South Carolina Agreement for Donation of Land to City

Description

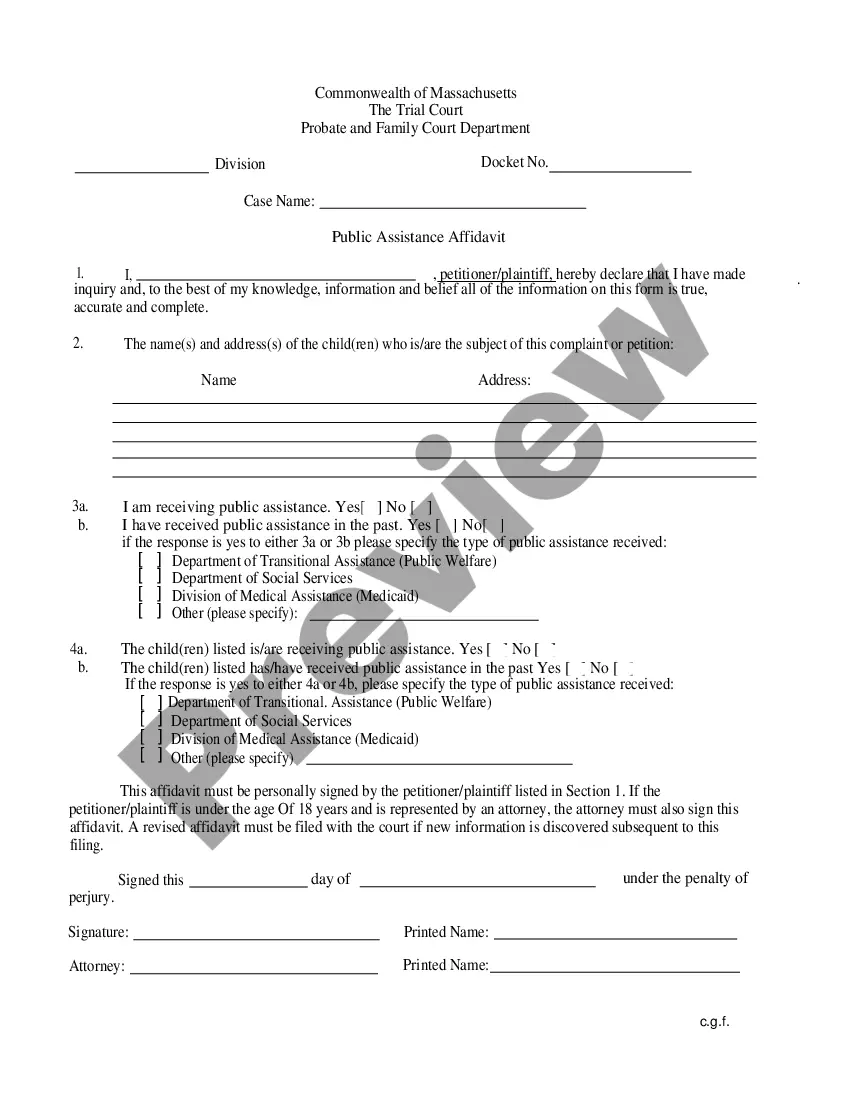

How to fill out Agreement For Donation Of Land To City?

If you wish to finish, retrieve, or print legal document templates, utilize US Legal Forms, the largest selection of legal documents, available online.

Utilize the site’s straightforward and user-friendly search feature to find the paperwork you require.

Numerous templates for business and personal purposes are categorized by types and claims, or keywords.

Step 4. After locating the form you need, click on the Get Now option. Choose the pricing plan you prefer and provide your information to sign up for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to acquire the South Carolina Agreement for Donation of Land to City with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then select the Download option to obtain the South Carolina Agreement for Donation of Land to City.

- You can also access forms you previously downloaded within the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Employee instructionsComplete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

Child deductions: South Carolina offers a deduction of $4,260 for each dependent child and an additional deduction of $4,260 for each child under 6 years of age. Almost a million returns claimed these deductions for tax year 2019.

What is South Carolina Form SC1040? South Carolina Form SC1040 is used by full-year residents, part-year residents, and nonresidents to file their state income tax return. The purpose of Form SC1040 is to determine your tax liability for the state of South Carolina.

The child can be your son, daughter, stepchild, eligible foster child, brother, sister, half brother, half sister, stepbrother, stepsister, adopted child or an offspring of any of them. Do they meet the age requirement? Your child must be under age 19 or, if a full-time student, under age 24.

These 2021 forms and more are available: South Carolina Form 1040 Personal Income Tax Return for Residents. South Carolina Schedule NR Nonresident Schedule. South Carolina Form 1040/Schedule NR Additions and Subtractions.

Does South Carolina mandate 1099 filing for 2021? Yes! South Carolina mandates the filing of the 1099 forms, only if you have withheld state taxes.

A dependent exemption is the income you can exclude from taxable income for each of your dependents. Prior to tax year 2018, you could exclude $4,300 for each dependent. The child tax credit is a credit that offsets the tax you owe dollar for dollar.

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return. 2022

The dependent exemption credit will increase from $378 per dependent claimed in 2019 to $383 per dependent claimed for 2020.

Child deductions: South Carolina offers a deduction of $4,260 for each dependent child and an additional deduction of $4,260 for each child under 6 years of age.