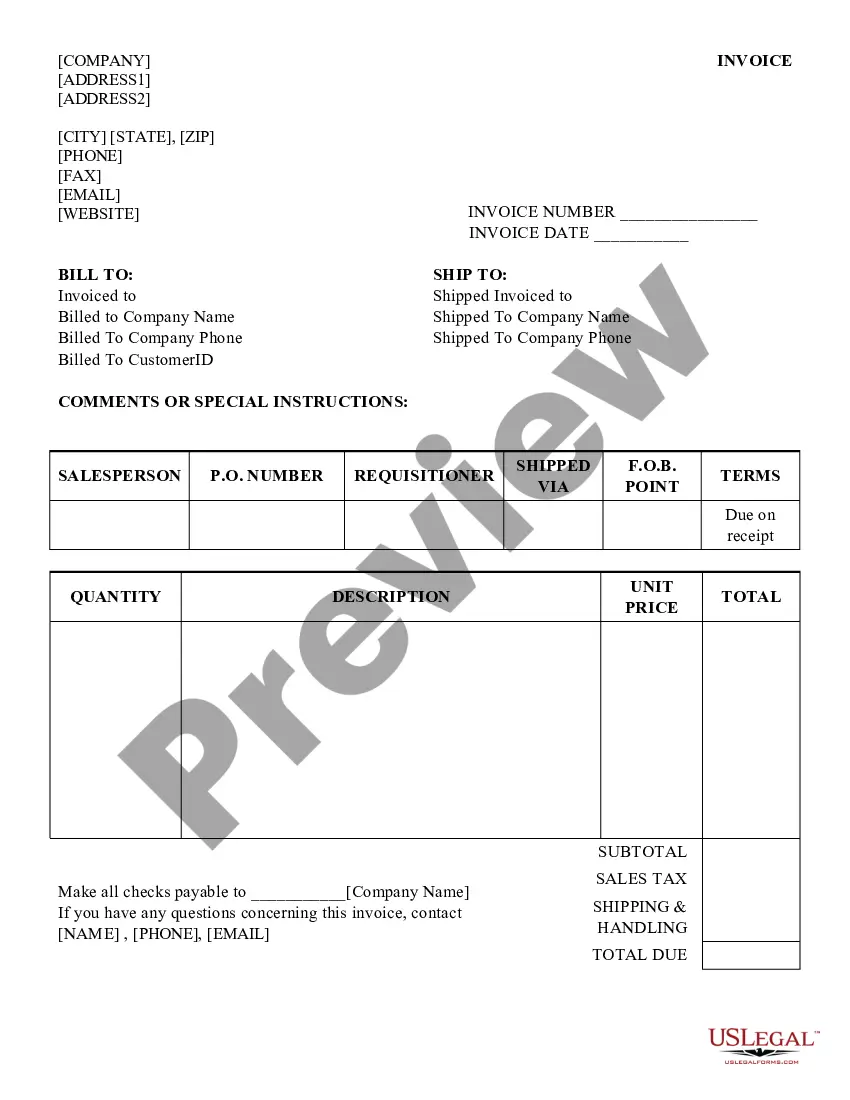

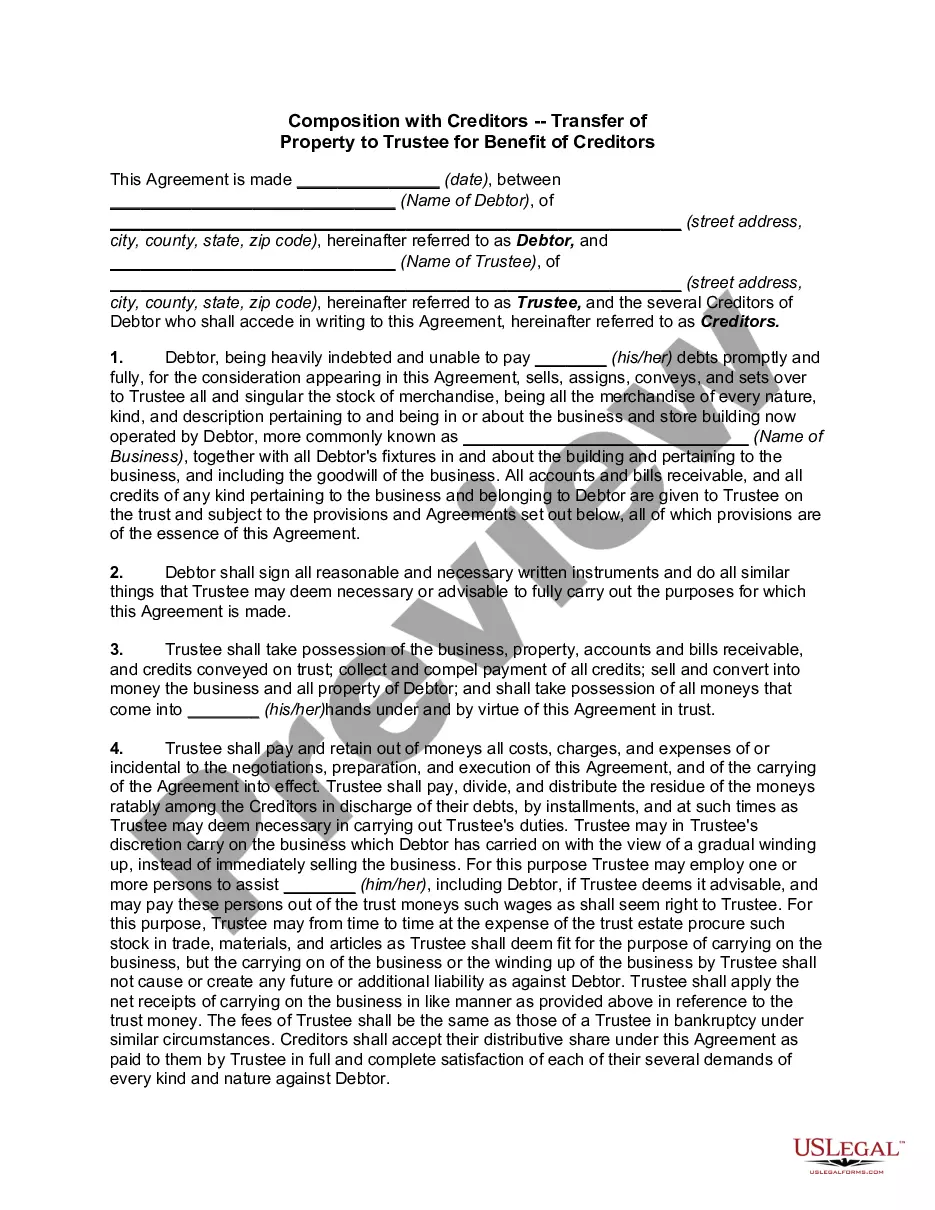

- Use the Preview button to examine the document.

- Review the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of South Carolina Accounts Receivable - Contract to Sale anytime, if needed. Just click the desired form to download or print the document template.

Form popularity

FAQ

Yes, accounts receivable are typically included in an asset sale unless otherwise specified. When a business sells its assets, it generally transfers all existing receivables to the buyer, allowing them to collect outstanding debts. Understanding the implications for South Carolina Accounts Receivable - Contract to Sale is crucial, as it can affect the overall valuation and terms of the sale.

In South Carolina, a notarized Bill of Sale is not generally required for most transactions, although it can be beneficial for proving ownership transfer. However, specific types of sales, such as those involving vehicles or certain types of property, may have additional requirements. When dealing with South Carolina Accounts Receivable - Contract to Sale, having a properly executed Bill of Sale can add an extra layer of security for both parties.

An agreement of sale should include several critical elements, such as the identification of the buyer and seller, a clear description of the goods or services, payment terms, and any contingencies that may apply. Additionally, specifying the terms for delivery and acceptance can help ensure both parties understand their obligations. When drafting this agreement for South Carolina Accounts Receivable - Contract to Sale, clarity is key to avoiding potential misunderstandings.

A sales and service agreement typically includes essential details such as the parties involved, product or service descriptions, payment terms, and delivery schedules. Additionally, it outlines the responsibilities of each party, warranties, and conditions for termination. When dealing with South Carolina Accounts Receivable - Contract to Sale, having a clear agreement can help prevent disputes and ensure a smooth transaction.

A South Carolina sales agreement must include specific details to be legally binding. This information typically includes the names and addresses of the parties involved, a description of the goods or services being sold, payment terms, and any warranties or guarantees. Additionally, it should specify the conditions under which the sales contract can be terminated. For assistance in drafting this agreement, USLegalForms provides user-friendly templates that cater to South Carolina accounts receivable - contract to sale needs.

To file the SC1120 in South Carolina, you must submit it to the South Carolina Department of Revenue. This form is essential for corporations operating in the state, particularly those dealing with accounts receivable. You can file electronically through the department’s website or send a paper form by mail. Utilizing USLegalForms can simplify this process by providing the necessary forms and guidance.

Selling receivables is known as accounts receivable factoring or invoice factoring. The first step is to partner with a third-party company called a factoring company or Factor. When you sell accounts receivable, the factoring firm buys them at a discounted rate. Small businesses receive a cash advance from the factor.

An account receivable is an asset recorded on the balance sheet as a result of an unpaid sales transaction, explains BDC Advisory Services Senior Business Advisor Nicolas Fontaine. ?More specifically, it is a monetary asset that will realize its value once it is paid and converts into cash.

While all transactions are as unique as the parties involved, in most small business sale transactions the seller keeps the cash and outstanding receivables. They pay off the bills and any other outstanding payables and deliver the business free and clear of debt to the buyer.

A receivable purchase agreement is a contract between a seller and a financial institution that allows the seller to sell unpaid invoices from buyers to the financial institution. This means that the seller can enable cash flow until payment is received from the buyer.